For the past year, one of the analyst teams that got their calls more right than wrong was Michael Hartnett’s team at Bank of America. Michael’s team have largely been bearish, but he got some short-term tactical calls right.

Some of their data work from their Flow Show can be pretty interesting for you. Here are some from recent.

The widespread theme for 2022 is more of inflation, rates and recession shock. They believe that the case for a possible wide-spread bullish narrative is more of peak CPI, Fed, yields and the US dollar.

Michael’s team thinks it is a situation of no recession and, therefore, no rate cut coming.

So the overweight is 30-year US Treasury or those that benefit from the yield curve steepening. There might be room to nibble into new leadership areas which they believed to be:

- Small cap

- Industrials

- Resources

- Emerging market bonds

- China and Japan

- Positions that does better when USD comes down

They believe tech and the FAANG will be derated.

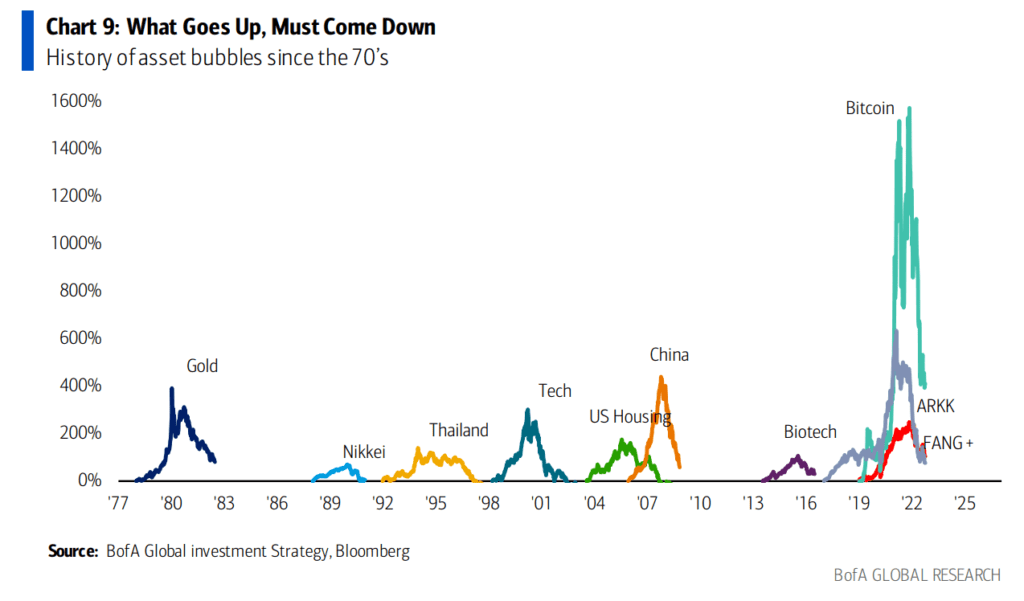

There are some secular (read long term) leadership shifts and over time, those who lead tend not to do so well. The chart above shows us some of the past trends, and they believe the FAANG as a percentage of the US to be similar.

Bitcoin went through a 77% peak-to-through loss, and this crash rivals some of the biggest crashes of all time. This chart shows us the extent of the crash. It dwarf those recent crashes by ARK Innovation and FANG+.

Bank of America thinks that the new economy now is a smaller economy and any contagion spread is more limited. The outlook for stocks and bonds are better in 2023 than in 2022 but with the psychological overhang of 2022 and the ongoing credit events such as “rate shock is in the early innings!”, asset managers will likely have a lower risk tolerance in 2023.

