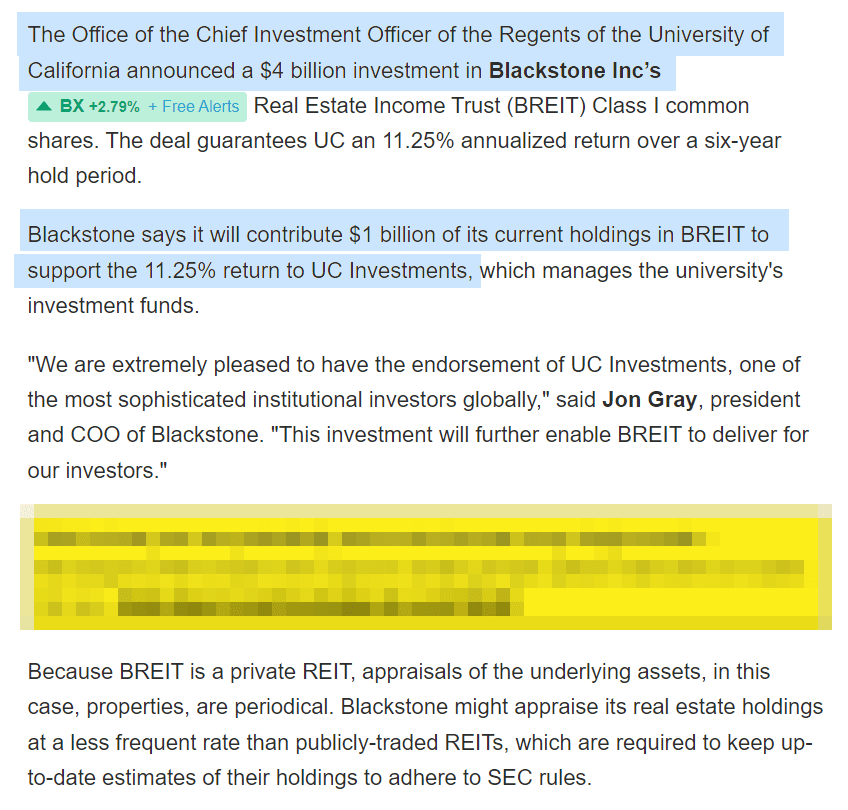

A couple of days ago, our investment analyst Choon Siong forwarded me this hilarious piece of commentary on the Financial Times.

The chart below shows the performance of six real estate investment trusts, five mainly listed in the United States:

For the past year, the performance of five of the trusts has been bunched together.

There was an outlier: Breit Class I Nav.

Breit Class I Nav is Blackstone’s Real Estate Income Trust fund. Breit, as of September, has a debt-to-equity ratio of 1.6 times and less than 10% of its debt is due within the next two years. 55% of the portfolio is residential housing, and 23% is industrial. By reputation, it has high-quality properties.

David Auerbach, who runs the fund, sums up the puzzle: “How can everyone else’s valuation be going down, and theirs is going up?”

As a private REIT or a private equity fund, Breit does not have to mark the value of their fund to market, unlike the other five.

Either Blackstone is damn outstanding as a manager, and the others are so shit (they are all in the same residential and industrial sector) that they can select the properties in regions where the price is not going down.

Or that all this is because… they haven’t mark-to-market!

If you are an investor in Breit, a trade would be to sell your stake in Breit and buy these publicly listed REITs, backed by physical properties, at a 25% discount.

But the manager at Breit tells you that you cannot get back your money.

Imagine you are a manager of the fund or any fund. If 20% of your unit holders wish to redeem their units, and you don’t have the cash to pay them, you have to liquidate some of your positions.

Now, what does liquidating your positions mean? Selling some properties to get cash so that they can pay you.

But if they sell the properties when urgent, can they fetch a good valuation? Most likely, they have to sell lower.

These unlisted funds are just illiquid.

If there is a stampede, the mark-to-market will happen.

This is not to say the assets in Breit are going to turn to shit:

On 3rd Jan 2023, the University of California announced they would invest in Breit. This should provide some much-needed liquidity. I think as a show of confidence (perhaps to motivate the University of California), Blackstone will be committing $1 billion of their capital as well.

This should provide additional liquidity to tide them through this period.

We get the returns and the emotional ride we deserve

This case study eerily reminds me of an upcoming rug-pull scene from a Defi crypto project that you lock in your tokens by staking.

Great returns, but when you want your money, you realize… you cannot withdraw.

This is likely not the case, but in this instance, you should understand that illiquidity is a characteristic of private equity that you must live with. You cannot suka suka sell anytime that you want.

- More affluent investors like the appearance of low volatility, which means that their performance looks better risk-adjusted (standard deviation is lower because there is less mark-to-market, so the performance looks better!)

- They also like to use leverage, and so these funds use leverage to such a degree that it satisfies them.

- There is a promise of good returns, and the affluent would pay up for it in big fees, which some may not realize how detrimental that could hurt performance.

Many investors are out there trying to find that holy grail of

- High-returns,

- Low-volatility or capital guarantee,

- Very emotionally comfortable investment journey.

So they either found scams or pretenders.

In this case, the pretenders are:

- Solutions or strategies whose tail-risk is more significant than your perception.

- Great returns are always possible in great managers who don’t need your money, which you don’t have access to.

- In most times, the volatility is as you expected until events that you least expect, which spikes the volatility to such a degree that you realize this investment is more significant than your emotional threshold.

- One day you realize the returns are just like a typical retail fund return, but the fees you pay are huge relative to retail funds. That is when you realize you are a vegetable head.

- There is nothing special. If everyone crowds into something, the premium eventually disappears, and there is no outperformance. Value, and illiquidity premiums also disappear.

Eventually, you may realize that investments you come across have different returns, volatility, risk, effort, and emotional journey characteristics.

There is seldom a holy grail and the surge is quite futile.

The uncomfortable truth is that you exchange a less-than-comfortable emotional journey filled with volatility, capital-impairment risk, and effort for better returns.

Asymmetric-return opportunities exist but are usually presented through a lot of extra effort, very testy emotional journeys.

Even after this, people will be searching for that high-return, low-to-no-risk investment.

And most often, I think they will get the returns and the emotional ride they deserve.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

lim

Saturday 7th of January 2023

Just because someone is affluent doesn't mean that person is financially literate. There are many ways to become rich which don't involve having financial literacy (including inheritance). These people form the main revenue stream for most of the finance industry, so its not nice to make fun of them :)

If everyone was financially literate, they would just buy Malkiel's 2023 50th Anniversary Edition and invest in a diversified basket of assets, and what would happy to the financial adviser's yachts?

Kyith

Wednesday 11th of January 2023

Hi lim, I don't think I am making fun of them. Rather, I am pointing out a certain observation. Everyone is on the path towards more financial enlightenment but each of us have different cognitive models. Our conservatism but at the same time a need for returns often makes us veer towards scammy stuff that on the surface alleviate both of these needs.

Aaron

Saturday 7th of January 2023

hi Kyith, think Michael Hartnett from BOA just said to buy Global stocks over US stocks, that US stocks have outperformed global in the last 15 years, time to flip around. Can you share the BOA report in your blog?

Kyith

Wednesday 11th of January 2023

hi Aaron, I think better not share it like this.