One of the most popular wealth concepts that I developed in the past was to explain to you the concept of owning wealth machines.

We go about our adult life trying to do the right thing and often this means seeking out financial planners to help us plan our finances so that we save up our money for the necessary financial goals.

However, we often do it in a very passive manner. Usually, it feels like we are trying to put the bare minimum amount of money into our accumulating goals for children’s education, retirement so that we have enough money to spend.

I think we cannot find enough motivation why we should put away more of our money to the future instead of spending it today.

Wealth Machines will make our intangible digital money into a more tangible object that provides an important use with a lot of people are looking for.

An object that helps you generate recurring income away from your main job.

Wealth machines fit well into my Wealthy Formula framework of becoming wealthy. It is the outlet for you to pay yourself first after earning more and optimising your expenses.

But I just want to be clear, wealth machines are not financial assets because if financial assets are the solution to the problem, I would just tell you “own as many financial assets as possible”.

In this article, I will explain:

- What are wealth machines

- Why wealth machines are important

- Why investing in financial instruments is not the same as a wealth machine

- The characteristics of different wealth machines

- How you can build them & keep them running in 5 Steps

- One of the most prevalent wealth machines which I own in the past – dividend investing

What are Wealth Machines?

A Wealth Machine is a concept I came up with a few years ago.

Essentially, a wealth machine is an asset that you put in money to build up, that accumulates wealth value for you over time.

You will also need to build in rules, systems & processes around how to manage the asset based on the knowledge, techniques and wisdom you learned so that your asset can accumulate value in a sustainable way.

As the wealth value of your asset grows, your wealth machine can then distribute wealth cash flow to you when you need the cash flow.

Let me give a more detailed explanation.

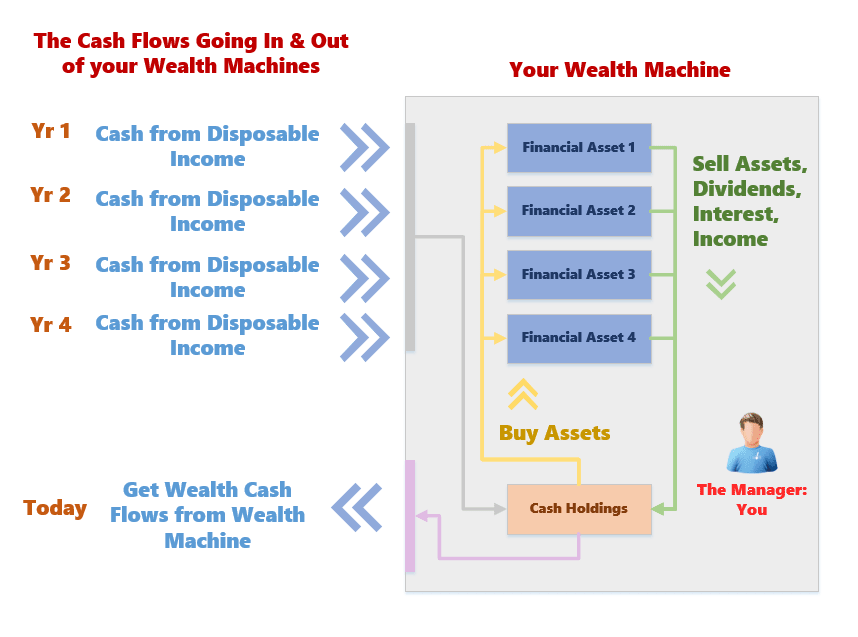

We create a wealth machine by separating the money we want to grow for a certain purpose, from our other goals & expenses.

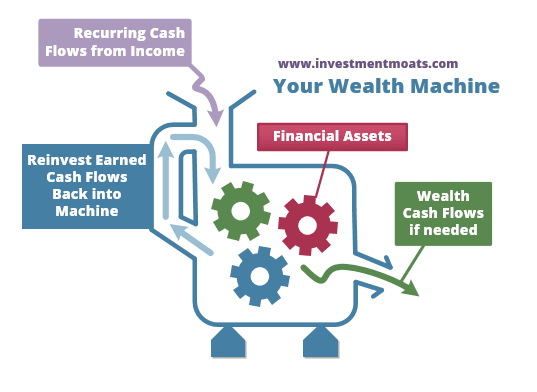

In the diagram above, your wealth machine is the grey box to the right.

The machine manager of this machine is you.

Every year, you will funnel a portion of your disposable income into your wealth machine. This disposable income ends up in your cash holdings. This cash holding is the cash that you set aside for the purpose of growing your wealth and cannot be touched for other goals and expenses.

You will choose to deploy the cash into financial assets or securities.

These assets can be unit trusts, insurance endowment, exchange-traded funds (ETF), REITs, stocks, bonds, property. The cash to fund the investments only comes from the cash holdings within the grey box.

When your financial assets give out interest, income, dividends, rental income or is sold for cash, this cash outflow from the financial assets flows back to the cash holdings in the grey box.

For some of you, Financial assets can also be wealth machines managed by other people/managers.

If you look at your investments in the wealth machine concept, your money is separated from other purposes and the money can compound within the machine without the money being disturbed for other purposes.

If you somehow require an income or cash flow from your wealth machine, you can take a wealth cash flow distribution from the cash holdings in the grey box.

The best example of a wealth machine is like a unit trust/mutual fund where you are the manager. You fund this unit trust/mutual fund managed by yourself (in a role as a fund manager). When you require a wealth cash flow, you “sell” units of this fund to get cash.

What happens in the unit trust/mutual fund is separated.

The Best Way to Explain Why you Would Want Wealth Machine(s)

Wealth Machine(s) are worth it.

Your human capital enables you to earn a good salary for a 30 to 40-year span.

