In this years National Day Rally, the prime minister focus on a few broad subjects that are closed to the people’s heard. Cost of living, housing, utility prices.

This becomes more like a session to provide justification for why they do things this way and answer to our most pressing concerns.

These are also some topics that affects us more, and not important topics that affects us indirectly.

Whenever this happens, I have a feeling we might be close to an election in 2019.

With that said, I would like to focus on a topic that I have think about in the past (not that I am very very concern with) which is what are their solution to get out of this expiring HDB lease situation.

To recap here are the information pertaining to HDB property announced during and after the National Day Rally (NDR):

- Introduce Voluntary Early Redevelopment Scheme (VERS) for flats that reach about 70 years old. This is something like the existing Selective En Bloc Redevelopment Scheme (SERS) but that not all flats can be eligible for SERS as not all have high redevelopment potential. This would allow them to redevelop old towns over 20 to 30 years. The government will compensate residents whose flats are taken early and also help them live in other flats. Terms are less generous than SERS with less financial upside. residents will have to vote for VERS

- HDB flats can expect to be upgraded twice under the expanded Home Improvement Programme (HIP). All flats will be upgraded when they reach 30 years and 60-70 years. Previously only the 30 years upgrade exists. The government pays up 95% of the upgrading cost, the residents would just pay a few hundred dollars. PM Lee said the first round of upgrade will make the flat serviceable for 30-40 years more, so it will be just right for the second HIP

- Previously the Lease Buyback Scheme is restricted to those living in four room and smaller. Mr Lawrence Wong said this will extend to all types of HDB flats. Current take up rate is low. Proceeds received average about $146,000.

- Mr Lawrence Wong said the ministry is looking to improve the liquidity resale market for the older flats. Currently if your age + remaining lease on the flat is greater than 80, then you can use CPF to finance your flat. If your flat is less than 30 years, you cannot use CPF to purchase. This pose a problem for Singaporeans with little savings

There are not much quantitative numbers provides but that is understandable since it is to rally our morale, make us excited for a short while. It is short on implementation details and that may come later.

These proposed initiatives are to address some major problems that they have help manifest over the years:

- The people thinks their HDB flat is freehold, and would appreciate in value over the long run

- Due to #1, and due to rising income, citizens felt is OK to purchase a home at a good location because the value will always go up, its a good investment, and overall a good place to stay

- The past prime ministers, at certain times have emphasis that our home is an important part of our identity and is an appreciating asset

- In recent years, the narrative shifts more towards that when the HDB lease expire, it gets revert to the authority

- People who have invested their heart and sweat in their HDB over the years faced the uncertainty that they are holding on to a depreciating asset, and would struggle to monetize it to fund their retirement

- There is a serious herd mentality for #1 to #2, and there are much vested interest in this issue

- #6 will affect not just the people but the peoples trust in the government’s ability to do things. And this is important to address ahead of the next election

If I were to further summarize this, it is to address the question of : can they assure the people they are not holding on to a depreciating asset?

From my initial thought process and the numbers that I see, it seems that their plan for VERS solves this question pretty well. However, I question whether the actual execution would work very well.

The short summary is that VERS will allow the HDB owner to sell their flat before the HDB flat starts depreciating. They have also provided an alternative to the issue of the low demand for old HDB flats.

However, I feel that most people are not able to gauge the value of the asset they have, and have wildly different expectations of what is acceptable. Some folks hold sentimental value to the place. This makes successful VERS challenging. Which would ultimately not work out well.

What I am interested in is to take a look at the valuation aspect, or the numbers part of this.

In this article, I will go on to explain:

- The speed of deterioration of the value of your leasehold HDB

- How the deterioration and growth will counteract each other, and where the depreciation will outweigh the growth

- Discussing the compounded growth rate of HDB flats

- Would government buy back at an attractive price, and if you reject that proposition, do you have good alternatives?

To start with, in order for us to see why buying back from the people at around 70 years is the right time, we have to understand about land lease depreciation versus a freehold land.

Bala Says 70 to 80 years is the Sweet Spot Before Things Goes to Shit

And to do that we firstly need to understand the leasehold table Bala allegedly created.

Who is Bala?

I have no idea. It seems an employee in the government last time that works for the land authority in Singapore. It is named after him.

