The CPF system can be rather confusing if we are trying to set up our CPF in a way that fits our financial plan.

In order to do that, we might need to understand a certain aspect of CPF. If we do not, then we might make some decisions that are difficult to reverse.

One area that is confusing for many is how much can you take out of your CPF after 55-years-old.

The short answer is that it depends, which is not the most satisfying answer and it is because of how confusing the CPF is.

So today I will try my best to see if I can lay it out clearly.

But before that, I may need to explain some stuff so that those newer to the CPF can understand things better.

You may be able to withdraw a certain amount of your monies in CPF

The main role of our CPF is to set aside enough money for our retirement. However, the government over the years have layered in a few functionalities such that in its current form, our CPF means more than retirement:

- Retirement savings

- Medical sinking fund

- Funds for our properties

- Loan for children’s education and for our higher education

Our CPF is made up of 4 accounts:

- CPF Ordinary Account (OA)

- CPF Special Account (SA)

- CPF Medisave Account (MA)

- CPF Retirement Account (RA)

Your CPF RA is created only when you turn 55 years old, and it is mainly used to house the funds meant strictly for retirement income.

You cannot withdraw in a lump sum from your CPF MA. You can use it periodically for your medical needs. After you pass away, your heirs would be able to have it.

After a certain limit, you have the potential to freely withdraw monies from your CPF OA, SA and RA account.

And this is what many of us would like to figure out.

Which part of our CPF OA, SA and RA can we get out as cash if we need it and when?

We can withdraw excess money above a certain limit after 55 years old

The magic number is 55-years-old.

When you reach 55-years-old, your CPF Retirement Account (RA) will be created.

At the same time, CPF will shift a sum of money from your CPF SA and CPF OA into CPF RA. Your CPF RA, like the SA, currently earns you a healthy 4% a year interest.

CPF will automatically shift your money to CPF RA during two milestones:

- At 55 years old

- From 65 years old to 70 years old, when you start your monthly CPF LIFE payout age. Their OA, SA will transfer to RA up to the FRS

CPF will first see if your CPF SA is enough to hit the limit, and if not, it will then tap your CPF OA.

If you have done well in your career and optimized your CPF well, you can leverage on the higher, stable interest of the CPF accounts to compound your money and then access the next time.

The Basic Retirement Sum and Full Retirement Sum limits that you need to hit to unlock excess monies for future cash withdrawals

The limit that we are referring to is the Basic Retirement Sum (BRS) and the Full Retirement Sum (FRS).

This is the amount of money that CPF force you to lock in your CPF so that eventually you can have a perpetual stream of income for your retirement spending.

Here is the current BRS and FRS (Dec 2021):

Currently, the BRS is $93,000 and FRS is $186,000. There is also an ERS where the government encourages you to set aside more in your CPF RA so that you have a stronger, more potent perpetual income stream (more money, stronger stream!)

FRS is 2 times BRS and ERS is 3 times BRS.

Notice that the BRS, FRS and ERS go up every year.

If you only set aside the BRS, FRS and ERS equivalent to today, you might not have enough monies to have an income that pays for your daily expenses in the future (due to inflation).

However, since we are concerned about how much in excess of the BRS and FRS that we can take out if we want to, which BRS and FRS should we take note of?

You take note of the BRS, FRS when you turn 55 years old.

For example, you are 53 years old in 2018 when you learn about this stuff. The BRS and FRS limit that you should zoom in on is the 2020 limit, which is $90,500 and $181,000 respectively.

So suppose you have accumulated $300,000 in your CPF OA and SA. At 55 years old, $181,000 will be automatically transferred from your SA and OA to your CPF RA.

The rest of the $119,000 will stay in your CPF OA and SA and you can treat that like a high-yield savings account and withdraw as you like. (A caveat: things are not so beautiful, but for understanding sake, just go with this flow.)

Okay, why is there a BRS limit and a FRS limit? Property Charge/Pledge

For those of you with a residential property, CPF allows you to pledge your property.

