Last weekend, I received this message from a friend: “Hi Kyith, I would like to put money into US stocks. I have no experience with an ETF, such as the SPY. How do we split this amount between an ETF and stocks like Apple (AAPL), or Microsoft (MSFT). What is the ratio of split and is an ETF safer for people in my age group? There must be many considerations but as a beginner, where to start of?”

I gave a big sigh after reading this.

I know that my friend is part of the 1M65 Telegram group. Mr Loo Cheng Chuan shared extensively about his confidence in investing in the S&P 500 until many, who were comfortable with their own wealth-building instruments, also got curious about whether they are missing out on the best investment since sliced bread.

I thought about what to reply to my friend, but typing messages was just too tiring. And those explanations may be less clear than what I wish to emphasize. The best way to explain may be through voice messages or meeting in person.

I considered for one minute then I asked if my friend is available this weekend. We eventually decided to meet in the after.

This year, I considered hard who I decided to give time to, whether for work or leisure.

Those closer friends and colleagues would be aware that it is not an easy period personally.

I just felt that there was a snowflake that needs some saving in case he or she plunged into darkness. Okay, to be fair investing in SPY is not that drastic haha!

My friend first contacted me upon seeing my feature in the Sunday Times some years ago. Back then, he has a relative in a delicate situation and needed to boost his income. I suggested to him to try and explore topping up the relative’s CPF LIFE to get the most significant boost. That worked out tremendously well for the relative’s situation. We interacted, and he shared about his investing journey and the eggshells he stepped upon. He reflected that he didn’t invest the right way in the past because he did not include a deeper analysis of the stocks he purchased.

What I hear is humility to admit our weaknesses but also take conscientious steps to correct those mistakes.

If someone is in need, and I can detect an openness to advise, and willingness to make incremental changes, I feel like I am willing to invest my time.

I asked my friend “From what I understand, you were investing in more local stocks that are richer in dividends. Can I understand how you look at this S&P 500 ETF, with respect to what you are doing now?”.

My friend explains that he has learned from his past mistakes and has put in more work to understand the business he is buying. This year, the REITs that he bought have the typical drawdown. He wishes to augment his portfolio with a more US-centric allocation. He keeps in touch with a few sources of public investing information, particularly what was shared in the 1M65 and became intrigued about the US stocks at this point.

The US stocks have corrected about 20% and perhaps present enough safety.

What my friend is more interested in is how to invest in S&P 500, but experience tells me… the most significant value I can add is whether there are gaps in his wealth management. But you got to address what he came for.

You Need to Understand the ETF Structure

“The first thing you need to understand is the ETF structure. Firstly, the S&P 500 is not the only ETF out there. So what is an exchange-traded fund? Do you recall how the unit trusts that you used to invest in work?”

I spend some time going through the similarities between the ETF and unit trust structure, their pros and cons, leaving enough room to ask questions about the structures.

We all need to understand that what many of us like about the S&P 500 ETF is the returns and volatility that come with a basket of stocks. You don’t get the shock of a 30% drawdown when the stock that you punt turns out very misguided because the basket of stocks is very well diversified.

I explain the difference between investing in a basket of stocks that are managed by a manager (be it an index tracking manager or an actively-managed manager) and how he is currently managing it.

My friend is his own fund manager, and at the same time, he is also his own financial planner. He must understand he is multi-hatting, and it does bring up a question about whether he is good at both roles.

The Two Great Advantages of Quant Funds That Many of You Would Like

“If your own portfolio moves down 10%, you know why the portfolio moves down 10%. But if a unit trust/ETF moves down 4%, you may get anxious because you cannot directly ask the manager why the portfolio is down 4%. The difference here is that you can ask the fund manager (who is yourself) what cause the fall and you cannot do that well with the manager.”

“When you invest in an ETF that tracks an index such as the S&P 500, you live and die by the index’s components and who decides what is added and taken out of the index.”

Another key advantage of an index fund or a quant strategy fund is the rebalancing and reconstitution feature of the index/strategy. I spend some time explaining that the reconstitution feature is one of the gems that investors searched high and low for.

“Many local investors remember that they may have invested in SPH thinking it is a company with the sturdy advantage that it won’t collapse easily. Whenever SPH’s share price goes down, it can either be an opportunity to collect more (if you think their business fundamentals are still intact) or to finally sell (if this matured business has finally met its match.). As an investor, you are always in two minds whether to add more, yet at the same time you have concerns.”