However, you are only one person. The following can happen to you:

- You are cautious. You crave for some financial security in your life. You would like to have the option to work less, switch to another employer or another career

- You would like to be financially independent or retire early

- You suffer from a disability that you cannot continue earning in this lucrative career you have chosen

- You thought that you are good at what you do and you will remain in this career for a long time. However

- You grow disillusioned about your field of work

- The job demands a lot of employees as they gain more responsibilities. The stress level is detrimental to personal health and family life in the longer term

- You realize your temperament does not suit to go into middle management or upper management

- You realize there is another potential career that you tried a little and you are liking this potential new career more

- Technological changes caused your lucrative career to be less or not lucrative any more

When you create some wealth machines, you are creating duplication of your human capital’s earning power. It is as if you are creating a few robot versions of yourself.

The more wealth machines you create, the less dependent you are on your main source of take-home income. You diversify the cash flow that you bring in.

The more you address or answer the questions above.

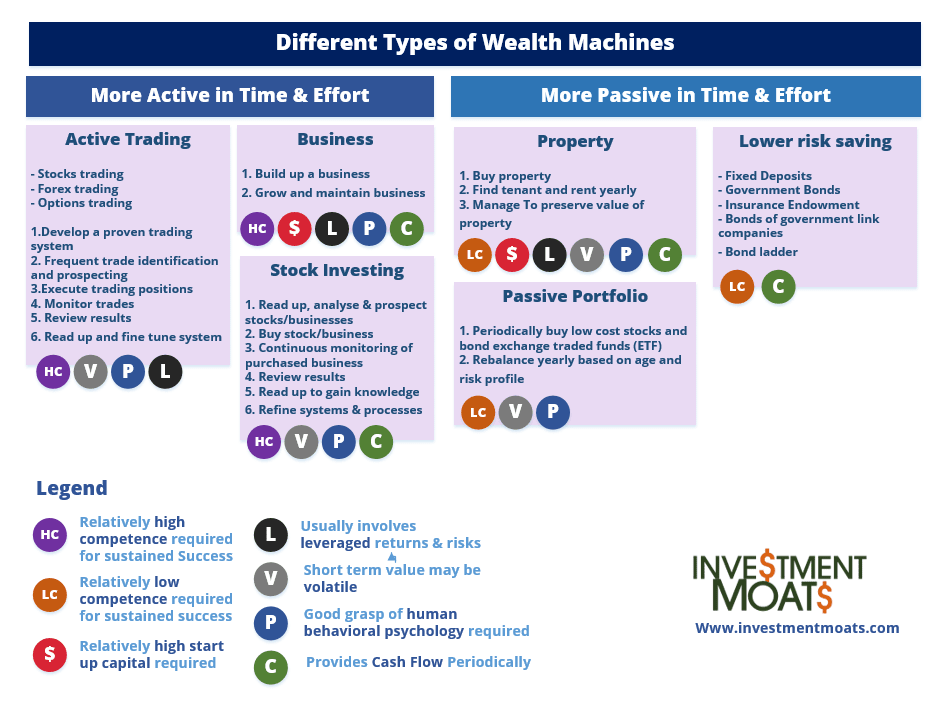

Different Types of Wealth Machines Based Upon Different Financial Strategies

There is not just one type of wealth machine.

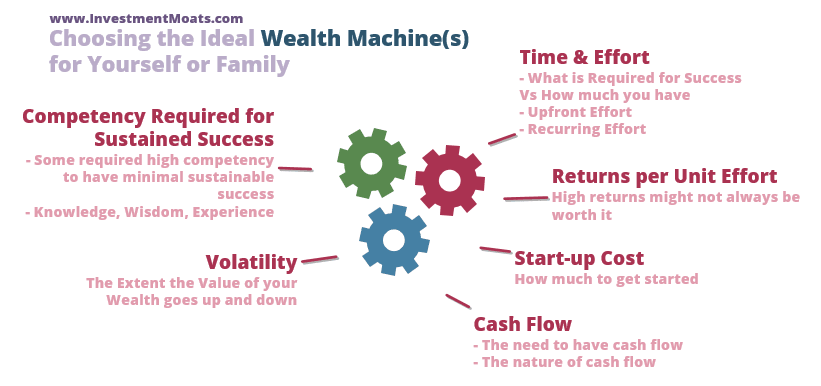

Each wealth machine will have its unique characteristics. These characteristics are explained in the legend.

For the same financial instrument, there are different wealth machines or ways to build wealth. For example, if we talk about stocks, you could do active trading, you could do stock investing. If you aggregate stocks by holding a basket, you can carry them in a passive portfolio.

These different characteristics make each wealth machine uniquely different.

In the next 2 sections, I will explain to you what you need in your wealth machines to be successful with them and what their unique characteristics mean.

My Wealth Machine: A Portfolio of Dividend Stocks

One of my main wealth machines in the past is to manage a portfolio of Dividend Stocks in a sustainable manner. This would be a good case study to explain the wealth machine concept.

The conservative Total Return that I used to target for my dividend stock portfolio is a dividend cash flow yield of 6% + capital growth of 2%.

The Total Return is thus 8%.

The financial asset is the portfolio of Dividend Stocks, which are stocks that pay a particular high dividend, or that the business is mature and solid that their dividend income payout will increase over time.

Each dividend stock in this portfolio distributes dividend cash flow.

Each dividend stock also has a certain capital growth.

I will take the dividend cash flow distributed and reinvest it in existing dividend stocks or dividend stocks with a higher total return.

This way the wealth value accumulates in the asset. I do not spend the cash flow from the portfolio of Dividend Stocks anyhow.

When I eventually need the money for the purpose of

- Having cash flow temporary for survival (financial security)

- To fund a high value life goal

- Having cash flow to supplement a semi-retirement lifestyle

I will transfer a controlled amount of wealth cash flow out of the wealth machine to meet this purposeful usage.

To ensure this portfolio of Dividend Stocks accumulates wealth value in a sustainable manner, I have built up the knowledge, wisdom and know-how over the years to set up systems, processes.

I have invested upfront effort to gain this knowledge.

