Charles SCHWAB did this annual survey with a seriously good name: 2019 Modern Wealth Survey

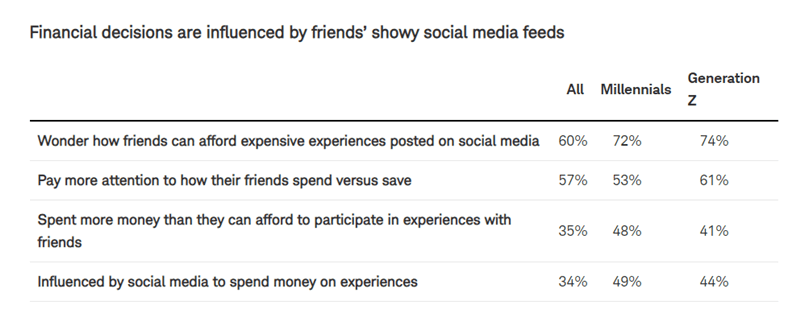

And the main highlight of the survey focus on how much Americans were influenced by what their friends shared on social media.

Respondents blame social media platforms, NOT the people as the bad influence when it comes to how they manage their money, while they put friends and family among their good influences.

Personally, I like the first one where they wonder how their friends can afford expensive experiences posted on social media. The survey zoomed in on the Millennials and Gen Z and you would think that the Gen X like ourselves would care less about our friends.

I do not think so!

I think we will wonder about very different things. We wonder how come our secondary friend who was useless in school is able to have that wonderful life now.

I think we are just curious by nature.

Which is why a lot of what we posted as title is geared to stir up your curiosity.

But I must say some ads were done to great effect and rather unfortunate that people fell for them.

Some of the most curious ones are how you can own 34 properties at a very young age and how you can sell your HDB flat and buy two condominiums. We become curious due to how hard it is to own private properties in Singapore.

According to the survey, we also pay too much attention to how much our friends spend then how much we save.

I wonder what would happen if one of your friends starts using their Instagram or Facebook to post a micro-blog on their debt pay off. They will put out an image of how much debt they have left and how much they cleared this month.

Their friends would get curious and start telling them they should not pay off their mortgage because it is a cheap loan.

Their friends might get curious how much they earn to afford them to funnel so much to mortgage payoff.

Their friends would be trying to find where the couple currently work, how long they been there and how much the folks that work at these places are paid. They would start seeing how unbelievable it is, for them to use that amount from their take home pay to pay off the loan.

And then they will start looking at their own situation and see whether that is possible for themselves. What is the math behind this.

How they can also post something similar at each debt payoff milestone.

That might be weird, but it is how we can use social media to start a different kind of movement.

In reality, this is not going to happen because, money is personal to most of us. And if you have a massive credit card debt, you do not want to embarrass yourself as someone will ask how did you get yourself into this predicament in the first place.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Teo See Hwa

Saturday 18th of May 2019

It is not how much you know, it is doing it after you know.

I can share every single step how I buy and buy, you will not know until you do it after you know.

"sell your HDB flat and buy two condominiums" is not a myth it is real, every estate agent knows how to do it but not all can do it.

"Some of the most curious ones are how you can own 34 properties at a very young age and how you can sell your HDB flat and buy two condominiums. We become curious due to how hard it is to own private properties in Singapore."

Kyith

Saturday 18th of May 2019

you don't quite make sense as usual