“The reconstitution feature of the fund would routinely replace some existing S&P 500 (or another equivalent index) companies that have become smaller (due to fundamental weakness) with emerging companies that are becoming more important. This means that by investing in a fund that tracks the index, you are able to capture the returns of these emerging performers. The fund is self-rejuvenating. It does not mean the index won’t lose money and do suffer from weakness from time to time, but you won’t be caught in a dilemma that the weight of your decision rest upon whether one or two company goes bust or won’t go bust. A fund has the blue chip feature that many blue chip investors searched for.”

I make sure to remind him the key aspect of the strategy. “This strategy is essentially a buy-and-hold strategy. There is little other considerations in place. This is why it is a easy strategy for people to understand.”

Looking into the Past, to Understand How Returns Will Look like in the Future

My friend thinks that it would make sense to invest in the S&P 500 if you can get higher returns compare to investing in the local stocks. I find that it is difficult for investors to grasp the kind of returns they expect to earn if they invest for long term.

Most investors lack good data. I think most investors are sold data that is too optimistic. Most of the planning returns illustrated to investors are based on returns in the past three or five years. If you exit a period of good returns, then you give people the optimistic idea that average return is 12% a year.

Over-optimistic returns set people up for great disappointments.

Yet, returns are important to give some guides to see if we can successfully hit our financial goals in time. So what is the returns we should be expecting.

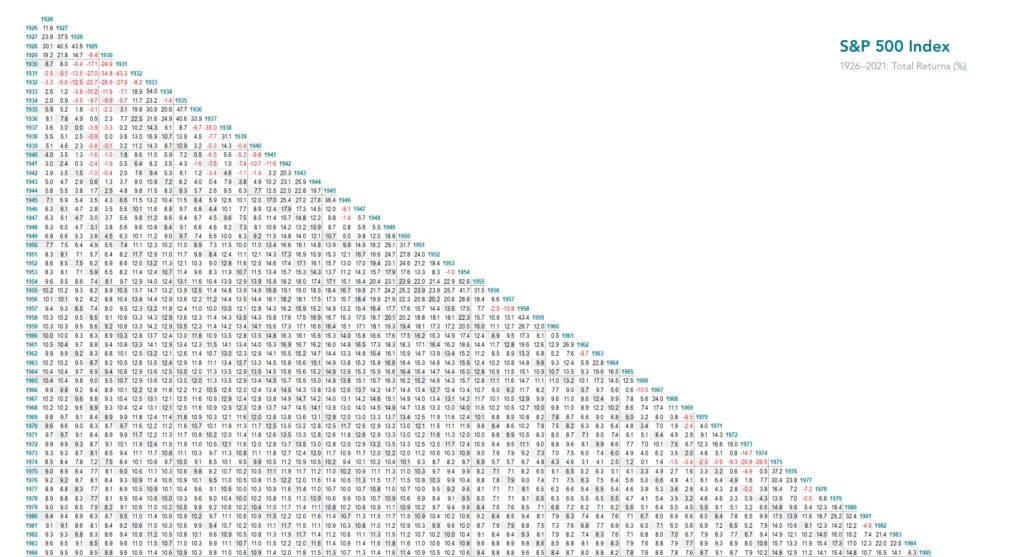

I brought along an old copy of Dimensional’s Return Matrix. The return matrix is a book which shows the historical returns of various Dimensional indexes as well as general indexes such as S&P 500, MSCI World, Bloomberg Global Aggregate Bond, Treasury bills. The historical data will give you a glimpse how returns are like in the past 90 years (S&P 500) or 45 years (MSCI World). It also shows the performance of style factors such as value, small, small value, high profitability.

This return matrix is old (like 2017 old) and likely not a lot of people appreciates it. I dunno if the people in the firm knows this is a treasure, and I got a feeling some that I passed it to, didn’t fully understand that the answers they are searching for is in the book itself.

I think it will benefit conscientious people and so I brought it for my friend.

I explain to him how to read the annualized returns in the book, especially the S&P 500 index. “Ultimately, I can tell you the average returns is 6-7% a year, but that may not be the returns you earn. You should view returns in a spectrum. You can either be lucky or unlucky. Eventually, all the returns are positive. But you have to view it based on the time horizon that you have. The general idea is that your returns are different but if you review the returns here, it can give you an idea what kind of planning returns you can use in your accumulation and retirement planning.”

