Shortly after I wrote that we could buy Irish domiciled corporate bond ETF that has a fixed maturity half a year ago, I decided to buy a distribution class of the iBonds that will mature in 2028 to see how the dividends behave.

Although there is a dual taxation treaty between the US and Ireland, there should not be any withholding tax on dividends from government Treasury bonds.

Since ID28 or the iShares iBonds Dec 2028 Term $ Corp UCITS ETF owns a portfolio of corporate bonds instead of government bonds, I am not so sure about the underlying tax treatment.

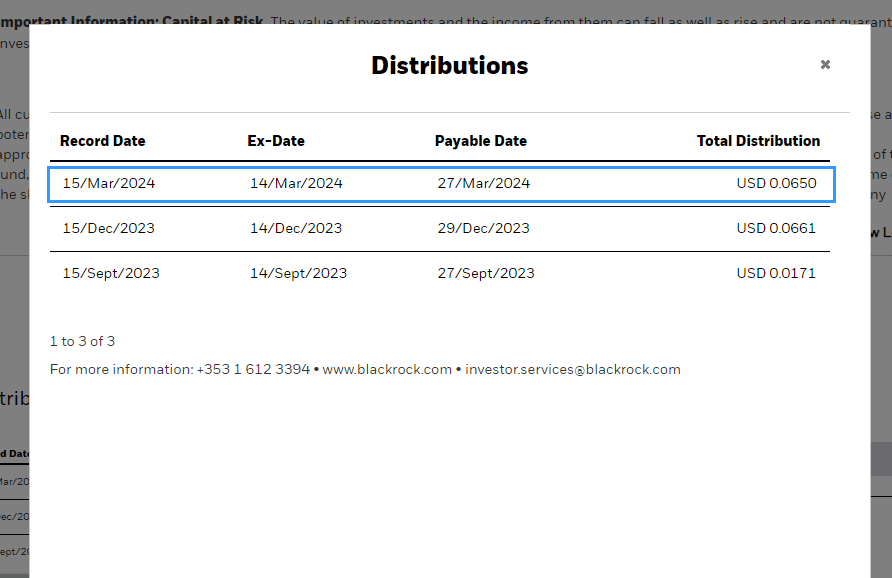

There is a recent distribution and here is further details:

Investors of ID28 should receive USD 0.065 of dividend.

Here is my IBSG statements:

There is only one entry in the withholding tax section, which is a withholding tax on another stock that I own in that brokerage account, indicating that we do not need to pay any withholding taxes at the fund level.

I took a look at the ETF annual report to see if there is any publication that indicates some form of tax leakage but I cannot find any.

Here is the income statement of 2023:

We didn’t observe any taxes paid.

If we go to number 9. Taxation, it accounts for the overseas income withholding and capital gains tax that were non-reclaimable. The table above shows the amount for various ETFs that has this.

The iBonds were not on the list. The list contains mainly equity ETFs,

So the short version is what you see in the dividend distribution of the ETF will be what you get.

In my case, I may have locked in 4.6-5.2% p.a. yield in this iBond that matured in 2028.

You can buy iShares iBond through a broker that allows you to trade on the London Stock Exchange and a popular one is my broker Interactive Brokers (link below).

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Revhappy

Wednesday 1st of May 2024

I am doing DCA into the accumulating share class of this etf. I like that fact that it is globally diversified corp bond etf and there is a multicurrency effect and it is not USD hedged.

https://www.ishares.com/uk/individual/en/products/297186/ishares-global-corp-bond-ucits-etf

lim

Tuesday 23rd of April 2024

I bought my ID28 at YTM 6.16%. My thinking is that it should be higher than Astrea 7 class B USD 6% coupon rate to give adequate risk-return (though of course Astrea 7 Yield to call (effectively the YTM) is lower than its coupon rate now).

I also presume that you bought your ID28 under $5, so if it matures at $5, you get some capital gain which increases your YTM. If you bought above $5, then you also need to factor that in.