On a recurring basis, there needs to be effort as well. This recurring effort is to

- Review the dividend stocks that I hold

- Keep up with the trends, data and results of the underlying businesses in these dividend stocks

- Continuously read and learn on dividend investing to tweak and improve the systems and processes

- Prospect new dividend stocks to identify what to add on, replace existing stocks, keep in view good stocks that are not at good prices

This recurring effort is done nightly and weekly.

Financial Instruments are NOT Wealth Machines. Here’s Why

Your first impression of wealth machines may be that it is a glorified term for some cash flow distributing financial instrument.

You may be right but there is a reason to look at them this way.

Sustainable success in your quest to accumulate wealth value requires some key ingredients that many do not realize.

Let me go through some of these important ingredients.

Sustainable Success requires Knowledge, Wisdom and Facts

I received many queries during my many years of personal wealth mentoring, friends and family whether certain stocks are good dividend stocks.

Or can we buy this unit trust and that unit trust?

When I ask them what they are buying and why they purchase, they have no idea what they are buying!

The level of explanation also leaves me with the conclusion that they do not have some of the basic critical know-how of building wealth with these instruments.

Some examples of basic know-hows for some financial instruments are:

- Dividend Investing: Dividend Stocks are not like fixed deposits. Companies pay dividend out of their earnings or cash flow but it is not mandatory

- Insurance Endowment (example of this here): what is behind an insurance endowment that helps you save money?

- Passive Index Portfolio Investing (some examples of this here and here) : What are the portfolio ETF made up of?

- Buy and Hold Property : What are the costs that make up your operating expenses if you buy and rent out.

Experienced wealth builders will find it incredulous, how is it that we can sink so much of our hard-earned money into these financial instruments without understanding how they work.

To make things worse, these facts and knowledge are the basics you need to know. They are not going to be enough to give you sustained success in building wealth. Yet they don’t even have that level.

It is not going to be the facts and knowledge that separates you from being a poor wealth-builders and a competent enough wealth builder.

You need to distil the knowledge and facts to become wisdom to build sustainable wealth.

Some examples would be:

- Dividend Investing : Scrutinize the sustainability of a company’s cash flow, with regards to the business model and not overpay for such a business

- Insurance Endowment: An endowment is useful as a pseudo bond because we cannot buy a diversified bond mix we can hold till maturity. Our returns at best matches a same duration bond yield

- Passive Index Portfolio Investing : Cost control determines much of the return. Learning and understanding behavioral finance and how to stop myself from doing stupid adjustment to my passive portfolio determines much of the returns

- Buy and Hold Property : Leasehold property with land lease after 20 years will start seeing the reduction in and lease factor into the property value. Property in some places is not a buy and Hold forever game

You acquire these facts, knowledge and wisdom through systematic self-education, going for courses, mentoring sessions and most importantly time and space for reflection to distil and tweak your wealth machine.

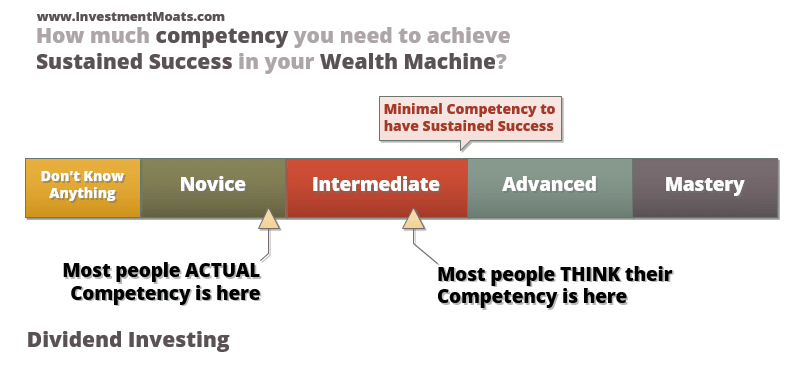

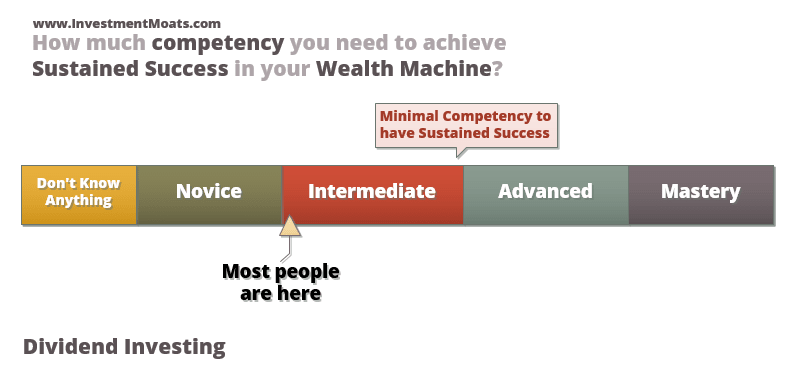

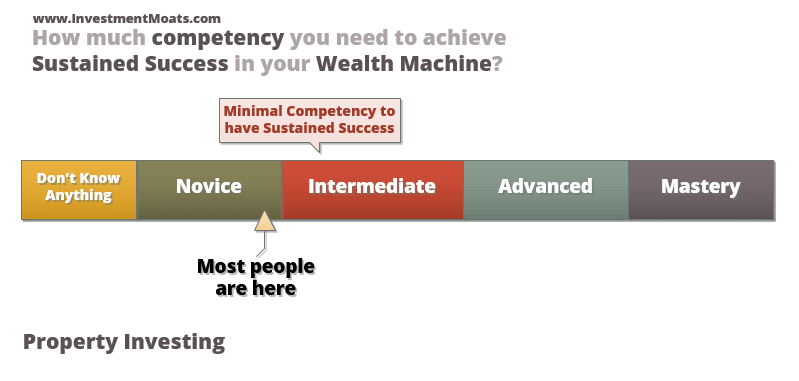

You Need to Reach a Certain Level of Investment and Portfolio Management Skill Competency to Build Sustainable Wealth

To build wealth in a sound manner with some specific financial instruments require a different level of skill competency.

