Since launching its bionic advice service in 2018, MoneyOwl has slowly added the necessary financial offerings so that consumers have cost-effective and sound tools to manage and build their financial life today and tomorrow.

They started offering insurance protection products such as term, whole life, critical illness, and disability income, if you prefer to DIY and not deal with a human adviser. Then they added a simple digital will writing service if your estate wishes are simple. This was followed up with their five strategic investment portfolios to help you accumulate wealth for your various goals or to spend down during retirement.

Following up with that, they added a cash management portfolio that is solely made up of very short term fixed deposits.

What is missing from this line-up is a portfolio solution for your CPF monies, if you wish to invest your CPF.

Last week (11 April 2022), they launched their CPF portfolios to kind of complete the lineup.

So now if you go to MoneyOwl, you could:

- DIY buy term and whole life insurance, critical illness, disability income, and others

- Simple digital will writing

- Low-cost strategic investment portfolios for Cash and SRS

- Low-cost strategic investment portfolios for CPF Ordinary Account

- Joint investment accounts

- Cash management portfolio

- Comprehensive fee-only advice

I hope to bring your attention to their CPF portfolios in this post.

How Should You Invest Your CPF Ordinary Account Monies?

The main portfolio of money our government considered as our retirement funds are our CPF Special Account and then our CPF Ordinary Account. The monies from these two accounts will form the basis of what will be the funds for our CPF LIFE Annuity Income when we turn 65 years old.

We cannot invest the first $60,000 of the funds ($20,000 of CPF OA, $40,000 of CPF SA) but beyond that, we can invest but there are limitations.

Generally, Singaporeans would prefer to “invest/speculate” and build their wealth through their buy-to-live residential properties. They would use the funds in CPF Ordinary Account to service their mortgage as they believe that the compounded growth through the property will be greater than the long term return of CPF OA (2.5% currently).

Usually, they would treat their CPF Special Account as the bond allocation of their net wealth. The current interest rate on CPF SA is 4% and the money is not subjected to any volatility. Still, some advisers managed to convince some of their clients to invest in unit trust funds to push their money to work even further, despite the limited number of funds that qualify for CPF SA investments.

There was a point after 2013 during the languishing property market when people asked if there is a way to grow their CPF OA by more than 2.5%.

With your CPF OA, you can also speculate or test your value investing skills by investing in individual stocks listed on the Singapore Stock Exchange, or purchase exchange-traded funds (ETF) listed on the Singapore stock exchange as well. You can also invest in gold savings accounts from UOB with up to 10% of your CPF OA funds. So there are many options.

A popular option is to invest in a portfolio of unit trusts or investment-linked policies.

These are what financial advisers recommend to people and unit trust funds also form the basis of what MoneyOwl and Endowus recommend to people.

The 2.5% a year return became a long term hurdle rate to be beaten if you choose to invest your monies.

I do agree with that.

The opportunity cost of investing is earning 2.5% a year. This 2.5% is artificially high, given how low the global interest rate is. It became a hard hurdle to beat.

But for most of you, given the hectic lives that you live, you should invest for the long term.

Select a portfolio of unit trust funds that are soundly constructed, then buy and hold the portfolio for the long term. Given the expected rate of return of equities and bonds, over the long run, these portfolios should do better than 2.5% a year.

MoneyOwl’s Strategic Portfolios for Your CPF OA Monies

You can review MoneyOwl’s CPF Portfolios here.

Here is a summary of the portfolios:

MoneyOwl created three strategic portfolios for investors with different risk profiles, based on different amounts of bonds in the portfolio. They would have a conservative and low-risk portfolio but that would have no point because the investor may be better off putting their money in CPF OA and not investing in it.

In this summary, you are able to see the annualized historical return if they use the data from Jan 2012 to Dec 2021.

The returns of the portfolio looked really good for all three portfolios and would have handily beaten the 2.5% a year CPF OA hurdle rate.

The annualized standard deviation, which indicates the volatility of the portfolio, ranges from 7.9% to 12.7%. The CPF Balanced portfolio has a volatility profile that is slightly higher than a global aggregate bond portfolio while the CPF Growth has a volatility profile of a 60/40 balanced portfolio.

The total expense ratio of all three portfolios is relatively low.