Singapore Land Authority (SLA) publishes a Leasehold Table. This Table, often refers to as Bala’s Table, shows the value of a parcel of land with different lease terms remaining, as a percentage of its value assuming it were freehold.

Basically this is a discounted values table, which tells us that the $1 today is much more valuable than the $1 99 years later. It shows that lease depreciation is not straight line.

This was originally an internal SLA document, until it was leaked, where property players can use it to form their own valuation estimates. In 2000, SLA wanted to encourage the optimization of land use, to facilitate the redevelopment of Singapore. So they release this table.

This table can be useful to property players, but also stock investors. It enables us to see for example, if you have a 100,000 sq ft property with 25 year land lease and you wish to top up to 80 years or freehold, how much additional charges you need to pay.

It also gives us the basis of the cost of converting a leasehold to freehold.

The Bala Leasehold Table, in this case, lets us know how fast our HDB lease could depreciate.

The table above is the Bala Table. You can see the amount of lease left for the leasehold, and the corresponding percentage of freehold, this leasehold property is worth.

Suppose you have an equivalent freehold HDB flat (we know freehold HDB doesn’t exist but hypothetically) that is worth $400,000. Next to it, there is a exactly similar leasehold HDB flat. If the flat has 99 year lease left, this leasehold HDB flat would be worth 96% of the freehold flat or $400,000 x 0.96 = $384,000.

If the flat has :

- 80 year lease left, it is worth 91% or $364,000

- 60 year lease left, it is worth 80% or $320,000

- 40 year lease left, it is worth 68.5% or $274,000

- 20 year lease left, it is worth 48% or $192,000

- 10 year lease left, it is worth 30% or $120,000

- 5 year lease left, it is worth 17.1% or $68,400

You will notice that the drop in value is uneven.

The table above lets you see the speed of the depreciation of the HDB Lease. This applies to your private property as well. Each point shows the speed of depreciation.

If your property have 80 years left, where the year of leasehold is less than 20, the year on year change is less than 0.74%. If you have 40 years left, or the year of leasehold is 60 years, the year on year change is less than 1%. After 60 years you can start seeing the drop off accelerate. After 80 years, the acceleration becomes crazier.

If you bought your HDB Flat for $400,000 and the Freehold Growth Rate is 3%, How does the Leasehold HDB Flat Value Change over the 99 Years?

We establish that the speed of depreciation start off slow but accelerate near the end of the lease.

But how do we factor in growth, economic progress and replacement value? Overtime, due to inflation, demand and supply and economic growth, the HDB should appreciate in value.

If the flat is freehold, where the government upholds the freehold nature of the title deed, the value of the property could theoretically grow at a compounded average growth rate (CAGR) of X% per year.

However, because we establish that for leasehold, the value goes down over time, versus a freehold, the growth and depreciation will counter each other. What is the end result?

Let us take a look at an example.

Suppose you just bought a 4 room HDB flat for $400,000. Economic progress, inflation, deflation goes up and down, but overtime, the CAGR of a typical equivalent freehold is 3%.

The table above shows the change in value if the HDB flat is a freehold status versus leasehold status. This is according to the bala leasehold table.

It takes 31 years for the freehold value to reach $1 mil, but it took 39 years for a similar leasehold to reach $1 mil. The value of the leasehold is always less than the freehold. that isn’t a surprise. But you realize, at some point at 80 years, the value of the leasehold starts declining.

You also notice there is a column call CAGR, The CAGR column calculates the compounded average growth rate if you sell off the leasehold property at that year, without factoring the closing costs due to the selling process.

For example, if you sell off at year 10, the CAGR you earn per year is 2.40%/yr.

The Reason for VERS Around 70 years

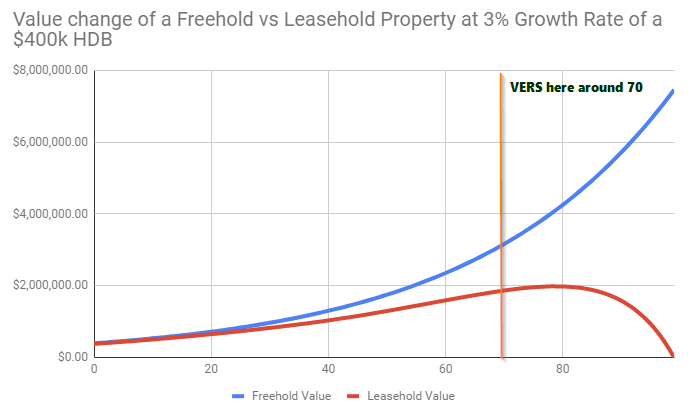

If we plot the freehold value and leasehold value in a chart, we can see why VERS is chosen at around 70 years.

