I first wrote this post in December 2018 to figure out the return on investment on our CPF LIFE annuity.

Whenever I met up with the team at CPF a long time ago, they would often suggest that I should see whether there are any products out there that are comparable to the CPF Life. And I often dismissed that outright because of how much of an edge CPF have.

The risk-free interest rate in Singapore has fallen for a number of years, and yet the return on our CPF Retirement Account remains above 4%. Our CPF issues bonds to our GIC who takes the money and invests. In return, GIC would need to pay CPF this high hurdle on the bond issued.

Suffice to say, there ain’t any annuities out there (that meet CPF’s criteria of an annuity) that are able to give us a better income payout that does not run out as CPF LIFE.

There are two ways to compare whether an investment product is better than an annuity-like CPF LIFE:

- The amount of income provided, whether it is inflation-adjusting that will last regardless of your age.

- The internal rate of return (IRR) of the stream of cash inflows and outflows of the investment against the IRR of CPF LIFE

A lot of products seem to give a higher income, but only in projection but seldom substantiated in reality.

But I thought not many people figure out the IRR of our CPF LIFE.

So in this article, I did the tedious work to tabulate the IRR that you could “earn” depending on whether you choose the Basic, Standard or Escalating plan, and when you passed away.

If you know the IRR, e.g. 7%, you can compare the IRR to those retirement income product pretenders such as

If the illustrated yield or IRR shown in AXA Retire Happy’s prospectus is 3.5% and the IRR of the Basic plan is 2.5% to 5%, you know it is about on par with CPF (but you got to check if the bulk of the return comes from the income or the value when you passed away).

Now, I got to tell you, that I think you cannot recreate this simulation today. Back when I did this, CPF has this CPF LIFE calculator that shows the income that you are projected to get and the bequest if you passed away at this age.

They have changed the calculator so this cannot be easily computed.

The new calculator does not compute the bequest anymore.

Here were my findings back then. They still apply today:

- I calculated the IRR for the total income payout and bequest if the assured passed away at different age

- I also calculated the IRR if it is just the total income payout

- If you estimate your life expectancy is short, then you should go for Basic Plan

- If you estimate your life expectancy is long, then you should go for Escalating Plan

- If your goal is to hedge longevity, then you should go for Escalating Plan

- If you love your next of kin and loved ones more than yourself, you should choose Basic Plan

- If you have no idea about the life expectancy and would wish to maximize the return you get from this “investment product”, then you should choose the Basic Plan

- To “break even” on your CPF Life, you should strive to live till 75 to 77 years old

The Role of CPF Life in your Retirement Spending Strategy

A lot of people cannot understand the meta of managing money for retirement and often use the same mindset from managing their wealth accumulation, in retirement spending.

Thus, they look at rate of return and growing their net worth as the important aspects of retirement spending.

While the rate of return and growing the net worth is important, the primary purpose of retirement is ensuring that you have a consistent cash flow that can meet your spending needs, while not running out of money.

If I were to summarize, the complexity of retirement spending can be boiled down to:

- financial markets are volatile, causing your wealth to be volatile, and in turn, causing your cash flow to be volatile

- we do not know for certain how long we need the money to last. You could have a short lifespan, and you should spend more, but if you have a long lifespan, you have to control your spending

- we do not know for certain the economic regime that we are facing in the future, whether inflation or deflation will take place, and in which sequence

- as we grow older, we wish to spend less of our time managing our money

- as we grow older, our cognitive abilities deteriorate, making active money management challenging

With this in mind, ensuring the majority of the people have a safe spending income floor that does not run out became a viable strategy for the government.

The main reasons are:

- most people tend to overestimate their abilities to manage #1 to #5 of the above

- it tries to provide a safe spending income floor to take care of citizen’s survival expenses

- by letting citizens see that how much spending income they will have in retirement is determined by their own actions, it preserves the meritocratic nature of the country

CPF Life, which is an annuity sought to address this.

The annuity has the added advantage of pooling the citizens together so that those who passed away first subsidize those who lived longer. We call this mortality credits.

The above shows a common retirement strategy of a safe spending income floor with spending down a 100% equity portfolio.

CPF Life annuity provides a baseline income to address the annual survival expenses.

This may not be enough for the citizen, and the additional income will come from the equity portfolio. The equity portfolio is readily interchangeable with insurance endowment, a unit trust portfolio, active individual stocks, or investment property.

