As the year draws to a close, two commercial and office REITs under the Mapletree umbrella decides to merge.

I chuckled when one chat group member commented that there seems to be more and more of these kinds of incestuous relationships taking place.

I would like to think that the objective of these mergers is not too different from the merger of Frasers Commercial Trust & Frasers Logistics and Industrial Trust and Capital Commercial Trust & Capitaland Mall Trust.

Usually, in this kind of merger, they would create a win-win situation but because many investors get invested in each for different reasons, they might struggle to process how to think about this merger.

If I am right, Mapletree Commercial Trust share price would be under pressure while Mapletree North Asia Trust share price would do well. This is not rocket science but usually how the share price behave for these merger and acquisition deals.

So here are some brief thoughts.

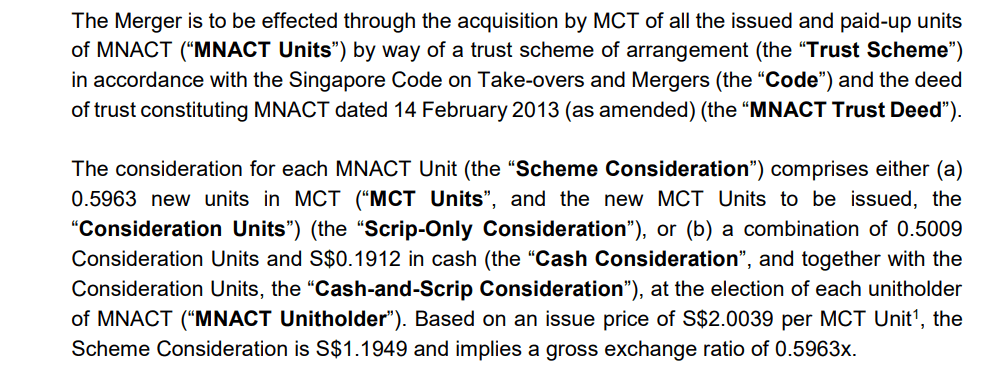

How the merger of MCT and MNACT will be structured

Both Mapletree Commercial (MCT) and Mapletree North Asia Commercial (MNACT) owns a mixture of commercial shopping malls and office buildings.

The main difference is that the properties in MCT reside around the city and southern waterfront of Singapore while MNACT spreads around North Asia.

With this combination, you will own 18 properties.

The new entity will be called MPACT (sounds quite good)

While this is an official merger, it feels more like MCT buying MNACT and renaming it MPACT.

If you are an MCT shareholder: Your REIT is doing a rights issue or preferential offering by issuing units at $2 to buy MNACT over.

If you are an MNACT shareholder: Your REIT is selling itself to another REIT and you will be getting shares or shares + cash depending on the option that you choose.

There are two options given:

Both options come up to you “selling” to MCT or the new entity at $1.19.

If you do not submit which of the two options you choose, they will take it that the default option is Scrip-only, which means you will get the new MPACT units only.

The price of the MCT units offered will be based on the last trading price of MCT immediately before the Implementation Agreement. I read that the final amount offered may change depending on how the share price of MCT changes in the next six months.

As MCT and MNACT shareholders, you may have some considerations down the road. I may go through some of them later.

