I was listening to a podcast and it provoked a conclusion that we might not have realized easily: Majority of us are now bullish on short-term interest rates.

- If you are investing in bonds, if interest rates go up, the value of the bonds that you are holding is going to go down

- Pseudo-bonds, such as REITs, structured products based on borrowing, in large part have the same dynamics

- The stocks of solid companies have some form of PE expansion. Due to the rates, the fair PE, if we want to call it is much lower than in the past. Companies are valued based on their future cash flow discount to present. If the rates are low, they are worth more. But if rates go up…. their fair value is gonna drop by a large amount

- The majority of the growth companies’ cash flow is in the future and a lot of growth is embedded in them. If rates are low, those huge future cash flows are worth more today. But if rates go up, those huge future cash flow would be worth a lot less

If we are protecting the portfolio from losing value, we are in a situation that whichever way, we either need to

- Learn to take on pain when it corrects, and believe that what we put our money into in the long term would work out

- Wish low interest rates stay low forever

The best case scenario is for rates to go up but in a controlled pace. I am sure if the interest rate spikes, there would be volatility in various markets.

What could cause that to happen? Usually… these events occur like Covid. We are able to identify them mostly in hindsight.

When Rates are Low… There is Some Form of Leverage in the Math

Perhaps you might not be able to visualize some of the fall in equity value of growth companies, or blue chip companies, or REITs I have mentioned.

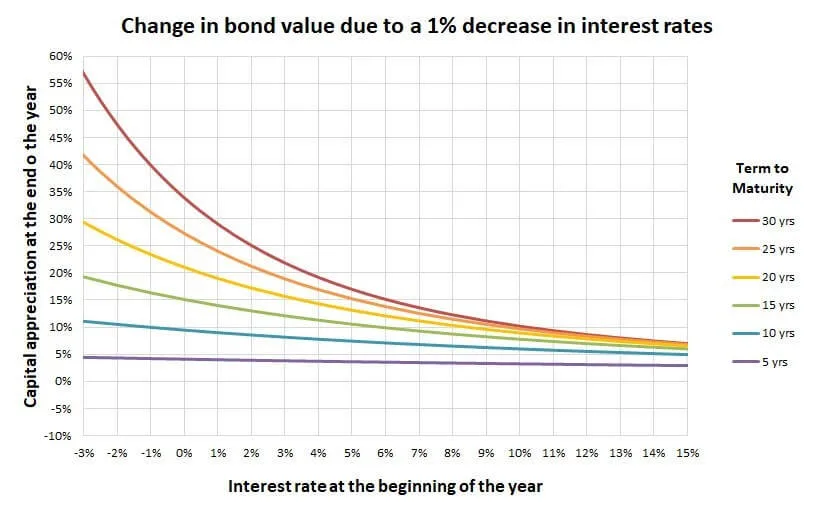

Portfolio Charts have a pretty good article that showed the difference in the move of value when rates are low, compared to when rates is high.

It is call Bond Convexity.

In this chart, the interst rate at the beginning of the year is plotted against the capital appreciation at the end of the year.

If you move the interest from 8% to 9% or 7%, for a bond with 10 year term to maturity, the value would move by roughly 10%. Those bonds with longer term to maturiy will see more variation.

But if the interst rate is not 8% but its at 1%, a move to 0% for a 25-year bond would result in a 27% appreciation in value. If it moves further down to -1%, it earns you 31%.

The opposite is also true. An interest increase for these long duration bond would result in a 31% fall in value.

That is a killer if you are a bond investor expecting your stuff to be safe (that is in your head) and yet it is so volatile.

You could appreciate why the average duration of the bonds stay at 3 to 7 years duration on average. The curve above is rather flat. This means that even if a 1% increase in rates, a bond fund with an average maturity of 7 years maturity would fall 7%.

