This post is more of a look at REITs as a general sector.

I came across an interesting part 2 post of a post on Permanent Portfolio. I will talk about part 1 perhaps sometime later. That post have enough interesting things that we should ponder about.

7 years ago, I wrote a post about exploring the permanent portfolio. And we explore whether that is the holy grail of what we are looking for in investments:

- We want a decent long term expected return

- We do not want too high of a volatility

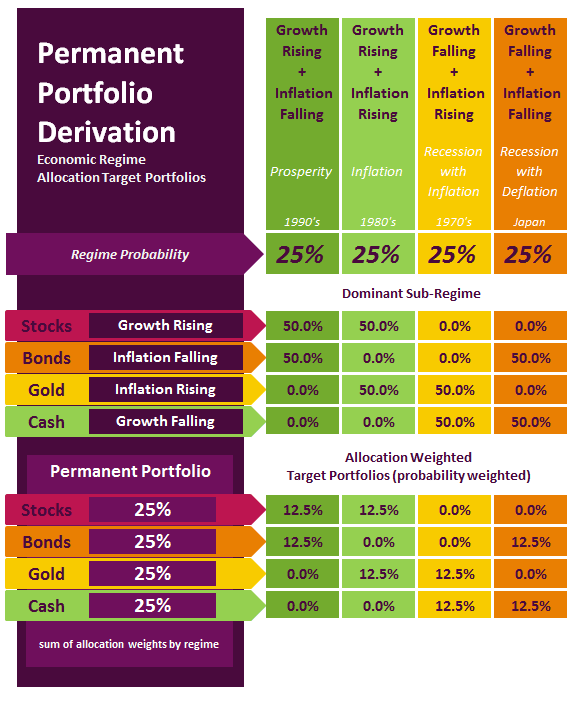

So a permanent portfolio, which is the concept of Harry Browne in the 1980, is to create a portfolio made up of

- Gold

- Cash or very short term safe instruments

- Equity

- Bonds

These 4 tend to be asset classes which are rather less correlated with each other.

The idea is that if you have 25% allocation in each of these, you can create a portfolio that would counter balance each other in different economic regimes. Browne highlighted 4 of these regimes which ranges from mild inflationary growth, stagflation, deflation, high inflationary period.

There should always be 2 asset classes that does well in each of these periods, so they counter balance those that do not do so well.

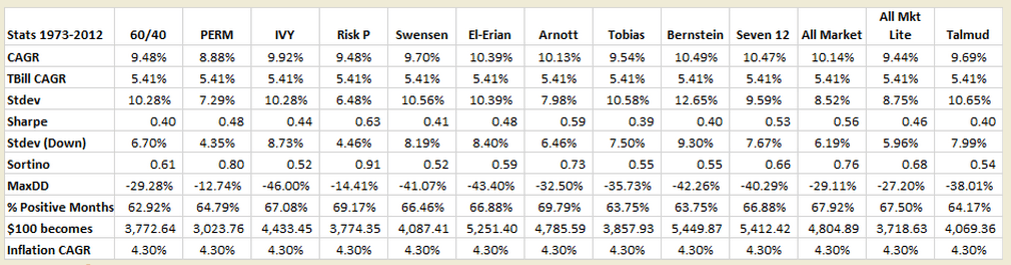

The table above shows the returns of various famous portfolio. Notice the permanent portfolio denoted by the column PERM.

What you will notice is that while the CAGR is pretty good, the max drawdown (MaxDD) is the lowest at -12%. The standard deviation is low at 4.35% as well.

In Demonetized, he thinks that the problem with the permanent portfolio is a lack of equities, and too much cash. So his portfolio is tilted towards:

- Gold

- Equities

- Bonds

Why Add REITs?

A reader thinks that the portfolio is too heavy towards gold.

And there might be a justification for it because:

- Gold does not provide a income or yield per say

- There are costs to storing gold

The author seem to agree that there are some characteristics of real estate that would make it work like gold in certain regimes:

- Real estate value tends to go up in inflationary scenario

- However, I do think that interest rates, which is a cost of securitized real estate borrowing will go up as well, counter balancing the advantage in #1

If there is one period that we should fear it is the stagflationary period in the 1970s.

From my research on retirement and financial independence, there is a few 30 year periods that resulted in the safe withdrawal rate to be 4% or less. And that is those 30 year periods that starts in 1966 to 1969.

Without these periods, I think the safe withdrawal rate can be much higher.

Real estate, was able to do pretty well during that 1970s period. But I would caution for us to conclude that just because gold and real estate did well during those period, that in a seemingly similar period next time, they would perform as well.

There are evidence that gold was able to do well then, because their valuation due to the purpose they performed, is cheap. Given another period with different permutations, and their results might be different.

