One of the most shared articles in the chat group happens to be an article titled DBS, OCBC, UOB raise interest rates for fixed home loans to up to 4.5%

- All 4 DBS fixed rate packages are set at 4.25% a year

- The one and two-year fixed rate packages of OCBC are now 4.3% a year (up from 3.35-3.5%)

- UOB 2-year fixed is set at 4.5% a year

- DBS floating rate: SORA + 1%. SORA is now at 2.66%. This means currently 3.66%.

I was a little perplexed about how come this was so widely shared when most realized interest had gone up and may continue to go up for a while.

A couple of my friends explained to me:

- The interest on fixed-rate loans went up from 1.25% to 4.25%. The difference is 3%, and that is a $1,500 a month increase or $18,000 a year.

- For one, when the interest moves from 3.25% to 4.25%, his two-year interest expense increase by $34,000.

- Between mid-Sep till today, the interest expenses on a two-year fixed mortgage in interest expense increased by $51,000 for a $1.73 million loan.

This is another case where percentage figures tell less compared to absolute figures.

We cannot feel the impact of these things through percentage return or cost, but where will you cut your expenses if you need to pay $51,000 more over two years?

We don’t eat percentages but absolute amounts.

You better hope you have lived a prudent life.

I suspect many don’t live a prudent life and would find it challenging to cut their expenses.

It would mean cutting down on discretionary spending, which will impact the real economy.

Here

The Pool of Buyers for the Same Property Shrinks (Unless Imported)

In absolute figures, I also realize that housing affordability has changed.

For example, let me use a condo my friend bought in 2015. The 3 bedroom, 1055 sqft, 99-years leasehold condo costed him $1,500,000. Downpayment was hefty, but he could make it work.

In July 2022, a similar unit of the same size transacted for $1,900,000 or a 26% gain or 3.4% a year unleveraged compounded rate of return.

Seven years later, he would have to sell his condo if he wishes to realize the gains.

But who would be the buyers of the condo?

- Finding buyers of resale versus a new development. Someone needs to like the place as a place for living or that they find his place undervalued versus its intrinsic value.

- Similar cohort like him when he was 35-years old. Those looking to upgrade for investments or buy a second one for investments. Those older, who have similiar ideas, would have invested in their own condo.

- Older cohort who enbloc and likes the place.

- Buyers from overseas.

Cohort for #1, #3, #4 may be a limited pool. His place (or his condo) competes with many competitors here.

I tallied the financial figures for my friend who bought his place in 2015, and the prospective buyer today:

Some things have changed:

- The maximum loan-to-value has been reduced by 5%. The prospective buyer would need to downpay more.

- The TDSR has gone down from 60% to 55%. The prospective buyer needs to earn more.

To get the condo off his hands, the buyer today needs to downpay more ($475k vs $300k). This depends on how many people in his similar 35 to 40-year-old cohort accumulated 58% more cash compared to 7 years earlier.

The new cohort’s mortgage is higher at $1.425 mil, and if the interest rate stays at 4.25%, the monthly mortgage payment is $7,655 a month versus $4,793 a month!

The new cohort pays almost $2,862 a month or $34,344 more.

The TDSR the new cohort faced is also lower, meaning they need to earn a higher minimum income to qualify.

So instead of earning a minimum $7,988 a month income to qualify, the new cohort needs to earn a whopping $13,918 a month to qualify.

The question is, how many of the 35-40-year-olds today earn $13,918 a month as a combined household?

Finally, let us put into perspective the interest difference you would have to pay on the same loan if paid over 25 years:

- 1.25% interest: $238,043

- 4.25% interest: $871,678

The interest you have to pay, if the average interest is 4.25% is almost half the cost of the $1.9 million property for the new cohort. If they are that reluctant to pay the ABSD and are finding ways to avert it, imagine how likely they are to pay that degree of loan.

But most likely interest will not stabilized at 4.25% over 25 years (I think), so let us see the total interest difference at each interest bands for a $1.425 mil loan:

| 25-yr Interest Rate | Total Interest Paid | Total Interest / Property Cost ($1.9M) |

| 1.0% | $185k | 9.7% |

| 1.5% | $282k | 14.8% |

| 2.0% | $383k | 20.0% |

| 2.5% | $486k | 25.5% |

| 3.0% | $593k | 31.2% |

| 3.5% | $702k | 36.9% |

| 4.0% | $814k | 42.8% |

| 4.5% | $929k | 48.9% |

What you will notice is that every 0.5% change in long term interest cost is like an extra $100,000.

The interest cost if you fully service the mortgage is really like another ABSD. The interest cost itself on a 3-bedroom 1055 sqft condo can almost be like the cost of a 4-room HDB flat a few years ago.

