A negative price on crude oil futures prices.

I remember reading texts how in the past oil can get to very low prices but I have never experienced this in my lifetime.

Well, this period I get to see some historical stuff. Allow me to indulge in some photo-taking.

Within a day, the price of the crude oil futures dip to negative $40 a barrel. And then after that it “shot back up” to $0.49 a barrel.

Many of us would think that the petrol station will be paying us to pump petrol at their petrol kiosk but price have not changed.

We need to understand that this prices we are talking about are futures contracts. These futures contracts are derivatives that allow us to take delivery/secure/buy or sell certain commodities and other stuff at certain prices.

In this case, a May crude oil futures allow the futures holder who bought the futures to take delivery of barrels of oil at the prevailing price ($20).

The issue is that… some people don’t want barrels of phyiscal oil!

- If you are left long when the futures contract expires, you have to stand for physical delivery.

- If you are short when the futures contract expires, you must deliver the physical barrels.

- These are binding, legal contracts

So there is this massive, last minute move to offload these futures contracts which causes the price movement we saw yesterday.

One of the culprits that was cited in the media is the Oil ETF USO. The United States Oil Fund (USO), the largest oil ETF, saw inflows of about $1.5 billion last week, as crude oil prices hit their lowest levels since the early 2000s on plunging demand.

They believe that the ETF owns 25% of the May crude oil futures contracts. However, there are sources that stated the ETF have rolled their contracts from the May futures to the June futures in the Week of April 7.

So it may unlikely be them.

I do not think a lot of people want to take delivery of a lot of barrels of oil. It is a costly endeavor.

Since oil prices are so low, and demand is down so much, a lot of oil producers are trying to store these oil produced. The supply for storage facilities is very low, and people are turning to shipping tankers to store them.

Shipping tanker stocks are skyrocketing. But I think the supply is also low there.

June Futures Priced Crude Oil Back to Prices 1 Day Ago Until…

While the May contract looks a little crazy, the Jun contract shows prices are still near $20 levels.

Well, I may have spoken too soon.

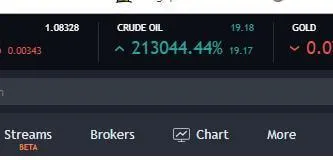

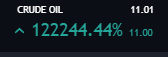

We seen the Jun crude futures contract taking over, with the ticker showing some very impressive return.

Then it started falling…

And this is where it stands at the time of writing.

Supply and Demand are like a Pendulum

I am not sure how the price will go but the situation will likely reverse nearer to May. That is when the COVID-19 demand destruction levels off and the global economy gets a little better.

The OPEC 2.0 producers begin cutting their production next month and there are likely to be some producers who cannot take this and file for bankruptcy.

Commodity supply and demand are like how a pendulum moves. They always swing to the extremes. We just do not know how long it will take.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Loo ky

Wednesday 22nd of April 2020

CLK20 expires on 21 April 2020, not 21 May 2020 as per link below

https://www.google.com/search?biw=1280&bih=610&ei=ERagXtm_LomY4-EP9_-koAI&q=crude+oil+May+2020+expiry+date&oq=crude+oil+May+2020+expiry+date&gs_lcp=CgZwc3ktYWIQDDoECAAQRzoICAAQCBAHEB46BQgAEM0COgYIABAHEB46CAgAEAcQChAeOgQIABAeOgYIABAIEB46CAgAEAgQDRAeUMzMAVittwJgp88CaAJwA3gAgAG0AYgBgxaSAQQwLjE4mAEAoAEBqgEHZ3dzLXdpeg&sclient=psy-ab&ved=0ahUKEwiZjILG4_voAhUJzDgGHfc_CSQQ4dUDCAw