I had a conversation with my colleague yesterday about when someone is REALLY open to listening to your financial advice.

When they realize they don’t know enough and need help, and you are sophisticated enough to help them.

Some People Made Enough Mistakes In Their Life or have Seen People Important in Their Lives Make Serious Mistakes to Know They Need Help.

Some of my readers share with me the stupid investments they made or the stupid things their financial decisions made.

They realize that they are ultimately at fault, and they take responsibility for that L.

By default, they are oriented to listen to what you have to say.

Some Know it Is Not So Easy to Be a Good Investor or Money Manager

The really good investors, or the sophisticated ones know that managing money or invest well is not as simple as some think.

While others look upon their results as successful and by all measures they are, they themselves suffer from the occasional poor investing decisions, or nearly did, to be vulnerable enough about it.

They also put in the hard work to get to where they are.

So they have an open-minded orientation.

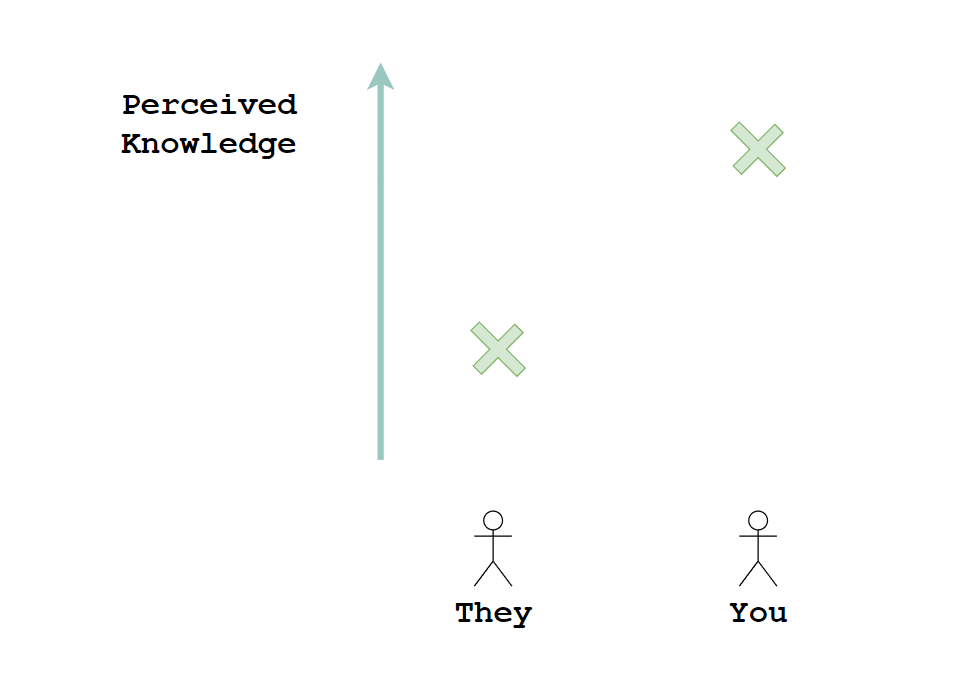

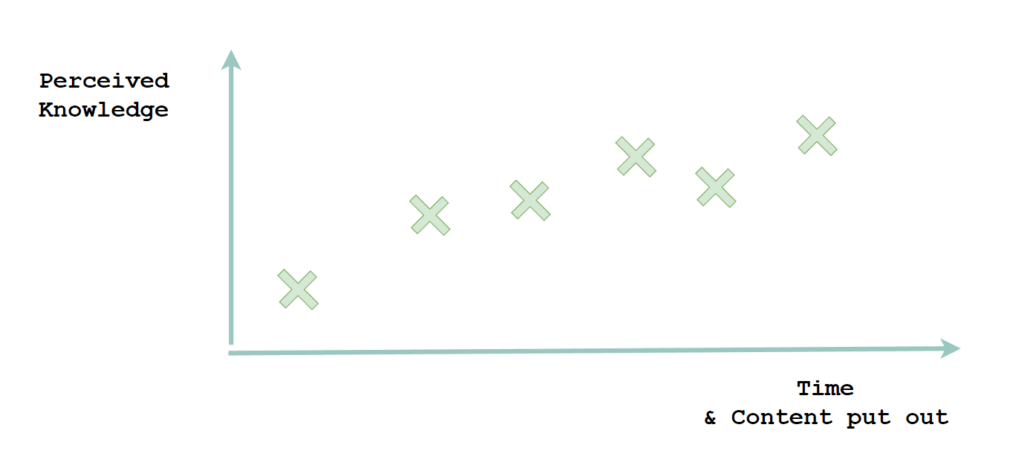

This can be best illustrated in the diagram above. These good and sophisticated ones probably have developed a lot of knowledge in the field to have a quiet confidence but know its complicated.

Some of our prospects or clients are in the financial field. They know there is probably some investment alpha to be made but whether that can be easily captured, or if the alpha stays long enough is a different matter altogether.

Where I disagree with some is that these more sophisticated people will actually make pretty good clients.