What If You Don’t Believe in Buy At Any Valuation?

My friend said: “Okay, I think I have a better idea the kind of returns that I can get. But I am a little uncomfortable with the buying and holding part of the strategy. At some point, you have to realize and lock in the returns as valuation run too optimistic.”

Every investment strategy has a philosophy behind it. My friend, as with you, or myself have our own philosophy as well. Sometimes, our philosophy is flawed or totally stupid. Other times, we got to find a strategy that fits our philosophy better.

“I explained to you near the beginning, the investment philosophy that you built up based upon a dividend investing strategy would conflict with what is needed to capture the returns of the S&P 500. The curriculum you learn influences you to have a value layer in your investment decisions.”

Sometimes, we cannot frame certain aspects of investing in a more coherent manner. That is where I hope to give people my perspectives.

“You can earn a certain degree of returns based on buying-and-holding. But certain investment strategies have higher risk but the investor is compensated for taking that risk. A premium is earned if you consistently execute these strategies. There are empirical evidences that substantiate this.”

“When you consider the valuation of the stocks you want to buy or sell, or that you own in your portfolio, you have a value layer. There are empirical evidence that tests whether these strategies compensate the risks and the effort you put in. Based on a basket of stocks, say the S&P 500, or the entire U.S. stock universe, rank the stocks based on their valuation (be it price-to-book or price-earnings). Then overweight those stocks that are rank more cheaply than those expensive ones. On a periodic basis (say every six months), re-rank the stocks, sell and buy based on the new rankings. How well do they do?”

I showed my friend the returns of those Dimensional indexes tilted towards value, explaining the historical outperformance over different periods and the underperformance in certain periods. Then I go through other style factors such as size, high profitability and then relative to the individual stocks he is more familiar with.

While this is not what the S&P 500 does, I find it is important to close the loop in his mind to see that you can apply the same dividend approach but that he does not have to be so deep in the stocks selection and portfolio management process.

There is a middle ground between becoming a portfolio manager yourself and being entirely passive but market cap-weighted.

I think what I have shared should have given him enough stuff to think about.

Does He Have Enough?

Since the last time, we met up was some time ago, I thought it would be a good idea to take stock of the financial planning side of things. My friend admitted: “Aside from investing, topping up CPF and performing SA Shielding recently, he has given less thought about the financial planning side of things.”

In our past conversations, I could detect concerns in certain areas. Usually, these areas bobbled to the surface when it became critical enough to make a decision. A common area is in deciding the health insurance approaches.

My friend explained that recently, he managed to shield his CPF SA successfully and partly his wife’s CPF SA with Treasury bills. His most immediate cash flow need is that his child would be going to university soon. He has an education endowment plan maturing soon, which should be enough for the tuition fee. However, he may not have set aside monies for the potential living expenses.

“A key client will eventually leave my business, which will greatly affect my revenue. I have to try and make sense of how to think about this loss of income.”

I reviewed the potential sum that may mature and thought it should be enough for a local university degree with some excess for living expenses. He can visit the university website to find out about some of the living.

“I have not thoroughly considered my retirement income plan aside from SA shielding.” I find that many find it challenging to arrange, consider, or frame their different assets into a coherent retirement strategy.

So let me see if I can make it clear.

“How much do you need to spend during your retirement if you retire today?”

He said, “I did consider this before coming here, and currently, my expenses come up to $3,600 a month. But about $900 will come to an end as next year will be the final instalment of my car loan.”

“That is great. It means your recurring expenses are lesser. How much you need greatly depends on your expenses in retirement. If you need a lot, then the capital you need to provide the retirement income will be large. If you need less, your capital needs will be less.”

He has two expenses that we agree that is non-recurring. $200 monthly in child’s expenses that should end in a few years’ time, and $800 monthly to his parents. “Technically, even if it is 15 or 20 years, there is an end to that expense. You can consider if it makes more sense to set aside money today to provide for them.”

