My formative investing years started in the 2003 bull market.

Investing from 2000 to 2010 was a fascinating period. There were many themes in that decade. There wasn’t a dominant theme. Real estate would work, and so would the BRICs (not sure how many of you remember that). If you are not invested in emerging markets, there is something wrong with you.

Strangely, the actions in the past two months reminded me of that period. This weekend, most of the financial content I consume seems to also remind me of that.

The chart below shows us the selected performance of some indexes during the past two months:

All of them outperform the S&P 500, a U.S. large-cap index, over the two months. These are the shit that did well, then.

If you use simple fundamental logic, you would be very befuddled. European banks are so shit, Europe is so shit, so how come they will do well? Isn’t gold suppose to hedge inflation? How come it only starts doing better when signs of inflation waning?

Here are some more results:

I think almost all of them are beneficiaries of the U.S dollar weakness:

Many people believe that the US dollar can only head higher. Since the US dollar graced the magazines, the US dollar went through one of the sharpest, lengthy corrections in its history.

Those who staked their money in short-term US Treasury bills would feel the pain.

International stocks, emerging market stocks, gold & precious metals tend to do well when the dollar weakens.

That is what we experience during the 2000 to 2010 period. The S&P 500 return was poor relative to international stocks, but a Singaporean investor would fare worse adjusted for the US dollar.