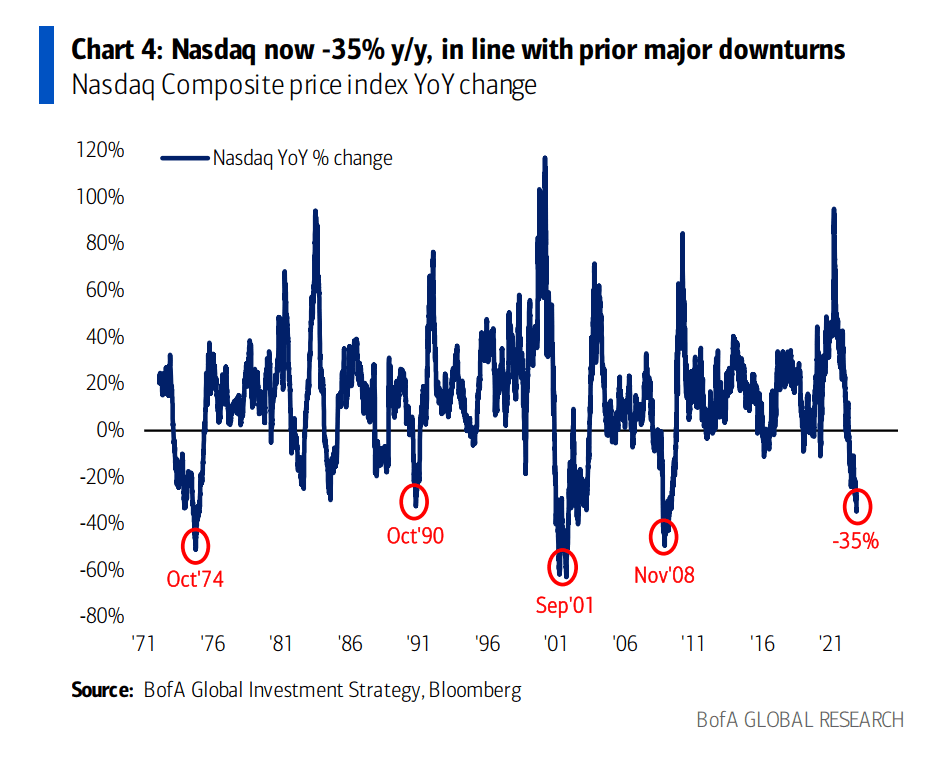

The degree of the drawdown in Nasdaq rivals that of past significant downturns. This chart shows the degree of correction. Notably, past corrections can be deeper.

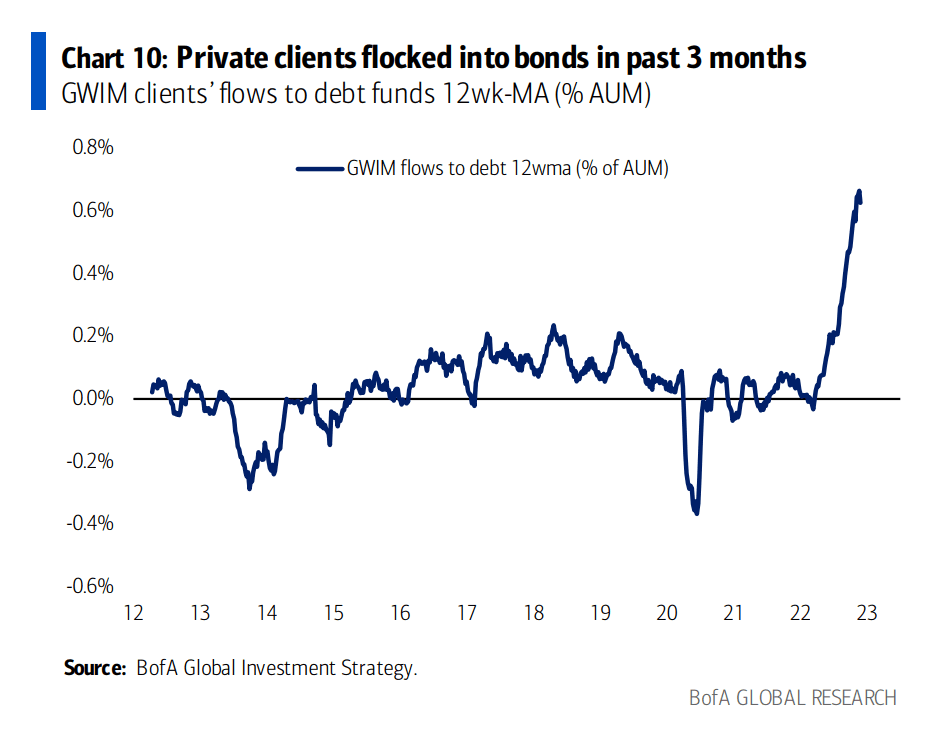

Data from Bank of America’s Global Wealth and Investment Management clients show that they are increasing money into bonds in a big way, while some slightly equity selling took place.