The CPF Life annuity might not keep up with inflation so well, and thus having an equity portfolio that is higher in the rate of return is necessary to ensure the purchasing power is preserved, and money lasts longer.

The issue with the equity portfolio is that it is very volatile. When the value is down, and you spend too much from the equity portfolio, you may end up depleting the portfolio so much that your portfolio does not last as long as it should. Thus, a sustainable spending strategy is required to ensure you spend wisely.

This is where having that CPF Life annuity income as a safe spending floor helps. As the CPF Life takes care of the essentials, the retiree can cut their discretionary spending, usually paid for by the equity portfolio more drastically, so as to preserve the value of the equity portfolio.

The CPF Life annuity thus acts as the bond, to reduce the overall volatility in the whole net worth. Researchers have shown evidence that it is beneficial to replace bonds with annuity and that for the portfolio to ramp up to a higher equity allocation.

There are 3 Different Schemes of CPF Life Annuity Plans

With the national service explanation out of the way, let us talk about the 3 annuity plans available by CPF Life.

You can choose from the Standard Plan, Basic Plan and the Escalating Plan.

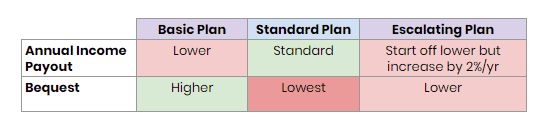

What differentiates them are:

- The amount of annual income payout

- The size of the bequest, or the sum of money left to the next generation

I tried to find a good image from CPF to illustrate this, but I couldn’t so I created something like this:

The Standard plan has the larger payout annually, but the amount left to your next generation is the smallest. The basic pays out less annually, but it sought to leave the most when you passed away. The escalating plan sits somewhere in the middle. It pays out less than both basic and standard but over time its payout increases.

In terms of cash flow, how do these 3 plans look?

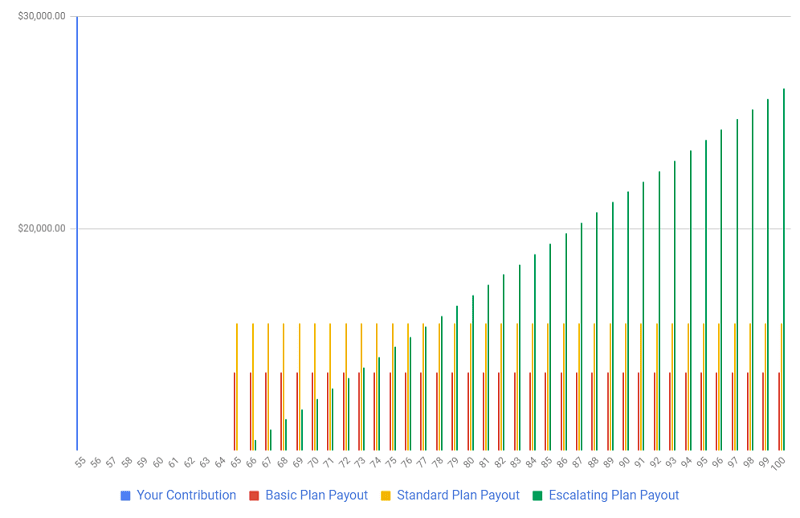

In the chart above, we can see how these 3 plans compared in terms of cash flow.

At 55 years old, our money from CPF SA, and CPF OA are transferred to the CPF Retirement Account (RA) to satisfy the CPF Full Retirement Sum (FRS). If you have pledged your property, you would only need to transfer the Basic Retirement Sum (BRS). Of course, if you wish to increase the payout, you can contribute an additional sum equivalent to not more than the BRS, to do that as the Enhanced Retirement Sum (ERS).

You will get roughly a constant size payout. The basic plan will have a lower constant payout. The Escalating plan will start off with a lower payout, but increase over time.

If the assured passes away, based on what is nominated, the assured would leave her loved ones a bequest (not in this picture).

So how do we measure which one gives you the most return? From the picture, it looks like the escalating plan!

In this article, we try to look at the actual numbers and see if I can help you see which plan fits your needs the most.

Simulating funding $180,000 into your CPF RA and Your Return

The problem with doing this exercise is that, the income payout and bequest that you will eventually get depends on the prevailing interest rate of the bonds available to the government, and other factors.

This would mean that your FRS, and BRS are different, and the income payout yield is also different.

We work with what we have.