If we plot the freehold value and leasehold value in a chart, we can see why VERS is chosen at around 70 years.

By giving HDB lessors the choice to vote for VERS, it allows them to sell back the HDB flat before the accelerated depreciation of the HDB lease. After 80 years, the drop off would be significant.

If the objective is to address the concern that your HDB is a depreciating asset, selling back at around 70 years would enable them to sell off right before the point where the depreciation beat out the property growth.

In this case, their HDB will always be seen as an appreciating asset.

Maximizing your Growth…. And is it an Impressive Growth?

While its damn impressive to see your flat grow from $400,000 to $1,900,000, you probably won’t enjoy much of it when you are 110 years old.

You only have one life.

If we were to be objective, let us plot the CAGR if we sell it in X year over time.

The table above shows the CAGR if you sell off from year 0 to year 99. If the CAGR for the freehold is consistently 3%, what you can get for the leasehold is in theory less than 3%.

The peak is at year 20 with 2.49%/yr. After that the CAGR starts dropping off as you take longer to sell off. If you sell off too soon, your HDB might not have reach the highest point.

Of course, this assumes a constant growth rate. In reality this is not going to happen, property market moves in cycles and so there will be opportunities for you to do better, but also to do worse.

These are unleverage returns, so by leveraging up, your mileage might vary.

Why Do I believe in a 3% CAGR?

Granted in the hey days of high property growth, we can see the 5 to 7 year CAGR to be 5%/yr or 7%/yr on average. (You can view the Landed, non Landed and HDB data here)

It is not what I believe but what the narrative says.

In his speech, Prime Minister Less stress that what they are focusing on is to ensure that housing is affordable for the people.

In the newspaper these 2 years, we are seeing a lot of the narrative talking about your HDB lease will expire. You should not deplete your CPF for housing and must think about your retirement.

When the developers secured en bloc land parcels, and the property market were in an early stage of the property recovery, the government put in more additional buyer’s stamp duty, higher down payment. This immediately halted the initial recovery in the property market. Why? Since 2013, they are still engineering a rather low growth property scenario.

Recently, Temasek pushed for unique structured bond products such as the Astrea IV bond for risk adverse people to invest in. the narrative is to have a varied types of investment products that the people in this country can rely upon to build wealth.

All this seem to point to a general narrative that the home is a place for you to live. If you do well and wish to build wealth, go to other things.

If we are to believe, the government have the demand and the supply tools to enable the property market to be high growth or to be anemic. Which would way would they want it to go? Its anyone’s guess but my bet is that the current narrative leans closer to the populist view that HDB flat has to be affordable for the people.

But at the same time they have to fix yesterday years problem.

Another aspect are the other data that flirted pretty close to this rate.

From 1962 to 2016 the inflation rate in Singapore is about 2.68%. For the past 20 years it has been below 2%. In the long run, if you wish for the home prices to be affordable, it should flirt closer to the inflation rate.

While it is not known what is the discount rate, or the opportunity cost of inflation used in the original Bala Leasehold table, many have reverse engineered and say its closer to 3.5%. To get a discount rate of 3.5%, you are expecting that the stream of cash flow that you can generate from the land grows at a rate that is closed to this discount rate but less.

In 2013, when MAS set about the interest rate stress test in their calculation of the Total Debt Servicing Ratio (TDSR), the rate that they used for interest rate was 3.5%, which should be what they assume to be the long term (10 years) government bond rate.

While it may be 3%, or 3.5%, I think that if they are intervening with this recent narrative, HDB is a segment of property they do not with the growth rate to go out of wack with inflation, long term interest rate cost of borrowing and GDP growth rate.

To be fair as a counter point, the GDP Annual Growth Rate in Singapore averaged 6.65% from 1976 until 2018.

Could there be more than 1 CAGR?

It should be noted that my valuation is based on the future value of the leasehold going forward.

What the government chooses to buy back at, is anyone guess.

There is likely to be a small incentive premium to it.

But my hypothesis is that it should not veer far from their current valuation metrics.

However, the CAGR could vary a fair bit due to the changing demand and supply.