By doing so, you only need to set aside an amount equivalent to the BRS limit, instead of the FRS limit, in your CPF RA to fund your retirement income.

The main reasoning is that you need a place to stay that is secured in your retirement. A secured dwelling can exist in 2 ways:

- You have a fully paid up residential property with a land lease long enough that last you till at least 95 years old.

- You have a secured rental income.

If you pledge your property, it is as if you have satisfied #1 and the government is more comfortable that you only have half the FRS for retirement income.

If you do not, then you need at least the FRS.

If you have a residential property, it means that you could potentially get out more money as flexible cash after 55 years old.

Going back to the same example, if you have $300,000 in your CPF OA and SA, and you decide to pledge your property, you will only need to set aside $90,500 to be transferred to your CPF RA and you can readily withdraw the remaining $209,500. (Caveat again: this is not the full picture and I will explain in greater detail later)

However, if you want a stronger income you can still set aside an amount equivalent to the FRS or even ERS.

What if your CPF monies are less than the BRS Limit?

If you have an amount that is less than the BRS Limit, the government allows you an unconditional withdrawal of MAX(20% of your retirement savings, $5,000), either from 55 or 65 years old.

This means you can withdraw a range of $5,000 to 20% of your retirement savings.

Can You Charge/Pledge Your Property and Withdraw from Your CPF RA after Your Monies have Transferred to Your CPF RA?

Some of you only realize this after 55 years old where the equivalent of the full retirement sum has been transferred to your CPF RA.

Can you charge/pledge your property after that and get out some money from your CPF RA?

The short answer is yes you can.

You can pledge your property and you can get money out but the amount will depend on some conditions (which I will explain later).

CPF Treats Each $1 of Your Monies in Your CPF SA and RA Differently

Okay, remember that I explain that you can withdraw the money above your BRS, FRS limit as cash if you would like to after 55-years-old?

There are conditions.

How much can be withdrawn depends on the source of your money in your CPF SA and RA.

The amount of money that qualifies towards your BRS limit is also different.

