I think the folks at Syfe wanted to see if I could write about their Roboadviser offering for some time but I did not get round to doing it.

Some readers have asked me as well.

Since Syfe just announced their Equity100 portfolio, I thought I will let everyone know what I think about it.

What is this Equity 100 Portfolio?

The Equity 100 portfolio is like a fund of funds managed in a rather active manner.

The illustration above gives you a glimpse of the composition of the portfolio. There are a few more funds but it is not shown.

The Equity 100 portfolio thus is made up of exchange-traded funds that are listed on the United States stock exchange (except for CSPX which is listed on the London Stock Exchange).

From what I understood, they will always make use of exchange-traded funds.

By putting your money into this portfolio, you gain exposure to a diversified basket of stocks.

The allocation of equity to bonds to cash is 100%:0%:0%.

In other words, your money is allocated to equity, which in the past is the asset class that gives the highest expected return over the long run.

This portfolio has the least damping because of its zero exposure to bonds and cash. By investing in this portfolio, you are expecting that if you go through another roller coaster in February and March this year, this portfolio will face the full force of the market.

The Smart Beta Aspect of the Equity 100

What is unique about Syfe when compared to the other Roboadvisers out there is their tilt towards the quantitative approach such as risk parity (for their Global ARI and REIT+ portfolios) and in this case smart beta.

You can read more about their Smart Beta strategy for the Equity 100 here.

Smart Beta may be new to you, but in my own words, managers or funds that does smart beta believe that there are certain methodology of securities selection that if you are able use these methodology to select a subset or these securities from the general basket of securities, or to overweight certain securities versus the other securities, you are able to gain outperformance over different time periods.

They are grounded in rigorous academic research and backed by Nobel prize-winning work, the most famous being the Fama-French three-factor model. Conceptualized by Nobel laureate Eugene Fama and Kenneth French in 1992, the model states that market returns can be explained by three factors – size, value, and market risk.

Fama and French found that, over time, small-cap stocks earned higher returns than stocks with a large market cap on a systematic basis. The value factor was established based on the stronger performance of stocks with a low price to book ratio (i.e. value stocks) as compared to stocks with a high price to book ratio (i.e. growth stocks).

Since then, other factors have been identified and become widely accepted within academia. Fama and French even expanded their three-factor model to include two additional factors in 2014.

Syfe

Based on what Syfe described, their Smart Beta work is based on the foundation built by Fama and French’s five-factor model research.

Syfe’s investment team identified three factors that based on past data, generate better risk-adjusted returns.

- Growth. Since 2010, growth stocks have handily outperformed value stocks. Over the past years, much of that outperformance has been driven by technology stocks the likes of Facebook, Amazon, Apple, Netflix, and Alphabet (FAANG). This is further reflected by the 260% gain made by the Russell 1000 Growth index from 2010 to 2019. Comparatively, the Russell 1000 Value index only rose 139%.

- Large-cap. For many years, small and mid-cap stocks have underperformed relative to their larger counterparts. During the March market sell-off, the disparity widened as small-cap stocks suffered much steeper losses than large-caps. This was perhaps because smaller companies have been much harder hit by the COVID-19 crisis and associated lockdowns than their larger peers.

- Low-volatility. Contrary to what many people think about “high risk, high return”, numerous studies have found that lower-volatility stocks have historically generated better risk-adjusted returns over time. Stocks, or portfolio of stocks, with low volatility, tend to avoid extreme swings in price. While prices can swing upwards for a volatile stock, it can also plunge. Over the long term, it may be harder for a high volatility stock to make back what it has lost.

But Syfe investment team also believes in mean reversion:

So they believe that due to mean reversion, this is why small cap and value factors have not done well over time.

The Allocations are Dynamic

The nature of each stock in the ETF change over time. Their prices rise and fall. Their business do better, stays well, or become worse off.

Thus, their valuation changes, their size relative to their peer’s changes, and at times some of these stocks exhibit momentum as well.

