Many retirees, pre-retirees or investors who think they need income are quite intrigued by unit trust or funds that distribute an income.

These unit trust, which could distribute 4-7% a year in income appeal to these group of investors because their requirements are:

- A fund manager handles the investment for them because they acknowledge they are not good at it or do not have the time.

- Distributes an income into their own bank account.

- As the investor only spends the income, their capital is preserved.

These funds seem to be the solution to many of our problems.

Even a 35-year-old who is still accumulating would like such a unit trust because they have the freedom to choose what they do with the income. If they get retrench or needs to take a break, they can temporarily rely on the income.

These solutions looked better than investing in a low-cost, diversified portfolio of ETF such as the IWDA, VWRA because the natural dividend income from these portfolios is low and you would have to sell your units to cash flow from these portfolios for your retirement.

If you sell units, you would run out of money.

Part of the Income from Income Funds comes from Your Capital

What many of you may not know is that part of the high-income distribution you get comes not from the underlying income-paying financial securities but from the funds’ cash holdings or capital value.

I realize that most of these unit trust declare on their fund website the nature of their dividend income distributions.

So these funds tell us, if they pay out $100, how much of that amount comes from income from the underlying securties and how much comes from realizing the capital.

Let us go through some example.

PIMCO GIS Income Fund

This PIMCO fund is a very popular fund because it gives such a consistent dividend per unit every month. I think the dividend per unit didn’t change much since 2013 or 2016 (cannot remember clearly)

The current yield of the portfolio is listed at 3.12%.

The table above shows PIMCO Income funds past monthly distribution. So damn consistent. On the far right column, we can see that in certain months, the distribution comes not from the distributable income but from the capital.

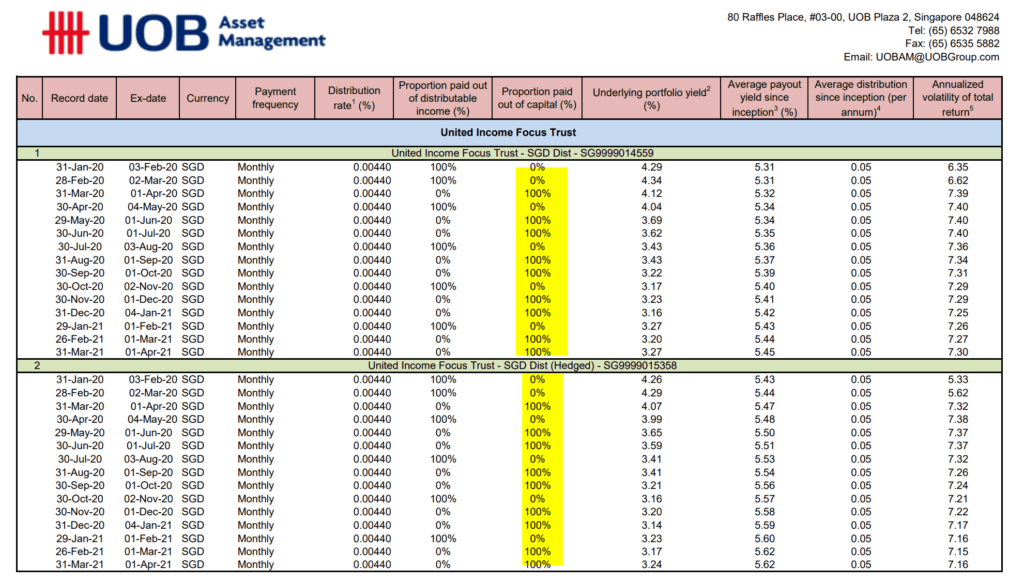

UOB United Income Focus Trust

The table above is taken from UOB asset management, which publishes more dividend information from the fund.

Notice that in a lot of months, the fund has to pay out from their capital.

Interest to see that the average payout yield since inception is about 5%, but the underlying portfolio yield is now 3-4%.

This fund was incepted around 2015 and currently, the NAV per unit is SGD 0.912. Usually, these unit trust debut with a NAV per unit of 1.00.

So technically, the NAV is lower than where it started out. We can infer that that the capital growth of the fund, after the income, has not grown or have came down after these 8 years of high distribution.