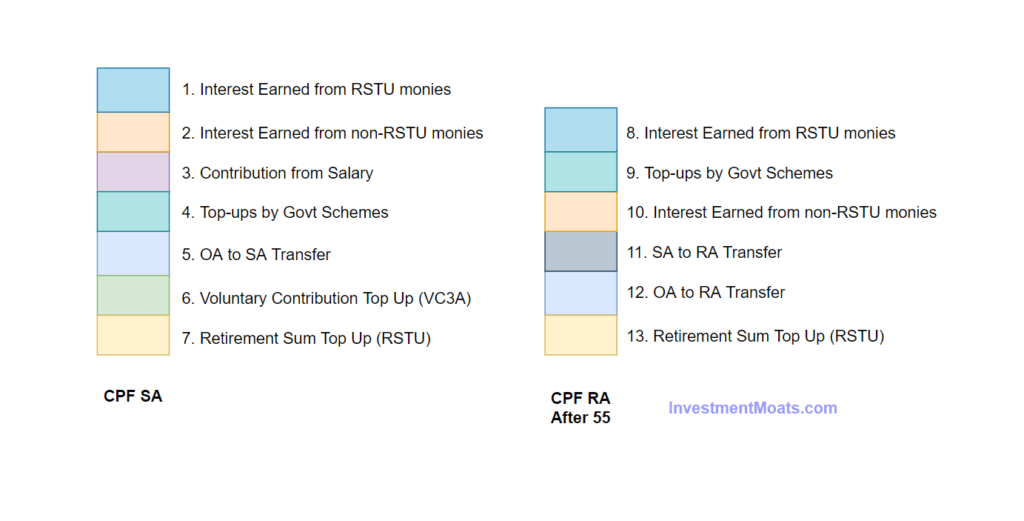

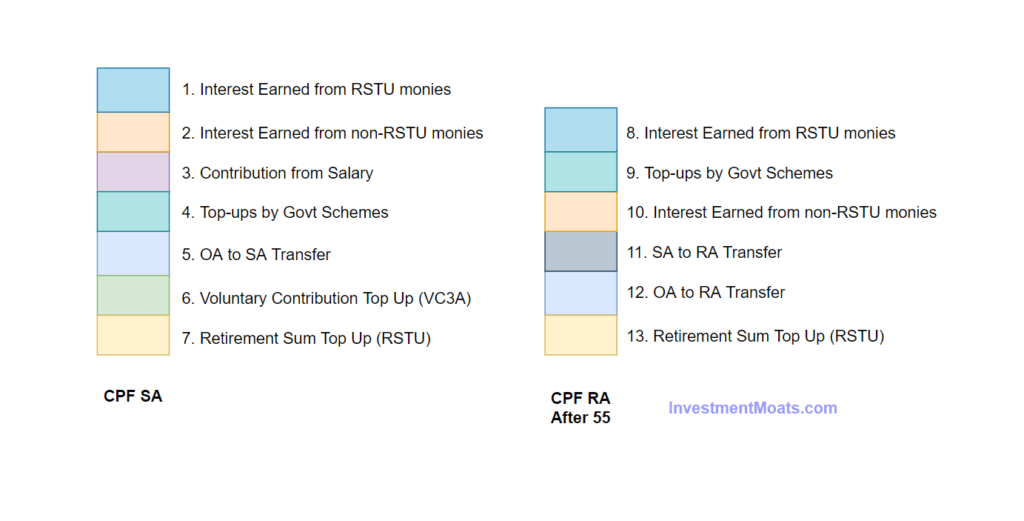

Here is a way that you can visualize your CPF SA and RA:

Basically, each dollar in your CPF SA and RA is viewed differently by CPF. You can assume that CPF knows the source of each dollar.

You can imagine the money from each source as a bucket and in each of CPF SA and RA, there are different buckets.

In the illustration above, I tried to list down all the different sources that could eventually contribute to your CPF SA and RA.

- Some of these sources can be taken out if you fulfil the BRS and FRS limit some cannot.

- Some of these sources qualify as evaluation for BRS and FRS limit, some do not.

For the newer folks, let me explicitly state some rules of thumb to make understanding this CPF SA and RA stuff easier:

- Not all top-up is the same. There is retirement sum top-up (RSTU), Medisave top-up and voluntary contribution top-up (VC3A). They are different. RSTU and Medisave top-up allow you to gain tax relief, while VC3A do not.

- Interest earned is not the same. Interest earned from RSTU monies and non-RSTU monies is treated differently for some stuff.

There will be some more rules of thumb dropped later.

Now let us go through the bigger ones.

You Cannot Withdraw RSTU Monies

Retirement sum top-up allows you to gain tax relief but the main objective is to really set aside more for your retirement.

For this reason, CPF does not allow you to withdraw RSTU Monies.

Thus, #7 and #13 can never be taken out unless through CPF LIFE Income.

Technically, #7 can still come out if the amount of RSTU monies before age 55 is more than the FRS at that time of assessment.

But no matter how I look at it, that seldom happens.

Think of it as go in won’t come out anymore.

You Cannot Withdraw Interest Earned from RSTU monies in CPF RA

The interest earned on your RSTU monies that reside in your CPF RA cannot be withdrawn, even if you pledge/charge your properties.

So this affects #8.

This is when you start noticing that if you top-up to FRS early in your CPF SA, technically you can withdraw the interest earned on your RSTU monies (#1)

Interest is handled very differently!

All Sources are Used to Evaluate Your FRS Limit Requirement

Whichever source, they are used to determine if you have hit your FRS limit.

For example, if you have all six different sources in your CPF SA and they are equal to your FRS, you fulfilled your FRS limit and can consider how much excess you can withdraw.