I believe the funds used to construct these three portfolios has the lowest expense ratio listed. The expense ratio is important in that future returns are uncertain, but the cost is definitely incurred and if your cost is high, it will affect the amount of wealth eventually you built.

These three portfolios are constructed with two newly listed CPF-OA approved unit trusts.

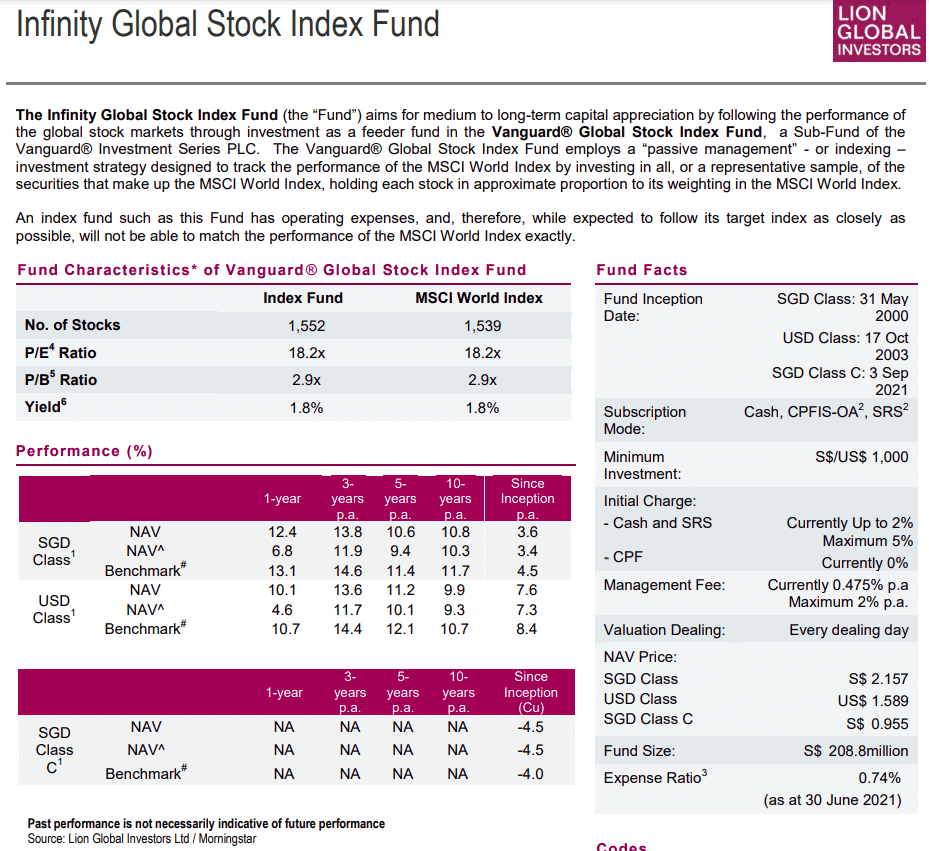

The LionGlobal Infinity Global Stock Index Fund Class C

MoneyOwl worked with LionGlobal to introduce an index fund class available for CPF-OA investment at a relatively low expense ratio with fewer trailer fees. The platform still earns some trailer fees but if I am right, the total expense ratio of this newly created Class C fund is 0.46% to 0.42% (Mar 2022 update).

Other share classes have an expense ratio of 0.74%. When I started investing in 2003, the expense ratio of Infinity Global is closer to 1%.

This is how far we have come.

Infinity Global is a wrapper unit trust that is wrapped around the Vanguard Global Stock Index fund. The Vanguard Global Stock Index fund gives you exposure to MSCI World FREE Index.

Fans of index fund investing can gain exposure to MSCI World for their CPF-OA monies.

You may be interested to read my review of the LionGlobal Infinity Global Index Fund written in 2014.

