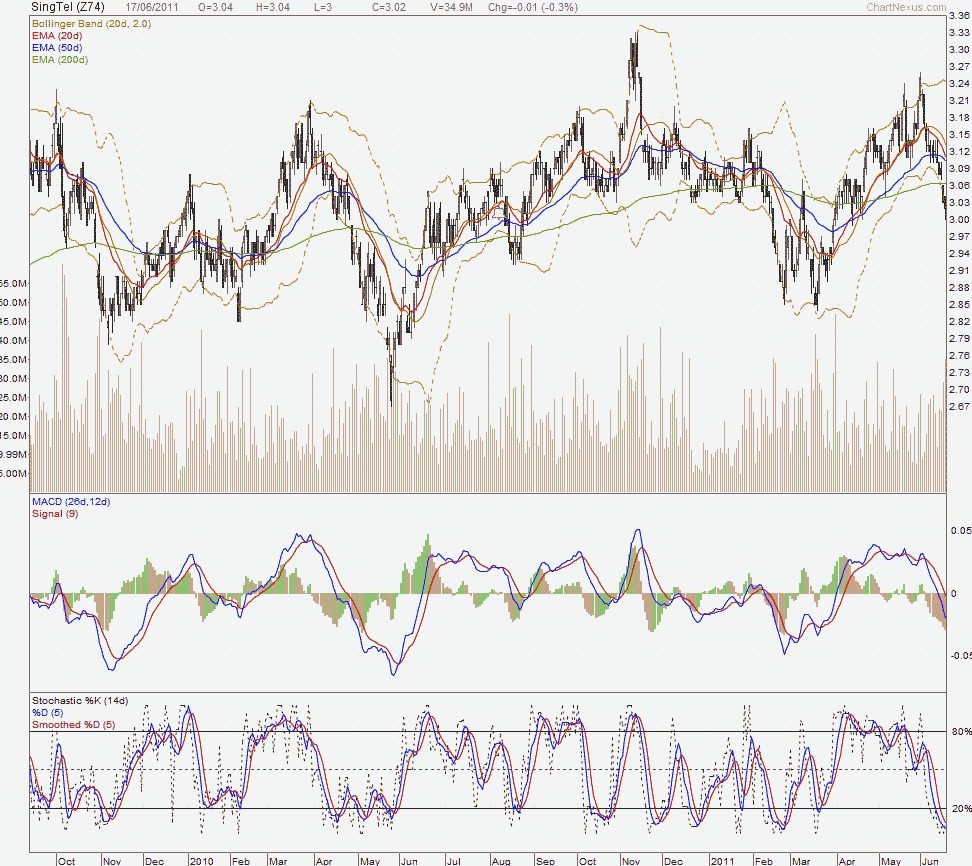

We written that 3.06 on Singtel is pretty significant and on Friday it reached 3.01.