In the meter above, our progression in a skill we want to learn starts from not knowing anything to mastery. Many people will be in the “don’t know anything” and very rare will we have people in mastery.

To be successful to make money with some financial instruments over time, you need to attain a close to a high intermediate level of competency or very close to advance.

One example is dividend investing.

You can invest in dividend stocks without knowing a lot, and you can make money, but seldom will you be able to do it in a sustainable manner over time.

You need to know

- what you are doing

- what you are supposed to do right most of the time

- and why you are not doing things well.

The problem many faces is that a lot of time, we overestimate how much we know to be functional in investing.

Most people think they are well equipped to have sustained success, but the reality is that they know much less than that, and are far from the minimal competency they require to make money consistently from investing.

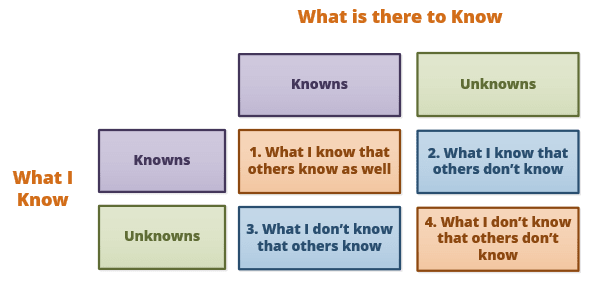

You Will Need to Know What You Need to Know and also Know what You Don’t Know

The biggest problem for many of us building wealth Is that we think just because we do some systematic self-education, or go for some courses, we know the majority of what we need to know.

What kills our wealth the most is not what we know but what we don’t know we need to know.

This would be #3 in the knowledge matrix above.

When we think we know a lot and go wack our capital in, sometimes luckily things turned out OK, you made money or break even, most times you just see your wealth dramatically reduced.

And the worst part is at this juncture, we conclude the method doesn’t work and failed to learn we didn’t know what we need to know.

Sometimes, it is just that we really need to learn more and build up more experience. There are no shortcuts.

Here are some materials on Knowledge, Wisdom:

- #2 Key Ingredient to Wealth: Acquiring Wealth Knowledge and Wisdom

- Understanding Wisdom in Wealth Building. Why the need to Build Wealth Wisely

- Why You NEED to Understand Other Wealth Topics, Wealth Machines

Sustainable Success requires Us to Build Good Systems, Processes and Habits Around Our Wealth Machines

Knowledge and Facts tell you how things are and how roughly to do things.

You need to do things on a consistent and recurring basis.

Many of us think x is the amount of time we need to spend to generate “passive income” or “passive cash flow”

These terms sell a beautiful picture that is an ideal outcome for many of us.

Unfortunately, the reality is for wealth building in certain financial instruments to be successful, you need a sizable upfront effort and recurring effort.

Take, for example, my Wealth Machine in maintaining a portfolio of Dividend Stocks.

Before starting, I need to figure out:

- What are stocks, bonds and various asset classes. What are their relationships, differences and what affects their returns, the kind of risks and the kind of volatility

- I studied various ways how stock investing is done, their differences, their potential returns and whether they are suitable

- I zoom into value investing texts and articles and also dividend investing texts and articles

- How to buy and sell shares

- Opening up the necessary CDP accounts and brokerage accounts

Then on a recurring basis, these are the things that I am preoccupied with:

- Daily

- A check on prices of some stocks that I am tuning into at night

- Go through the news and announcements, scanning through recent quarterly results to have an idea how are certain businesses doing, any interesting business to zoom into

- Read reports on companies from brokerages where available

- Read annual report when release

- Listen to wealth podcasts or related podcasts

- Weekly

- Zoom into 1 or 2 business depth to see if I can invest, or that I can dive even deeper. Read a series of annual reports, compiling the numbers and making sense of the numbers

- Review the trends and data surrounding the stocks that are in the portfolio. This is so as to understand and risk management any change in business trends particular to the stocks invested (risks can be positive and negative)

- Read wealth building books, articles

- Review technical charts for prospective business, assets, existing holdings

- Monthly

- Review portfolio

- Tabulate dividend cash flow income credit into bank accounts into spreadsheet

Perhaps this is why I can never associate this cash flow earned from stocks to be passive.

To me, I need to exchange time and effort from doing other things to focus on doing this.

The only thing passive is, we are not managing the business directly but enjoying the cash flow dividends from the earnings.

Active wealth management requires time and effort, and a systematic well thought investing process ensures you do not burn out during the investing journey.

As you become more familiar with these systems by executing them recurring, they become less of a chore but a part of your lifestyle. You formed investing habits.

Sustainable Wealth requires Reinvestment of Our Earned Cash Flows from Our Work Income Consistently

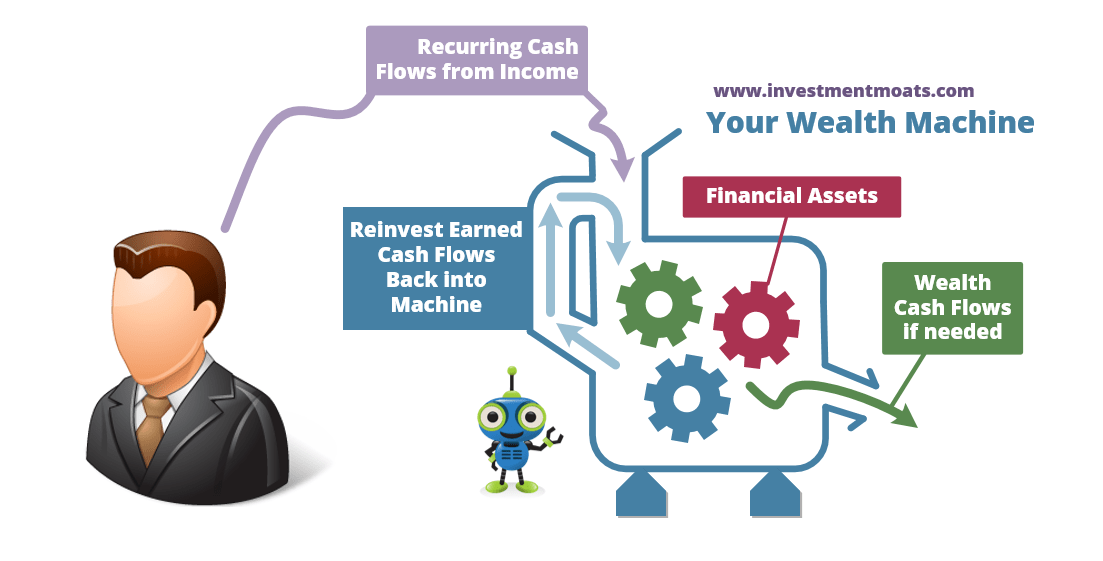

A feature of your wealth machine is feedback of earned cash flows back into the machine.