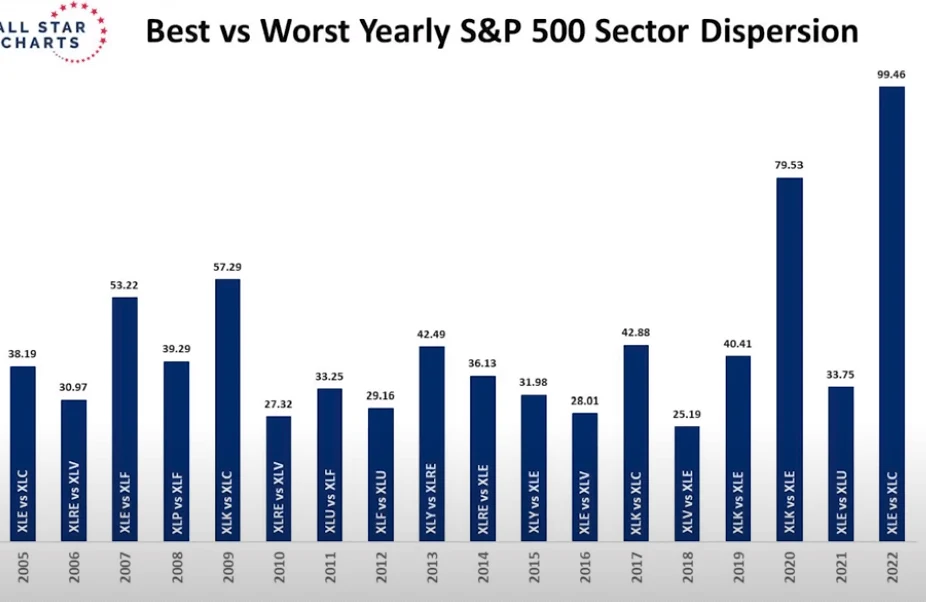

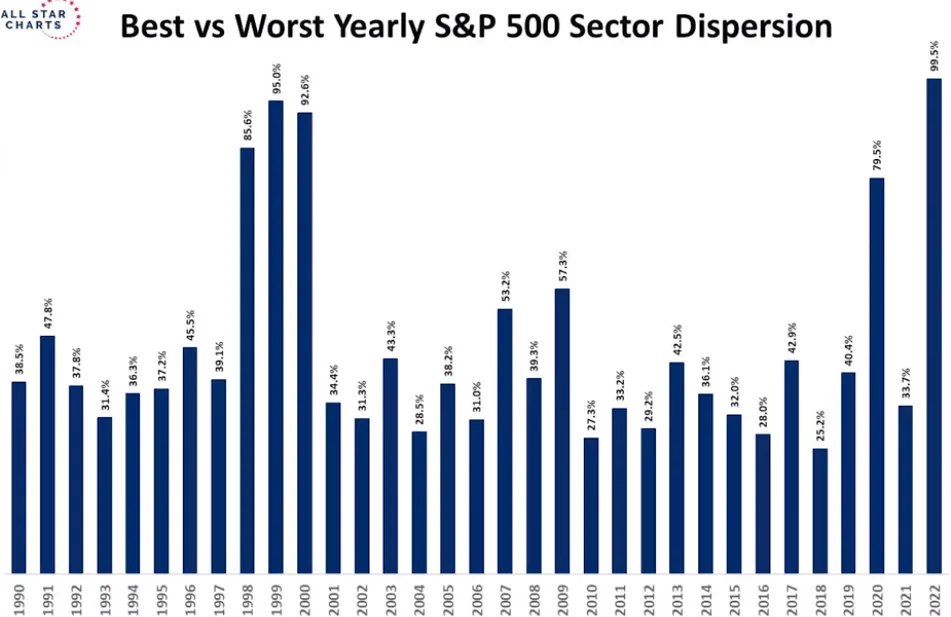

JC Parets highlighted the following two charts in the Compound show this week:

The charts show the performance of the best sector (in 2022, it was energy) versus the worst sector (in 2022, it was communications). In 2022, we saw the biggest dispersion between the best and worst US sectors in the past 17 years. If we extend the period all the way back to the past 30 years, we can see the last time we have such a situation was during the dot-com period.

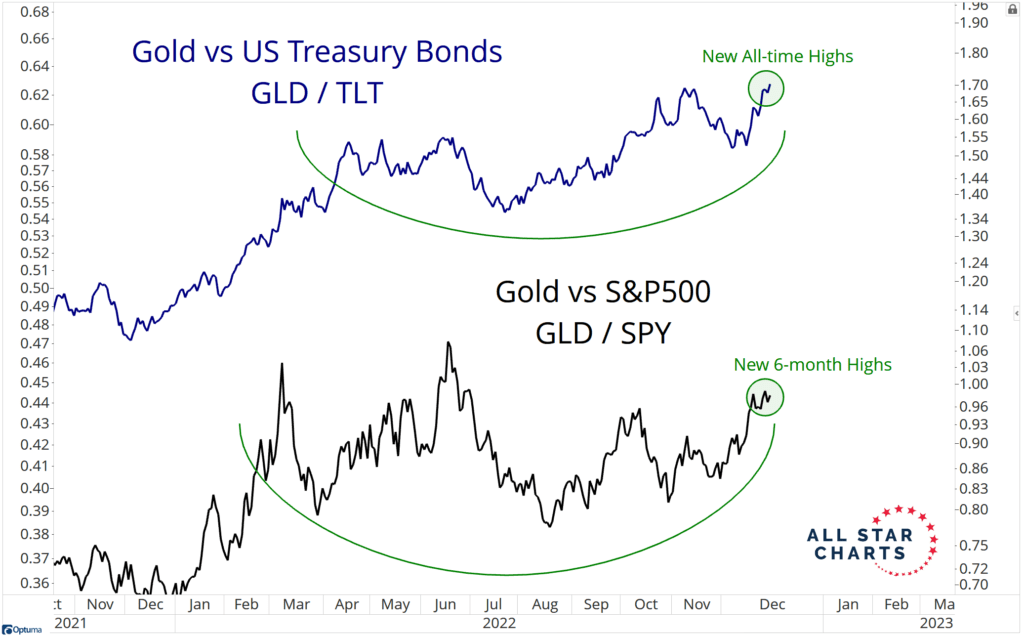

Gold, relative to US equities, seems to be on the verge of a significant breakout.

I think cycle analyst Larry Williams was the first to observe that… gold does well only when inflation is declining. No reason was given, but if you go through enough historical charts, that was the observation.

So gold is doing well when inflation declines are not new.