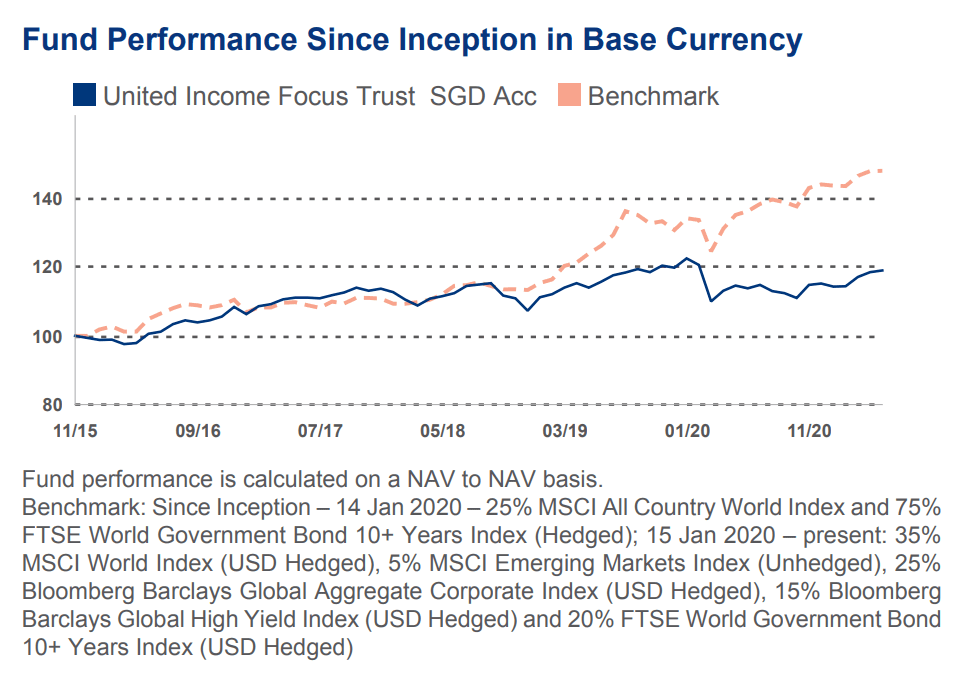

The fund performance will show after taking into consideration the income distributed to you and the capital growth, whether the fund did better than the benchmark index it measures against.

And in this chart, we can observe that it is underperforming the index.

This is performance before the sales charge and wrap fee.

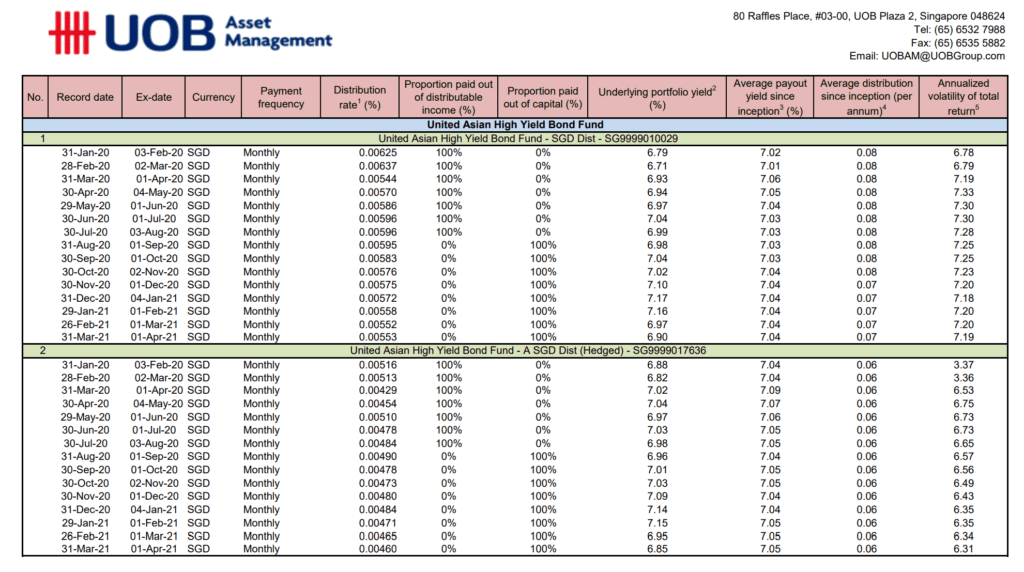

UOB Asian High Yield Bond Fund

This is a very high yielding fund but also notice that the income from many months were paid out not from income but capital.

The historical income yield of this fund is really about 7%!

This fund is incepted in 2013 and currently, the NAV per unit is SGD 0.945. Usually, these unit trust debut with a NAV per unit of 1.00.