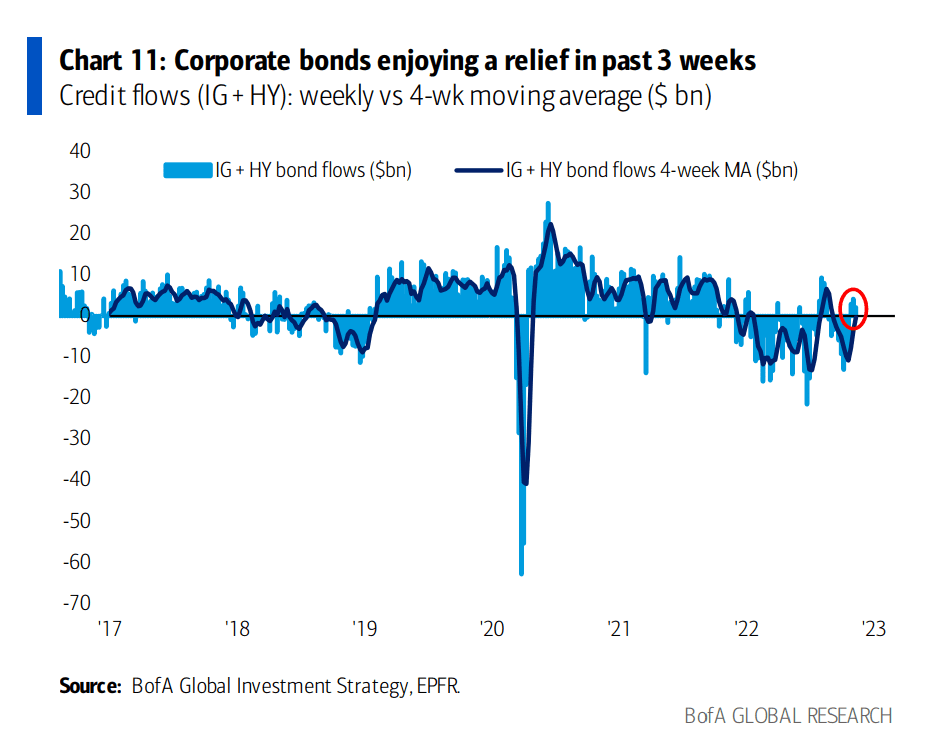

Clients’ money has flow into the investment grade and high yield funds for three consecutive week.

The clients bought more equity funds for the fifth consecutive week.

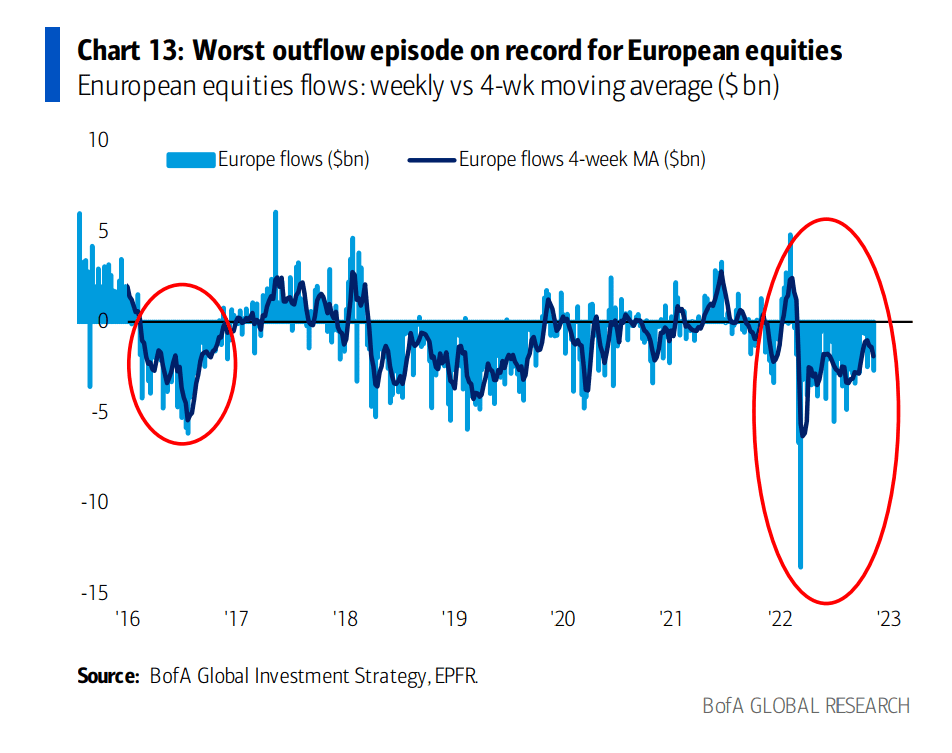

Clients are shunning European equities, perhaps like the same way they shun them in the 2016 to 2017 period.