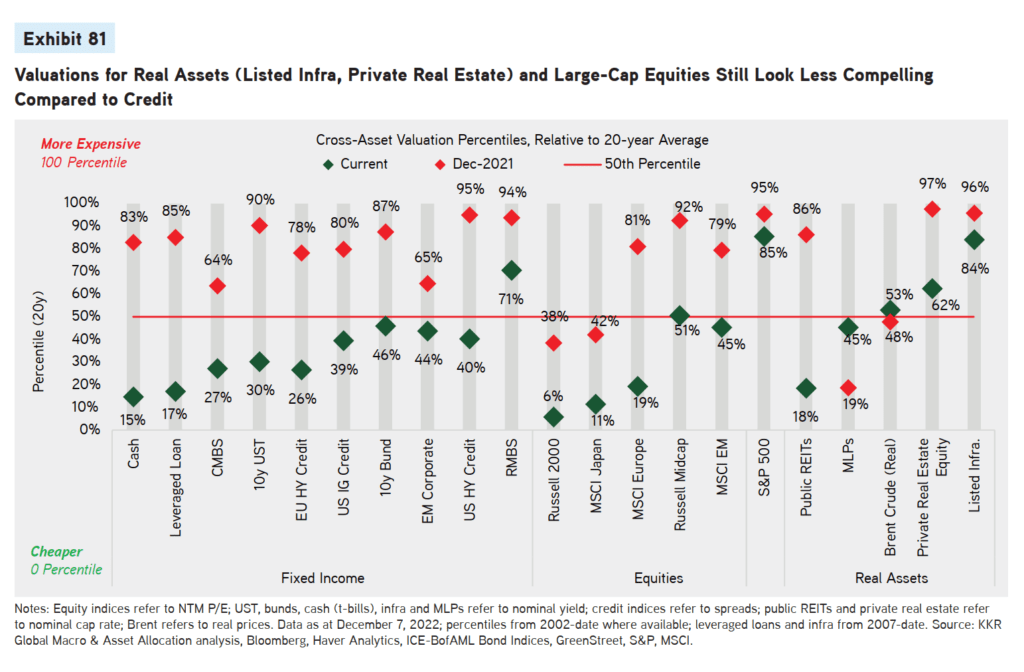

Perhaps the reason why the rest did well relative to the US large cap is that… the valuation is just so rich relative to history. The table above shows the valuation of fixed income, equities, real assets relative to their 20-year history and Dec 2021.

As an investor, you should be glad that you have a lot of fixed-income and equities options at cheap valuations. If you are diversified enough, you should do Okay.