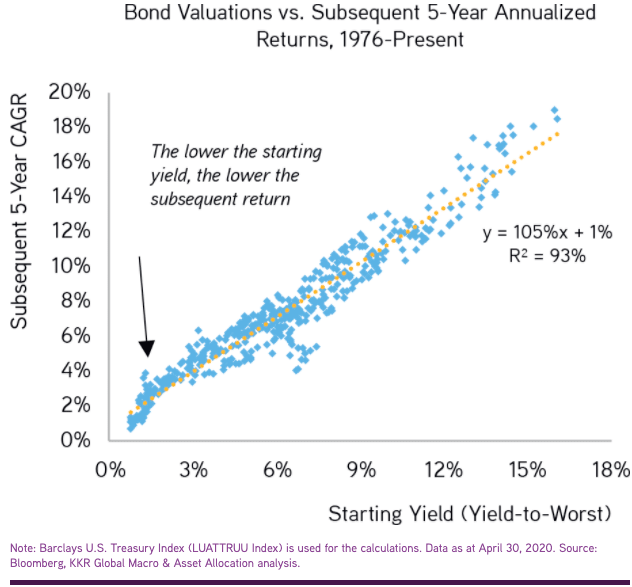

Strong Correlation between Future Bond Returns and Current Yield

There is a strong correlation between the starting yield now and the future return that you can get from bonds. This chart would probably show the relationship.

In some of my past data work on high yield and emerging market bonds, we will also observed the future returns get lower and lower. We cannot escape this relationship.

So if the starting yield now is near zero…. there is a high likelihood our future returns is going to be near zero.

Why have Bonds at All?

It was mentioned in the podcast that more and more clients in the equity funds just throw their hands up and move their money to cash.

The idea is that if the returns based on that correlation relationship is low, and the risk of draw down is high, then why play that game at all?

I think what they would missed out is that, if rates go to -2%, their portfolio will missed out on massive capital appreciation from bonds.

If they chose a safe route, they would missed out on potential returns.

If they choose to stay vested in bonds, there would be some potential downside risk.

So it is not always an easy decision.

Derisking… may cost you opportunity costs.

There is a financial planning answer to this:

- Bonds are the thing that give you positive expected return AND damp your portfolio of volatility

- When your equities are in a drawdown, taking money from the bonds gives your equity time to recover

If your goal is to build wealth for a financial goal, you should respect the role of bonds first.

But if you ask me if the expected return is so low and its to damp your portfolio of volatility, then cash also does the same purpose now!

So you cannot fault them from doing something like that.

How do We Get More Yield?

I think firstly, we got to wipe that yield thing out of your head and just focus on total return. Traditionally, a high yield is used as an indicator of value and less for its income.

For the retirees trying to reach for more yield, there would be folks touting you with solutions such as emerging market bond, high yield bond funds in the name of snazzy names.

I am not saying these are not good.