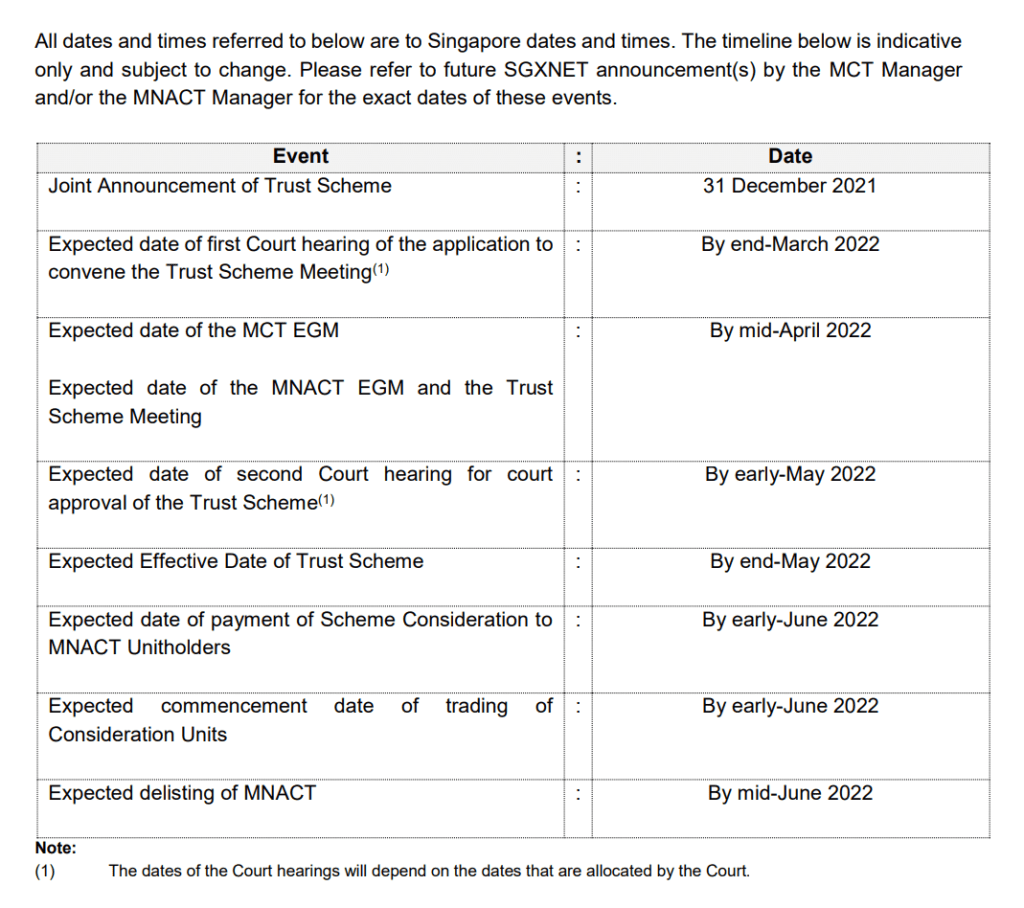

This Merger Will Not Conclude So Fast

You would have some time to think about your decisions because like most of the mergers, there are extra-general meetings and approval from shareholders to be sought.

Here is the rough timetable published:

Some MCT and MNACT Data Before We Go On Further

I took a look at the most recent data of the two REITs, before this announcement, and tabulated them below:

