I get a few questions that are pretty common over the past 18 years writing on Investment Moats, listening to what clients ask from client advisers at Providend, friends and the people I met.

I think a few questions are of similar nature.

I would classify them as:

How should we allocate our money when we have a few very competing financial goals?

I hope in today’s short article, I can explain this better.

I feel the problem is that in your mind, you do not have a good map of how your money problems and goals are linked together.

These are even more messed up with the financial tidbits that you hear such as the following:

- You should build an emergency fund.

- You should invest in an STI ETF or S&P 500 ETF.

- You should set aside for investment.

- You should put your money into Singapore Savings Bonds.

- You should top up your CPF SA.

- You should pay off your home loan early.

Your brain tells you not to do anything because some of the tidbits are conflicting.

Which one to do first?

How do you rank one above the other?

I will break down my answer into two parts, the Wealth Foundation and Advance Wealth.

Wealth Foundation: Implement whatever Increases your Net Worth

I have written a series on Investment Moats called the Wealth Foundation. If you read that series, and are able to comprehend most of the stuff written in there and implement them in your life, you should do very well in life.

The first part of the answer addresses this.

In life, there can be tangible metrics, there can be intangible metrics.

Intangible metrics are whether you have led a fulfilling, happy life. These metrics are very subjective, so we would try to evaluate based on more tangible metrics.

The key tangible metric we should all focus on is whether we are doing well financially.

Whenever someone suggests you do something, you got to ask whether it improves you financially today, if not tomorrow.

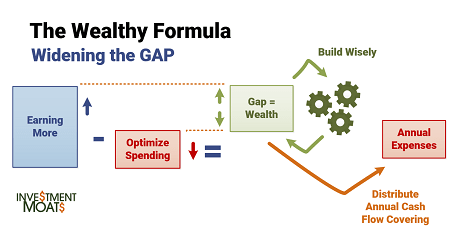

In my wealth formula (explained in detail here), you will generate a lot of wealth if you

- Find ways to earn more

- And learn to optimize your spending

- Whatever you have left between #1 and #2, is your net cash flow/additional wealth capital/free cash flow. You should deploy this free cash flow to build wealth wisely

If you repeat those three steps again and again, you will be OK. To dive deeper into the formula, you can read that article.

Now let us look at it from another angle.

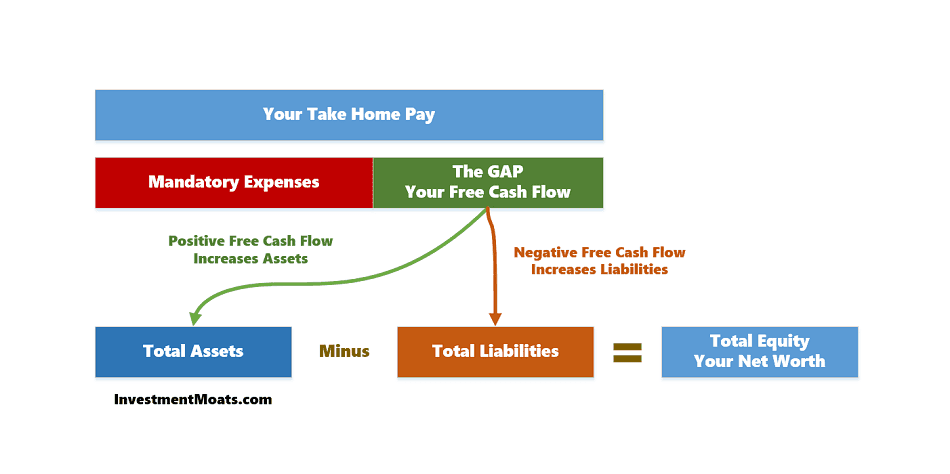

Out of our take-home pay, we spend on essential expenses. The essential expenses are our spending required for us to maintain a minimum satisfactory life. Not a happy life but a satisfactory one.

This will leave us with money which we have to decide.

I call this money “The Gap” or your free cash flow, like a listed company.

Like a listed company or stock, you can do all sorts of things with this free cash flow:

- Save in bank

- Put in investment

- Pay off your debt

- Reinvest in yourself or your spouse

- Spend on entertainment such as vacation, enrichment classes for the kids

- Donate

The critical success in your wealth foundation is that the majority of the decisions that you take in the wealth foundation with your free cash flow will improve your finances.

The critical metric of measurement is your personal net worth.

This is what financially you can be worth. It is made up of your total assets minus your total liabilities.

Most of what you decide to do will improve your net worth.

Here are some examples:

- Build an emergency fund. This increases your total assets. Your net worth goes up.

- Invest in STI ETF. This increases your total assets. Your net worth goes up.

- Set aside for Investment. Similar to #2, this increases your total assets. Your net worth goes up

- Buy cryptos or Singapore Savings Bonds. ditto

- Top up your CPF SA. Your CPF is part of your total assets. This move converts liquid assets to illiquid assets. Your net worth goes up

- Pay off more of your home loan early. This reduces the interest expenses you need to pay. It leaves more future cash flow with you, thus retaining more assets. Also, when you pay off more, this reduces your liabilities/debt. The combination of these 2 actions increases your net worth

But you want to know which one gives me the most bang for the buck or the sequence for which to do first.

And I am telling you that is Advance Wealth.

In Why You Should Not Force Yourself to Start Investing ASAP, I explain the relationship between funneling more of your free cash flow to building wealth, versus the rate of return you get on average for investing your wealth.