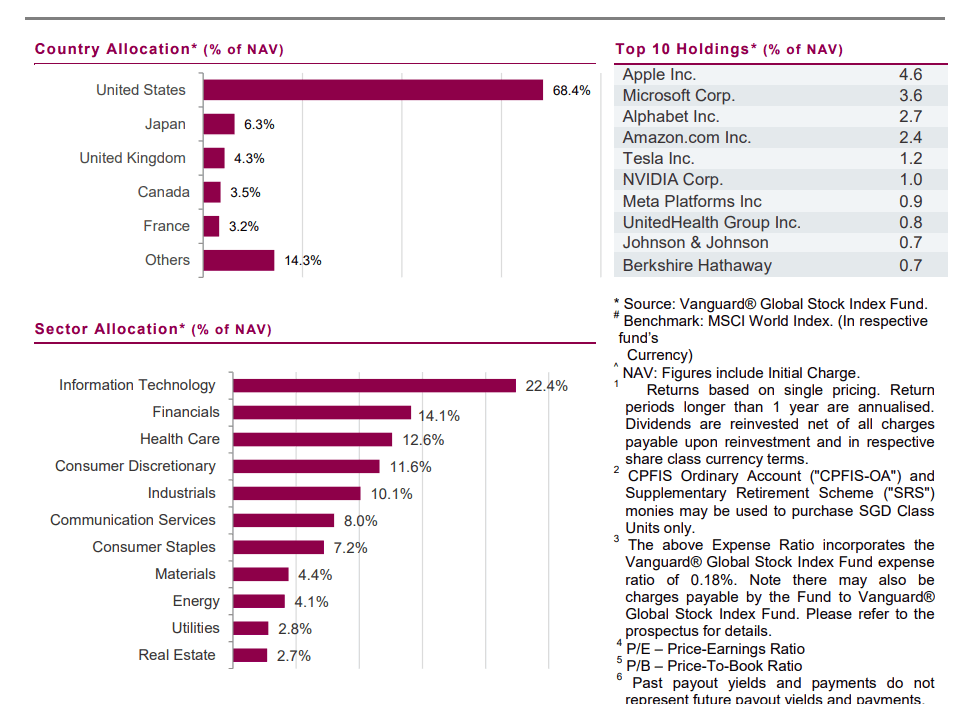

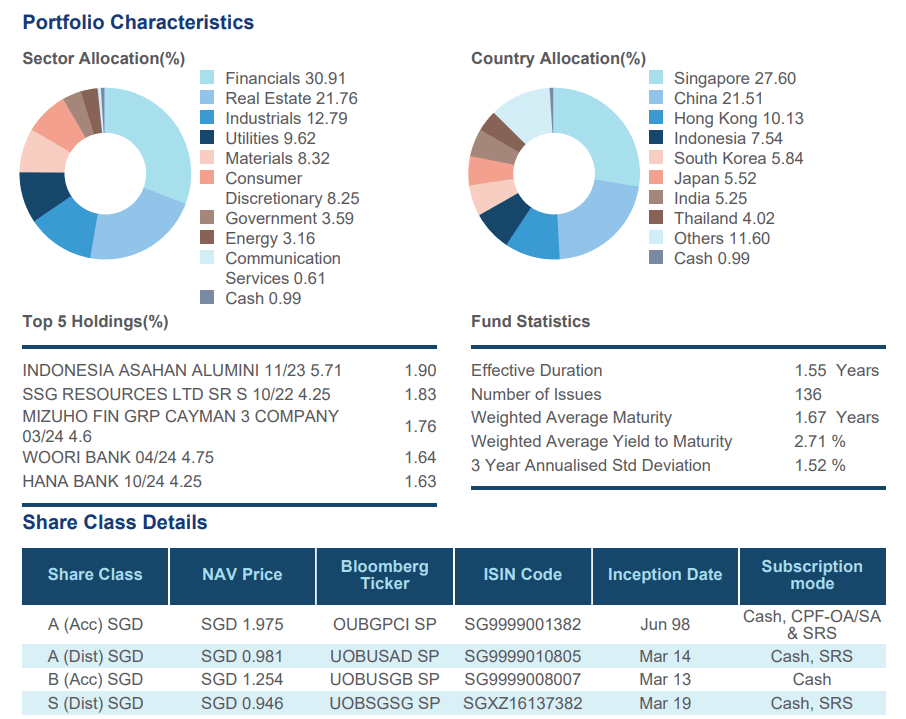

UOBAM United SGD Fund Share Class D

If I am right, MoneyOwl also linked up with UOB asset management to introduce a new Class D fund with a lower expense ratio with less trailer fees.