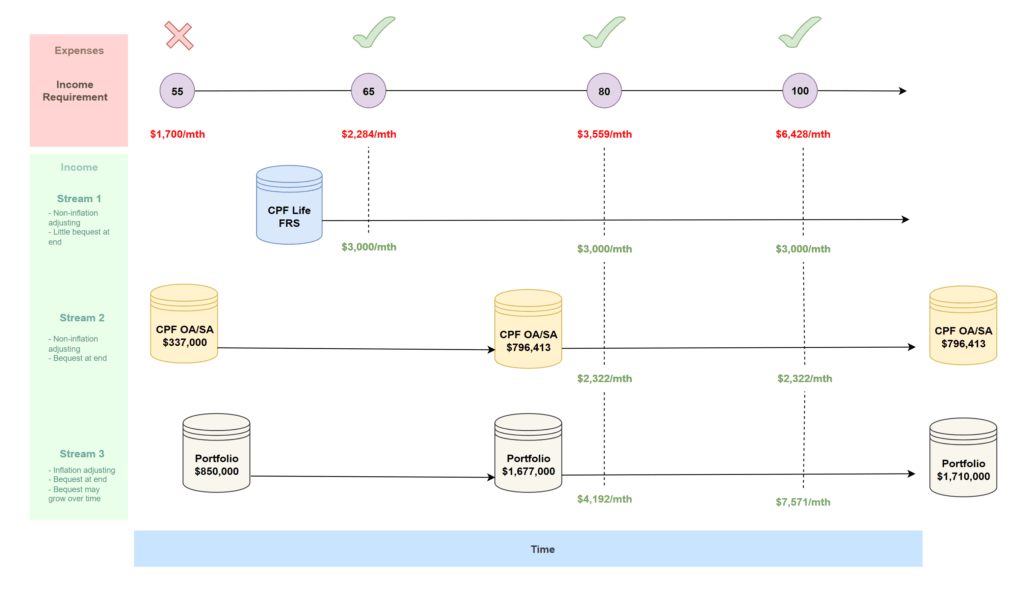

This will reduce his recurring expenses to $1700 monthly.

I looked at the revised recurring expense and knew immediately he could have an excellent retirement income outcome.

“Your first income stream at 65 years old will come from your CPF LIFE annuity income. Your wife and you have the Full Retirement Sum in your CPF Retirement Account. If we use the CPF LIFE Estimator, if we choose the Standard CPF LIFE plan, both your wife and you should have a combined income of $3,000 monthly, which should last for as long as you live. This income is not inflation-adjusting.”

“At 3% yearly inflation, your $1,700 monthly income need will become $2,284 monthly. This means that both your CPF LIFE can cover your recurring spending needs from 65 onwards. There is a possibility that inflation may require you to have other income streams to supplement and provide the inflation adjustment.”

“At the end of age 100, the same $1,700 a month will become $6,428 a month. This means that there may be an income shortfall of $3,428 a month at the tail end of your retirement, should both of you ever live till that long.”

My friend and his wife have about $337,000 in CPF OA and SA, after the mandatory contribution into CPF Retirement Account (RA). He has the option of taking out this monies and invest in investments that yield a greater rate of return or they can choose to leave it in the CPF OA and SA, which yields reasonable returns.

We can assume a conservative blended return of 3.5% yearly for their CPF OA and SA monies. What would be the potential interest income, if they decide to only spend the interest income?

“At 65 years old, your interest income would be 16,640 yearly or $1,386 monthly. Your total income (CPF LIFE + CPF Interest income) would be $4,386 monthly. That is double what you need. But if we only consider spending the interest income closer to 80 years old, the interest income would be $27,874 yearly or $2,322 monthly, giving you a combined income of $5,322 monthly. This is still short of the $6,428 monthly at the end at 100 years old but if you decide to spend some of your capital, your CPF LIFE and interest income may be enough.”

I asked: “What other assets do you have?”

Then he tell me that he has a shoebox apartment that is not fully paid up. The property is valued at $1 million and the outstanding mortgage is $400k, thus the equity is $600,000.

The property is tenanted out, where the rent covers the mortgage payment. But given the current interest rate environment, he may look to sell it before he needs to refinance his mortgage in 2025.

This together with his $250,000 worth of equities, should give him an additional capital value of $850,000.

My friend currently has his own idea about how he will invest the $250,000 but with his interest in the S&P 500 ETF or US stocks, things might change. He has enough time to figure out what is the ideal asset allocation, how active he wishes to manage it, based on his needs. Most likely, he will need to tap this income may be from 75 or 80 years onwards, which means by right, he has a 20 to 25 years duration in income needs. We can use different layers of initial safe withdrawal rate to determine the amount of inflation-adjusted income he can draw from his portfolio, for the portfolio to last until 25 years. A reasonably conservative initial withdrawal rate will be 3% of his $850,000 portfolio, and a more conservative rate would be 2.5% of his $850,000 portfolio.