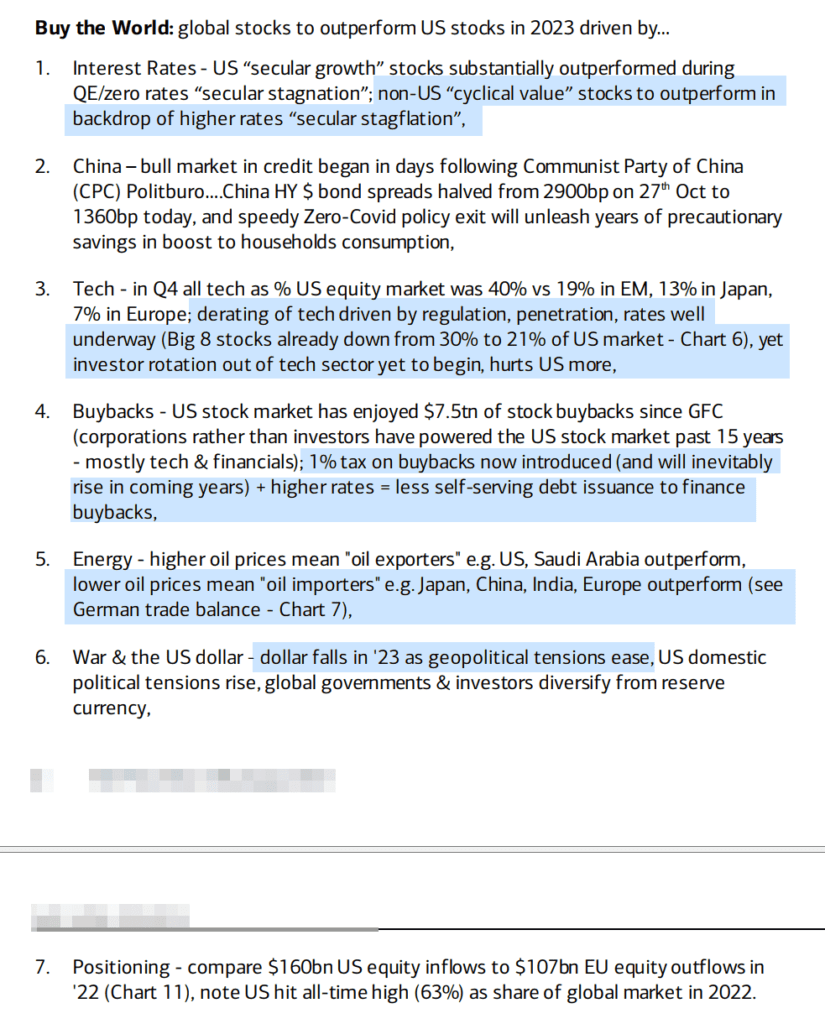

Bank of America’s team, led by Michael Hartnett, justifies where we are heading with the summary above. What it’s fascinating is the potential effect of regulation and taxes on buybacks.

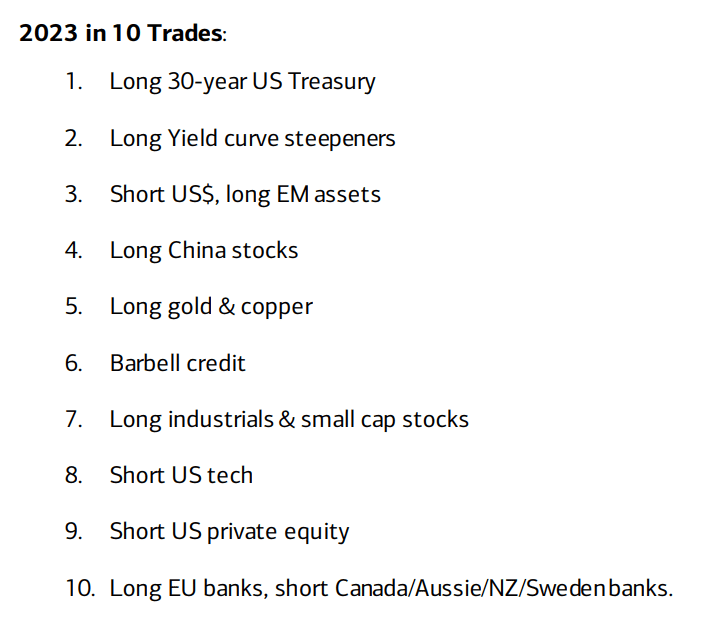

Here is their call btw:

The past three years lead me to conclude that… you can either position based on momentum systematically or… you have to be more contrarian and identify neglected places. That is where the most significant value lies.

If everyone crowds into something, then the assets will trade at prices closer to fair value. There is less premium to be earned.

But… neglected things usually look very shitty and therefore require you to be able to sit with investments that went nowhere comfortably.

This is hard for 99% of people.

Neglected things didn’t work so well in the era of quantitative easing, where money was abandoned, and money flows amplified the momentum effects and dampened reversion to mean.

With less money out there, perhaps reversion to mean can appear more.

Josh Brown, CEO of Ritholtz Wealth Management, said this about how portfolio managers or advisers position their client’s portfolios:

When most financial advisers and portfolio managers decide what to overweight for new prospective clients based on what has done best in recent past few years, this is because you can get very strong recent backtests. Typically, in the portfolio, you will have a 15% sleeve to alternatives, including gold. Since gold was flat last year, which means it did well relative to everything else except energy, gold will get allocated.

While this gives a reason for gold to do well, it also shows that YOUR behaviour and posture lead the advisers and managers to give you investments that have already run their course.

This is because you are only comfortable investing when you see excellent past performance.

But perhaps the better investments are the more uncomfortable ones, which it is uncomfortable for most.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Sinkie

Sunday 8th of January 2023

I've been holding my nose & just getting more greater China, western Europe, sreits, US value, long duration treasuries, and some gold & gold mining stocks.

Agree having some deja vu with the early 2000s.

If all these really true, then STI should also be gangbusters next few years, ha!

Kyith

Wednesday 11th of January 2023

haha that will give some respite to the sti etf investors and irritate those who just switch to the S&P 500