This is a new share class for an actively-managed short-duration bond fund that was incepted in 1998 so it has a 25-year history. This short duration bond fund is very popular, often used by Endowus in their Cash Smart solutions.

I cannot tell what is the expense ratio but likely it should be around 0.38%, which is lower than the other share class, with an expense ratio of 0.67%.

The portfolio has an average maturity of 1.67 years and an average yield to maturity of 2.71%.

The duration of the bond portfolio is short, and thus less sensitive to interest rate fluctuations.

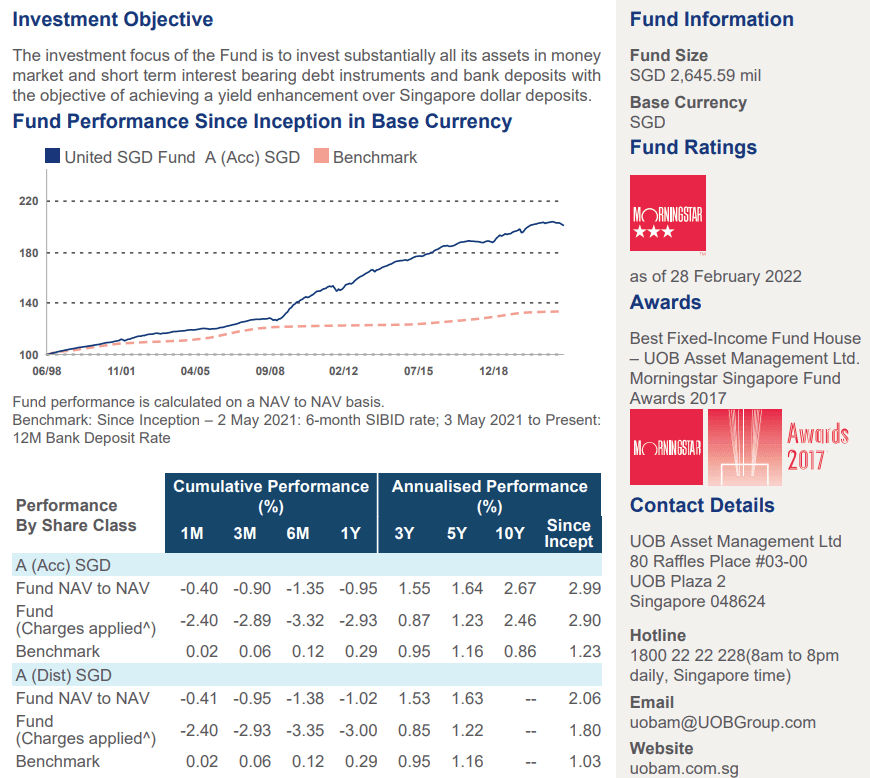

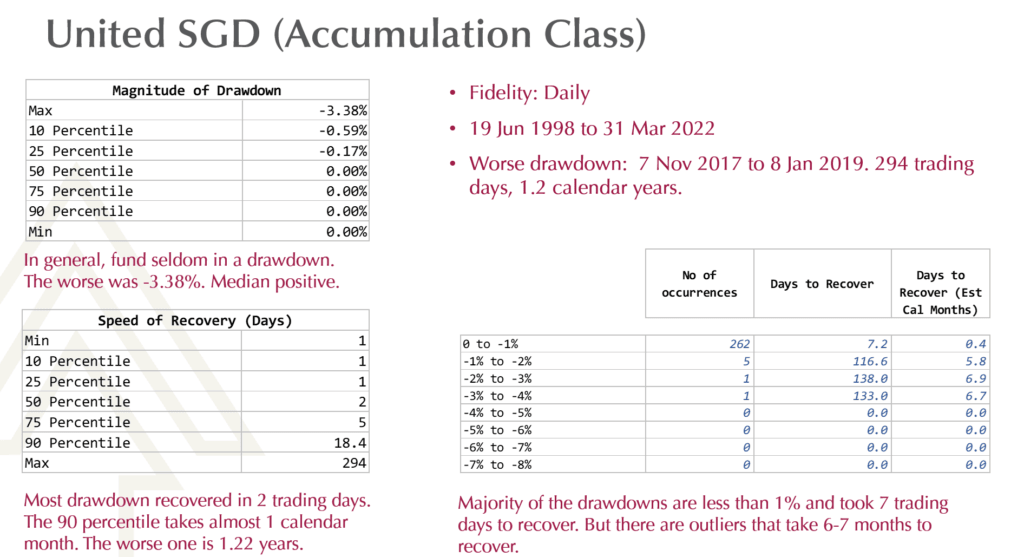

Drawdown Profile of the United SGD Class A (Accumulated)

The class A share class (not the new class D) has existed for almost 25 years so we can take a look at how bad the fund performance can get.