When you deliberate on whether to top up CPF SA first, build an emergency fund first, or pay off your home loan first, what you are doing is optimizing the overall average rate of return you will get.

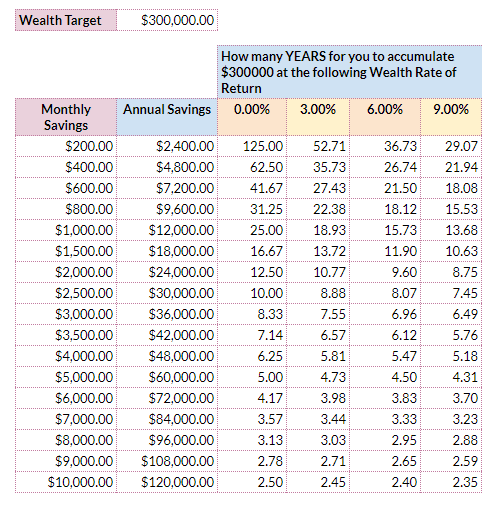

In the table above you see 4 different rate of return from 0% to 9%.

Whether you do well or not, your average should be between them.

But to build up $300,000 from $0, as the table above, you realize the bigger determinant at the start, is your monthly savings or the amount of free cash flow you have, to build wealth.

For example, if you free up $1000/mth and you can invest, save, pay off debt, which result in different rate of return, the time to get to $300,000 is between 13.7 years to 25 years. If you bump it up to $1500/mth, the time is shorten to between 10.6 years to 16.7 years. So you get a 3 to 8.3 years improvement.

With more free cash flow, or if you increase “The Gap”, the rate of return matters less.

So the more important question you should ask Kyith is, have I really optimize my expenses well, and whether I have maximize my earnings potential?

Let the Net Worth Lead You

Another aspect that I think does act up is that we have different relationship with the financial actions that we need to do.

Some of you hate debt and feels anxious if you have more of that.

Some of you felt not good if you are not saving money.

Some of you are absolutely impatient about money rotting in the bank account and would want to invest it.

If you wish for things to be less confusing, you track the net worth, or the rate of change in the net worth (read this why you should track it).

If you absolutely need to invest, but the right thing to do is to pay off your debt, don’t feel discouraged that you cannot.

Just do a monthly tabulation of your assets, debt and work out your net worth.

Then plot it like what I did above.

Doing well means it is rising.

If its not rising as fast as you want, or declining, then we talked about the advance wealth: which financial action should you prioritize.

Works for those with no debt, works for those with debt as well (as it crosses over to zero net worth)

Consider if you are one of the follow 3 ladies:

- You have a lot of personal loans and student loans left over. You learn to optimize your expenses, minimizing those non mandatory spending and don’t live life so much. You manage to free up $1,500/mth in “The GAP”. You decide to put away $200 for emergency and the rest into intensive debt clearing. Your net worth graph goes up

- You start off with a clean slate, and don’t have a clue about investing, but willing to learn. You learn to optimize your expenses, minimizing those non mandatory spending and don’t live life so much. You manage to free up $1,500/mth in “The GAP”.For the first 12 months, you put that $1,500/mth into high interest hurdle accounts earning 1-2%. You do this while learning to invest. Then you deploy $10,000 of the $18,000 build up into a Mapletree Industrial REIT earning 5.9% with some residual growth and $8,000 into the STI ETF. You continue to channel your $1,500/mth into the high interest hurdle accounts, to think of where to deploy next. Your net worth goes up

- You start off with a clean slate, don’t have a clue about these money stuff, but listen to the advice in a group like Seedly. After spending, you reckon you have $600 to invest. So you put $300 in Stashaway, and $300 in a Prudential Savings Policy. Your net worth goes up

#1 to #3 start off at different state, yet the conclusion is that things will improve for them. #1 is weaker in that she has some baggage, but she should see bigger improvements than #3 because she puts away more into improving her net worth.

#2 doesn’t really know what she is doing, but at least she is taking the prudent route. While learning, her net worth is still growing. And you realize, compare #2 to #3, #3 decide to put into recurring plans passively, while #2 deploys her money in an active manner. Both started off not knowing what they are doing, one is more willing to learn.

My money is on #2 to do better than #3. This is not because active manage trumps passive. It is basically that #2 seems to take a more conscientious role to managing her money and have more personal free cash flow per month.

As a summary, whichever actions you take first, or if you do a mixture of them, would improve your net worth today, if not tomorrow.

And that is good enough.

If I can, let me go into the advance wealth portion next week.

I ran a Dividend Stock Tracker that Updates Nightly the dividend yields and various metrics of the popular dividend stocks such as Blue Chip Stocks, REITs, Business Trusts and Telecom Stocks In Singapore. Start by bookmarking it and view it daily.

Here is my current portfolio. It is a FREE Google Spreadsheet that you can use to track your stock portfolio by transactions. It is especially good for a dividend portfolio or a passive ETF portfolio. Get it for Free Today.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Sinkie

Sunday 29th of July 2018

First things first.

1. Properly sized term & Shield insurance.

2. Emergency funds of 6-12 months expenses.

3. Read & educate on nitty gritties of investing, long-term savings, market history, debt management etc etc.

4. Know yourself; develop a philosophy.

5. Apply & evaluate strategies & tactics.

6. Iterate thru 3-5, it's an ongoing process.

Kyith

Sunday 29th of July 2018

Hi Sinkie, thanks for contributing a good SOP!