At Investment Moats, we have profile telecom shares and list out the fundamental reasons why they make good dividend shares (read article here)

The current dividend yields of the 3 telecom are (daily yield tracked here):

- Starhub: 7.1%

- M1: 7.3%

- Singtel: 4.7%

It may seem that there is no reason to buy Singtel since the yield is 2.3% lower than the other 2.

If we are talking about

- how sustainable are the dividends

- whether there are room for dividend increase

we have to look at free cash flow.

Free Cash Flow

Free Cash Flow (FCF) (Detail explanation here) tracks how much the telco earned in hard cash for that year minus off the capital expenditure spent on investments and existing asset touch up

I find that for dividend stocks, FCF is a much better figure to use than net income because we get the dividends paid out from cash flow.

This is effectively the nutrients that gives life to a company. In the absence of this, a company has to take nutrients from other sources (debts and cash holdings) thereby depleting the company.

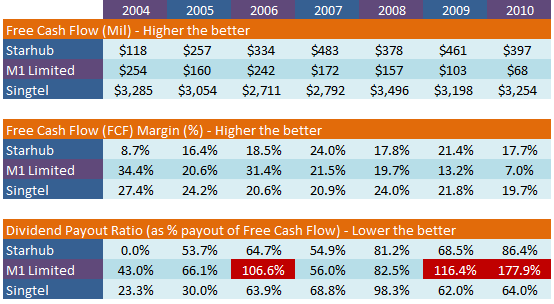

By virtue of being the larger telecom, Singtel have much higher free cash flow. It is important to see that for the past 6 years, all 3 telcoms are earning positive free cash flow.

However, Singtel is generating much better than the other 2. M1 in particular have been decling so much so that they are reaching negative free cash flow territory

The current Free Cash Flow yields for the 3 telcos are:

- Starhub: 8.22%

- M1: 3.18%

- Singtel: 6.5%

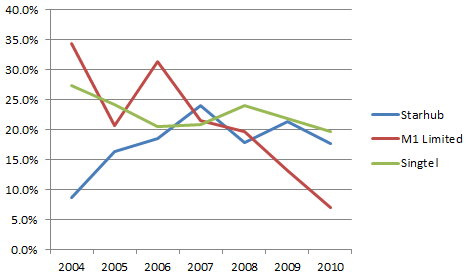

Free Cash Flow Margin

Most investors are more familiar with profit margin or gross margin. How about free cash flow margin.

This is essentially free cash flow / revenue. In other words, it measures $1 of revenue generates how much free cash flow.

Singtel have been a winner here by virtue of being able to maintain the highest FCF margin. $1 earns them $0.19 in FCF. Starhub have been doing well to stay close to Singtel by generating 17.7% in FCF margin.

M1 on the other hand shows massive decline in FCF margins. This makes them the most troubling telco here.

But essentially, competition have resulted in all 3 telcos earning lesser and lesser.

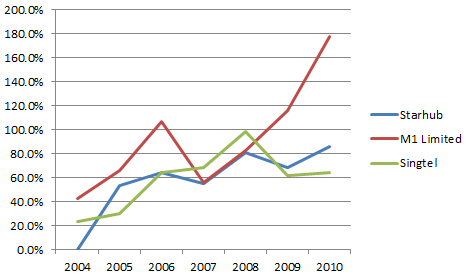

Dividend payout of Free Cash Flow

We usually calculate dividend payout using dividend paid / net income.

Here we vary this to calculate out of $1 of FCF how much dividend is paid out.

The lower the payout the better. Payout greater than 100% is a warning indicator.

Starhub and Singtel have been very prudent here. Singtel especially have a history of low payout they are maintaining it at 60%.

Starhub have always been the darling for high yields but their payout have been climbing to 82%.It is still safe but perhaps its been capped pretty much at the top compared to Singtel.

M1 on the other hand have consistently paid out more than FCF. Probably the least prudent.

