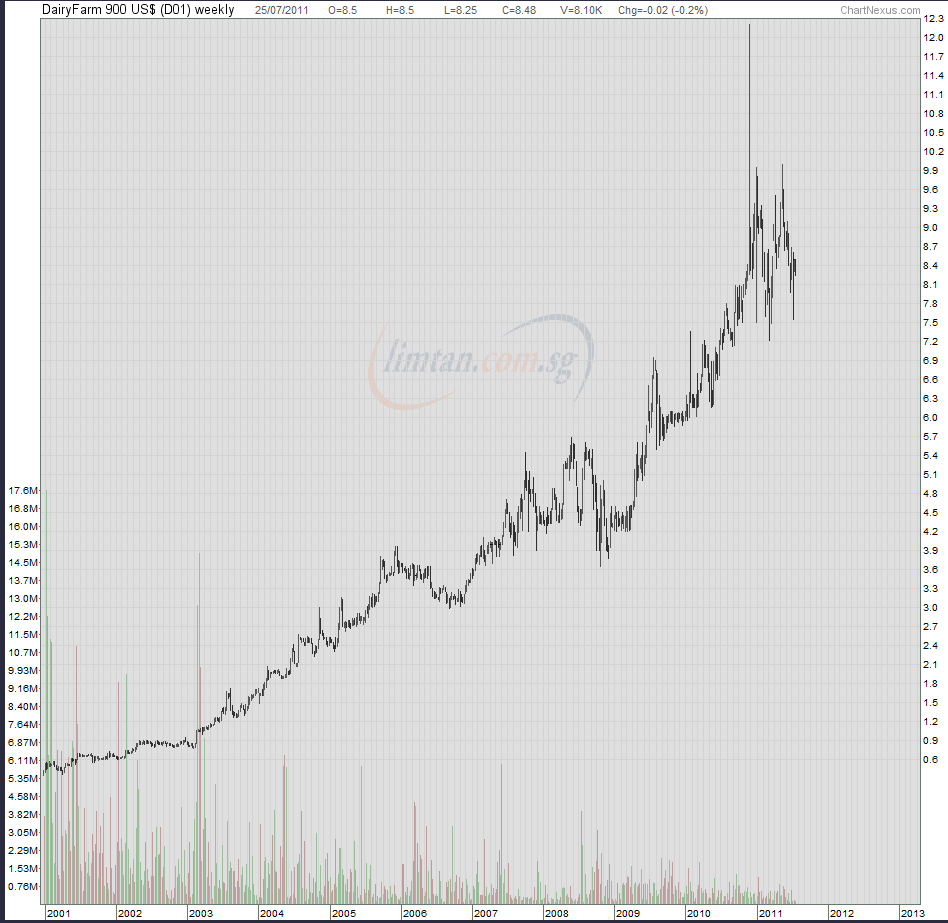

I knew Dairy Farm as a stock for sometime and have known that it is relatively less volatile then most of the other stocks.

But it is beyond my perception that it is trending so well.

For those who are unfamiliar with Dairy Farm, This company’s history dates back to 1886! It carries a lot of the moms and pops business or the WALMART kind of business that we engaged in today. These are the group of companies under Dairy Farm:

- wellcome

- mannings

- HERO

- 7 Eleven

- Marketplace

- Jason’s

- guardian

- Giant

- IKEA

- foodworld

- GNC

- Cold Storage

- ThreeSixty

- Oliver’s

- starmart

These are businesses that even during recession you will do ok but during good times it will move up as GDP moves up.

I only manage to grab the share price from 2001 till today. If any readers have a longer chart feel free to provide me.

Click to see larger chart.

Take a look at the period from end 2007 till start 2009. Crazy Shit. Help me disprove that Dairy Farm’s price is stable by providing one during the Asian financial crisis.

Disclosure: Author is not vested in Dairy Farm

I run a free Singapore Dividend Stock Tracker . It contains Singapore’s top dividend stocks both blue chip and high yield stock that are great for high yield investing. Do follow my Dividend Stock Tracker which is updated nightly here.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Weiz

Wednesday 17th of February 2016

Hi Kyith, I was going thru Dairy Farm's reports, seems like the growth sustained till 2013, stagnated and dipped a little subsequently. But the price seems to have dipped more than proportionately, particularly unusual in 2013 when results were still positive. Just wondering if there were other contributing factors.

Kyith

Thursday 18th of February 2016

hi Weiz, this post was done during the good times, and apparently, the reason why share price falter is like all other companies, the business faltered. Consumption in its area of operation was affected. The key thing was the growth expectation. When the share price values the business with x% of growth and it doesn't seem it will live up to it, then we will see an issue there.

Jared Seah

Friday 29th of July 2011

Hello toiletsiao,

Yes, you are right. But currency risks are all around us. Even if a company is listed in sing dollars, if their sales are mainly in foreign currencies, it's affected too - like Armstrong.

Diary Farm in USD is in fact more "transparent" since a big chunck of its sales are tied to USD (HK dollars). Conglomerates with multinational footprints have greater currency exposures, but they also have geographic diversification advantages - unless the whole Asian region goes kaput!.

SMRT is less affected by currency risks; but it's fortune is closely tied to the economy of Singapore - which can either be good or bad; depending on how you cut and slice :)

toiletsiao

Thursday 28th of July 2011

i think u forgot to factor in the currency in which Diary Farm is trading at ... Dairy Farm is trading in USD... readjust back to SGD terms the returns will be lesser... but yes.. on nett basis its still very good returns...that i will not disagree on

Jared Seah

Wednesday 27th of July 2011

You are right Drizzt!

SMRT, Diary Farm, and Armstrong (got this one from CJ's blog) are now on my radar. Patiently waiting for anyone of them "correct" a bit more so that I can tip-toe in at a good entry point to have that extra "margin of safety".

temperament

Tuesday 26th of July 2011

Hi Drizzt,

There were many stories in the books i read (maybe the truth) about simple folks in US who bought a few lots and forgot completely for the 20 to 30 years. And when they remembered, bingo they were already millionaires. Lucky asxxxxx.

Buy and forget then happen to remember one day seems to be better than buy & hold. Ha! Ha!

Seriously in 1982 i have bought 73 shares of HP as an employee's subsidised benefit shares and put into drips later. Today my shares have reached 640 @ US $36. + 2 free spin-off companies's shares, which do not worth much.

Shit, i wish i have work for Microsoft or IBM or AT&T. You see some people buy and forget become millionaire while me buy and hold long, long also like that.

But based on HP historical data on their webside, if i purchased about maybe 10 - 12 months earlier, i will be a millionaires due to their bonus issues.

Well if it's not yours, it's not yours. i got nothing to say.

Drizzt

Wednesday 27th of July 2011

oh man! temperament i feel your pain but you are still doing great!

i also wish i worked for one that way. i didn't know you used to work in the tech industry. could really get alot of advise and tips from you!