Syfe’s investment team from time to time will change the weightage and allocation based on the change in these factors.

For example, if large-cap stocks go out of favor over time, we might reduce the exposure to this factor by using equal-weighted ETFs instead. That’s because equal weighting greatly increases the footprint of smaller stocks.

To be sure, dynamic factor selection does not mean we will be rushing in and out of factors. In a multi-factor portfolio like Equity100, it means that we might choose to over- and underweight selected factors to generate the most optimal risk-adjusted returns based on cyclical market conditions.

Syfe

Currently, the Equity 100 is overweight in growth, large-cap and specifically NASDAQ technology stocks.

The Possible Future Expected Returns and Management Cost

Your question would be, given that this fund is gonna expose me to the full market forces what kind of returns should I be expecting?

Based on the past 10 years return, Syfe is expected to give you 13.4% a year.

Do note that these are historical returns and likely what they backtested (this means that they go through the past returns data and simulate that if you were to invest through this period, using their strategy, you would earn this kind of return).

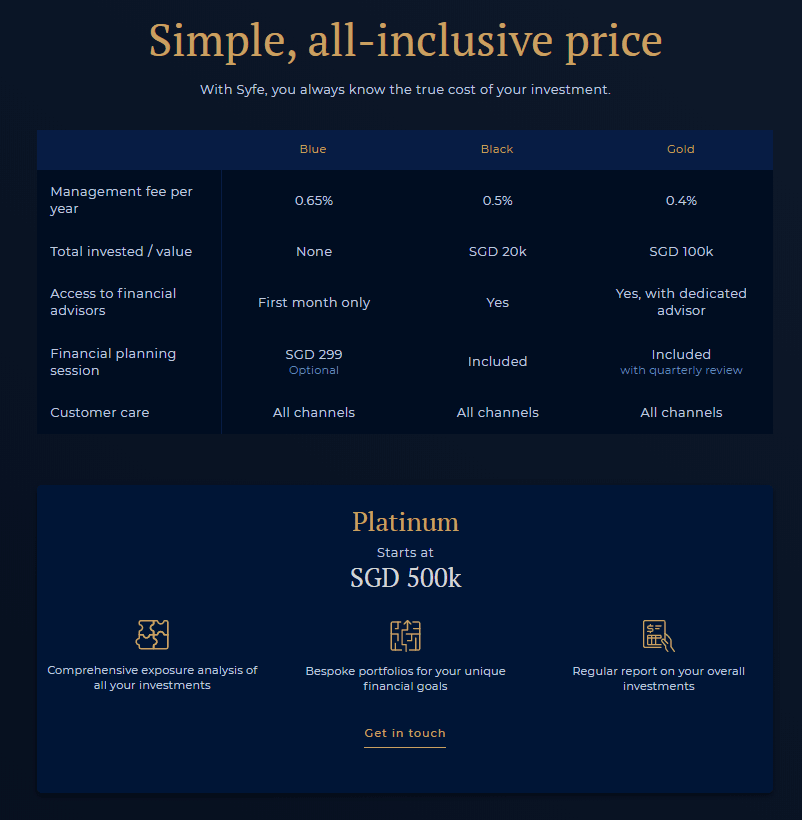

You may have noticed that in the illustration above, the annual management fee is 0.4%. How much Syfe charges will depend on the amount you invest with them.

Here is a better breakdown of their fee structure:

Syfe holds a CMS license issued by the Monetary Authority of Singapore. The CMS is essentially more of a fund management license versus an advisory one. The primary advantage is that it allows them to chop and change the composition of their product without the constant authorization of the clients.

If your invested amount is larger (currently more than 100k), Syfe will assign a dedicated adviser to you. They will be able to give you financial planning advice.

As to the extent of their coverage, that one I am not too sure.

What Does Kyith Think?

Ok, before you hear what I think, you need to know some background here.

