Some don’t measure their investment performance because they don’t dare to face up to reality.

Some don’t measure their investment performance because they are lazy.

Some don’t measure their investment performance because they don’t know how to do it.

It is not so challenging, and I can sustainably do that.

If you wish to track your investment performance over the long term, today’s video might interest you:

You can make a copy of the FREE Google Sheet and use it to track your portfolio here.

If you don’t wish to hear the introduction, the sensible reasons to track performance, skip to 17 min. That is where the spreadsheet explanation starts.

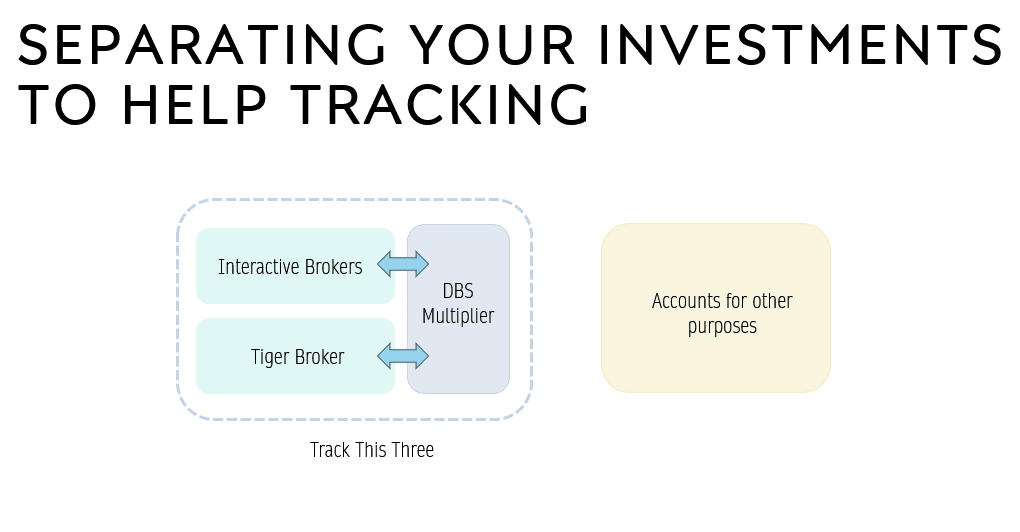

The key to easy performance tracking is being able to frame how you manage the portfolio this way:

You must look at your portfolio management as a group of securities in a few securities accounts with some cash holdings that is part of your portfolio. When you sell off some securities or get some dividend, business or rental income, the money is kept IN the portfolio and not “paid out to you”

If you can to view these securities accounts and cash as a box, then what we need to track are 3 things:

- Your inflows to the portfolio.

- The outflows from the portfolio. These can be deliberate withdrawal for certain purpose.

- The current value of the accounts in the box.

You don’t have to bother about:

- What is the buy and sell price of your securities.

- All the rights issues, preference offering or corporate actions.

- Accounting the dividends, rental income received.

You need to understand the above.

You do need to re-arrange your money such that you can have a cash account or a set of cash account that is part of the portfolio. Withdrawing from this account is an exit from this box. Adding to this account is an entry into this box.

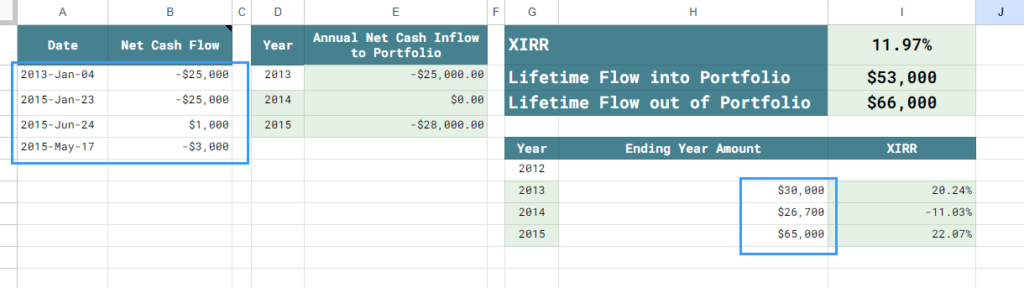

You fill in two different sections. The first is the stream of cash inflow to the portfolio (negative) and cash outflow from the portfolio (positive). The second is the ending portfolio value at the end of each year.

The spreadsheet shows the

- Net cash inflow for each year.

- XIRR or money-weighted return for each calendar year.

- Overall lifetime money-weighted return.

I am quite lazy but I do remember every year, how much I would funnel into the portfolio. I know the ending value at the end of each year.

Therefore, I can make this work.

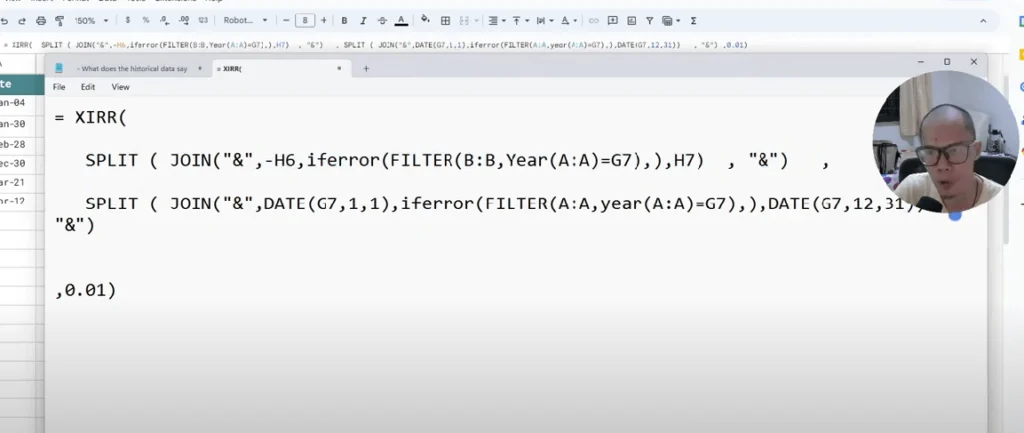

I also try my best to explain some of the weird formulas that I use to make these calculations possible.

TAKE NOTE: As far as I know, some of these split and join formulas don’t work the same way as Microsoft Excel and so this spreadsheet would not work so well in Excel.

Let me know if this spreadsheet is useful.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Edmund Ng

Sunday 7th of January 2024

Another useful and simple way is Stockscafe, dividends and current market prices + Profit & Loss + dividends are automatic calculated. Multiple portfolios can be created, eg, CPF, Int. Broker, Poems, SRS, FSMONE or by stock markets. US, HK, Spore, Msia and most countries are included. Hence, current value of portfolios is auto calculated. I used mine to track my investments and my wife & son as well.You can select and combine various portfolios to calculate your net worth. Also, another feature, how close are you, in terms of dividends covering 60,000 expenses. Well worth the subscription and with various promotions in joining or referrals to WeBull/Moo and etc, it is free. I have 4 years og free subscription.