This is to say there are periods in the past where inflation was high, but gold didn’t do as well.

The author decide to do 2 portfolios by adding the US REITs index.

The first portfolio halve the gold and puts it in REITs:

The second portfolio halve the US Stock Market and puts it in REITs:

The third portfolio is a pure 100% US Stock Market.

Here are the results:

You would notice that the compounded average growth (CAGR) is slightly weaker than a pure US Stock Market portfolio 3. But it should be good enough for most people.

By reducing gold, the max draw down is higher (portfolio 1 vs portfolio 2).

Replacing gold with REITs improves the return per unit risk (Sharpe ratio) and the volatility profile (Stdev).

So it seems:

- Your portfolio is less volatile

- But if there is a draw down, it might be much worse

- The long term compounded growth is not too shabby

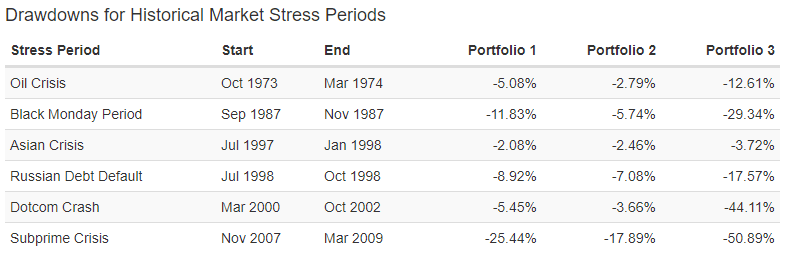

The table below shows the level of drawdowns for the three portfolios in some of the tough periods:

In most periods, the draw downs of the permanent portfolio, be it portfolio 1 or 2, was able to reduce the draw down to a manageable level.

We notice that the draw down for portfolio 1 is usually greater than portfolio 2.

Subprime crisis, is also a crisis of the equity market, real estate market, and the credit market.

Portfolio 1 has less gold than portfolio 2, and we can see that the draw down is larger without gold.

Why are Volatility and Drawdowns an Issue?

Because they affect human beings. We do not like it when we lose money. We fear losing our hard earn money.

Imagine painstakingly building up $500,000 over 20 years and seeing that cut by $250,000 (see portfolio 3 in subprime and dotcom)

When we see our position in a money losing situation in the absolute sense (compared to in percentage, like losing 10 years of hard earned savings), it makes us do stupid things like pulling out the money at the absolute wrong time.

Whether it is portfolio 1 or 2, you realize that for a lot of those crisis, the draw down might be much more manageable in the behavioral sense.

If the volatility is small, but the returns are slightly lesser, you keep your mind, and your mind will tell you that this is the opportune time to add more to cheaper positions.

It is easy to brush off that you can endure a 30-50% draw down on a portfolio that is 10 times your annual savings rate, until you do it. I for one admit that I hate seeing my portfolio in a draw down state. (if you wish to see my thoughts on portfolio management, position sizing and risk management, there are a few articles on this in my active investing section)

Summary

Many investors take it that REITs is an asset class. Various research have shown that if you add REITs to the portfolio, it does not improve the returns of the portfolio, it does not improve the volatility profile of the portfolio.

It is not an asset class. An asset class has a few characteristics that would classify them as such.

REITs is a sector and should be evaluated as such.

This back testing by the author is by no means super comprehensive but it does show that there are certain periods where REITs is less correlated than equities.

But the draw downs are more fierce.

Some of the reasons is this:

- when there is a major equity drawdown, the credit market tends to switch from very lax to very cautious. Lenders become more stringent

- REITs or real estate tend to be leveraged in some ways, so if you have trouble getting refinanced, you are in trouble. You might need to sell off assets at fire-sale prices

- REITs despite people thinking it is a separate asset class, is still equities and would behave in a similar matter when investors lose general confidence and decide to sell rather than buy

Of course the credit market might not always be in a euphoric situation.

We can see less correlation in the Singapore markets recently.

Due to the increase in trade tension between USA and China, the markets have been in a wobble. However, the local REITs prices have largely been stabled.

The worse sin would possibly be to treat REITs like a bond, thinking that they are so low correlated that in an equity drawdown, the REITs would stay stagnant or counter balance. Sometimes it would, but most often if you think that way you might be in for a shock.

I write about more REIT stuff in my learning about REITs below. Do check it out.

Do Like Me on Facebook. I share some tidbits that is not on the blog post there often. You can also choose to subscribe to my content via email below.

Here are My Topical Resources on:

- Building Your Wealth Foundation – You know this baseline, your long term wealth should be pretty well managed

- Active Investing – For the active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024