At the start of 2021, Prime US REIT set the theme for 2021 to be the year of growth.

Yesterday, Prime US REIT announced the acquisition of two U.S Grade A properties.

These properties would be yield accretive.

Prime US REIT currently trades at US$0.88.

Based on the annualized distribution of their second-half 2020 distribution, the DPU $0.0684, the historical dividend yield is 7.77%.

If you look up my Dividend Stock Tracker, you would notice that it is one of the higher yielding stocks. Perhaps, Prime US is a higher yielding dividend stock with less overhang compare to other higher yielding dividend stocks.

The two properties will cost about US$245.5 mil. Prime US REIT will finance the acquisition with:

- The debt of around $164.5 mil

- Private placement of 100 mil shares at US$0.809 which comes up to $81 mil

The following figure shows the change in DPU after the acquisition, funded by debt and the expanded equity due to placement:

The DPU will be boosted to about US$0.0711.

The dividend yield after acquisition is 8%.

This deal is DPU accretive even after the placement dilution.

I think it is great that even with such a high hurdle rate of 7.77%, they can make the accretive acquisition.

The CAP rate for both buildings is 5.3% and 5.8% respectively. What boosted the deal is the ratio of debt to new equity used.

After this acquisition the net debt to asset would have changed from 31.4% to 33.2%.

I think Prime US REIT still have much room for acquistion.

Why invest in Sorrento Towers and and One Town Center

Prime’s two acquisition resides in San Diego and South Florida respectively.

Both of these are considered Tier 2 cities.

Both of these cities have their appeal.

Sorrento Towers’ neighbours sells itself.

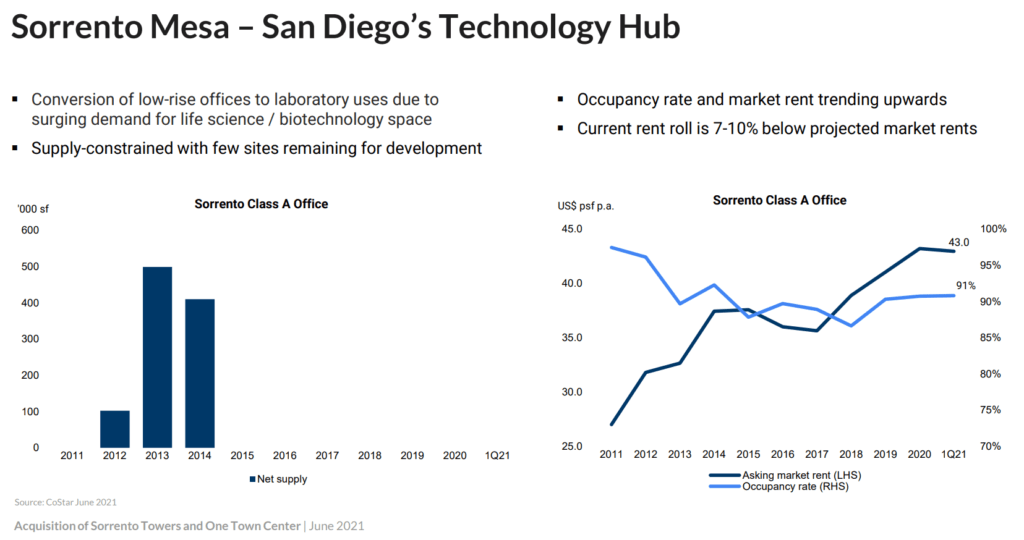

San Diego is getting more expensive but also more vibrant as technology companies and biotechnology companies gather. Venture capitalist are also attracted to this place.

The education level is pretty high and this may be what is appealing about San Diego.

Properties used to be a network effect. You need an educated work force, to attract companies to setup offices there, which then attracts people to move there.

There isn’t much new builds but I reckon that older buildings will be turn into areas that are more fit for purpose. Occupancy rate remains high btu with slack. Rent has picked up over the years.

Dexcom is a major tenant occupying 50% of Sorrento Towers. They started the lease in 2018 but in the pandemic, they decided to add 3 more floors and commit substantial capital investments, pulling their senior executives to the location.

What was not announced are some subsequent leases completed which will bring the total occupancy closer to 98%.