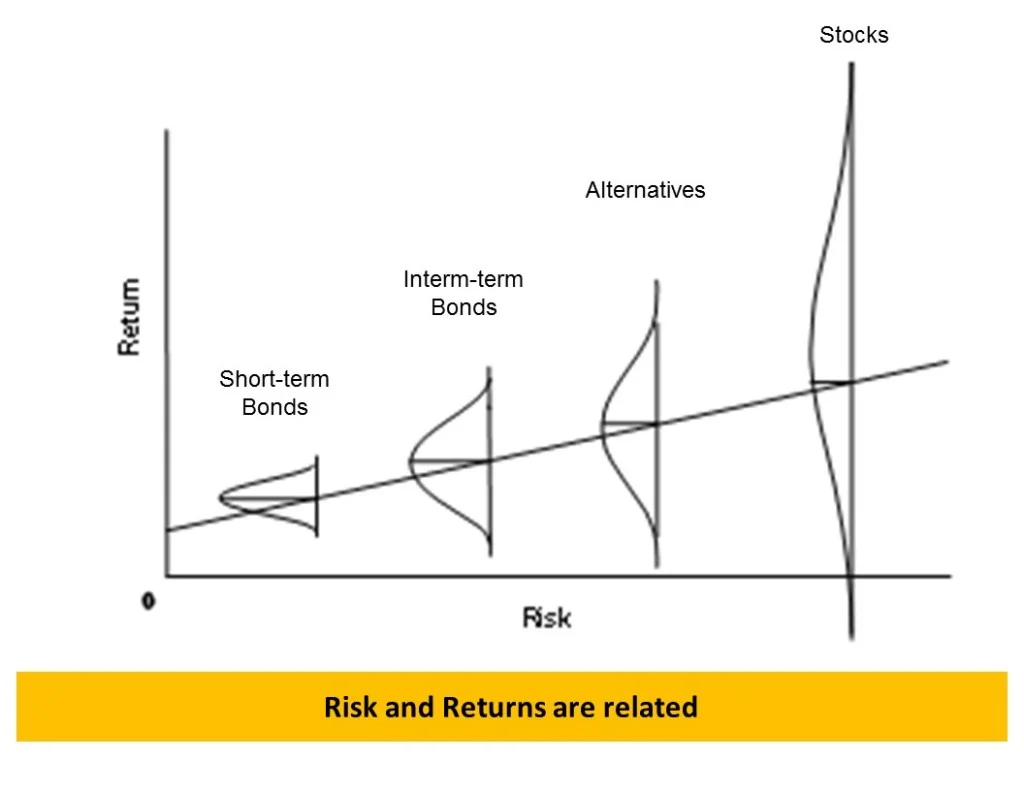

But just know what this means: You are trying to get more returns by taking more risks.

There is a reason why emerging market bonds and high yield bonds are not trading at a yield similar to AAA-rated treasury bonds.

And that is because there are some risks to it.

When you go up the risk spectrum, the range of returns you will get also widens, and potentially you would earn higher average returns.

But you are just taking more risk.

This means if your targeted return is still 7% a year, you got to take more risk. This could be having cash + more equities.

Just see it for what it is.

But Could You Take that Risk?

If you still have a targeted return of 7% a year, and you have to take more risk, the question will be is that the right approach to take?

We usually do a risk tolerance assessment of clients and that is not just a paper work kind of thing (at least for the firm that I work in).

If a client cannot accept the risk, eventually they might do the inappropriate actions that is not good for their portfolio. The assets would leave us, so it is a lose lose relationship.

I believe that each of us have a true risk tolerance. The risk tolerance that you filled in today may not reflect that true risk tolerance.

Coaching and re-programming some fallacies that you have on the markets may allow you to be closer to your true risk tolerance.

So it might allow you to shift to more risk stuff, and potentially earning higher returns.

But there are also others that even after coaching, you cannot raise their risk tolerance.

In truth, it means you have to accept lower returns because risk is lower. You could go to another firm that promises a higher return, but likely, they (and yourself) are making a bet outside your true risk tolerance that things would work out for you and you do not see downsides.

Sometimes it really pisses me off when you hear other investment managers, advisers make pitches without talking about a person’s risk tolerance.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Revhappy

Friday 6th of August 2021

Your portfolio is currently 50% cash. So based on this article is my assumption correct that you have decided to stay in cash and use it as dry powder for allocating to equities when there is a crash?

Kyith

Saturday 7th of August 2021

Hi Revhappy, I wanted to invest. but usually it ends up I am either 50% in cash or 20-30% in cash.

lim

Sunday 8th of November 2020

unfortunately I don't think investment grade bonds are currently that attractive. I had been doing DCA of LQDE and VDCP but stock as prices shot up and yields went down.

I either look for investment products with 2%+ returns (eg: Singlife account), or just refund my housing back to CPF and earn 2.5%. Furthermore while earning 2.5% in CPFOA I can use the money anytime for CPFIS investments.

Kyith

Friday 13th of November 2020

bonds nowadays are more known for their capital appreciation than for their income.