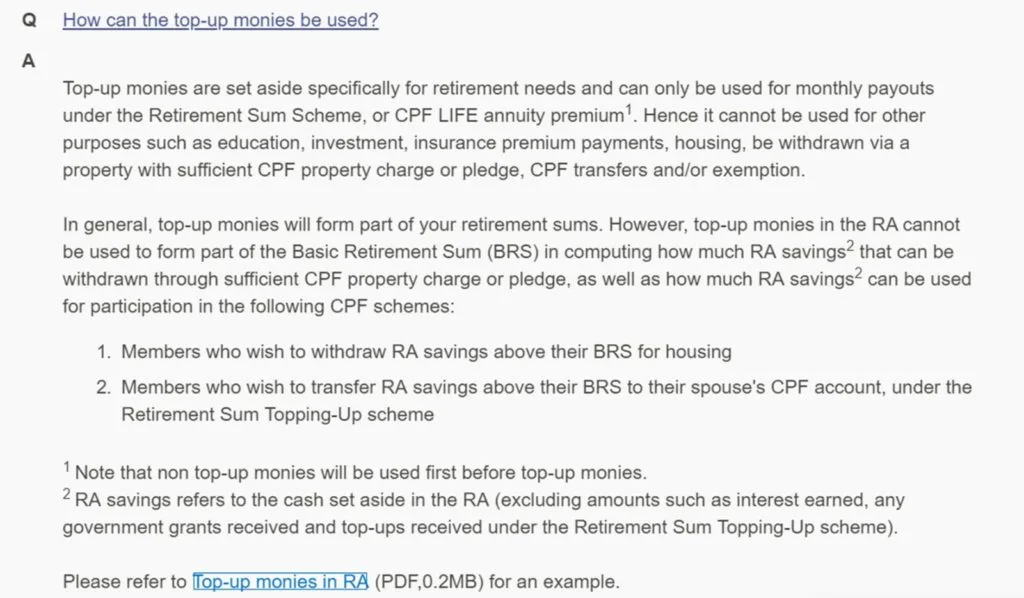

RSTU Monies are Not Used to Evaluate Your BRS Limit Requirement

RSTU monies are not used to evaluate if you fulfil your BRS limit, despite property pledge/charge.

So in my diagram, only #1 to #6 are used to evaluate the BRS limit when your money is in CPF SA and #8 to #12 are used to evaluate the BRS limit when your money is in CPF RA.

Here is the extract from CPF:

If we understand this, and the part where RSTU monies cannot be withdrawn, we can understand this example better:

I adapted this case study from CPF in a 10 Important Aspects About Your CPF Retirement Account (RA) on Providend’s Portal.

The case study tried to explain how much John and Steven was able to withdraw from their CPF RA if they decide to pledge their property.

But some struggled to understand why Steven cannot withdraw anything.

The main reason is that Steven’s RSTU monies ($100,000) are not used to evaluate if he satisfies the BRS limit of $90,500.

Only $28,000 is used, which is less than $90,500. Therefore, Steven cannot withdraw any.

It is not quite feasible to top-up via RSTU, charge property and has the option of extracting half of the FRS in the future.

Some of you might wish to give your family some flexibility by charging a property, then getting out half of FRS when you turn 55 and gaining tax relief by doing retirement sum top-up.

I think this is not feasible simply because the money they contribute under RSTU is not used to evaluate their BRS limit.

Suppose the FRS is $181,000 and the BRS is $90,500.

If they RSTU $90,500, this money won’t be used to evaluate whether you fulfilled the BRS limit.

This means to get out money, you need to set aside another $90,500 that is non-RSTU monies.

So that would mean $181,000 cannot be withdrawn after 55 years old.

It feels to me that if you have the ability to top-up (means you are financially quite flexible), you might still need to set aside $181,000 or the full retirement sum.

Can You Surgically Extract Certain CPF OA and SA Monies, In a Certain Sequence that You Desire?

