There is this ongoing debate whether the inflation we are seeing in various pockets is going to be transitory or not.

The communication from the Federal Reserve puts it across that they see inflation as transitory.

Then, a lot of market commentators are saying this is not.

In your daily lives, you may lean over to the camp that this is not transitory.

Inflation is kind of an important metric when it comes to planning for your future spending.

I think what is dangerous is the Fed’s definition of transitory.

Transitory means that what we are experiencing is temporary.

I think in a lot of our minds, temporary means that… things will return to where they were.

But that is not what they mean.

What they mean by transitory is that the high rate of inflation that we are experiencing will moderate to a normal rate of inflation.

My chicken rice cost me $4 a plate in Jan 2020.

Today, it cost me $5 a plate.

Our idea of temporary is that my plate of chicken rice will go back to $4 a plate after a while.

This is not how it works.

Their definition of transitory means that in the future, the plate of chicken rice will rise to $5.20. Less drastic, but still rising.

Inflation in the United States is often measured by the Personal Consumption Expenditure or PCE for short.

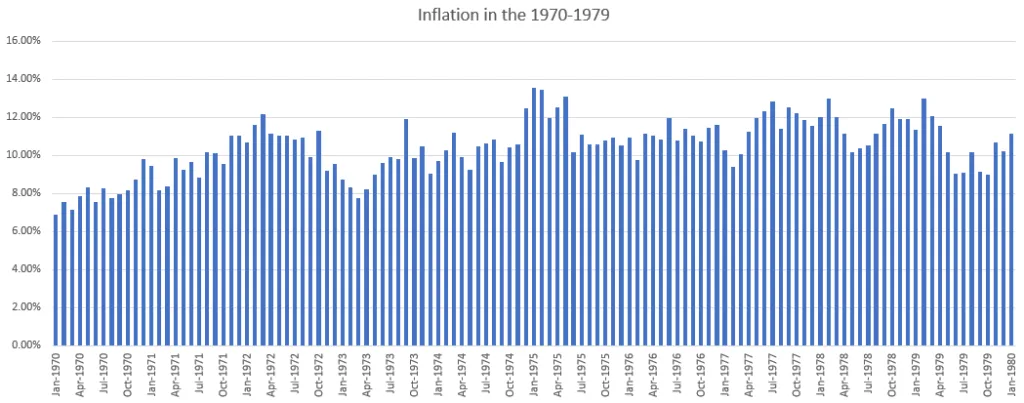

The chart above shows the 1-year rolling PCE inflation.

What you will observe is, other than the deflation periods we in the two different periods, inflation have been positive.

PCE can be rather scary.

- The average annual PCE is 6.51%

- The 25th percentile PCE is 4.62%

- The 75th percentile PCE is 8.33%

It just feels crazily high.

In the chart, we can see the transitory aspect was the abnormal low and high inflation we see recently. A return to normal would be to return to an annual range of 6.5 – 8.3%

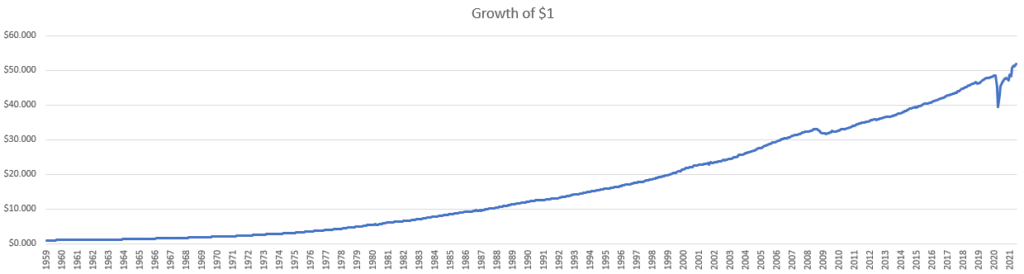

Here is the growth of 1 dollar:

The impact to all of us from the financial planning is that transitory does not mean some sort of deflation, that returns our chicken rice to $4.

Inflation does not have to be the sort in the 1970s.

If we zoom in, the inflation is quite high.

But just a mere 1 year bump up of 10% inflation and returning to a normal 3% can dramatically affect your future spending power.

And that affects how you plan for your retirement.

But I think in reality, some stuff like high used car prices is transitory… they will come back to a lower price. Commodity foodstuff prices can be transitory.

But a lot of the things we buy tends not to be transitory. It sometimes means our salary will go down.

Do you want your salary to be reduced? Have you seen your work salary reduced? Seldom right?

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

KLKT

Tuesday 17th of August 2021

When it comes to inflation, we should look at 1) how much inflation per major cost category (housing, medical, food/groceries, travel, educ etc.) 2) what is the proportion % that one spends across different categories.

Edu's inflation can be 5 to 10% but doesn't affect retirees whose children have already grown up. Medical's inflation can be 8-12% and will badly hit retirees as they consume less but spend more on medical/improve their quality of life. Young adults have less of this concern (for now) and can buy some form of insurance to transfer the risk to insurers.

A 10c increase on $1 kopi is a 10% increase and even if we drink 2 cups a day, I like to think it is still manageable compared to a major surgical bill and hospitalizations/followups/medication that can run up to 5-6 digits easily.

Would love to hear practical ideas on how to hedge inflation (gold? crypto? stocks? real estate?)

Sinkie

Monday 16th of August 2021

I think most financial / economics literate people roughly understand what is meant by "transitory inflation".

Those who fear-monger it tend to have vested interests to sell something, or promote themselves.

The target market appears to be boomers approaching retirement or already in retirement. They will be those most affected by high inflation, even if temporary, as prices for many essential items are sticky e.g. healthcare, food / groceries, electricity, water.

Retirees or near-retirees no longer have rising active income to offset inflation. But they still have substantial savings that vested people want to help themselves to, in exchange for "anti-inflation techniques or methods".

Kyith

Monday 16th of August 2021

I am not sure about that. I think the general group of people are just afraid that this inflation is going to be around longer than normal.

John

Monday 16th of August 2021

I am puzzled by your conclusion that there's inflation based on your experience with your chicken rice. This may not be due to inflation, it maybe the seller wants to increase his profit margin and decided to increase price. Can you go to his competitors and get $4 or lower? The answer is probably yes. So is there really inflation?

Kyith

Monday 16th of August 2021

Hi John, good question. I think i might not have stated clearly a few assumptions. If those factors are held equal, then it be possible the whole cohort to charge lower? I think they might not be. The price is dictated by margin but also by the cost that goes into it. This can be manpower cost, the ingredients, rental. By right, there is a possibility for them to reduce the price as ingredients and rent moderated downwards. But it almost always do not happen. Chicken rice is a good example, but also other services. Ultimately, everyone just bumps up a little each, and it aggregates.