What are earned cash flows? This will depend on what kind of financial instruments.

Stocks, exchange-traded funds (ETF) distribute dividend cash flow. Buying and holding property and renting out provides you with rental cash flow. Selling your stock gains translates unrealized gains or losses into realized gains. Your insurance endowment in some cases provides annual payouts. Business when stabilized may provide business income.

It may be tempting for you to take this cash flow out and use them. This will be your Wealth Cash Flow.

However, if you keep pulling out your cash flow to use, it means the cash flow you earned is not put to work and are not helping you earn even more cash flow. This is the compounding effect.

There will be a time when you take wealth cash flow, which may be when you reach a stable state after accumulating wealth value over a starting period of years.

However, before that, do note that if you use your wealth cash flow, your wealth machine grows at a slower pace or even decelerates.

You got to make a wise decision.

A Wealth Machine Case Study: My friend Wilson’s Passive Index Portfolio

One of my ex-colleague Wilson built his wealth machine around buying and holding a low-cost portfolio of Exchange Traded Index Funds after reading about it 10 years ago.

Wilson targets a total return of 6%. This is made up of a dividend yield of 2.5% + capital growth of 3.5%.

The asset here is a portfolio of ETF held long: One World Stock Market ETF, one home country Singapore ETF and one home country Singapore bond ETF.

Every quarter, he would add on to this 3 ETF Based on a targeted allocation percentage.

And then he will do nothing. He will keep up with the general wealth building articles and books to aligned himself to good wealth management ideas. He reads articles on how we all suffer from cognitive biases and how to best prevent them.

The majority of the effort is done upfront in learning why this way of investing is sound, what makes the most impact when it comes to this form of wealth building.

The recurring effort is more to allocate money to the portfolio and reading to galvanize his conviction.

How to Choose The Ideal Wealth Machine(s) Suitable for Yourself or Family

By now, you would know the difference between wealth machines versus mere financial instruments.

Depending on your character, and the resources available to you, some wealth machines suit you better than others.

Some wealth machines, you would hear friends recommending to you, but in reality, they just do not suit you because of your current life circumstances.

Different investment strategies applied within different wealth machines affect certain attributes of your Wealth Machine to different degrees which makes some wealth machines more suitable for you than others.

In this section, I will explain more about these common attributes of your wealth machines or investment strategies.

I hope you take note of these 5 attributes before you embark on some wealth-building venture or that when you are finding out if some wealth-building venture is suitable for you, ask these important questions.

1. Competency Required for Sustained Success

The key difference between just buying financial assets, financial instruments, selling or holding them, compared to wealth machines, is doing them with competency in a sustainable manner over time.

You have the knowledge and wisdom to create systems and processes around the financial instruments and execute them to be successful over time.

You need knowledge. You need to execute. You need to learn from your mistakes and what you do right, by having time to reflect. Then you need to adjust your systems and processes.

Different wealth machines, however, have different competency levels that you are required to attain to allow you to build wealth with sustained success.

Take the example if you wish to embark on dividend investing as a wealth machine

You can’t certainly achieve success in building sustainable wealth by not knowing anything and to be honest, knowing the minimum will give you some success but also your fair share of failures.

For most people, who have attended some courses, or read enough and try to execute to learn along the way, their competency lies somewhere close to the start of intermediate.

The problem is to have consistent results, dividend investing requires you to progress somewhere closer to being advanced.

The novice and don’t know anything wealth builder would think that to achieve sustained success, the minimal competency is not that high. The wealth builder that is closer to advance would feel the opposite, that he still has not reached the minimal competency.

Compared to Property Investing, to gain sustained success, the competency require are relatively lower. This is also matched closer by the availability of resources and how relatable property investing is in the region.

Thus more people view property investing as a much better wealth machine compared to investing in dividend stocks.

2. Time & Effort to Learn and Execute the Investment Strategy Over Time

If you want to achieve sustained success, you need systems and processes, not to mention the time to gain knowledge and wisdom, and execution.

Different wealth machines will have different levels of time & effort.

In my example of dividend investing, it seems like it is a second job for me. There is much recurring effort on a nightly, weekly basis.

In comparison, if you hold a passive portfolio of index ETF, contribute to them quarterly, and rebalance them annually, the time and effort spent is much less.

You still need a recurring education effort though!

3. Returns per Unit Effort

Each type of wealth machine will have its own characteristics and potential to build wealth at different rates of return. Your speed of compounding will depend on not just the rate of return of your wealth machine BUT also your effectiveness in being competent, having wisdom and generally steering your wealth machine well.

The above figure shows the potential rate of return of some different wealth machines, and their potential rate to accumulate $500,000 in wealth starting at age 25.

It shows that you can choose particular low return wealth machines, but you would have to live with the expected pace of when you will achieve that level of wealth.

The novice and the don’t know anything wealth builder will go for the wealth machine with the greatest returns that he or she could understand.

#1 and #2 already gives us an idea some wealth machine requires a minimum level of competency and time & effort.

Some returns might look appealing but when you factor in the effort required, the returns might pale versus another wealth machine.

The best contrast here is if we compare dividend investing versus a passive portfolio of index ETF.