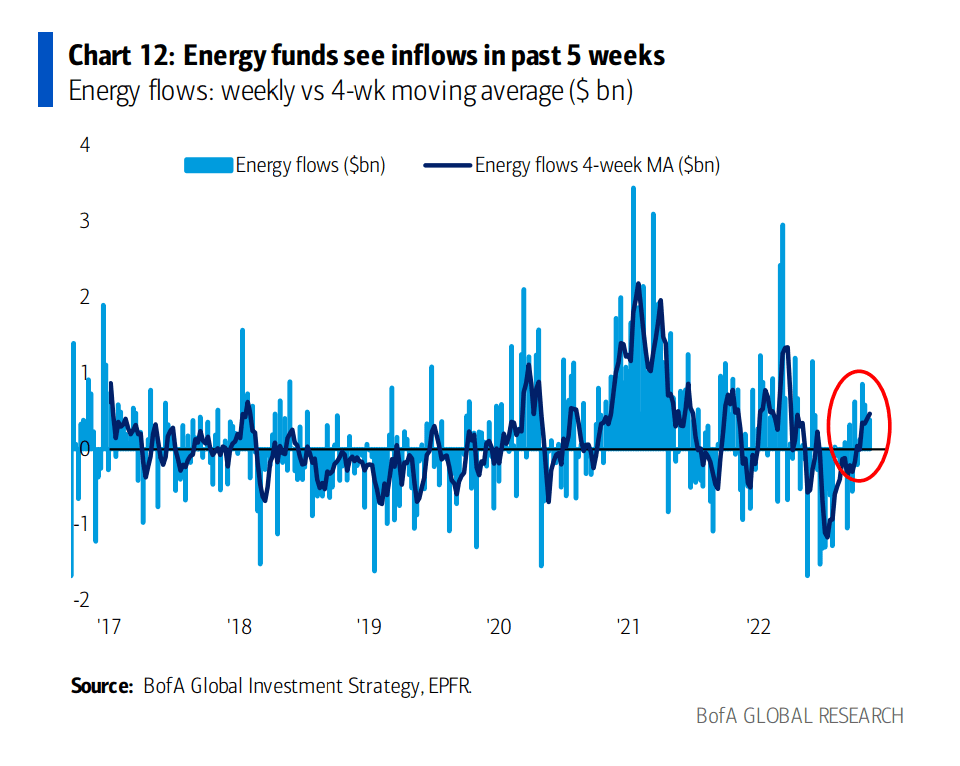

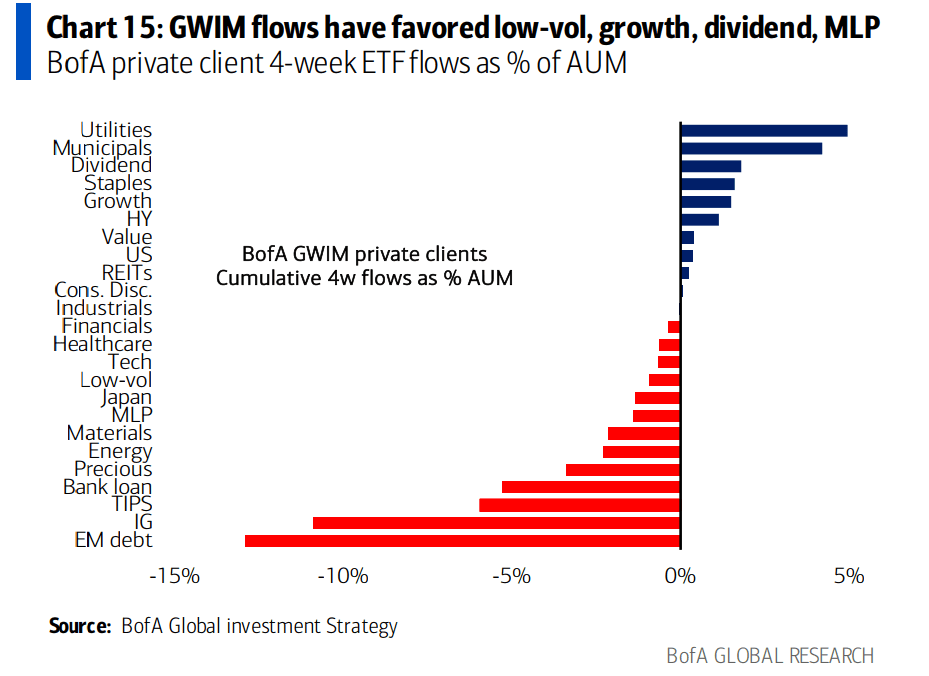

Money is flowing to defensive areas and leaving emerging market debt and investment-grade bonds. Strangely, there are outflows in energy funds as well.