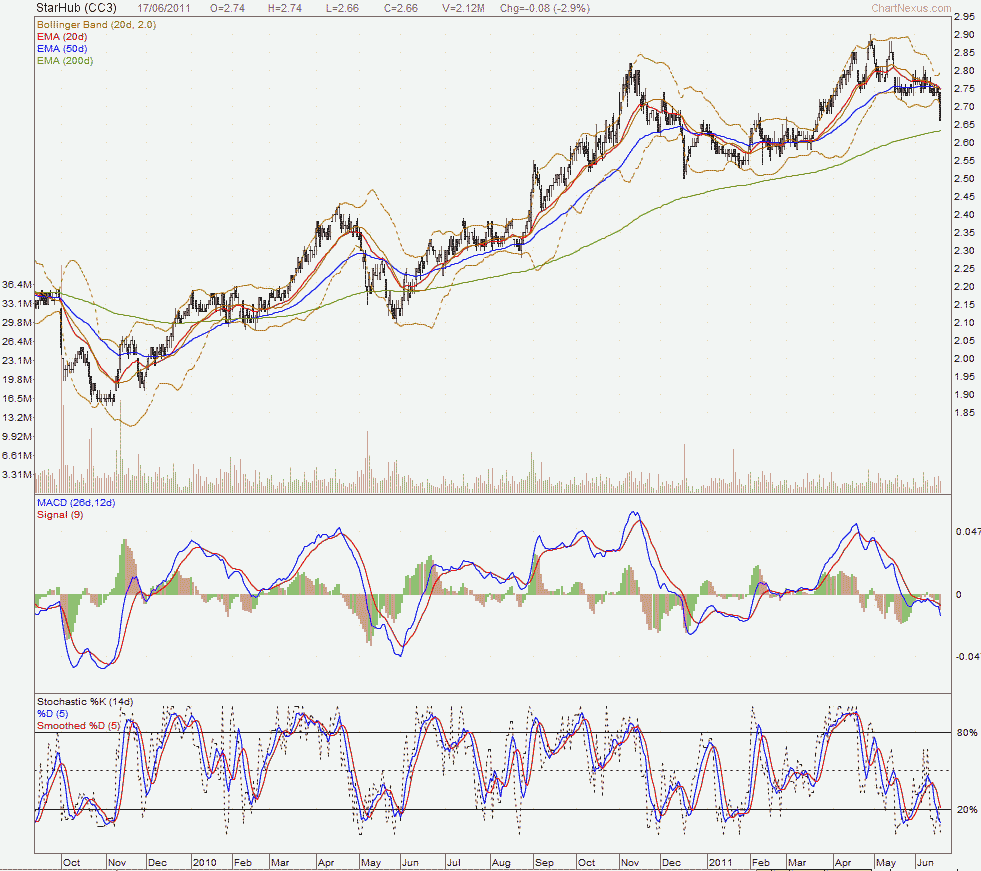

On Friday, Starhub finally went down a huge 2.9% to 2.66. Both these presents good opportunity but I reckon people would wait at 2.90 for Singtel and probably much lower for Starhub.

To be honest, after market went straight down for 6-7 weeks, the chances of a snap back is rather high. Based on how oversold it is on both sets of breadth indicators and that Starhub have always been above the 200 day MA, I don’t expect both to be lower next week.

The high probability outcome is a move up. If it doesn’t happen, you guys will get your dream of accumulating these 2 telecoms at much lower prices.

For those interested in tracking my most current holdings, you can review my portfolio over here. Learn to use our Free Stock Portfolio Tracking Google Spreadsheet to track stock transactions.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

FoodieFC

Monday 20th of June 2011

Hi,

which website do you use to get the chart data (TA) that you have shown for singtel and starhub?

thanks.

Drizzt

Wednesday 22nd of June 2011

hi FoodieFC, great blog there i should RSS your blog for the wonderful pictures.

The charts are taken from DecisionPoint.com. its a paid service for TA charts.

Temperament

Monday 20th of June 2011

Hi, I see. But i mean i like best like SPH's cash reserve or SIA Engg's. Of course the nature of the businees may allow the Company to operate on a lower % of cash to capitalization or lower equity to debt or more debt to equity.

I think it's the same for an individual:- the nature of his occupation may allow him to use his cash flow to the maximum to service his liabilities(debt). This means he has no cash reserve as assets to cover his debt in an "emergency". Do you think this individual should operates this way. What's the difference between individual and company in this comparison? In fact, can we compare them at all? Of course, some company may be able to ask the public for more money if it's operation is still viable. But the individual? Can you share your take of this?

gregg

Sunday 19th of June 2011

Hi Dividends Warrior,

I like your Average Price for the three telco company..... you are awesome..

gregg

Sunday 19th of June 2011

Hi Temperament,

As long Starhub keep maintain their dividend payout, 5cents/share, with DY@7%~8%, i would happy to keep putting $$ to this counter. I am dreaming of owning 50lots of starhub somewhere at my retirement age.....

Dividends Warrior

Sunday 19th of June 2011

Hi Drizzt, Temperament & Gregg,

Actually, I have no strong preference on any of the 3 local telcos. Tats why I decided to get all 3 bcos they are all good. Lol. ^^