SingPost this week announce its 4th quarter and full year results. Not many highlights except that domestic mail continues to decline and SingPost is looking into expanding overseas into more logistics.

I shall not go too much into SingPost’s fundamentals, SingPost is one stock with a very stable and easy to understand balance sheet.

Readers who want a glance at SingPost financial ratios from IPO till 2011 can view it here >

Some highlights:

- Increase in investments in associated company (100% more)

- Quarter free cash flow generated: 43 mil vs 65 mil (2010)

- Quarter dividend payout: 24 mil

- Full Year free cash flow generated: 150 mil vs 175 mil (2010)

- Full Year dividend payout: 120 mil

- Net Income decline to 161 mil vs 165 mil (2010)

- Mail Segment Margin is 36.6% vs 36.1% (2010)

- Logistics Segment Margin is 6.89% vs 8.2% (2010)

- Retail Segment Margin is 14.2% vs 14.9% (2010)

- Mail Segment ROA is 174% vs 166%

- Logistics Segment ROA is 7.7% vs 9.5%

- Retail Segment ROA is 53.5% vs 38%

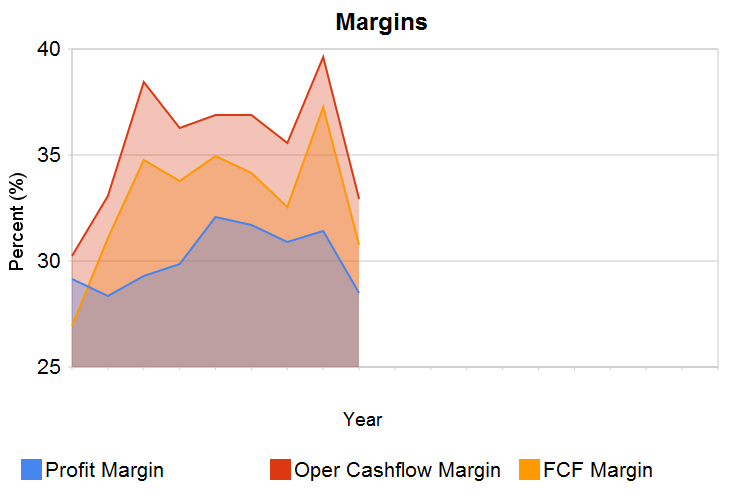

Margins

Margins across have dipped since last years’ surge. What we gather is that FCF margin of above 30% is a very good position to be in.

The question is whether it will become a gradual decline.

Future of Postal

My opinion is that SingPost is still a well run entity because it still has its moat, which is a strangle hold over domestic postal.

Much of its future success will depend on the prospect of postal, which we all know is getting bleaker by the day. I suspect it is still necessary to have postal, no question there. But many retail communication means will be switched to electronic means.

Still large items needs to be moved by mail and this is where SingPost come in.

Logistic Expansion

There is synergy between postal and logistics, as well as retailing, which SingPost tried unsuccessfully to venture into in the past.

Looking at the ROA and the Margin’s above, you can see why this is the last frontier for them.

The margins and ROA is the lowest! There is such a big difference between mail segment ROA and Logistics. Mail business is a great business if you have the monopoly, but losing it and technological changes have killed it.

Switching to a logistic business will effectively turned SingPost to your FreightLinks, or Cougar Logistics

Cougar Logistics still pays reasonable dividends, so its really not the end of the road for SingPost investors looking primarily for that. But its really asset intensive yet you earn peanuts.

This is an opinion without quantitative backing, so I need to do more research in this area.

Conclusion

The darling dividend stock is in transition no doubt. And likely shareholders are in anticipation after the retail failure if this logistic expansion will be another waste of time and money.

It is necessary no doubt, but I do not have high hopes that this enhances SingPost. the cracks are starting to show.

What do you guys as investors or prospective investors think? You can track SingPost daily yield changes here >

I run a free Singapore Dividend Stock Tracker . It contains Singapore’s top dividend stocks both blue chip and high yield stock that are great for high yield investing. Do follow my Dividend Stock Tracker which is updated nightly here.

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

- The LionGlobal APAC Financials Dividend Plus ETF Won’t Give Singapore Investors 5% Dividend Yield Always. Further personal thoughts (with some data). - April 13, 2024

Jared Seah

Wednesday 4th of May 2011

It's so nice to find 2 dividend evangelist in the same place :)

Singpost does not go down much in crisis; but it does not go up much too. Even if it's a pure dividend play, we also want to cash out of it some day. So capital gains to match inflation will be welcomed. We don't want to sell Singpost in 10 years time at the same price we have bought...

I can't remember when was the last time a sent out a post? For company documents, we use couriers a lot.

The growth story are couriers who deliver articles to people have bought on Amazon and Ebay?

Drizzt

Wednesday 4th of May 2011

hi Jared, it is for those who like low volatility. but i can see you have a great brain because really that was what i am thinking. even if domestic mail goes down, as long as emarketplace is vibrant they will still have a piece of the mail pie.

Dividends Warrior

Monday 2nd of May 2011

Hi Drizzt,

I have a few lots of SingPost. What I like about this stock is its stability in terms of price and dividends. I observed that during market corrections such as the Japan Earthquake or Libya Crisis, the price does not fluctuate much.

Of course, I will probably not add any more lots since it is going into a very slow gradual decline.

Good stock for retirees though. They can park their money in Singpost since I dun foresee any major problems in the next decade.

Drizzt

Monday 2nd of May 2011

its low volatilty but i am still open if logistics is a good business. its possibly an easy to understand business and you will be aware of what u are putting your money into. take a look at cougar logistics while you are at it.