| MCT | MNACT | |

| Dividend Yield | 4.8% | 6.2% |

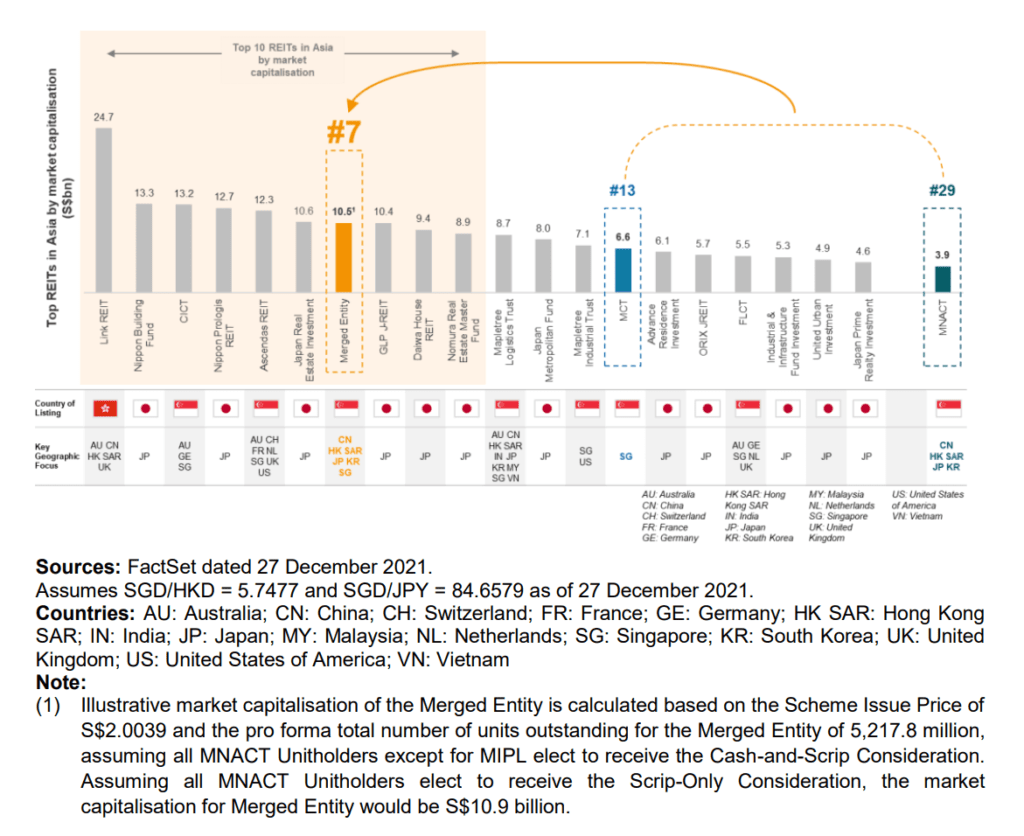

| Market Cap | 5.9 bil | 3.8 bil |

| Debt | 3 bil | 3.4 bil |

| Cash | 0.2 bil | 0.25 bil |

| Net debt to asset | 32% | 38% |

| Price to Book | 1 times | 0.8 times |

Note that these are my own tabulated figures which may be different from what is provided in the official announcement.

How does this deal look for existing MCT shareholders?

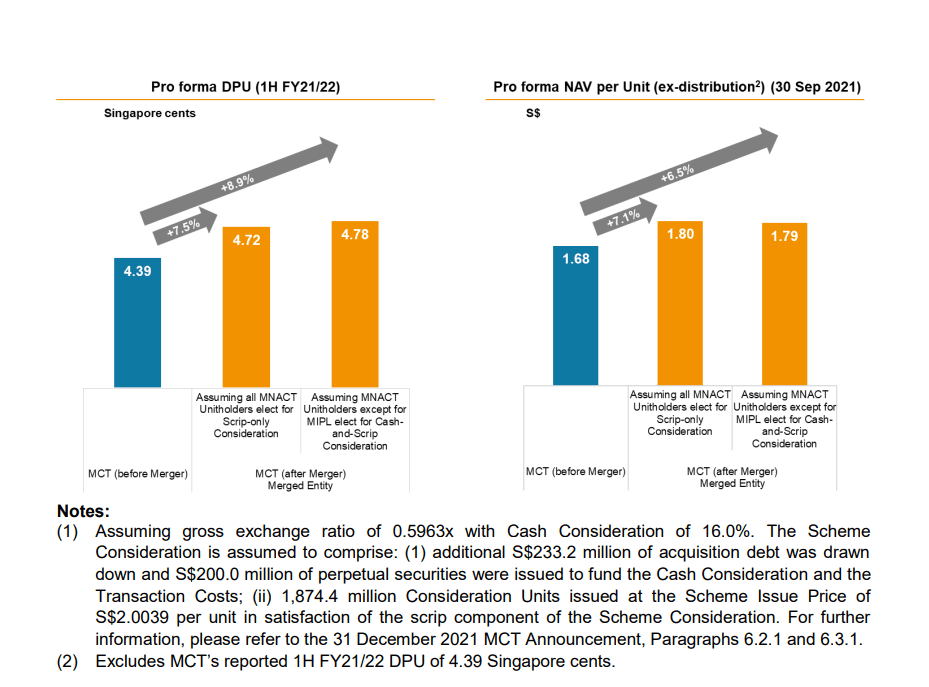

The joint announcement explains that the deal would be dividend per unit and NAV accretive.

This means that your payout will increase, despite the dilution from issuing new units to purchase the MNACT portfolio.