I tried to measure the degree of fall in the United SGD class since its inception.

The largest drawdown the fund encountered was -3.38% before turning around. The median drawdown is 0% which generally means in the past 25 years, the fund does not fall much. The median recovery of any drawdown is 2 days. The worst drawdown took 294 days or 1.2 calendar years to recover.

The majority of the falls recover within 5 trading days.

The majority of the falls are between 0 and 1%. Even a -1% to -2% fall is quite uncommon. But those 7 outliers can take 6-7 months to recover.

Long story short, on average the United SGD have very low volatility but that does not mean there aren’t outliers! There is a reason it’s called bonds and not cash! You can wait for a while for it to recover!

But given the magnitude of the fall (if my data is correct), I think it may be something a lot of people can live with.

How do the historical returns for the portfolio look?

While the share class of the funds that made up the portfolio is rather new, we can make use of the data from the existing share class to give us a glimpse of what the returns are like.

We have 20 years’ worth of Infinity Global SGD Class and United SGD Class A Shares to work with. Both are accumulating classes which means that the net asset value (NAV) of the fund factors in the dividend reinvested.

However, do note that the total expense ratio of the older fund classes is higher. Particularly, Infinity Global used to have its total expense ratio at 1%.

From Jun 2000 to End March 2022, here are the performances:

| Portfolio (older share classes) | 3Y (Ann) | 5Y (Ann) | 10Y (Ann) | Since Start (Ann) |

| CPF Balanced | 8.9% | 7.2% | 7.6% | 3.6% |

| CPF Growth | 11.5% | 9.1% | 9.3% | 3.7% |

| CPF Equity | 14.1% | 10.9% | 10.9% | 3.7% |

You might be wondering… why is the Since Start performance so low? Didn’t the MSCI World do well in the past decade?

Yes the MSCI World did well in the past decade, but in the previous decade, the performance has been poor.

Secondly, this is in SGD. USD have weakened against the SGD in the past 20 years.

| Portfolio (older share classes) – in USD | Since Start (Ann) |

| CPF Balanced | 4.7% |

| CPF Growth | 4.8% |

| CPF Equity | 4.9% |

About a 1% difference.

The other reason is that the total expense ratio of the infinity global used to be high. Suppose we assume that the infinity global has a historical total expense ratio of 0.85%, here is the performance of MSCI World in USD without cost and with 0.85% in cost:

| Since Start (Ann) | |

| MSCI World USD – with 0.85% TER | 4.9% |

| MSCI World USD – with TER | 5.8% |

Ah… now the returns look closer to what you would expect.

Eventually, even if you invest in a USD denominated fund, you will have to convert it to SGD cash to spend it.

Rolling 5-year and 10-year Annualized Portfolio Returns If Constructed with the Older, Higher Expense Ratio Share Classes