So technically, the NAV is lower than where it started out. We can infer that the capital growth of the fund, after the income, has not grown or have come down after these 8 years of high distribution.

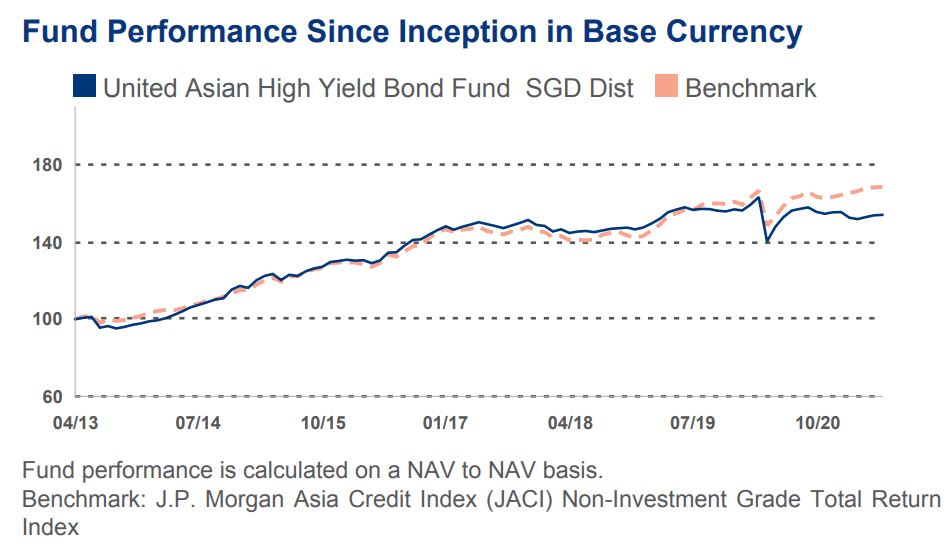

In terms of performance, the fund, taking into consideration income paid out to you and capital growth, are just keeping pace with their benchmark index.

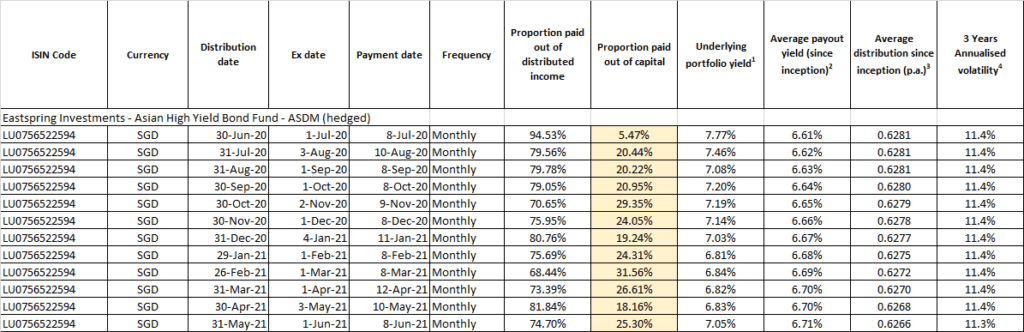

Eastspring Investments – Asian High Yield Bond Fund

This is one of the monthly income funds that received Fundsupermart’s recommended stamp.

The historical income yield of this fund is 6-7% as well.

The Asian High Yield Bond Fund shows a consistent flow out of capital instead of actual income.

The NAV per unit of this fund started at $10 in 2012.

Since then, the NAV has come down to $8.13.

If you are an investor at the start, while you received the high income, the capital growth has been negative.

Most Fund Managers Published the Dividend Information

I said most but you would have a hard time finding out the information.

You can try Google “{fund manager name} dividend information”.

Here are some that I came across:

- UOB Asset Management Dividend Information

- Eastspring Investments – Go to Download Distribution Record.

- Fullerton Fund Management – PDF download link at the bottom.

Why Does the Income Fund Need to Payout of Capital?

I think paying out of capital is only natural.

Here are some reasons why they do this.

Dividend and interest income received is Uneven over the Year

If you have invested in stocks or bond before you will realize that:

- Most stocks do not distribute income monthly or quarterly.

- Even the distributions are not uniform (more for stocks)

And based on the time of your investments, your total dividend and interest received is not even as well.

Now, if you are the fund manager running this fund, and your mandate is to provide as smooth, and as conservative of income, how would you smooth out the income distrbution?

You would have to tap your capital.