I wouldn’t profess to know everything about Smart Beta, but in my work, I get bombarded by factors and dimensions from time to time. On a frequent basis, I get the stuff of Fama and French pushed into my head even if I do not wish to receive the information (you know too much, you need to do too much.)

But still, I am not a thought leader in this space, so take what I said with a pinch of salt.

The Impetus for the Equity 100

What I understand from the Syfe team is that, they introduce this Equity100 partly due to the request by their clients.

They have a risk parity strategy in their Global ARI portfolio that if it works, are suppose to reduce the downside volatility for their clients. So that worked well enough that the clients felt that they could not dollar-cost-average into something well.

When you are in your accumulation stage, you would hope that you have more down periods than up periods, but over the long run, the things you invest in eventually ends up higher.

So those volatility period presents the investor opportunities to accumulate at the low.

If the price does not fall, they do not get as good of an opportunity.

Hence the Equity 100, which expose your funds to the full force of the market. This will be volatile and you will get opportunities to dollar cost average.

Ok, there are two contrasting feelings here:

- Dollar cost average and volatility is good for accumulation. We cannot deny that

- People do not handle volatility well in general. They tend to do stupid things. If you are able to help people avoid that, they can stay in the game longer and able to capture the return

So their GRI strategy handles #2 better and Equity 100 handles #1 better. But which one makes a bigger impact?

I think #2 makes a bigger impact. And I think while risk parity reduces the volatility, it does not mean there are no volatility.

And if you know your strategy do not go down much, just keep investing!

So that is my thoughts about the reasons for the impetus for the Equity 100.

Syfe’s Smart Beta Strategy

From what I understand, the dynamic allocation will not be super frequent. Perhaps twice a year (don’t take my word for it).

The exchange traded fund used, from what I see are market-capitalization weighted.

Syfe’s smart beta strategy is not in ranking or selecting a subset of stocks in the underlying stocks but selecting based on the attractiveness of the exchange-traded funds.

This makes their management easier and perhaps cleaner.

As to the strategy? I am not sure how Professor Fama and Professor French will feel if you tell them that the eventual result of their work results in a portfolio that is tilted towards large-cap and growth.

I have not associated any of their past work to favoring these factors.

I think what Syfe is trying to do is to explain what Smart Beta is about, and the two professors work may have brought about the attention to factor investing.

It does not mean Syfe’s work is based on this.

It is either that, or they would like to plaster the name Fama and French in the same breath as their stuff.

Another thing is that Syfe’s investment team are currently overweight on the growth, large-cap and tech.

However, they believe that from time to time, the value and small-cap premium will show up.

And then they can pivot accordingly into it the moment those premium showed up.

From my understanding of the professor’s view on this, these value, profitability, market, small-cap premium show up from time to time, but it is difficult to time them.

That means that Syfe means that they are able to time and get in, when the value and small premiums showed up.

This to me is another level of work already. If Syfe is able to do that, they are better than a lot of funds out there.

Could they do it?

I am not sure.

Our conversations with Dimensional folks tell us that there are alot of factors out there, or the way to implement factors. However, if we remove a lot of the layers, their premium may go away, or show us that the premium is due to the small, profitability and value premium.

It will take a long time for these to be verified.

The thing about investing is that you know it better after you have seen the result. However, when you see the result, you cannot turn back the clock to amend your decision. You only live one life.

This is why there are risks and perhaps there are returns.

The Lack of Ability for you to Track Equity 100 Performance

I forgot to add this point into my original article.

If you realize, Syfe did not publish what is the factors they are targeting.

The factors are not based strictly on Fama and French’s five factor model.

So if we do not know what are the factors, there is no way for you (the investor) to verify if the strategy is underperforming or outperforming.

You will also not know if you are taking excessive risk by them just tilting their portfolio to high beta.