The NAV per unit will also increase which is good for the MCT shareholders as well. This often means that MCT is using its stronger book value as currency to acquire properties. The cost of capital used in this financing (the MCT equity) is not overly expensive.

From a financial planning perspective, if you have MCT in your portfolio to provide income for retirement, this would likely result in a higher immediate payout.

Thus, this is not a big problem for now.

However, if there is a reason why you did not invest in MNACT previously, it would be good to revisit whether that is a concern or not.

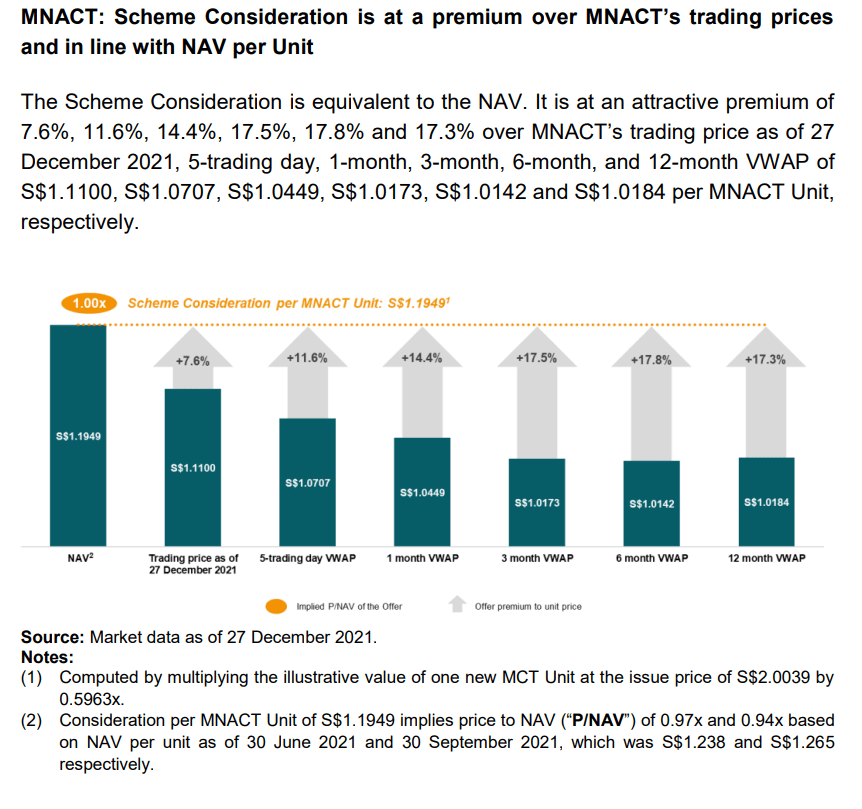

How does this deal look to existing MNACT shareholders?

MNACT shareholders would be “selling out” MNACT and buying into a combined entity.

The joint announcement tells you the offer price of S$1.19 per unit is attractive versus the price traded in the past 1 year.

However, some of you might have purchased MNACT in the $1.40 range and this would still be underwater for you. So your mileage may depend on your purchase price.

Based on September 2021 results, the NAV was $1.26 per unit. So MNACT unitholders are letting go below net asset value.

If you depend partly on MNACT for retirement income, most likely the dividend income payout from your transition to MPACT will be lower.

The Benefit and Downsides of the MPACT Combine Entity

As an investor, you would eventually have to think about why you would hold on to MPACT instead of selling it and rebalancing to another investment.

The joint announcement lists a lot of upsides but a lot of it is quite obvious.

I would summarize the benefit as the following:

- It will be easier to divest non-performing properties with minimal impact on the income.

- It will be easier to do asset enhancement on certain properties with minimal impact on the income.

- With greater scale, the combined entity can have more flexibility or acquire a larger portfolio of assets.

- This smooths out the volatility in income. MNACT shareholders would understand this well given the political and economic impact on their China and Hong Kong concentrated portfolio.

- Some fees were saved.

With all the merger trends, the REIT sponsors probably are thinking that there is not much upside in having REITs that are niche in particular areas.