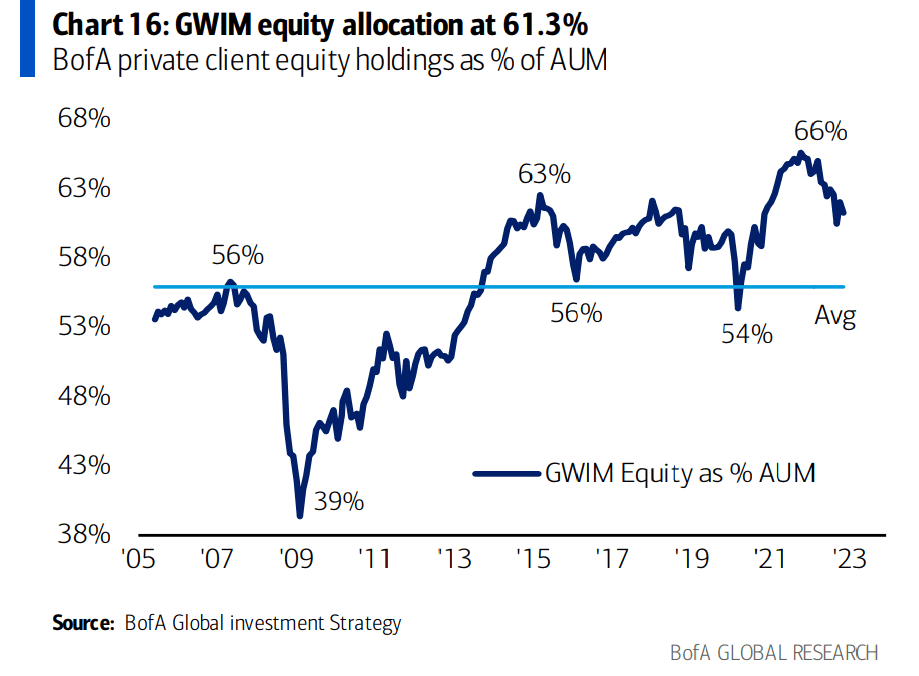

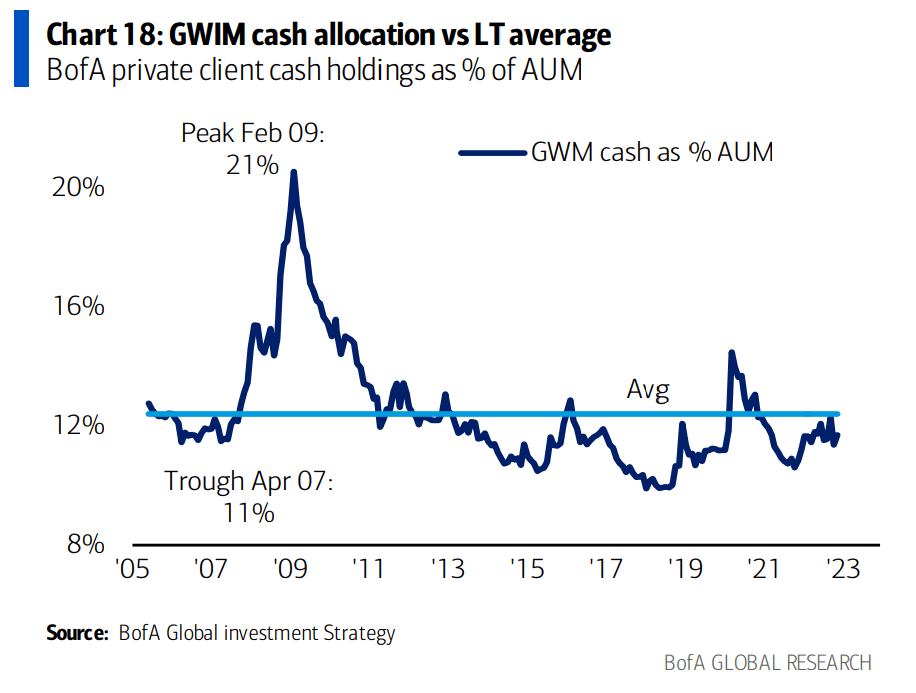

Allocations of Global Wealth and Investment Management clients are still quite high despite the lacklustre sentiments.

Cash allocations have retreated but compared to the past, clients are still not holding high levels (perhaps due to inflation?)

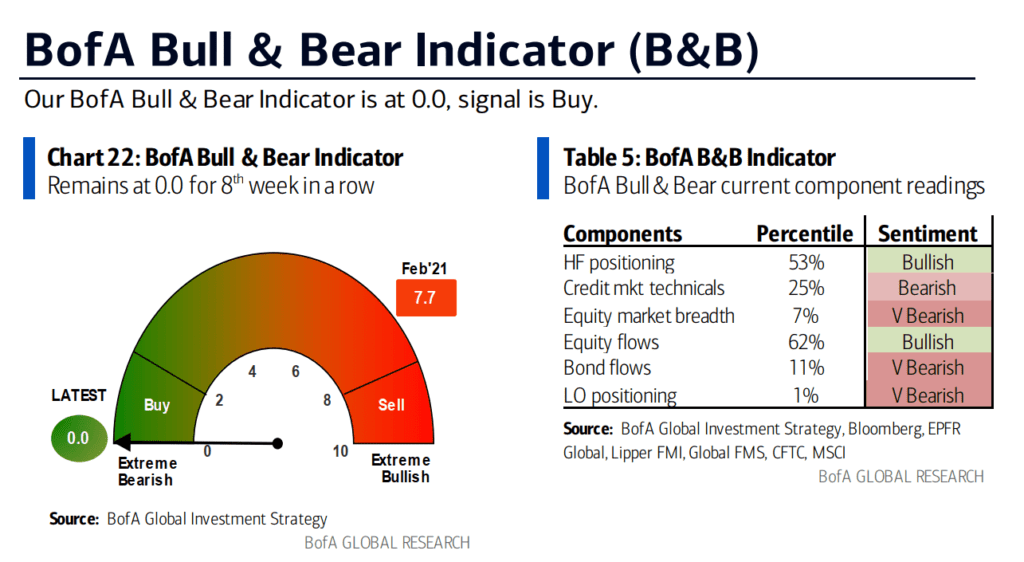