- If you have a fund that benchmark against the index, you will know if they are doing better or worse

- You will know a value fund is sticking to it’s core when you know the value factor is not doing well and your value fund is not doing well. If your value fund is doing well while the value factor is not showing up, this can be a discussion point with your manager

If we do not have a way to verify, there are no easy way for you to verify performance.

Some First Principles of This Area of Investing

Ok just some things to recalibrate everyone after reading so much of what I have to say:

This is still an equity portfolio. Whether smart beta or not, the volatility (in terms of standard deviation) of this portfolio is not going to be veered far from equity.

In fact if the returns are higher, the volatility is expected to be higher.

So do be aware of your tolerance to volatility.

Execution Counts. I learn that there are a lot of strategies out there. But strategies that can be implemented and executed well is another matter altogether.

How do we identify good or poor execution? I have no idea at this point. Perhaps this is a topic for another day.

Estate Duty and Dividend Withholding Tax Considerations. Majority of the funds used in the Equity 100 are the ETF are domiciled in the United States.

If an investor passes away, the country where the fund domiciled in may levy an estate duty or death tax depending on the tax rate in that country.

In the case of United States, the estate duty is 40% of your assets above US$60,000 (the first $60,000 not subjected to estate duty) for non-resident aliens.

The UCITS ETF mentioned in the fund is domiciled in Ireland and have less of this problem.

Update: I did some pondering over the weekend and I remembered that Syfe holds CMS license but they are operating the portfolios as a discretionary manager.

This means that the investments are still under the client/investor’s name, which should still make estate duty an issue for the client/investor.

This also does not eliminate the dividend withholding tax between the ETF’s declared dividends and the Singapore entity, although based on the holdings, their ETF is not overly focused on dividends.

Your Surplus/Savings Rate Matters As Well. There are investments that get you from $20,000 to $300,000 but majority of the investments do not go like that.

A large part of the growth comes from continuous contributions. But in order to contribute all your money into it, you got to build conviction in the investments.

There is no shortcut but to take some time to learn more about what you put your money in.

If you are interested in the Equity 100, you can check it out at Syfe today.

To support Investment Moats, you can sign up with my Referral Code SRPRV6MG7 here.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

Zhubham

Saturday 1st of May 2021

Hi, regarding Syfe Equity100, could you please advise if tax is payable on the earned interest? If so, how much?

And how big is supposed to be the impact of withholding tax on dividends? Thanks.

Zhubham

Saturday 1st of May 2021

Hi @Kyith, both

Kyith

Saturday 1st of May 2021

HI there, are you asking about dividends or interest income?

LK

Saturday 20th of March 2021

Hi, any idea if the syfe backtested results include factor changed or did they use the same factor throughout the backtest?

Kyith

Saturday 20th of March 2021

Hi LK, i think the factors do change about. You would have to ask them yourself because it is really not so clear.

Dennis Tan

Friday 17th of July 2020

It’s pretty clear that they have optimized for past performance just so they can have a higher backtested performance compared to major benchmark equity indexes. So they can sell its past performance. Backward looking high octane equity portfolio misusing factors and misleading investors. Really don’t like what they are doing with this.

Kyith

Friday 17th of July 2020

Hi Dennis, thanks for sharing your thoughts. There are a lot of factors out there that you can form a strategy. Whether we can prove the factor is persistent and pervasive is another thing altogether.

CK

Saturday 4th of July 2020

Hi Kyith,

From my understanding, US Estate Duty tax applies if the ETFs are held under a US Custodian. If our ETFs with Syfe is held by a non-US custodian, then the tax might not be applicable.

Kyith

Saturday 4th of July 2020

Hi CK, that is my thinking. Have to confirm if it works that way especially since they hold CMS license

Yoyoyo

Saturday 4th of July 2020

Sponsored article, I guess that's why we won't see reply to any of the comments

Kyith

Saturday 4th of July 2020

If it is a sponsored article i will say it is a sponsored article. Don't jump to conclusion. Even writers have a life.