There can of course be different CAGR.

There will be older estates like Toa Payoh that is popular due to its proximity to town. There is a legitimate justifiable organic growth to the prices of such places. So we can see areas where the CAGR is higher.

However, my take is also that since, today, we know these places are in demand, so you are already paying a premium for flats in this estate. The CAGR for these in demand estate might remain similar to other housing estates, but because you paid more for it initially, it gives you that feeling that you actually gain more out of this due to the better location.

Would the Government Buyback the HDB Flats at a High Valuation?

From Prime Minister’s speech, their idea is that this buyback is going to be costly, and it will not be as lucrative as SERS as these buyback are not going to be resold to private redevelopment at good prices.

The term he is using is that there will be “less financial upside”.

“People are going to decline if they feel that the pricing isn’t attractive enough or they feel that if they accepted the price, they don’t have the financial ability to find another place,”

“There’s always this issue whether people feel they can find an appropriate replacement.” – Singapore University of Social Sciences (SUSS) Associate Professor of Economics Walter Theseira.

If there is little financial upside, the conservative way to look at it, would be to ask what is the likely CAGR that we should expect the government to wish HDB flats to grow at.

Which goes back to my previous CAGR discussion.

Could You Reject this Buyback and Sell Your Older HDB Flat at the Open Market?

Technically you could.

However, the recent narrative in the newspaper have been that, now that everyone knows there is this land lease permutation (which everyone seem to discard previously), they are finding people are conscious about the land lease and the demand dropped off.

As I have explained near the top, to purchase flats with 25 year of lease left, you cannot use your CPF anymore. With such a short lease, I wonder would banks be willing to lend at a reasonable rate.

Currently, for a lot of people, they are asset rich and cash poor.

On top of that, for older flats, in older estates, there is an ambience that may not be what younger dwellers are looking for. There might be a valid utility for estates that are closer to strategic working locations as the proximity to work place will override the ambience.

There are also some individuals that would not live in a second hand places. I wonder how prevalent that is.

It will be a niche group of people who would demand, and yet capable of buying these old HDB flat with short lease.

If we look at the supply side, if a lot of your neighbors are rejecting VERS, that means there are a lot of available supply in the market.

If you have constrained demand, and a lot of people supplying because they wish to sell of their old flats, would the price be higher than that of what the VERS can provide?

The price the government offered by the VERS may act as a reference point, or a price ceiling what people are willing to pay for when purchasing a flat.

For those who are Unwilling to Move: Home Improvement Plan II

While it was not spell out explicitly, I find it rather strange that the government announced the home improvement plan II to be around 70 years, which is close to the age that they would wish to VERS the HDB flats.

I would think if you do it 10 years before VERS, where the owners can improve the estate, the estate looks better, it will improve the aesthetic attractiveness and make VERS more possible.

This gives us the idea that the government thinks of it as:

- I could subsidize you by improving where you wish to spend the rest of your life by building a better estate

- I could subsidize you by helping you liquidate at a low CAGR

But I won’t do both.

However, I feel that this home improvement plan might prove pivotal if we consider how many people would opt for it.

Would VERS Create a More Divisive Community?

Through the En Bloc experiences we read for those successful and unsuccessful En Bloc, we can see that there are people who are motivated by the monetary gains. There are also folks who loved their neighbors and their estate and would not want to move.

I do see what happen in En Bloc, happening in VERS.

There is just less financial pot of gold, so I wonder if it will be much less successful.

One thing I learn from writing about finance, and interacting with people around is that many do not know the value of what they have well.

They overestimate the value of the asset they have, or underestimate the value of the asset they have.

If you multiply this across many people, you wonder how successful this will be.

VERS Provides You with a Way to Get Out

But ultimately it is their way, as with many things to push the responsibility of your future into your hands.

Having freedom of choice is good

- You can choose to sell

- You can choose to rent if your place is close to important work locations that is in demand

- You could choose the Lease Buyback route

- You could choose VERS

But ultimately you live with the consequences and not them.

You will Still Need a Place to Stay – So It seems its a Little Zero Sum

At the end of the day, the government wishes to realign to the idea that HDB is meant firstly for staying to form your family nucleus.

If you manage to liquidate your old HDB flat, it is likely that you will need to purchase another place to stay with a longer existing lease.

If you liquidate at slightly above market value, but purchase it at market value, it will not make so much difference to the wealth you can spend down.