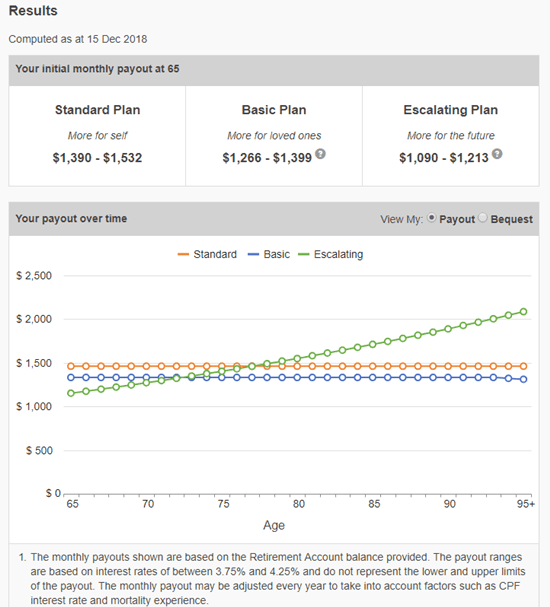

CPF have an intuitive calculator to help you estimate the potential payout you could get, and the corresponding bequest, under the three schemes. You can access the CPF Life Payout Estimator here.

So I use the calculator to simulate if I am a 55-year-old born in 1963. I just transferred the equivalent of $180,000 based on 2020 full retirement sum into my CPF RA.

At age 65 I will start taking 3 different kinds of income payout:

The above is the result.

In 10 years’ time, at age 65, I could enjoy the following payout. If you are a couple, and both met the FRS, then you can multiply that by 2.

The difference that you can spend between the Standard versus Basic is $120/mth more. The difference between Basic and Escalating is $170/mth more.

You can start thinking, in terms of your expenses, how big of a difference, $120, $170, $290/mth will make.

What are the monthly necessities that this additional cash flow can afford you?

I would contend that feels like a utility bill, town council charges, or a combination of mobile phone bill + public transport + home broadband.

Overall Investment Returns Depends on When you Passed

The CPF Life payout estimator provides 2 sets of income payouts.

The income payout will depend on the interest return projection, whether the return is 3.75% or 4.25%.

This is rather different from what the insurance companies use, which tends to be 3.0% and 4.25%.

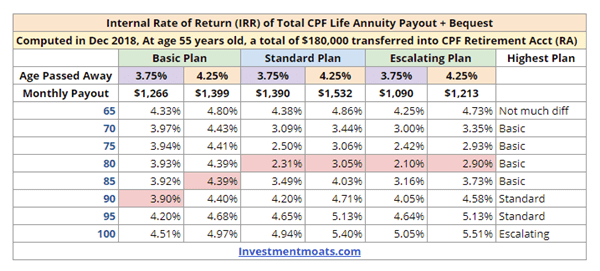

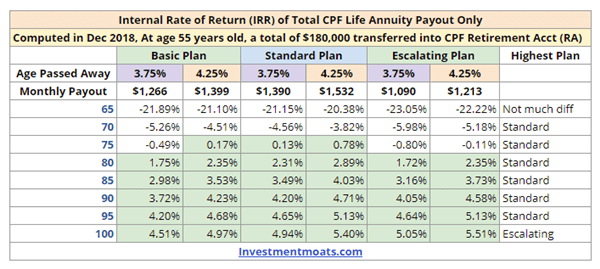

We will measure the rate of return by measuring the internal rate of return (IRR) of the 3 plans, over different tenures.

We will take it that a CPF member could live to 70 years old. He would collect 5 years of payment + the bequest to his family. So we measure the “interest yield” on this stream of cash flow.

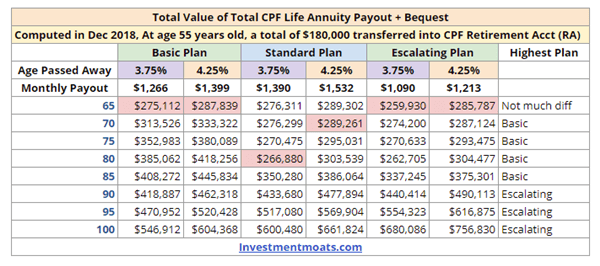

In the table above, the y-axis shows the age that which the CPF member passes away. For each basic, standard and escalating plan, we provided the corresponding IRR. The higher the IRR, the better this investment.

The IRR over time resembles a smile. The IRR starts off high and then falls down, before rising up again.