If you explain something that is sound to them, they get it.

You just reminded them of something they had forgotten.

Unlike others, you don’t have to wreck your brain to dumb it down or explain the concept in different ways. You can have a conversation with them to explore whether this happen in their lives, or whether they encounter this in their professional lives.

You have to Measure Up.

You have to be perceived to be good enough, or far better, compared to themselves for them to be open to listening to you.

I use the word perceived because some might not have worked with you so closely to see your financial impact on their lives. Some just spend the time paying attention to your past conversation passively.

They are open to listening to things they are less knowledgeable about. If it is a casual conversation, they are sizing up whether you know your shit or are sprouting nonsense.

If they are paying money for advice, they are sizing you up to see whether you are worth it really.

So how do they size you up?

The content that you put out.

Let me explain more.

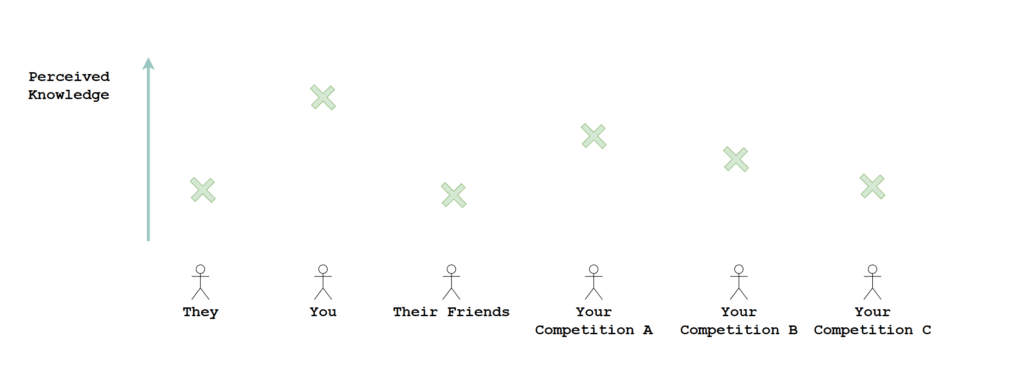

You will only have that small window to let them see how you measure up.

If this was their first meeting with you, they have no good way of judging you other than THAT conversation with them.

So they are sizing you up in that conversation with the people they encounter, be it their friends or your competition/peers.

For those who made enough mistakes, the bar may not be so low for you because they work with enough “idiots” in their lives, which got them to where they are at now.

They automatically assume by default you are like one of those “idiots”.

Until you prove them otherwise.

How do you do that?

I think it is a combination of:

- Showing how oriented to reality.

- Less about sales and more about helping them. Being personal enough.

- The depth of knowledge or you are a student of the subject.

- The depth of positive and negative experiences

- Admitting you don’t know everything.

- There are some difficult things you cannot do, and others cannot do it as well.

You got to drop enough truth bombs.

I connected with some of my peers in the space because not just did they do well, but they were somewhat truthseekers. They are open about mistakes or challenges they struggle to get around, but also drip enough things that show their investing sophistication.

To put it simply, in the more sophisticated space… Game Recognizes Game.

Those more sophisticated ones, who are prospecting for an adviser, will also know that it is unrealistic to expect one person to know everything and are open to understanding how your team supports them.

But they don’t want to work with someone who is “just a client service coordinator”.

Sometimes, I look through the lens of a client and concluded that it is a humongous challenge to be sophisticated enough just to measure up.

It is either that, or I am being too demanding.

How to Establish Perceived Knowledge Beyond a Short Meeting

It is challenging when the conversation is short.

There is a reason we encourage our advisers or staff to put their work out there.

It is an open market to let people understand us better. To know if we are real idiots or if we know our staff. This is also a way for deeper conversations between prospects and our client adviser.

The People Who Are Not Open to Listening (But Pretend to be Open)

There are conversations that I have had over the years that I go back to wondering how I manage to sit through that whole dinner.

They would say they are a fan of your work and would like some advice.

In the conversation, I can detect that they seem to think they know the “financial reality” but you realize they make pretty flawed conclusions.

The biggest challenge they face is confirmation bias. Too stubborn in wanting something (a strategy, investment product) they held a great affinity towards to be successful.

That conversation with me is to validate that strategy or product.

I shared this with some people.