It gives me the feeling that many may be unwilling to service the loan and would sell it soon.

Your Rate of Return in the Initial Years Goes Down With Higher Interest Rates

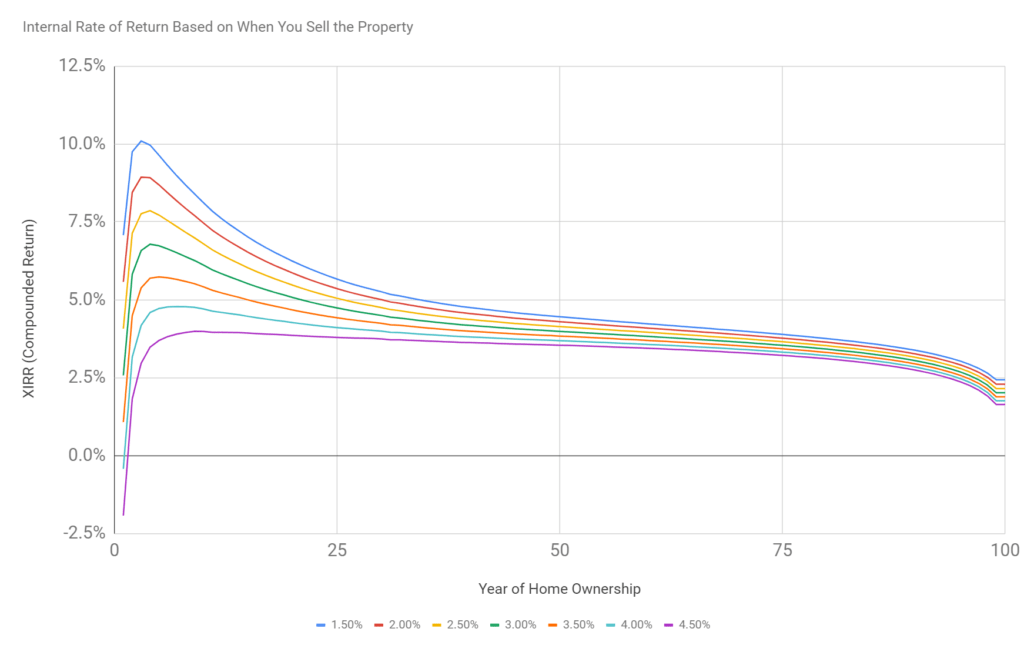

I decided to plot the change in XIRR of the $1.9 mil ($1.425 mil mortgage) property if you sell at different timeframes (between year 1 to year 99)

The XIRR measures the “compounded interest” that you earn on a stream of cash inflows, and outflows, including all the rental income, expenses, less any home closing costs.

I assume a 1% a year long term rental growth rate and 3% property appreciation. This does not matter so much since the objective is to see the impact of interest rates.

At each point on the x-axis is when you decide to sell off the property, and you will earn the XIRR on the y-axis.

If you sell the property at year 3, your XIRR would be:

- 1%: 11.2%

- 1.5%: 10.1%

- 2%: 8.9%

- 2.5%: 7.8%

- 3%: 6.6%

- 3.5%: 5.4%

- 4%: 4.2%

- 4.5%: 3%

The XIRR at year 50 ranges from 4.5% to 3.5%.

The difference in interest rate affects the initial periods if you wish to sell it early, due to the leverage effect. Beyond that, as you hold long term, the compounded returns converges (although 1% difference over 50 years is big)

If interest is at 4.5%, the year 3 returns is worse than the long term average!

Your question is more like what a stabilized interest rate will look like for the next twenty years.

Can the Next Generation of Condo Upgraders Afford it?

A resale 3-rm Condo may cost a mortgage of $7,655 a month and need a salary of at least $13,918.