At 65 years old, the IRR does not differ much among the three plans.

However, the IRR for Standard and Escalating dropped down from age 70 to 80, with 80 being the lowest.

For those with shorter life expectancy, the Basic plan provides the “best investment”.

In fact, the IRR for the Basic plan is remarkably consistent. The highest was 4.5% and the lowest it dropped to was 3.92%.

However, if your life expectancy is long, the greatest IRR is that of the Escalating plan.

The problem is that we do not know our mortality that well, and I would think due to this reason folks might be inclined to choose the Basic plan because it is so balanced.

Choose Basic Plan to provide the most Absolute Total Value

We cannot just look at IRR because while it measures performance by taking out the absolute money value, we have to see how the absolute money value fare since you are going to spend it, or your loved ones are going to spend it.

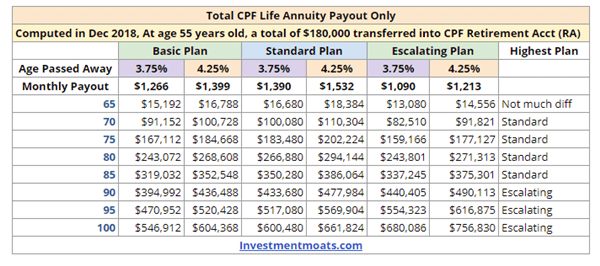

The table above shows the total income payout if the assured passed away at that age and the bequest paid out.

One of my takeaways is looking at the actual numbers of the “total value”, we seldom feel short-changed.

If you do not get the payout income and pass away, your nominated loved ones get it.

People are very afraid that they are short-changed by the system.

I know for the fact that out of all the payout after someone passed away, the CPF bequest payout is the fastest (besides those joint accounts which I could withdraw)

If your longevity is hard to determine, CPF Basic looks the way to go because from 65 to 85 years old, the Basic plan gives the highest payout income + bequest.

However, if medical science has its way, then you would want to put your money in Escalating plan.

If the annuity is to hedge longevity risk, then the logical selection here is to choose the Escalating plan.

Choose Basic Plan if you Love your Loved Ones more than Yourself

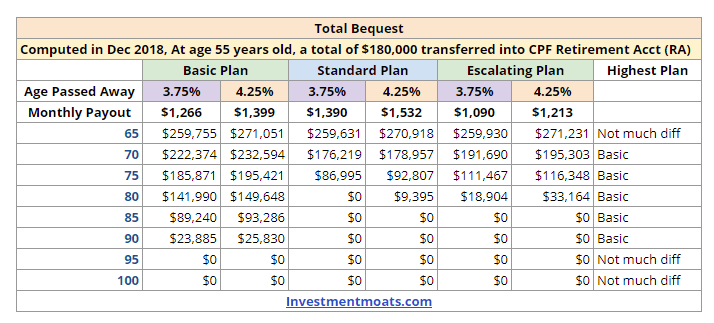

I have also tabulated the amount of bequest that you would leave behind for your loved ones:

The aggregation of total payout + bequest shows that either you or your loved ones will get the money.

This table shows how much of your CPF you will leave for your loved ones. No prices for guessing which one wins out, but you got to wonder if it makes sense to bequest so much since we cannot bring it to the grave.

To not feel short-changed, you must try to live till 77 years old

In this table, we look at solely the payout you will get. The table shows the IRR if the assured passes away at different ages, and the payout they had to utilize.

In terms of payout, the Standard plan wins out, unless you live passed 100 years old.

If you cross over to 75 or 77 years old, you more or less “break-even” with your CPF contribution.

The IRR will look very beautiful if you could live passed 85 years old.

In terms of actual payout, they increase over time.

Summary

I know this is not the usual way to look at the CPF Life. Or that is how they don’t wish you to look at it.

However, if I understand most people, don’t want to feel short-changed, so these numbers should allow you to make that assessment.

I think once I have this set of figures, it will be better to measure some of the retirement products against the CPF Life, over the different durations.

The Basic plan’s payout looks deceptively close to that of the Standard plan, and it is why a lot of people would rather choose the Basic plan.

And since people underestimate their longevity, they would choose the Basic plan. However, our children might grow up in an environment where they could know their mortality or longevity, and in that case, they could possibly choose a plan that is different from ours.

Do let me know if you have some interesting take away from reading this.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

Pete

Saturday 30th of April 2022

Hi Kyith, thanks for a detailed article. I especially like that you set out the parameters that favor one option over the other.