In a way, the sponsor may have reverted to a model of:

- 1 x developer

- 1 x property manager

- 1 x property investment

Instead of many vehicles for the sponsor to recycle matured assets, they just need one.

Investors would have to think about whether a combined entity lessens some of the reservations you have about why you do not invest in the other REIT (for those who are not invested in both).

- Some MNACT shareholders may have reservations about the lower dividend yield of MCT.

- Some investors may feel that MNACT is undervalued versus MCT.

- Some investors may have reservations about owning properties, not in Singapore.

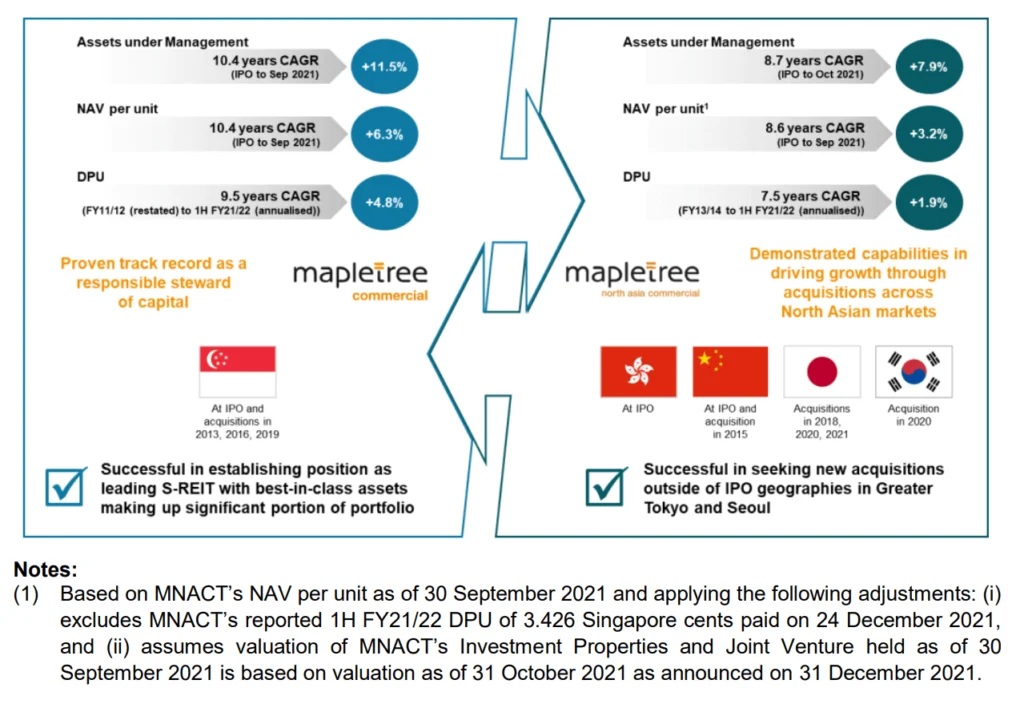

- Some investors may feel that MNACT have not grown as well as MCT (see illustration below)

Ultimately, there is no right or wrong decision. Investors came into MCT and MNACT differently and you will have to make your decisions based upon how this changes your original plan or thesis.

You can learn more about REITs in Learbubg about REIT section below.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

lim

Sunday 2nd of January 2022

Thanks for the very useful summary. As an MCT investor I can't say I am thrilled about forking over money to buy MNACT at $1.1949 per share when market price is $1.11.

Any views on whether one should buy MNACTnow as long as the price is below $1.19.

Kyith

Monday 3rd of January 2022

Hi Lim, it depends on a few dynamics which is quite a problem. I assume you think that MCT is the better one with MNACT that is not so good that you need some safety. In my mind if MCT share price does not move from $2, if MNACT is less than 1.19, you are getting good value, but the problem is MCT share price is likely to move (unless my info is wrong in that the offer is MCT share price offer will die die be $2). Most likely MCT share price will go down and so the off value is lower, so MNACT share price will be slightly lower.

HF

Sunday 2nd of January 2022

Interesting ideas