Conclusion

I believe based on this data, Starhub is the dividend cash king here by virtue of higher payout yet still having a good cash flow discipline.

M1 in their latest quarter have rebounded and have much better FCF figures.

I still feel Singtel is a competent dividend play because they will be able to defend and build their free cash flow much better than the other 2 by virtue of its size.

If we compare 80% FCF payout ratio, Singtel vs Starhub’s Div yield will be 6.2% vs 6.9% which is not far off. Starhub’s prospect is much more capped compared to Singtel.

I run a free Singapore Dividend Stock Tracker . It contains Singapore’s top dividend stocks both blue chip and high yield stock that are great for high yield investing. Do follow my Dividend Stock Tracker which is updated nightly here.

gregg

Saturday 7th of May 2011

Hi Drizzt,

I was using the nickname "KK" and don know why my msg could not posted here after I hit 'submit' button. Anyway, this is the side story.. :)

I did not invest Neratel yet, have not done any study the company yet, not really sure who is their major customer and competitor in Singapore.

Should we invest in the Neratel as 9% yield is quite attrative....!!??

Drizzt

Sunday 8th of May 2011

hi kk or gregg,

Neratel is interesting and i like the fact that it has an infocomm division. But essentially it will compete with ST Engineering for alot of the contracts. Its dividend track record in the past is long and this ex div may present a good opportunity.

But i feel that if you get vested you should watch it. I believe it is not very defensive during recession times.

CJ

Monday 2nd of May 2011

Hi Drizzt,

yeah, I'm not saying that they're wrong to take on debt. lol. I'm just saying if it weren't for the debt, their FCF would not be suffice to distribute dividend and repay debt. In other words, I'll take it that distributing dividend in FY09 is possible because of the loans drawn.

You're right, for FY09, no substantial debt is being paid off.

KK

Monday 2nd of May 2011

Hi Drizzt,

Just happened to know that there is one dividend player which able to offer ~9%, Nera Tel Telecommunication.

http://www.neratel.com.sg/

Drizzt

Monday 2nd of May 2011

hi KK, am aware of Neratel, are you an investor? my gripe with them is how many people would want Juniper network equipment which they are distributing. granted Juniper is killing Cisco in the states

CJ

Monday 2nd of May 2011

Hi Drizzt,

You are right, FCF is already taking away capex and that left with 461 mil. By definition, FCF is an indicator of the ability of a company to return profits to shareholders through debt reduction, increasing dividend or stock buybacks.

For FY09, repayment of loan and dividend both adds up to 534.6 mil and this is already more than the amount of FCF (461 mil). This also means that the cash that is necessary for debt reduction AND distributing dividend is more than the amount on FCF.

Thus in order to repay the debt(which is probably structured to be paid at the end of FY09) and distribute dividend, it is necessary for Starhub to borrow the 200k. I would take it that without this 200k, Starhub would not be able to either repay its loan, or to distribute the dividend according to their divy policy.

I hope this is clear enough lol. I tried my best. :)

Anyway do you think they would have an issue with increasing their amount of dividend in the near future?

Cheers, CJ

Drizzt

Monday 2nd of May 2011

hi CJ, i think your figures are right. but i see that 200 mil as refinancing. lets be realistic that if Starhub wants they can go either net cash fast or stick with some debts. their cost of debt should be lower than alot of other companies.

It is not wrong to take on debt and for singtel and starhub having a comfortable level enables them to have cash for other purpose.

i feel the FCF - DIV is a good measure. it shows that cash is added to retain earnings or paying off debt.

in the case of FY2009, probably no debts is being paid off

KK

Monday 2nd of May 2011

Hi Drizzt,

Great to see your analysis of three telcos here. It is very useful.

I would prefer Starhub since they have stated clearly the dividend payout. :) going to add 1~2 lots this year.....

Drizzt

Monday 2nd of May 2011

hi KK, great to hear that you are adding. price is steep now though.