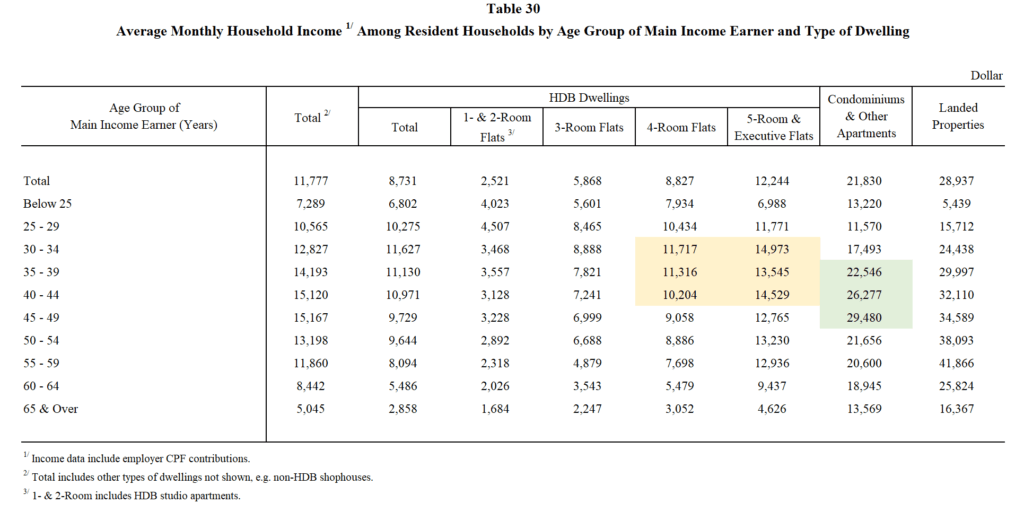

I took a look at the 2017/2018 Household Expenditure Survey to see if we can find clues about it. A new survey should be out soon (every 5 years) but this is the best we have. Likely the salary has gone up.

The table below shows the average household income by age group, including employer CPF contribution:

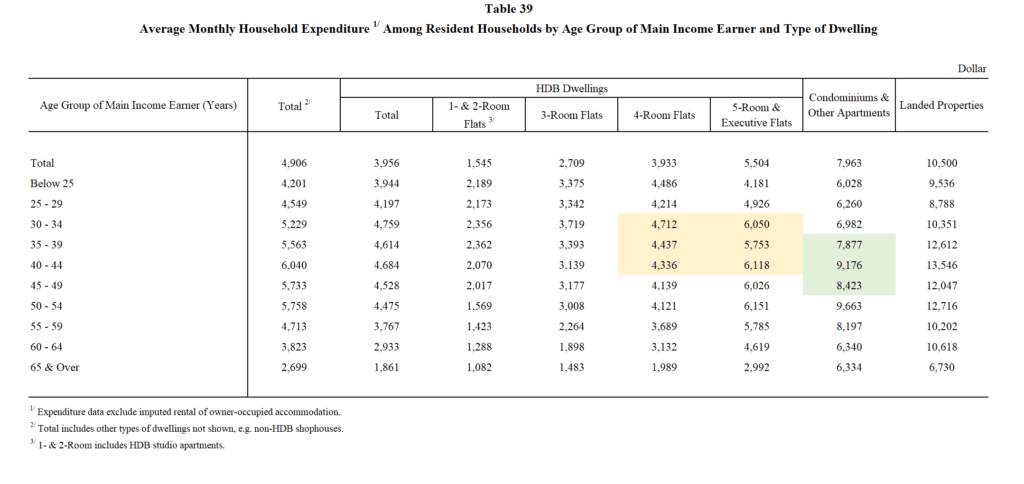

The table below shows the same but only the average monthly household expenditure. This likely do not include imputed rental of owner-occupied accommodation:

The group of people marked yellow is the group most likely to upgrade (age 30 to 44). The group of people marked green is the group that are currently living in condos.

Some things you may notice is:

- The salary increase for those living in condos versus 4/5 room flats is significant.

- The expenses for the same batch do not step up proportionately. This more or less means those staying in a condo have a higher savings rate.

- Most likely, those living in a 5-room that is 30-39 can meet the income requirements of $13,918, and just nice… they can pay a $7,655 mortgage but there are not a lot of room to spare.

- Salary peaked at 40-44 for those living in 5RM HDB and 45-49 for those living in condo.

I think in general, it looks like they can afford a mortgage payment on high interest, but I highly doubt everyone has that power of a savings rate. Most likely, everyone is paying for some sort of mortgage.

I think it is also quite challenging for them to decouple and buy a 3-br condo. It is likely they have to invest in a smaller unit. They can make the math work, but it leaves them with little room for error.

Conclusion

The dollar value of a higher interest rate psychologically feels different than a mere percentage.

It will cut into your buffers or your other expenses. This may affect discretionary spending in some ways.

If people hate ABSD so much, then I am not sure how they can live with the amount of interest they pay out.

The only reason they can is because they have no choice but to live with that, or they are unaware the dollar figure is so significant.

Ultimately, our salary has to move up for the next cohort to buy it off you, or there has to be demand from other cohort or external.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Jackson

Monday 21st of November 2022

I think you may add in assumption for 5% - 6.5%, maybe more useful for reference.

Kyith

Thursday 8th of December 2022

Hi Jackson, for the interest rate? I don't think I mention anything about 5-6% isn't it?