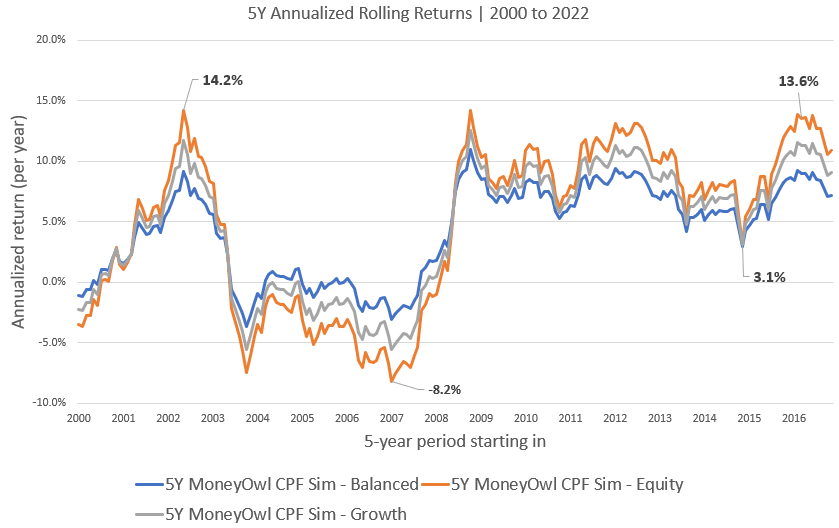

We can take a look at the portfolio performance if we use the more expensive share classes.

We want to examine the 5-year and 10-year rolling annualized portfolio returns to see if an investor were to invest at a certain point in the past 20 years, and what would his 5-year and 10-year returns look like.

Here is the 5-year annualized rolling return:

If your returns in the future mirror the past, there is a possibility you would compound your money at 13% a year for five years. But there is also a possibility, you do -8.2% a year for 5-years.

This may put some investors off, considering that the hurdle rate for CPF is 2.5%.

But if you don’t risk your money (by putting in relatively sound investments), your CPF monies won’t have a chance to earn higher returns.

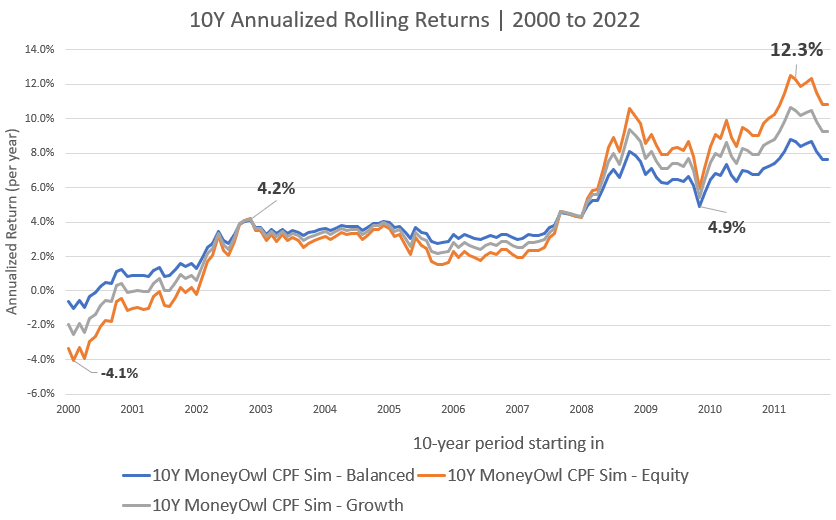

Let us take a look at the 10-year annualized rolling return:

Most investors who have invested for 10-years would have beaten the 2.5% a year CPF OA hurdle, but there are also investors who have invested for 10-years and are making losses.

Those are the investors that invested at the start of 2000.

I think your experience in the MoneyOwl portfolios will be the same because if you factor in the MoneyOwl Advisory fee of 0.4% after the promotion period, it will almost be at 0.8%, which is perhaps close to the expense ratio of the share class used to simulate the above.

If you invested in a balanced and a growth portfolio, your experience may be better.

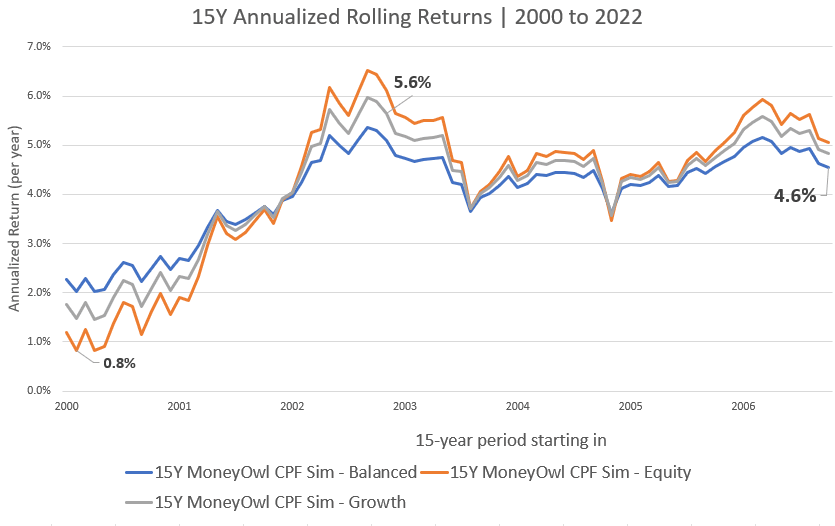

How about if we roll 15-years?