Interest Rate have been Declining

Majority of the income funds are invested in higher-yielding, lower quality bonds.

What influence the yield-to-worst for these bonds is a mixture of government risk-free interest rate, and the default risk of the underlying business.

While the latter have provided a bigger boost over higher quality bonds, they are still influence by prevailing interest rate, which have come down.

Fund managers can identify mispricing in bond markets in different regions, and in different grade of bonds and are able to capture capital appreciation.

So what this means is that

- The proportion they earn from actual interest income compared to the past may be lower.

- Greater proportion of the funds total return comes from capital appreciation.

And thus, returns will come from the capital.

The Fund Manager Faced the Same Problems as You

You may realize from the above two points that the fund manager have the same issue as you:

- distributed income is uneven.

- need to get returns in a low return world.

- interest rate and yields are falling.

- need to assess the risk of individual securities.

- if they distrbute from the capital, they have to be cautious about it.

The difference may be the manager has more sophistication in this area and are less emotional than yourself.

But in a way, if we peel things away, everyone faces the same issue.

A Fund Manager of an Income Fund is Forced to Wear Two Hats

I always tell people that a fund with a mandate like this are forced to wear two hats:

- The investment manager.

- The financial planner.

The investment manager’s role is to ensure that they curate and select the best securities for the portfolio, do great portfolio allocation and rebalancing, assess and manage the risk of the portfolio and underlying securities, and identify mis-pricing.

The financial planner role is to provide an income the investor need, smooth out the distribution.

The financial planner needs to communicate with the investment manager to find out how much income to distribute so that the fund does not die.

The financial planner here (Eastspring, Pimco, UOB) do not know you, so they have to set a rule how much to distribute.

Thus, they could try their best, but you need to find out what is the rules of the distribution. What if the fund does not perform well? How would the manager adjust the payout?

Knowing this will help you factor into your financial plan better.

There are implications when a fund manager wears two hats.

A. It distracts the Investor from a Focus on Total Return and Beating the Benchmark

Investors would clamour for monthly, quarterly income and force themselves to invest in a fund with that characteristics.

But what is important is how the investment manager part of the fund is doing.

How do you evaluate performance?

It is less about the income but more of the total return. The total return is made up of the capital appreciation and the income distributed.

A well-performing fund should have a total return per year or compounded average growth that keeps up or beat their benchmark index consistently.

If you look at our examples above, almost all except for the PIMCO Income fund failed or at most keep up with their benchmark index.

This means that the investment manager role of the fund manager are not adding enough value through their securities selection and management.

We all know that we probably need to spend money on a daily basis.

Let us say that John needs $135 a day for his family.

He has the choice to work for two company.

Company A can give him income daily.

Company B can only give him income annually.

Company A is in a matured industry and its revenue is not growing. By all accounts, there are benefits but not really much more than the Singapore average standards. Career progression can be said to be unclear for most employees his range.

Company B on the other hand has stabilized after an initial stage of growth. Their revenue is still growing well. In order to attract talents, they have put in place better benefits. The company is trying to innovate and in need of people to eventually lead the teams after getting more experience.

Which company do you think John should join?

A good guess would be company B.

His employment decision should be more than just the frequency of when the company pays him.

In the same way, that is how you should think about the financial product you encounter out there.

A lot of the time, they package the investment and financial planner role into one product.

If a product is suppose to give you a good risk-adjusted return, evaluate it as such.

B. Your Sustainable Income Plan is More than an Investment Product

This leads us to the second implication.

When the income fund manager wears the financial planning role, they do not know you.

And so, the rules of distribution cannot be tailor to your needs.

If you needed less, they would distrbute the same amount.

If you needed more, they would distribute the same amount.

If you need a lump sum amount, the income fund manager cannot advise you if you take this out, it will impair your income stream.

This is why I often say it is best to take the accumulation class of these ETF and unit trust.

You or your trusted financial planner decides, based on your circumstances how much income to take out a year, or semi-annually or quarterly.

If you need to take out a lump-sum, we can have a conversation what is the rationale behind the withdrawal and whether after this, what is the income to withdraw in subsequent years.

Your income plan needs to be sustainable, and such a plan is probably not just made up of one or a group of income funds. It is usually married with your CPF Life annuity income, your cash in your bank account.

And thus, it may be best for you or someone else to is dedicated to thinking about the role of distribution than the fund manager.

Preserving Capital While Getting Consistent Income

So today, you may realize that the income that you get comes partly from capital appreciation or growth.