Everyone have their own bull & bear indicator and Bank of America is no different. It is important to recognize that different groups have different philosophies, which impact how they construct their bearish/bullish indicator.

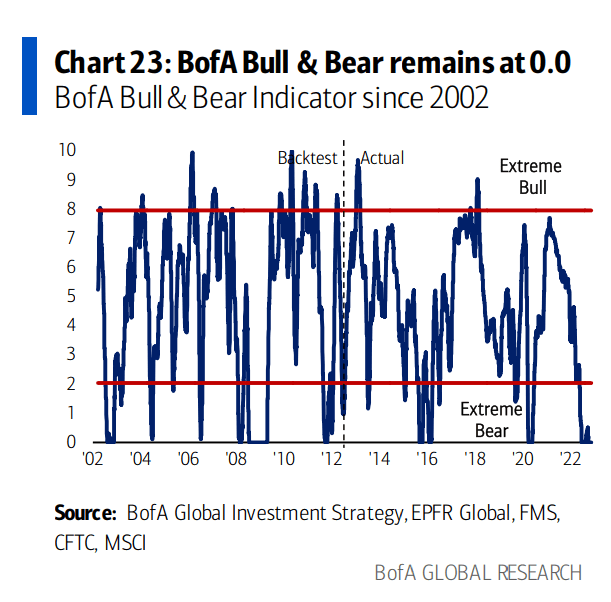

Bank of America’s indicator have been pinned to extreme bearish for months.

Here is a profile of the duration of bearishness in the context of the last 20 years.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024