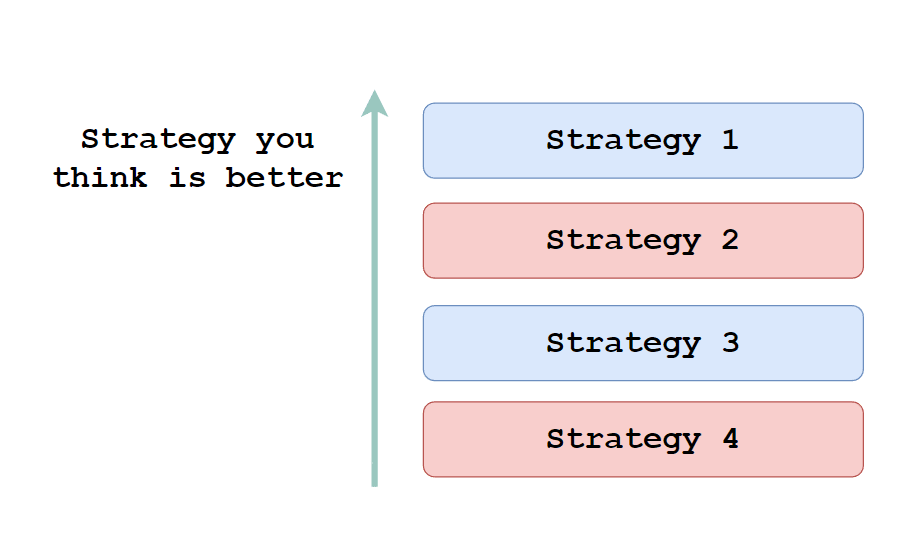

We all have this mental order in our heads about what is the better or best strategy to build wealth.

It is going to be damn difficult to overwrite the mental order.

There is enough confirmation bias, seeking out to validate that Strategy 1 is really the best strategy.

The sophisticated ones will understand that strategy 1 to 4 has their good and bad points and are less fixated on them. In order to reach this plane of understanding, they might need to reflect on this more neutrally.

In our realm, it is that property income or dividend income strategy.

Those are giant monsters to get round.

Strangely, we see that evolution in the property income space.

We experience a period where those who held property suddenly realise their property income is stagnating, not as consistent, a lot more work than they think and the prospect might not be good.

Basically, they begin having doubts about their “Strategy 1”

And so…. they began to be more open mentally to hear about other income strategies.

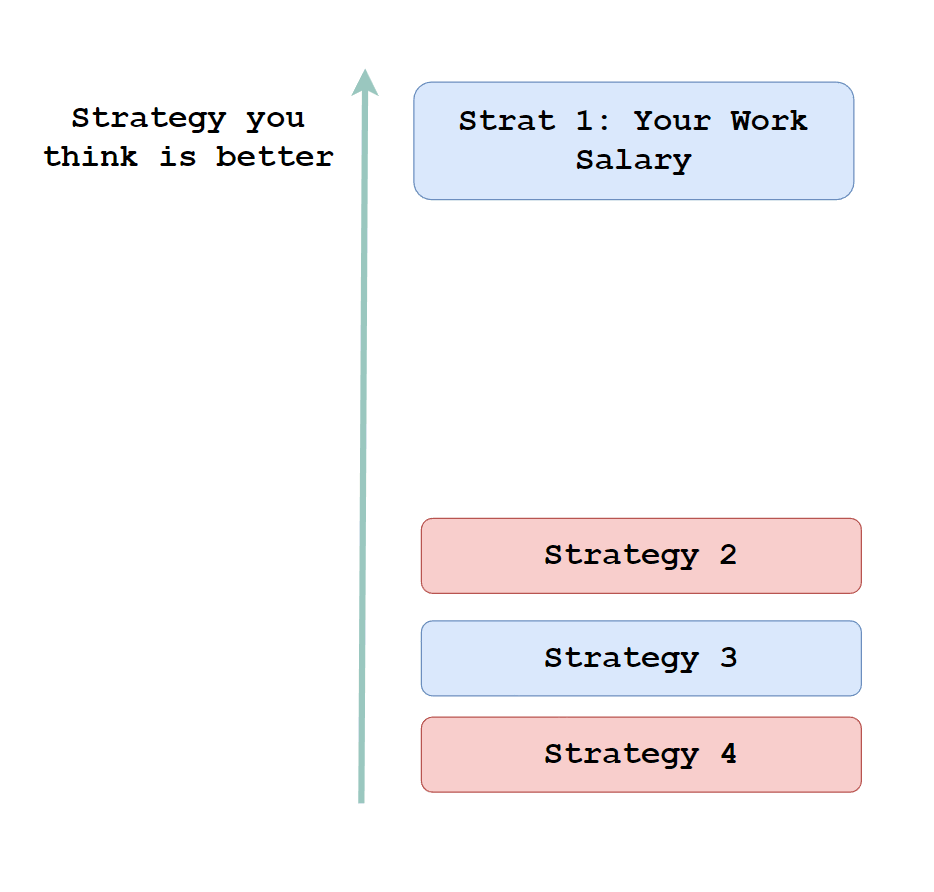

What Happens When Strategy 1 is Your Salary from Work?

I think for most of us, we depended so much on our work salary.

We are conditioned to be assured that our Strategy 1 will always be far better than the rest.

I reasoned that when you realize your strategy 1 looks weak, or crumbling, then you become anxious because you don’t know of other strategies or are so out of depth about them that you don’t trust them.

This is the case for many people.

This is why there is an anxious rush to find out what is the best second strategy and a search to validate it works.

Conclusion

Whether you will pay for it is another matter.

You may or may not disagree of the value you get for what you pay.

But before that, it is good to recognize why people look for financial advice and philosophically how they think. It is not easy to convince that you have value to add and they may not all be open to listen to what you have to say.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.