The ways to get around this seems to be:

- Geographical Arbitrage – Sell a place that is more in demand and move to a place that is less in demand, and you can earn the difference in location premium

- Downgrade to a manageable size – Your children might have moved out, so it might make more sense to get a smaller unit. My previous article does show you have to move from Condo to 4 rooms, or 4/5 rooms to 3 rooms to earn a comfortable spread. If its a 5 to 4 room downgrade, usually there is not much difference.

- Get a subsidized BTO or Resale with grant – These are the proposals for relocating that was talked about in the national day rally

Either way, to me its a very concentrated bet always to put all your wealth in your HDB.

How would the Buy Back be Funded?

There is a question that to carry out VERS across so much estates (since a lot were built together), how would this be funded.

One obvious way is to increase the taxes to fund this.

Another plausible way is that some of these successful VERS would be sold to private developers, with the proceeds used to fund subsequent buybacks.

To relocate those people who decided to go through VERS, they might reallocate them to new BTOs, which tend to be more optimize based on home size and plot ratio.

So on a large scale you see land parcels being free up, while squeezing the existing people in much optimized spaces.

This seems a better way for the government to get a better margin compared to SERS.

Are there other points I did not consider? Share with me your thoughts? Keep it Politics Free as much as possible.

Here are My Topical Resources on:

- Building Your Wealth Foundation – It is imperative you know these stuff as early as possible, because this is the most important stuff

- Active Investing – For the active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – The Deeper stuff on REIT investing

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Sinkie

Tuesday 21st of August 2018

VERS sounds good on paper, especially without the nitty-gritty details, pricing etc.

But if you think about it, how practical is VERS??

Majority of HDB buyers don't move & stay on in their 1st timer or 2nd timer flats which they bought mostly in their 30s.

If you bought a new HDB flat when you're 30, you need to be alive at 100 just to hope to vote for VERS. Do people like to move house when they're 100 or even 80+??

So it's mainly children who inherited the old flats, and resale buyers of the old flats who will benefit from VERS. And how many children hang on & live in inherited HDB flats? I would say most sell them off after the funeral.

As for compensation, I have a feeling that the amount for a flat with 20+ years left on the lease will only be enough to buy a new replacement studio flat.

This is why for leasehold private property, owners die-die will be very motivated to enbloc by the time their property is closing in on the 40 or 50-yr mark.

desmondsph

Thursday 23rd of August 2018

Children have to sell away their parents flat they can't have 2 flats

assuming simple maths if vers happens now. 29/99 years x market value. 3 room at 350k gives u 103k. how to buy a new flat? 2rm BTO possible.

Kyith

Wednesday 22nd of August 2018

Disagree on some parts. the fact is that someone will hold on to the flat, be it the descendents or themselves. what they wish to prevent is the idea that this will go down to zero. this might address this because if you inherit the home at 20 years old, you could VERS and move to a BTO.

If they do not wish for the hdb flat to lose value, the VERS price should be the market price. i know it is unrealistic, because they are essentially buy the flat back when the lease is much shorter than the lease than runs its course.

Kai Xiang

Tuesday 21st of August 2018

"One thing I learn from writing about finance, and interacting with people around is that many do not know the value of what they have well.

They overestimate the value of the asset they have, or underestimate the value of the asset they have."

Mind elaborating more on this? any more vivid example?

Kyith

Wednesday 22nd of August 2018

Hi, in order for people to accept or reject the VERS we hope that most have a sound mind what is a reasonable deal. Unfortunately from our experience we realize that most do not have a skill of taking in all the various piece and bits of information, review it, and think this is a sound or unsound deal. thus if the amount looks damn low, they would outright reject the deal. this would frustrate those who are more rational, or those who really need the money.

Siva

Tuesday 21st of August 2018

Well thought out and analysed; appreciated! Re. Buy or Rent decision for an youngster and Sale or Rent decision for a owner. There is a rental yield or the opportunity cost of staying which is around 3%. I am not clear as to how this has been considered/ presented in your analysis.

Kyith

Wednesday 22nd of August 2018

Hi Siva, i don't think my analysis factor in that portion. That might take the topic away from what I wish to discuss. The home value should be the aggregate of future recurring rental cash flow. Which is the rent there. This is meant to stay in so its difficult for us to add in the permutation of rental yield