I have a friend who asked me about the performance of First Sentier FSSA Dividend Advantage against the Emerging Market index.

FSSA Dividend Advantage is one of the most popular funds since I started investing in 2003.

Comparing the performance of Dividend Advantage to an Emerging Market index is an apples-to-orange comparison.

That aside, here is the annualized total returns:

| Fund/Index | 1M | 3M | 1Y | 3Y | 5Y |

| iShares MSCI Emerging Market IMI Index ETF (EIMI) | 8.4% | 8.7% | 17.7% | -0.7% | 4.2% |

| FSSA Dividend Advantage | 8.0% | 8.4% | -0.4% | -4.3% | 2.9% |

I adjust the EIMI, which is a USD denominated index, to factor in SGD appreciation over the different time periods.

EIMI is doing better than the FSSA Dividend Advantage.

But there may be not much surprises because we are comparison a portfolio of Asia stocks against Emerging market stocks.

Here is the region allocation for First Sentier Dividend Advantage:

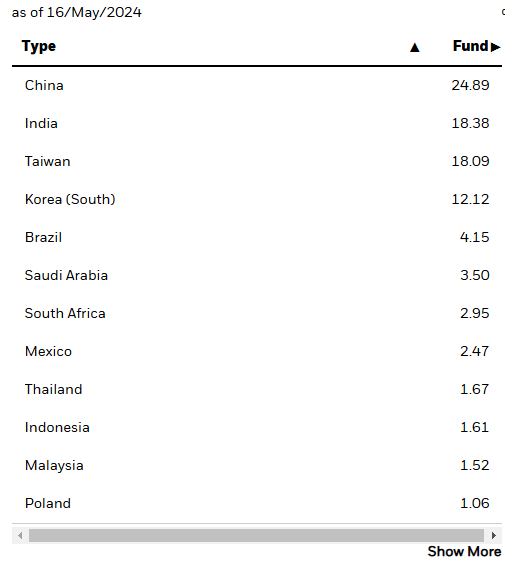

And this is EIMI:

The biggest difference is how much of South Korea, Brazil, Saudi Arabia and South Africa over Dividend Advantage’s allocation.

The funds live and die by their holdings.

We should take a look at some longer term performance, and a greater data set if we are curious about whether it is a good idea to switch to an emerging market fund.

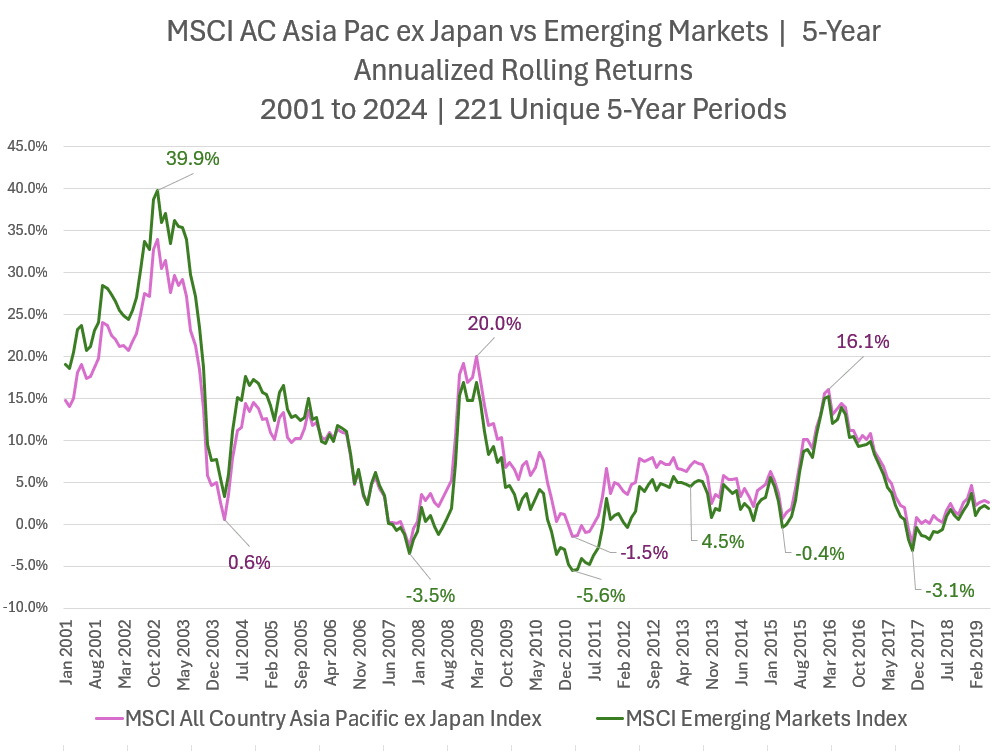

In the chart below, I collated the rolling 5-year annualized returns of the MSCI All Country Asia Pacific ex Japan index against the MSCI Emerging Market index:

We have returns data from 2001 to April 2024, which allowd us to reflect upon 221 unique 5-year returns.

Any point on this chart is an annualized return so 39.9% is the annualized return if you start investing in Oct 2002 to Sep 2006.

You may notice that the green line (Emerging markets) is consistently above the purple line (AC Asia Pacific ex Japan) if you invest before 2008 and since then, the AC Asia Pacific ex Japan have done better.

But not by much.

There are certain 5-year periods where the difference is significant enough. The five year periods starting in Jan 2010 is one. If you are in MSCI Emerging markets, your annualized return will be -5.6% p.a. but if you are in AC Asia Pacific ex Japan, it will be better at -1.5% p.a.

What can we learn from this? There are a few major countries that make up a sizable composition of both Asia Pacific ex Japan and Emerging markets and so what will separate the performance is the performance of those countries that is present in one and not in another.

Brazil and South Africa may be some of the major countries.

I leave it to my friend to make his investment decision.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.