I would expect a total return of 8% from dividend investing versus 6% from holding a passive portfolio of index ETF, but factor in the effort, holding on a passive portfolio of index ETF might trump dividend investing.

If you are a good performer at work, and if you put in the time and effort in your job to gain the promotion and increment, you might be able to efficiently add more cash flow to your net worth, compared to if you take up dividend investing.

A wealth builder like myself, who might have found an entrepreneurial venture that will take much effort, may need to shift to a different form of wealth machine that requires less effort.

Each kind of wealth machine suit different wealth builders, at a perhaps different stage of their lives.

4. Start-up Funding Cost of the Strategy

If you look at the level of minimum competency required to have sustained success for properties, the return per unit effort and the time & effort required, property investing looks ideal.

And certainly, that is why it has been a favourite form of wealth-building for many.

The challenge for buying and holding properties is that you require a high start-up cost.

On a recurring basis, you can put $3000 per quarter into index ETF, you can buy dividend stocks with $3000 – $10,000. To purchase insurance endowment and unit trusts, you can put from $300 per month onwards.

To purchase an $800,000 2 bedroom condominium, you would require a 20% down payment, coming up to $160,000. You would have to commit to a recurring mortgage as well if the rental income does not cover some of the expenses.

5. Volatility of the Value of Your Wealth Machine

Volatility refers to the gyrations of the value of your financial assets over the different time frames, whether daily, yearly or decade.

For some wealth builders, this is a primary concern. They may require their wealth machine to have the value they require when they require.

One scenario is when a parent requires the wealth value from a wealth machine 20 years later for his child’s education.

In this case, some wealth machines, such as dividend investing, may have the probability that when the parent requires a certain amount of wealth, to fall short due to a poor market condition.

6. Cash Flow

Some wealth machine by their nature distributes cash flow. Good examples are dividends from stocks, dividends from ETFs, rental income from properties you rent out, payouts from whole life and endowments.

There is also a wealth machine, where their financial instruments mainly accumulate in value, and thus do not provide a cash flow.

For some wealth builders, they require the option to have cash flow. An example would be someone who in the next 5 years may be thinking of financial independence and would want the cash flow to pay for their expenses.

Wealth builders might have less preference for non-cash flow distributing wealth machines but when you view your wealth as a wealth machine, you can create your own cash flow.

For example, the returns of a passive portfolio of index ETF may come mostly from capital appreciation. A wealth builder could sell a portion of units equivalent to his or her annual expenses.

In this way, wealth cash flow can be generated.

However, some wealth machines are very illiquid, and would only mature at a fixed time period. Some examples are live-in property, insurance endowment.

The 5 Steps to build wealth with your Wealth Fund and Wealth Machines

So with such an explanation on wealth machines how do you get started building wealth machines?

I will let you know the steps here.

Step 1. Put a % of your disposable income on a recurring basis into a Wealth Fund to channel to your Wealth Machine(s)

To build wealth with wealth machine(s), you need to put money periodically into wealth machines.

What I would recommend is to build up a Wealth Fund.

A wealth fund is a way for you to compartmentalize your money that is meant specifically for building wealth. You are not going to use it for all your expenses.

It is

- meant to invest

- for the earned cash flows to be deposited here,

- and this is where your Wealth Cash Flow will flow out to your expense account.

What I do is I designate a physical account in a bank for this purpose. You can have more than one account as your Wealth Fund, just be clear about what these 2 or more accounts are for.

You need to make a commitment to put a portion of what you earned on a recurring basis into your wealth fund. I suggest you think well, whether you have other saving goals in mind. If some of this money is for something within 5 to 10 years, perhaps do not include it here.

The diagram above shows how I would compartmentalize my wealth fund in a bank account 2, how this wealth fund funds 2 wealth machines, and how the earned cash flow in dividends, interest and realized returns goes back to the wealth fund.

When you are paid to your salary account (Bank Account 1), do a scheduled automated transfer to your Wealth Fund (Bank Account 2). You can take reference from this article on scheduled automated transfers for banks.

What you have achieved here is that you have your first wealth machine, which is a wealth machine centred on low bank deposits. It grows, purely by how much you put in recurring from your job.

If you follow my wealthy formula and focus on increasing the gap of earning more and spending less, this wealth machine will grow as well!

Step 2. Fund your Wealth Machine

Depending on which is your chosen wealth machine, you will need to fund it. In the figure in the previous point, the person chose to invest in stocks and unit trusts and since he needs to purchase the stocks and unit trusts, he funds these 2 wealth machines with the money from the wealth fund.

