Folks will be thinking why after a 4 year market run, we are still getting higher prices. Here is my quick take on it (Spoiler: It looks really bullish)

Equity Risk Premium

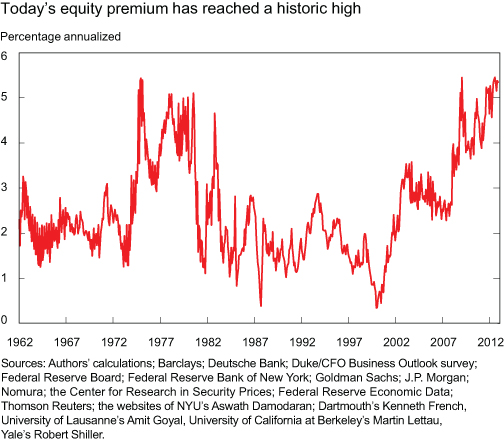

The equity risk premium measures the premium required to take on more risk over the risk free rate.

At market highs, the risk premium are usually low because everyone neglects risk and just chase prices. At market lows, risk premium is usually high because everyone is so scared to buy. There is a real premium to earn for the level risk you put in.

This chart shows that current premiums look close to 1975, 1982.

Markets breaking out of new highs

Markets breaking out of new highs above previous psychological levels are very bullish. That, provided that they can stay above for the mean time to reverse it to form support.

Everyone is expecting a triple top. This sort of invalidates it.

I am not one who is focused on technical analysis, but much old school technical analysis folks are pointing that these formation looks like 1982 and 1995.

Note that they are not calling for a straight line move, but the strength of the price movement, even at this stage where things are suppose to weaken is remarkable.

Singapore markets have been in a funk compare to other markets. This chart post recently shows a break out over a multi month consolidation.

QE and the chase for yields

If you scan my dividend stock tracker on all the blue chips and popular yielding stocks, you will see that their yields are approaching a 4-6% range from a 5-8% range.

Yet earnings don’t seem to be following.

Fundamentally, we will say that if earnings don’t substantiate the price rise, these stocks will be overvalued.

That is still valid.

But fundamental valuation requires an important variable: discount rate.

That is based on your required return for the risk you put in.

It used to be the case where gets reset back to the norm as interest rate fluctuates from high to low.

Based on the riskiness of the stock, you may require 8% for the risk you put in, 12% for the risk you put in, 3% for a lower risk stocks.

This QE seems to put a far lower bottom to this. The perspective is that anytime there is a market shock, the FED will go into asset buying, asset reinvestments, loading the market with liquidity.

The safety level or discount factor could have changed so much that 4% is considered the new high yield.

Bond Yields are insignificant, the chase for yield

We know that bond yields are at record lows, and to gain any respectable returns (for major institutions and retail investors), they have no choice to take on more risk.

- Junk bond yields near default grade is trading at 6%

- Folks are looking at Rwanda government bonds.

- High yield corporate bonds are now at government bond yields 10 years ago

The move now is to find a better yielding asset. In this case earnings yield. Thus a strong explanation to this “unsustainable move without earnings increases”

This will end badly, or will it?

The folks will be thinking this is unsustainable and we are near a financial meltdown.

The fear is that we will fall face flat.

The possibility is that decision makers do have a few case study in the past (Ben Bernanke being a student of the great depression) and 2 severe bear market that was unprecedented.

They would have learn if you jerk it hard, a lot of bad things can happen. The fact that their taking their time with keeping things low for so long is that their indicators don’t see things getting better.

Until things get better, there are a few steps that they will need to unwind. For more on this do read The Reformed Broker’s take on this from an investment perspective.

Summary

All this put in, will we get a 20-30% correction? Its possible, but with the flush on everyones balance sheet and infinite QE, that may be hard to happen.

Still it is good to gain that.

But we are still far from the STI 3800 high. And we have not even factor in inflation.

I wonder whether you get more risk in staying in 100% cash in this environment. I guess being vested in a 50% equity allocation make sense here.

The chase for a 6% yield looks difficult so you got to look harder. But if you want lower risk, your best bet could be 4% yielders now.

To get started with dividend investing, start by bookmarking my Dividend Stock Tracker which shows the prevailing yields of blue chip dividend stocks, utilities, REITs updated nightly.

FREE Stock Portfolio Tracker to help track your dividend stocks by transactions to show your total returns.

For my best articles on investing, growing money check out theresources section.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

victortancheongwee34

Sunday 19th of May 2013

It is hard to sell to a rising market, because after u sold, your counter head higher. But if u don't. then when mkt tumble, u are caught.

But it is still better to sell to a rising mkt , then a bear mkt.

I am a seller in these days, for i believe all these rally are liquidity driven. U see even when days the data are so lousy, but the dow still rally, on the basic that the mkt are confident that Ben will continue with money printing, as the lousy data supported that.

Money and profit in my pocket is much better than on the monitor, for what is in youre monitor are subject to changed, but not thast in your pocket..

Thanks to Drizzt especially, and AK 71 too.

God blessed you allr

Kyith

Sunday 19th of May 2013

if i were to give a humble opinion, when a market is rising even in the face of a poor news, it is usually very bullish.

the problem is that people think that cause and effect takes place IMMEDIATELY. the FED is really not seeing the signs that they want to see. and that the main indicator for them is the unemploymen rate. to go to 6% that is so long drawn. this could play out much longer.

and i believe when you take in the news you should take in both sides. this is still a very skeptical bull.

i am more of a buyer these days then seller.

Victor

Sunday 19th of May 2013

Both AK 71 and Drizzt are guru in their own right. I really benefited from both of you. Sincere thanks form my heart for sharing.

A K

Wednesday 15th of May 2013

Hi Drizzt, Stay invested and have a war chest ready. Don't be too bullish or bearish. Stay pragmatic. Works for me. :)

Kyith

Wednesday 15th of May 2013

Hi are you Ak71? Not saying to get out or anything but this is a pragmatic reasoning in case youI are overweight on cash