“At 65 years old, your $850,000 will grow to $1.07 million if it grows conservatively at 3% a year. Using an initial withdrawal rate of 3%, you can draw upon an income of $32,302 yearly or $2,692 monthly. If we delay the income to 80 years old, you will have $1.68 million and based on an initial withdrawal rate of 3%, you can draw upon $50,326 yearly or $4,194 monthly. Together with your CPF Life income of $3,000 monthly and interest income of $2,322 monthly at 80 years old, you can potentially have $9,515 monthly, which is more than the $6,428 monthly you need at 100 years old. You basically have a very conservative plan!”

My friend felt surprised and glad that he is in a better position than originally thought.

Before this meeting, his plan was to spend his time getting his investing right, rather than make up for the lost revenue from having one less key client. Now, it turns out that he has a rather conservative plan, with adequate buffers.

There are other opportunities that we have not to consider.

“Based on what you have, you may have enough to retire five years earlier if you wish to. If not, part of the proceeds from the sale of the property may be used as a sinking fund for the parent’s allowance. If you start by taking a 2.5% initial withdrawal rate on the $850,000 in 2 years’ time, you may have $21,250 yearly or $1,770 monthly which is currently enough to pay for the parent’s allowance. Take whatever is needed. If the need is only $800 monthly or $9,600 yearly, then that is 1.1% of your $850,000 portfolio. Based on historical estimates, providing this income won’t impair your portfolio. You have options instead of paying from your work income.”

How to Dilute the Role of Investment Returns in the Success of Your Plan?

Sometimes, when you are unsure about a person’s situation, you try to manage the emotions of the other party, just in case the person won’t have a good outcome. Given my friend’s often stoic face, I didn’t expect to be pleasantly surprised that he has a happy situation.

I realize my not-so-super power is to estimate if you have enough and whether your enough is conservative or wildly optimistic.

As it turns out, whether to invest in the S&P 500 becomes less critical. However, I think my friend still has to get the asset allocation and the ideal investment strategy that matches their needs right. He has a few years to do that. You must spend enough time experiencing what it feels like living with your investments. All the stuff in textbooks goes out of the window if you cannot live with it.

You can become jittery as the volatility or negative news picks up and has numerous questions that didn’t come up as you were researching or the guru that you followed didn’t share this stuff with you. A sound plan is to learn to live with a sizable amount (e.g. $250,000 for him) early.

Many look upon returns, thinking that is what will give them a sound retirement income plan.

Returns are a component but not the most critical component. If you have a plan that is solely based on how well your fund performs, what happens if “suay suay” that seemingly great performing fund starts underperforming? Does past performance guarantee future great returns?

Many end up trying to validate the performance of this fund, this region (read S&P 500), and this strategy. They only live one life and they are afraid that the failure of that fund or strategy will kill their retirement.

Perhaps the area to focus on is:

Has your plan diluted the importance of returns to the success of your financial outcome?

Unlike many, my friend’s plan work because he has an “absurdly” low recurring expense of $1,700 monthly. This is the spending of a dual-income 55-year-old couple, owning a car and living in a five-room flat with a child almost nearing university. If he says that is his recurring expenses, less the parent allowance, less the child allowance, then could you get to that level?

Because he needs less, given the capital he has, his plan gradually becomes more conservative, and even if he is unlucky, his plan is likely to work still. His capital base is not wildly great. I have seen a personal balance sheet that is higher than this.

But they cannot have what my friend will have, which is greater peace of mind. I can fxxking guarantee you that if he ploughs all into S&P 500 and it crashes 60%, his plan will still be OK but how many other people’s plans will crumble?

Many retirement plans live and die by having a lucky return outcome.

Your philosophy on how you view your expenses will determine so much of whether you will have a good retirement outcome.

More retirement planning articles are in my retirement planning, and financial independence section below.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Sinkie

Sunday 18th of December 2022

"Has your plan diluted the importance of returns to the success of your financial outcome?"

Think you meant "Has your plan elevated the importance of returns to the success of your financial outcome, to the exclusion of all else?"

Kyith

Wednesday 21st of December 2022

i think i do mean whether you reduce the importance of returns to the success of your plan.