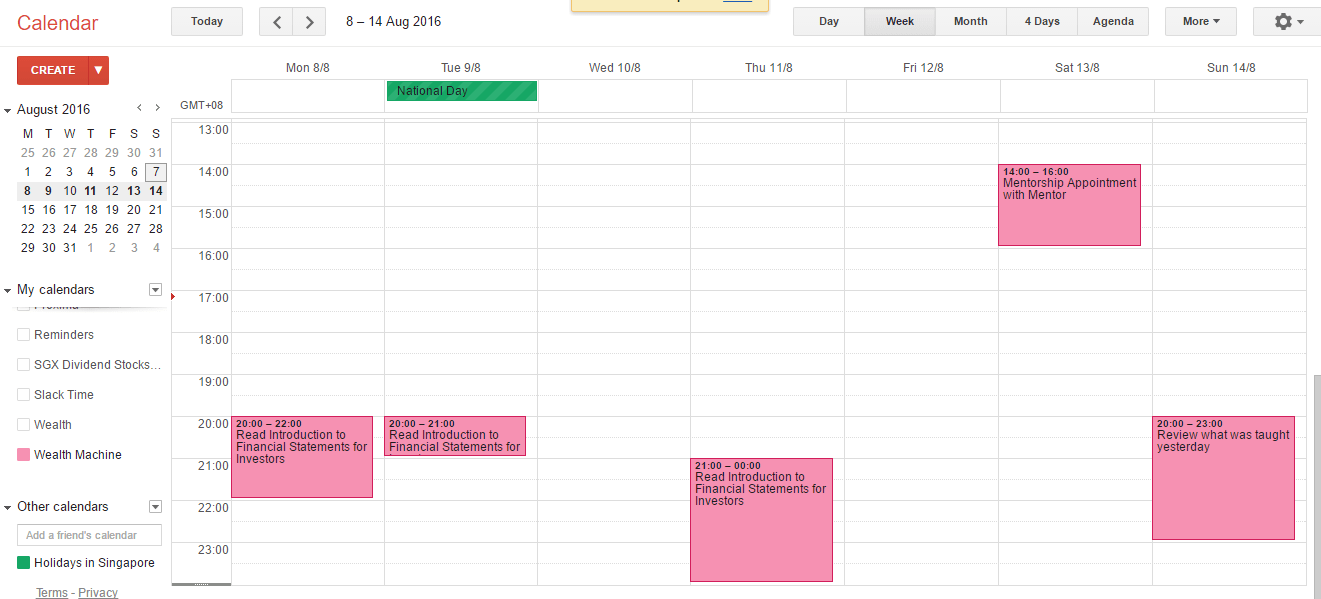

Step 3. Manage your Wealth Machine like a Job: Allocated Time and Build up Competency

By now, you would have known I repeated this many times.

If you do not have an adequate level of facts, knowledge and wisdom, you cannot build sustained wealth.

For that to happen, be a very productive person.

Build your first system which is to follow your calendar diligently.

(Click to view larger image)

Many people do not make use of their calendar but you can use it on a very simple level.

Make an appointment with yourself. If you do not prioritize this, wealth will not come to you. In the example above, 2 hour periods and 1 hour periods are blocked out to focus on reading and attending a mentorship program.

Your objective here is:

- create a system to facilitate you to build wealth over the long term. Treat this as an experiment to find out whether you have the time & effort for some more time intensive wealth machines

- start building knowledge and competency on wealth building

To acquire knowledge on how to invest, make time for yourself to “fine-tune” and construct your wealth machine.

Here are some methods:

- Talking to people who are experienced: I list this as the first item, because, when you are starting you have no idea which wealth building method suits you. It will be better to talk to someone who have a good view in this area. What you want to achieve is to get the most no bullshit perspective of a certain form of wealth building. This gives you an idea which rabbit hole you should jump through

- Read: Go to the library, buying a book, read a series of articles on investing. I gain most of my knowledge and facts on wealth building through free articles from great authorities in this field. Note: it is more common to read, but this includes watching videos and listening to audio books which are very popular nowadays.

- Attend a course: This is an upfront investment, if you do not have the time, and would like to speed up your knowledge acquisition. I must warn you that, not all courses takes you to the level of competency you think you will achieve. If you don’t block out time daily, or weekly to attend to your wealth machine, all this will be for nothing.

- Find a mentor: Getting a mentor is somewhat like attending a course, or a tuition class where you have an experience person guiding you on what to do, making sure you do your homework when it comes to investing, answer your queries to make you better. When your mentor is good and experience, watching him or her work, allows you to speed up your competency build up and iron out the most silly novice mistakes. It also gives you an opportunity to validate what you have been doing.

I share more tips on acquiring knowledge and wisdom on investing here:

- #2 Key Ingredient to Wealth: Acquiring Wealth Knowledge and Wisdom

- Understanding Wisdom in Wealth Building. Why the need to Build Wealth Wisely

- Why You NEED to Understand Other Wealth Topics, Wealth Machines

Step 4. Put cash flows from Wealth Machine back into your Wealth Machine to compound wealth

Whatever you sell off your unit trusts, stocks, the money stays in your Wealth Machines or they flow back into your Wealth Fund. If your stocks distribute dividend income, your unit trust distributes income, they are designated to flow to your Wealth Fund.

In this way, your wealth does not exit the cycle.

By following these 3 steps on a high level, you can let the wealth accumulate.

Step 5. Continue to build Systems and Processes

When you work in operations, we live by our standard operating procedures. These could be machine instructions or processes that came up from the team as a whole.

These processes and systems make us disciplined. It is this discipline that gives us results.

In wealth building, it is no different.

Over time you will need to come up with your little system:

- Come up with a way to block out time to focus on your wealth machine (the calendar before?)

- Check prices and trends

- Update trading records

- Checklist for prospecting business to ensure you have a minimal level of detail on business you are prospecting

Keeping track of your Various Money Accounts in a Spreadsheet

Here is one system that I have.

One tip that I have is to use a spreadsheet to add up the accounts so that you can at a glance see the value of your Wealth Fund and Machine.

You can come up with one or use a blueprint of my Google Spreadsheet here. Schedule one day per month (typically your budgeting day, or the day you update your interest income, dividend, rental income) to update the values of various wealth accounts.

During that time archive last month’s total value so that you can reference in the future.

It is also a way to make wealth-building a little bit interesting and motivating to see your Wealth grow over time.

A process for learning and continuous tweaking of your wealth machine

Systems and processes need not be very complicated.

This flow chart, it frames your mind to what you must do when you come across a piece of useful learning materials. Does it affect your current system, if it does, tweak your current wealth machine and see its results?

Then reflect if your wealth machine comes better as a result of this.

There May Be Certain Times When You Need to Replace a Wealth Machine with Another if the Current One Does Not Suit You or When Your Life Situation Changes.

Looking at your wealth-building method as machines allows you to comfortably understand that your machines are to generate an end product that you desire.

At times, you will:

- realize that certain instruments are scams

- certain wealth machines take up too much of your productive time versus what you can spend generating additional income

- certain way of selecting instruments in your wealth machines do not work very well

When a machine does not work very well, you replace the cog within the machine, or that it does not measure up to what you envisioned when you started this method, you replace that wealth machine with another.

The result may be better or worse, but looking at it in this way, you diligently focus on the goals you set out for your wealth and not lament that all is over just because you failed with a certain wealth machine.