The CPF Life calculator mentioned that if one choses Basic, the payout amount will actually decrease when the balance is $60,000 or below. The table you provided does not actually shows this decrease, I wonder why?

The scenario will happened when a person chose Basic and "outlive" the expected payout period.

Phileas Fong

Monday 9th of May 2022

@Kyith, Hi Kyith, I had already provided some clarification on 30 Apr. As I see that you have replied to others on 1 May & 7 May, not sure whether my clarification has escaped your attention? Or you are too busy, sorry?

Kyith

Saturday 7th of May 2022

Hi Pete, what the CPF want to let people know is the income is based on the capital in your CPF. So if you have less than 60k in your CPF RA, you will have less income. That is the message and my table shows a limited amount of capital because... i cannot show everything. Hope that helps.

Sinkie

Sunday 1st of May 2022

@Pete,

See the end of my above reply.

It's becoz of the extra 1% & 2% interest on the first $60K.

If your remaining RA balance goes below $60K, you start losing the effect of the extra interest.

Standard & Escalating plans push all RA into CPF Life par fund upon payout date, so they don't have this declining RA balance thing.

michelle

Saturday 30th of April 2022

Kyith, good article. I summarised it to my frens...they love it. Simple to understand and able to made "informed" decision. :P Thanks for the time to prepare and explain it.

Kyith

Saturday 7th of May 2022

Wah michelle, thanks for the vote of confidence. IRR returns is something i am afraid people might not grasp easily

Robin

Saturday 30th of April 2022

Good work. From my perspective, I would look at payout. Since I am taking CPF Life payout for basic needs. For inflation aspect, investment portfolio will help take care of this.

Kyith

Saturday 7th of May 2022

Hi Robin, I realize later on the escalating one is something that doesn't really work so well.

Tay

Wednesday 2nd of March 2022

Hi Kyith, It seems the monthly payout amount would increase, should you choose to defer your payments until a later age (after 65). According to your IRR calculations, would it be worth it to defer the payments until 70 yrs?

Below extract taken from CPF website: "If you have already started receiving payouts but do not actually need the funds yet, you have the option to hold back your payouts until age 70. This will increase what you'll receive later on. For each year that you defer, your payouts will increase by 7%. This means if you choose to defer until age 70, your payouts will increase by up to 35%."

Phileas Fong

Saturday 30th of April 2022

@Phileas Fong, Hi Kyith, thanks for your reply, sorry if I didn't make my enquiries clearer. 1. As your conclusions for choosing the "best" Plan under various criteria (e.g. IRR, Absolute Total Value) were based on the withdrawal age of 65. I just wonder if withdrawal age becomes 70, will you still come to the same conclusions regarding which is the "best" Plan? 2. You had you mentioned that if a couple is involved, just double your assumption of $180,000 to arrive at a conclusion (in choosing the "best" Plan). Could you please enlighten me if only one person is involved but the amount is $360,000, will the double amount ($180,000 X 2) for such person come to the same conclusions regarding which is the "best" Plan?

Phileas Fong

Wednesday 13th of April 2022

@Kyith, Hi Kyith, many thanks for your article "Which CPF Life Plan Gives the Greatest Return?". This is really enlightening 👍. How much do I like that CPF Board can also issue a similar report so that people can make enlightened decisions.

1. Since postponing withdrawal age to 70 years old can give people an increment of 7%, this is very attractive comparing to fixed deposit & stock dividends. If people are still working at 65 & would like to postpone withdrawal to 70, will your conclusions be the same?

2. While you mentioned that if a couple is involved, just double your assumption of $180,000 to arrive at a conclusion. What if only one person is involved but RA is $360,000. Is it also doubled? I am not sure whether the conclusion is on linear pro-rata basis.

Grateful if you can share your findings with email recipients, as a follow-up of the previous email👏👏👏

Kyith

Saturday 5th of March 2022

Hi Tay, the payout will definitely be higher. This is also an advise given in another country to increase your income which is to delay your retirement. Of course, not everyone can do that. Some can take a spouse payout at 65 while delaying another one.

kelly Tan

Thursday 21st of October 2021

How was your IRR rate derived ?

Kyith

Thursday 21st of October 2021

Hi Kelly, if you go through the CPF Life calculator it estimates for you how much is the payout and the corresponding bequest at different age. I merely used those figures to compute the XIRR of the amount that was put in.