A long time reader wishes to purchase a condo that is valued at $1.65 million.

Currently, the family is staying at a 5-Room HDB valued at around $500,000 that is fully paid-up. This HDB can potentially rent for a gross rental income of $2,500 a month.

He considered 3 options.

Option 1:

- Sell current HDB

- Use the sales proceed + CPF + cash to buy the condo

- Do not leverage up

Option 2:

- Sell current HDB

- Use the sales proceed + CPF to purchase

- Also loan $300,000

Option 3:

- Keep HDB

- Use CPF + some cash to buy a condo

- Also Loan $900,000

- This will incur an additional ABSD of $198,000 since this is the second property they would own.

Other assets the family own include:

- CPF OA: $900,000

- Cash: $500,000

- Stocks and Bond: $1,500,000

So he asked for my second opinion. I can’t give much advice since I am not his planner. But I think I can provide him some guidelines how he can go about to identify which option is most ideal for his situation.

He needs to know what is the life he wishes to live

The toughest thing to work out is if you do not know what you want.

If you want everything, then it is tough because that would mean you need a lot of resources.

A plan that gives you a lot of flexibility often comes either with greater hidden costs or needs a lot more resources.

My friend here knows roughly what he wants:

- Move closer to their workplace to cut traveling time

- Their child is older and do not need to be near the HDB anymore

- Retire in X number of years

Given this, we can at least apply some sound, fundamental planning concepts to it.

He needs to have One Eye on the Longer Term Ideal Life

Buying a home that provides a better lifestyle today needs to fit in with his longer-term goals.

Sometimes by trying to satisfy one goal, other goals get impacted.

My friend would need to ask what is his desired retirement lifestyle.

A typical one would be living in this prospective condonmium, with enough assets to provide an income to last for X number of years.

Typically, you would like to have a peace of mind in retirement, you would prefer to pay off the mortgage for your residential property you reside in. Or at the very least, you can service the mortgage but have enough cash to offset that mortgage.

With that in mind, the best option would be the option that allows him to

- Fund his condo purchase and pay off the mortgage at retirement

- Accumulate enough for retirement

The option that allows him to do #1 and #2 the earliest as possible is the best option.

Calculate Which Option Gives the Greatest Net Wealth at Retirement Date

- Each of his current assets have a rate of return. Cash earns something, Stock portfolio earns something, Mortgage incurs some interest, CPF earns something

- Use the least costliest or lowest return asset to fund the property purchase and loan repayment

- Leave the assets that earns the highest rate of return for accumulating towards retirement

So what he can do is that if his targeted retirement date is 55 years old, then for each option:

- Fund the purchase of the home and pay the mortgage if the option requires a loan

- Any residual surplus from his work income after expenses will go towards wealth accumulation, together with his other assets

- At retirement, clear off any outstanding loan with his other assets

Compare his net wealth for each option less the value of residential property.

The highest net wealth is probably the best option.

Do we need to care about which assets are More Suitable for Retirement Income?

Money is fungible.

If you grow your money with Bitcoin till US$5,000,000 and that is not suitable to provide retirement income, just rebalance that US$5,000,000 into a portfolio that is more suitable to provide retirement income.

The important thing is to grow your money to the right targetted amount that can conservatively give you that retirement income.

For example, if you need $4,000 a month 10-years from now, a suitable way to generate retirement income is a low cost, portfolio of diversified equity, and bond. If we factor in the return profile of this equity and bond portfolio in retirement, the math estimates this person needs $1.8 million at least.

So your job is to grow your cash, CPF OA, stocks and bonds, HDB flat equity value + rental income to hit $1.8 million. If there is another asset that gives you a greater chance to do that, then go ahead and switch to it.

Too much opportunity is lose by people believing they need an instrument that throws out passive income so they lock their money in a plan that provides that mechanism but the actual returns during accumulation is rather lacklusture.

How to Model The Option of Keeping the HDB Flat for Rental Versus Selling It Off?

In order to evaluate which of your asset is the least costliest or lowest return, you need to know the return of your HDB flat.

This is probably a bit tough to do. How do you get a rate of return to compare against the CPF OA, cash and stock portfolio?