The layer of Wealth Fund and Wealth Machines will always be around. Reflect on whether you need to improve or replace your Wealth Machines.

Should you have More Wealth Machines?

In my example, I probably have one main one. However, at times, I do experiment with different wealth machines and I realize that I may not have built up adequate competency and that the reward per effort is higher in the main one.

The friends who I am acquainted with tends to have a few different systems of building wealth:

- A short term trading system and a long term dividend asset system

- Fixed deposit based wealth machine, Insurance endowment wealth machine and Unit trust based wealth machine

To be fair, your wealth machine is a system of building wealth, and it depends on how you articulate it and how you understand it. In my case, it is a rather high level, but here in these examples, I simplify to make understanding easier.

Having more of these wealth machines:

- More time & effort

- More competency & skills build up required

- Capital is diversified

Whether each of your wealth machines effectiveness scale with these 3 would depend on how you do it..

Personally, I felt it’s better for most to learn 1 or 2 and then consider more once you have established competency. It is better to be competent in 1 or 2 disciplines rather than be good in a few and not able to effectively build your wealth, yet expand a lot of needless efforts.

Summary

When we can visualize on a high level how our wealth can be built, it makes it easier to plug in the right modules so as to get started, plug holes in the way you are currently building your wealth:

- You may wonder how sizable of a wealth fund and wealth machines are required to be financially secured, is it $1 million, $600k or $500k? You may find the answer in this article here, and you realize that you have to build up competency in a higher return wealth machine to reach that goal earlier. This would need some changes in your life as well

- Perhaps you are feeling less than motivated because it seems like putting into fixed deposits are getting you nowhere. The reason could be the cash inflows from the interest income are small yet they are immediately spent. Such a situation can be easily plugged by using separate accounts

- You may realize that you have not defined your wealth machine that well, and that you are trying to do it in a haphazard manner. You may be jumping around in a few different kind of wealth machines. Perhaps it is time to be good at one before moving on to another

The main takeaway I hope everyone would have is that how you go about building wealth is important, but only a part of an overall wealth building system.

It is important to develop that framework in your mind, and to galvanize the idea that be it whether you are successful or not, whether there are problems with a wealth machine, the overall wealth system will still need to be around, to be maintained for a change or addition on how you are going to build wealth.

Once you have reflected and figured out how to set this framework up in your wealth system, you can then move on to ‘plug and play’ which wealth machine that fits what you are looking for.

Here are some Wealth Machines that I will be profiling one by one to accumulate over time:

An Alternative Wealth Machine: Non-performing Mortgage-Backed Notes >>

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Koala

Friday 12th of January 2024

Dear Kyith

Great and insightful read!

You mentioned in this article that dividend investing is one of your wealth machine.

Given almost a decade later (this year being 2024), has this wealth machine been tweaked/changed or have you added on new wealth machines?

Can you share the rationale behind any tweaking/changes/additions (if you're willing, of course)?

Curious to hear your thoughts on this.

Thanks.

Koala

Sunday 28th of January 2024

Dear Kyith

Thanks for the sharing!

When you mentioned that you get "more unsure about the returns despite seeing more data on past and future returns", are you referring to being more unsure about your previous dividend investing wealth machine hence the decision to pivot away from it, coupled with your current lifestyle? Which is the "bigger" determinant behind your decision to pivot?

Perhaps allow me to elaborate why I am curious to know about the thought process behind someone's selection (or pivoting away/to) of wealth machine(s).

I am myself at somewhat of a "crossroad" between a dividend investing vs growth investing. Bloggers such as AK has shown how successful they can get with this approach, while others such as 1M56's Mr Loo extols the benefits of growth investing. I would say both approaches have their respective advantages.

My current portfolio is a "chapalang" mix of SGX holdings (i.e. dividend) and LSE-listed accumulating ETFs (i.e. growth), and I am trying to reconcile internally as to which is a better wealth machine to pursue for the next 20-30 years.

PS: Haha nope, I am not the Koala from the 1M65 Tele group. :)

Kyith

Monday 15th of January 2024

hi Koala, I am not sure if you are the same Koala in 1M65 group but thank you for reading my article.

Wealth machines are machines only when we understand how it works, and we have some experience with it so that we have a degree of confidence that we can get the returns we need with it. I think I can consider using dividend investing as a wealth machine when I turned 30 and until I am almost 39 years old. One of the reasons why I decide to pivot was due to my understanding about what is needed to operate that wealth machine well. It requires effort to be an active portfolio manager essentially which is less compatible with my life currently.

Curently, my portfolio is based on a more strategic, systematic portfolio concept. Strategic means that I don't intend to be too tactical over it. I maintain an allocation and I don't shift from it too much. Perhaps the only shift will be between the equity and bond allocation. Systematic aligns to my investment philosophy that returns come about by taking risks that can be compensated. There are empirical research that shows we get better returns by investing in equities, cheaper, more profitable companies, more illiquid companies. As a portfolio manager, we have our own process of screening for stocks that fit our criteria before we do deeper research further before deciding whether to buy or not. We can replace that by using a rules-based system. That is what my factor or multi-factor funds are trying to help me execute. The funds are executing in a systematic manner.

So this strategy, and systematic, low-cost portfolio can be rather passive.

As I get older, I get more unsure about the returns despite seeing more data on past and future returns.

But I feel that this is the first time I have a more passive wealth machine.

Let me know if you require me to further elaborate.

Truong Nguyen

Thursday 16th of July 2020

Very informative and insightful articles. Real step-by-step action plan.

Kyith

Friday 17th of July 2020

no issue. let me know if it does not answer something

Leonard Ng

Wednesday 12th of August 2015

Nice information! I like your previous blog posts on the analysis of the companies that you are vested in. Hope to read more of your analysis articles in future!

Kyith

Thursday 13th of August 2015

Hi Leonard,

Been sometime since I wrote something like this. Hopefully I will write some. A lot of the times I don't want to trigger folks herding like some other bloggers do.

Cheers