In all the past instances when held for 15 years, the three portfolios did not suffer losses. But those early 2000 investors did not manage to beat the 2.5% hurdle rate.

I think that is the price of the game.

If you made a pricey property purchase, you end up holding the property for an extended duration and might just break even as well after 15 years.

What you are looking for is a very passive way to buy and hold and capture a long-term return that is higher than 2.5% a year and the CPF portfolios crafted by MoneyOwl allow you the greatest probability to do that. We already saw the impact of higher total expense on Infinity Global’s performance.

Given that most of the other unit trust available for CPF-OA investment has higher expense ratios, it is likely that portfolios crafted with other unit trusts available for CPF-OA would do even worse.

How Does the Infinity Global Compare to Other CPF-OA Approved Global Unit Trusts?

A lot of the returns are driven by the performance of Infinity Global so there may be some investors who wonder how the index fund did versus its peers.

There are not many globally diversified funds that are CPF-OA approved (then again the number of unit trust have been dramatically reduced)

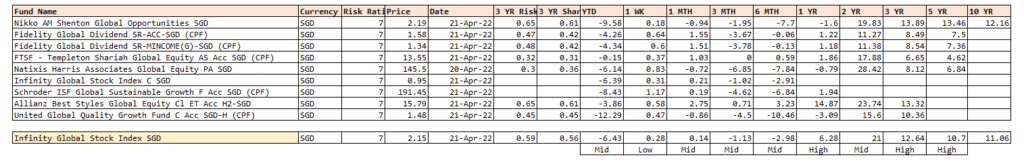

Here is the list:

You would notice that only 1 of them, Shenton Global Opportunities, has a ten-year history. The rest are rather young.

Since the Infinity Global C Class is rather young, I added the non-CPF-OA approved SGD class below so that you can compare the performance.

The index fund does not serve to outperform the actively-managed unit trust and you would see that across different timeframes, the fund achieves the middle performance.

But observe that longer-term, Infinity Global shines against the competition.

Nikko AM Shenton Global Opportunities SGD is quite a beast though.

Now, if you are concerned about those poorer rolling returns periods observed previously, selecting another fund might give you better performance over some shorter-term timeframe, but over the longer-term, substituting these funds instead of Infinity Global would likely give you the same or even worse outcome just because how the global markets are linked.

The performance would be different if you have incorporated an emerging markets allocation into your CPF portfolio, which the MoneyOwl CPF Portfolio does not allocate.

Would It Make Sense to Invest in the Balanced and Growth Portfolio Instead of Just Invest in the Equity and Use Your CPF-OA Monies as the Bond Allocation?

I think whichever way is fine.

From July 1998 to Mar 2022, the average compounded return of the United SGD is 2.85% a year.

Here are the Best and Worst Rolling Return Over Different Time Frames in the Past:

| 1Y | 2Y | 3Y | 4Y | 5Y | 10Y | 15Y | 20Y | |

| Best | 11.8% | 8.7% | 6.5% | 6.4% | 5.9% | 4.3% | 3.6% | 3.1% |

| Average | 3% | 3% | 3% | 3.1% | 3.1% | 3.4% | 3.3% | 3% |

| Worst | -2.1% | 0.4% | 0.7% | 1.1% | 1.2% | 2% | 3.1% | 2.8% |

Historically, the worst 15-20 year rolling returns of the United SGD fund have been higher than the hurdle rate. The United SGD only suffers from a loss in a 1-year timeframe and even the magnitude of the loss is very acceptable.

Usually, the future return of the portfolio is very correlated to the current yield-to-maturity of the portfolio and currently, the yield to maturity is 2.7% from the factsheet, so I think we stand a pretty good chance of beating the CPF-OA hurdle.