The question that is in your mind may be:

So can my income fund last for 30, 40 or 50 years?

That is a good question.

I wonder if anyone asks the fund manager that.

I think each fund manager will have their own way of answering that question.

If the fund manager is using capital to smoothed out the income payment, it shows us the inherent flaws of the dividend income model.

- The income is going to be volatile.

- If you are planning, your planning norms is going to be different from your actual spending experience. (Initially it gives you 7%, then 5 years later, would the dollar value be similar or will it be more or lesser)

- You have no idea if the income stream will eventually be able to keep up with inflation!

I am not putting the blame on the fund manager. That is not his or her job basically.

Consistent income while preserving capital is more than just spending only income from underlying securities.

It is based on using a conservative, low enough initial absolute amount.

Then, along the way, we adjust for inflation, we also adjust based on life circumstances, your longevity, changes to future returns and inflation.

Articles on Getting Passive Income

Here are a set of articles focus on leveling you up on the topic of getting passive income from your investments:

- How to get Passive Income from Funds that don’t distribute Income

- Why Living Off Dividend Income in Retirement is Not Perfect

- Why Your Income Fund Pays the 3-7% Income partly from Capital

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

lalaman

Saturday 26th of June 2021

thanks for the write up.

This reminds me of those overseas properties which guarantee a few years of high rental yield (which ultimately comes from the purchase price you paid higher than the locals).

Its all about how they package the sale :P

Kyith

Saturday 26th of June 2021

Hi lalaman, this is not so bad la. perhaps it is similar in the sense that there is a mismatch in expectations. The same can be said about my recommended flexible spending strategy. suppose I tell you today you could spend $40,000 but due to subsequent poor markets, we keep adjusting the $40,000 down by 10% each time until $25,000 (a good example is the 1929 30-year period). That may not leave a good taste in the investor's mouth.

Sinkie

Saturday 26th of June 2021

There are funds that consistently pay out of underlying dividends, but these are usually (1) at least balanced or pure equity funds, and (2) payout mandate of no more than 3%-4% of NAV. Pretty much similar to the safe-withdrawal rate.

So while the capital is left more or less untouched to grow, the income payouts can be volatile e.g. if markets crash -50%, your payout will also be similarly affected.

The danger with having investment mandate focusing on dividend stocks is the fund manager may become biased & hang on to formerly-good dividend stocks even after a few years of business deterioration. Just to satisfy a minimum underlying amount of dividends to distribute.

Prime example for US will be GE. Singapore examples too many liao LOL.

Some common sense is also needed here. With lowest govt bond yields in a thousand years, and lowest junk bond spread in a few hundred years, any bond fund that promises 3% or higher payouts is going to have to pay a portion from capital.

A whole new generation of investors have not experienced the financial engineering blowup of 2008.

I think the next few years will be prime period for financial engineering to produce new higher-yielding products, just like in the low-yield period of the early-2000s.

Kyith

Saturday 26th of June 2021

Hi Sinke, I think you brought up an important point that I missed out. As a manager, you are forced into an uncomfortable decision to keep some companies because they are the main stalwarts that provide bulk of the dividends.

ron

Saturday 26th of June 2021

One possible way around the inconsistent income is to build a portfolio that can smoothen out income on a monthly basis. It takes time and money though ( as always ). Using the SGX as the one and only source of buying shares, look for companies that pay dividends outside the usual financial year, which is around May & October. One such company is Singtel, which pays out dividends in Jan & Aug.

The other companies are REITs.. which pays out 4 times a year. There will be months where the is zero payment. But since the concentration of payments are in May & October, it will average out.

The other investment is Singapore Savings Bonds which pays out 2X a year too.

All this requires money of course and there is no certainty that capital will be preserved. But it is a plan, a scaffold to use and build a strong financial position. Strong does not mean wealthy, but it allows a balanced, diversified financial position. It requires monitoring and attention, but not like buying & selling shares on a daily, weekly or even monthly basis.

Thank you Keith, always enjoy your articles.. stay safe.

Kyith

Saturday 26th of June 2021

Hi Ron, thanks for sharing your thoughts. There is a blogger called Paul who invest for dividends who is able to fill every month with dividends. That is an active management portfolio though.

Pete

Saturday 26th of June 2021

Very good article, thanks for writing this.

Just want to say I benefited from spending my time this morning reading this and the 2 other articles you linked. Really appreciate it.

Kyith

Saturday 26th of June 2021

Hi Pete,

Glad it is useful.