In some previous article, I worked out the longer term internal rate of return for some private condos. We can do the same thing here.

In planning we try to be realistically conservative. If the actual performance is better, then we can reach our goals earlier.

I try to estimate the net rental yield of his place and it works out to be around 4.7%.

I use a property growth rate of 3% a year.

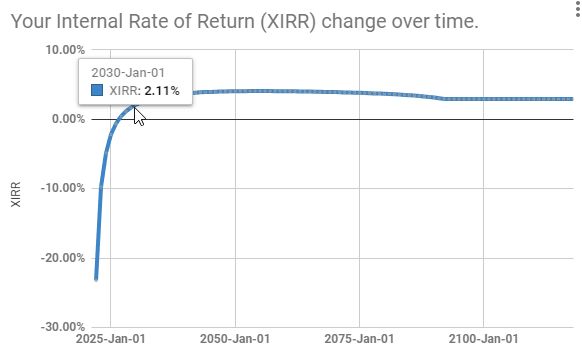

I have also worked out the range of internal rate of return that he can get for holding on to his property over different timeframe:

If he held on the property for 10 years, earn rental from it, and then sell off the flat before retirement and shift it to something else, the internal rate of return is 6.6%.

That looks good. If the capital growth rate is 1.5% instead of 3.0%, at the same point, the internal rate of return would be 5.35% instead.

Now the difference is that if he held on to the HDB, he would need to incur the additional buyer stamp duty (ABSD) which comes up to $198,000.

We can factor in this ABSD into the cost of this HDB flat as a first-year cash outflow. Then we re-compute the internal rate of return.

At the 10 years mark, the internal rate of return fell to 2.11% instead of 6.6%.

Conclusion

Unfortunately, I could not determine which is the better option (nor do I wish to cross that chasm to do that).

I suspect the mathematical, better option is to borrow as much as he can, then for the rest, take the cash and invest well to capture returns at the appropriate risk levels.

The reason is that if you look at the returns/costs of what is available:

- Cash: 0.25% or less

- CPF OA: 2.5%

- Stocks portfolio: 4.5% (assume as a conservative estimate)

- HDB Rental + ABSD for new Condo: 0.9 to 2.11% (depend if the growth rate is 1.5% a year or 3.0% a year)

- Mortgage Interest: 1.3% to 1.5%

The return/cost rank from the lowest to highest is Cash, Mortgage Interest, HDB Rental+ ABSD then Stocks Portfolio

We can see based on the guidelines what may be the most appropriate steps to take.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Meileng Tong

Thursday 28th of May 2020

Have to consider the age of his hdb. If say after 10 years of holding , the balance lease is less than or close to 60 years , then he may not get a good price in event of selling then . By holding on to his hdb flat , he has to pay absd for his condo, so better to sell the hdb flat if he is keen on upgrading to condo.

Considering his affordability, he can enjoy the upgraded lifestyle and sell the condo to cash out when there is good capital appreciation or to hold on to his condo if resale price is not right .

Kyith

Monday 1st of June 2020

HI Meileng, thanks for sharing. I think you have given some scenarios to pivot to, just as I have. However, in terms of financial numbers what would you do given his situation?

Andy

Sunday 17th of May 2020

The readers age and time to retirement age is not mentioned. If in their late forties or fifties - best to remain in the HDB as this purchase will deplete their retirement savings significantly.

Kyith

Monday 18th of May 2020

He probably has 10 years more. If he has built up this at this age, 10 years more should be less of a problem. Thanks for sharing your perspective.

Jeffrey Chee

Sunday 17th of May 2020

Thanks Kyith, fun analysis. Another factor to consider for the option of keeping HDB flat. If the owner used portion of CPF, portion of the capital gain has to offset the CPF interest, so the IRR at 10 years is less than 2.1% in this effective. At the same time there is also risk of hdb capital gain to be less than 2.5%, depending on gov measures, location and etc.

Kyith

Monday 18th of May 2020

Hi Jeffrey, I think i worry less about the accrual interest since it might go into his retirement fund. Keeping the flat is tough due to the ABSD really.