But if you wish to, I think is perfectly fine to invest just in the CPF Equity portfolio and use CPF-OA as your bond allocation.

The role of the bond allocation is not just to earn a positive expected return, but also to cushion the volatility of the equity so that you have a more livable experience. I think both the United SGD and CPF-OA will serve that purpose.

MoneyOwl’s Advisory Fees

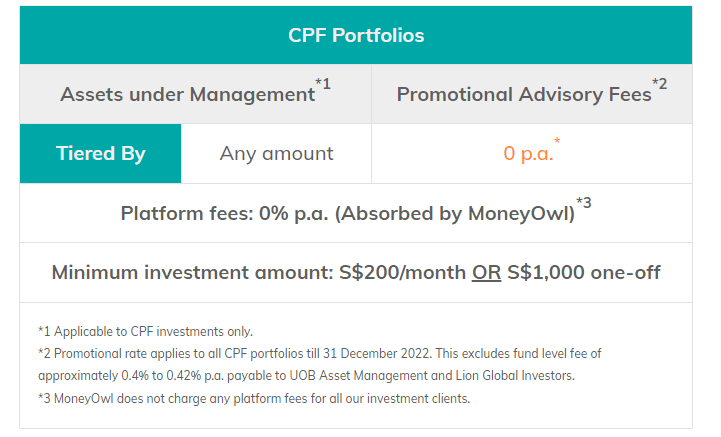

The table below shows the fees charged by MoneyOwl if you invest in any of the three portfolios:

Currently, till the end of 2022, you will enjoy a promotion rate of 0% in advisory fees. This fee is recurring.

Thereafter, it is likely that the advisory fee will be 0.4%, which is the max any adviser can charge on managed investments with CPF monies.

You can start with a lump sum CPF investment of $1000 or a minimum RSP of $200 a month.

How to Sign Up for MoneyOwl’s CPF Portfolio

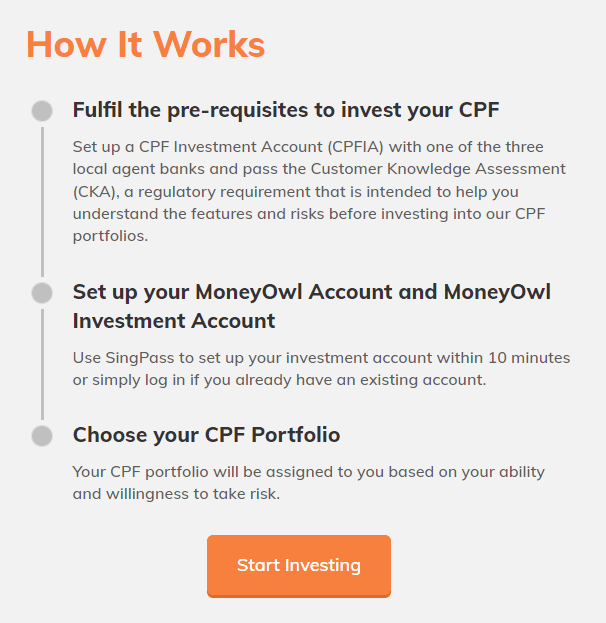

The following image explains how you can get started:

I think firstly, you need to set up a CPF Investment Account with one of the three local agent banks. This should not be too hard. Note that the local agent banks do levy a quarterly charge for each fund or stock that you hold. You can check with the local agent bank for more info.

You will need to pass the CKA before you can invest.

If you do not have a MoneyOwl account you can create one.

Here is my referral link: My MoneyOwl Referral Promo Code Link

If you go through my referral link, you can earn some Grabfood vouchers but that is more like a good to have. You should only sign up if you happen to be interested to invest and not sign up for the sake of earning those vouchers.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

J

Saturday 14th of May 2022

Hi Keith, if we buy the Infinity Global Index Fund through FSM, which charges 0% platform fees and sales charges, we just pay the fund TER annual charges, isn't it cheaper to go for the FSM option?

Longtime Reader

Saturday 23rd of April 2022

Hi Keith. Considering that Endowus rebates the trailer fees, at offers the exact same equity fund, wouldn’t that be an overall better option?

Kyith

Friday 29th of April 2022

HI Longtime reader, I think they are about the same.