With the hot property market, it was no surprise that the Singapore government would roll out some cooling measures.

It is a question of when and which area the government is surgically targeting.

You can read the official announcement in this press release over here.

Here are some of my thoughts.

Curb Demand for HDB From Private Property Opportunistic Speculators to Protect Those Who Truly Need Resale HDB Flats

The government wishes to address the rising cost of HDB flats.

In the past few months, we have seen this HDB flat in this region selling for more than $1 million, followed by that region. The government’s data likely show that many of these transactions are from those who sold off their private properties and have the purchasing power to buy HDB at suitable locations.

The more affluent Singaporeans get to profit from private investments while at the same time driving up the prices of HDB flats meant for the relatively poorer Singaporeans or Singaporeans with fewer means.

That is not healthy.

So they want to curb demand from a particular side for the time being.

In this announcement, the government introduced a wait-out period of 15 months for both current and former private residential property owners to buy a non-subsidized HDB flat. Before this announcement, current and former private residential property owners can buy non-subsidized HDB resale flats on the open market. Still, they must sell off their private property within six months of the HDB purchase.

This is to curb the demand from young private property speculators, perhaps selling and waiting out for price collapse. Now they cannot do this anymore but live in private properties.

This will not affect those with residential properties but speculate on investment properties.

So they cannot do a more significant price arbitrage. They can still do geographical arbitrage with private properties.

But the government will allow current and former private property owners that are 55 and above (likely retiring people) to buy resale HDB flats that are four rooms or smaller.

If private property owners face financial difficulties, they can approach HDB for case-by-case evaluation.

The most puzzling thing was why former private residential property owners were affected. This means if you bought a private property, then sold it off and moved to an HDB flat, you will also have to wait 15 months. If you fall into this group, you cannot right-size or move to a more suitable location.

But I think those affected here are those who ALREADY JUST SOLD their private property and bought HDB flats. Those in transition will likely be affected.

The net effect may be that the property speculators can only rent, which they may already be doing. And if enough people are renting, this would still prop up private property prices.

This wait-out seems to be a temporary measure and most likely means that it may go away if the Singapore economy changes drastically in the next few months.

More Financial Prudence is Demanded If You are Making New Property Purchases on Properties

The next category of measures ensures that property buyers exercise more financial prudence before making purchase decisions.

The TDSR is one of the good policies the government has rolled out. It tries to ensure that those who want to buy a property have enough margin of safety in their cash flow to service the loan. All the debts you need to service must be less than 60% of your gross income. This includes non-property loans.

The interest rate used to calculate the TDSR is currently 3.5%, but this announcement will be increased to 4% a year. Most likely, that 3.5% is less prudent, so they need to increase it.

All else being equal means the amount you can loan will drop by about 6%.

This applies to:

- Loans for purchase of properties where OTP is on or after 30th September 2022

- If no OTP, the date of the Sale and Purchase Agreement is on or after 30th September 2022.

- Also, apply for new mortgage equity withdrawal loan applications

This change will not affect borrowers who are refinancing owner-occupied property loans. Other property loans will be subjected to the prevailing medium-term interest rate when they first take up their loans.

This means that if you refinish your existing loans, you will likely not be affected.

Introducing a Floor Interest Rate and higher Loan-to-Value for HDB Loans

HDB will introduce an interest rate floor of 3% yearly to compute the borrower’s eligible housing loan amount.

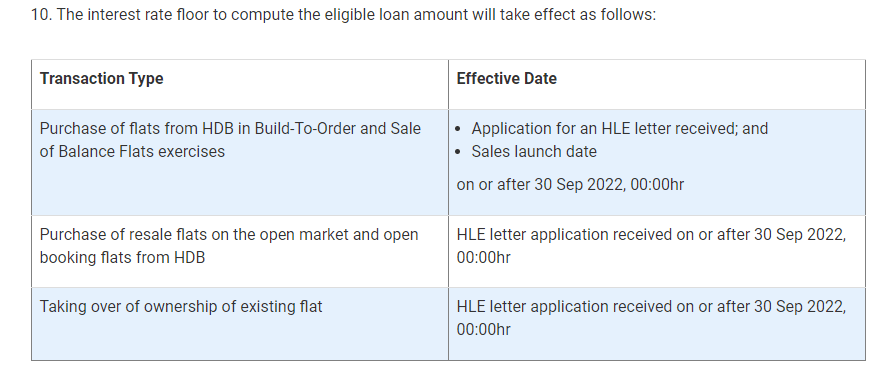

This means that how much you can loan from HDB is higher at either 3% or 0.1% above the CPF OA Interest rate. Here are those affected:

The Loan-to-Value limit for HDB housing loans will also be lowered from 85% to 80%. This applies to new flat purchases on or after September 2022. (in comparison, the LTV for loans from private financial institutions remain at 75%).

The net effect is that you can only take a slightly lower loan amount for HDB loans.

The implication of this TDSR, MSR computation, floor interest rate and high HDB LTV is that you can still purchase the properties you desire, but you have to exercise more prudence. The magnitude of the increase is not so drastic for those relatively well-off but may affect those with tighter contains.

Implications of this Round of Cooling Measures

In general, property cooling measures have the following overall effect:

- Moderate property market euphoria – Creates a smoothing effect of prices that corrects over time but not sudden price corrections.

- Increase transaction costs – Only allow those with more significant resources to participate.

- Lengthens holding period – Encourages long-term holds.

- If #1 to #3 is implemented successfully, it quickly reduces the internal rate of return (IRR), the unit of investment return measurement, to the long-term return instead of a speculative high short-term return.

I think it is clear that, first and foremost, the government is more concerned about the escalating prices for HDB in recent months. If this trend continues, Singapore might have more significant social problems. Their data might also tell them that there are some supply chain issues to be worked out and the situation is dynamic. Hence, the 15-month window may change.

If the economy deteriorates dramatically, this might be tweaked or removed.

The lack of cooling measures to curb property purchases in the private markets is also saying something.

This means that you all can have your free-play all you want if you have enough financial prudence and afford it. But don’t affect the HDB market. You can do all you want in the private market. The demand for property properties may be more robust for those with more financial resources after this cooling measure announcement as it removes some investors’ uncertainty.

If this government stance is precise, I wonder whether there will be a more significant future price spread between HDB and private property in the future. The wider the spread, those with more significant financial resources but not ample resources may struggle with their residential purchase consideration.

One significant implication might be that more people may be renting, making the current rental market crazier.

In the past year, we have seen a 50% rise in asking rents, which may worsen the demand-and-supply dynamics for rentals. Those who wish to profit might have to bear the high rents.

Higher rents support property valuations, which may be what the government wants.

With the economy turning down, this demand may even out the expatriates leaving Singapore as more get layoff.

The 15-month waiting time may mean you have to evaluate whether to sell off to pocket the gains or rent for your family for 15 months which will blunt your profits.

The government is always trying not to kill the property market because so much of Singaporean’s net wealth is tied to it, and killing it would have severe social and consumption implications.

—

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

- The LionGlobal APAC Financials Dividend Plus ETF Won’t Give Singapore Investors 5% Dividend Yield Always. Further personal thoughts (with some data). - April 13, 2024

Nick's Pizza

Friday 30th of September 2022

"The wait-out period will also not apply to seniors aged 55 and above and their spouses who are moving from their private property to a 4-room or smaller resale flat.

These seniors can continue to buy 2-room Flexi flats on short lease and Community Care Apartments, if they are aged 65 and above, from HDB."