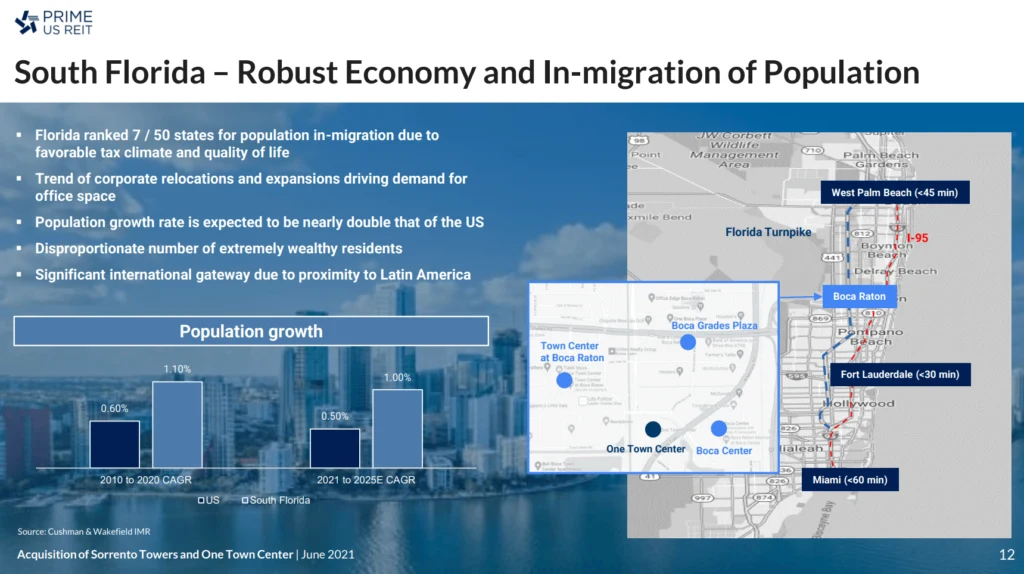

People go to Florida because it is one of the more tax friendly state.

Florida do not have state income tax. Other kind of taxes are average compare to other places.

My research of Boca Raton gives me that feeling that it is one of those small quiet places where the companies are to serve those businesses who are around there just due to the tax friendliness.

No major surprises that majority of the tenants are in the financial services sector.

Both of these acquisitions are rather medium in their WALE (about 6.5 years).

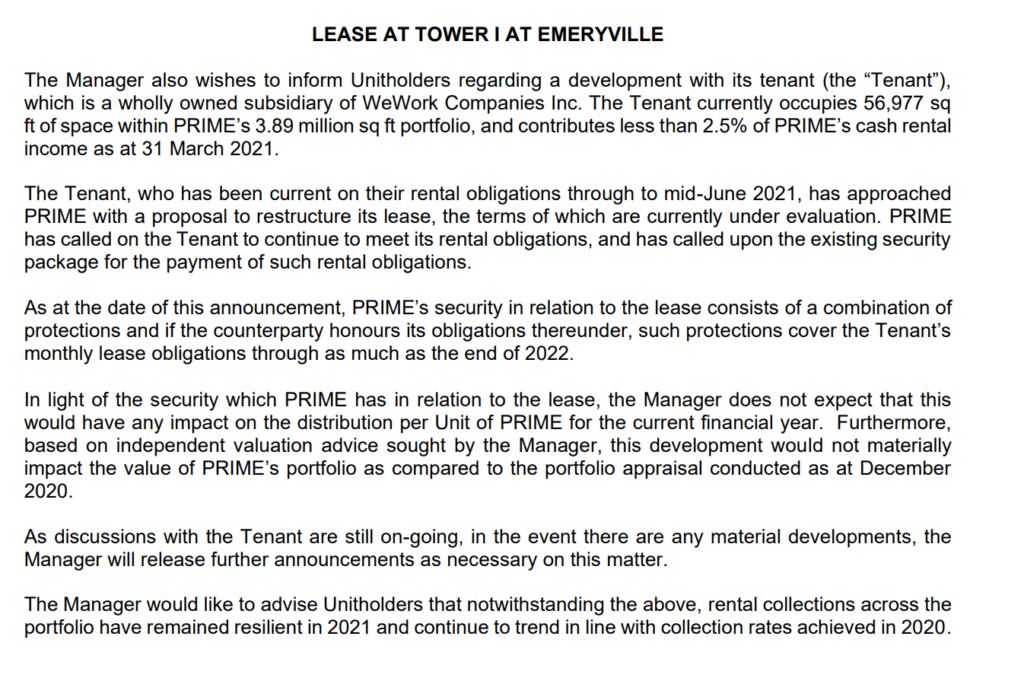

WeWork Would Like to Restructure their Lease

Not too long ago Prime updated that WeWork, who was leasing a sizable portion of their spaces have request to restructure their lease.

Prime basically (my interpretation) told them to pay up and have started to eat into the security deposit placed with Prime.

Prime updated that this would not have material impact on their DPU this year. Just not sure about in the future.

If you would like to learn more about investing in REITs, you might be interested in my REIT training center which is a free set of article written in the past. You can check it out in the link below.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024