Okay, some of you might be wondering that, if CPF viewed the source of these CPF SA, RA and OA funds differently, is there a way for us to surgically extract certain types of monies out the way we want?

The answer is no.

I tried to frame your CPF monies in this way so that it is easier for you to visualize.

You can withdraw your money out from your CPF OA and SA after 55 like a normal FAST transfer.

But you have no control over the sequence.

When you wanna withdraw, CPF views the OA and SA together. They have a certain withdrawal sequence for the funds in your accounts that goes like this:

- Your CPF SA interest

- Your CPF OA interest

- Your CPF SA capital

- Your CPF OA capital

Basically, they empty out the interest then the capital, and the higher-yielding monies first.

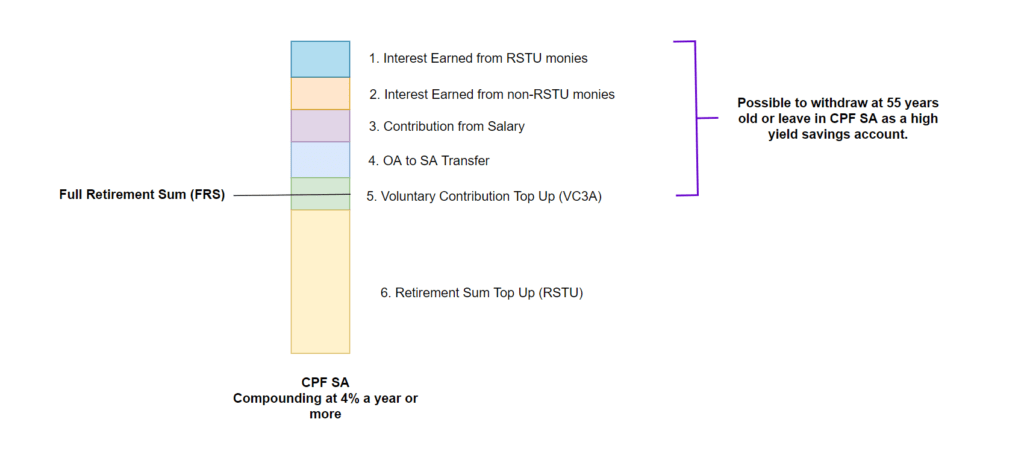

Why do so many people do Retirement Sum Top-up as early as they can?

A newbie would be wondering why there are enough people who would proactively do RSTU until they hit the full retirement sum as early as they can.

This is the model:

- There is no cap on how much your CPF SA can grow above the FRS limit. This is unlike the Medisave, which have a cap.

- The interest rate that we can earn on CPF SA is relatively high and your money does not suffer from any volatility.

- You can eventually have a high-yield savings account after 55 years old if you hit your FRS.

If someone does an RSTU top up such that they hit the FRS limit fast, their income from work, income from side job that they VC3A into, interest earned can eventually stack on top of the RSTU monies.

The appeal is to compound at 4% a year.

Conclusion

If you managed to have excess monies above the FRS or BRS (if you charge/pledge your properties), you can potentially withdraw them out after 55 years old.

How much you can withdraw will depend on the make-up of your CPF SA and RA. RSTU monies, interest earned on RSTU monies in CPF RA cannot be withdrawn. Interest earned on RSTU monies in CPF SA is available.

RSTU monies cannot be used in BRS limit evaluation. Interest earned by RSTU monies can.

Hope this is useful.

I would like to thank my boss Christopher Tan and Lena Teng from MoneyOwl for some fact-checking.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

save4arainyday88

Monday 3rd of January 2022

Hi Kyith,

Many thanks for the write-up, this is especially useful for readers who make voluntary top-ups and for our CPF planning purposes :)

May I also seek your advice if it's a general rule of thumb that any excess amounts above the FRS (at the year of assessment for the retiree) can be withdrawn, or whether you are aware of any further specifics that CPF members should take note of limiting withdrawals of such amounts?

Wishing you and all readers a Happy New Year and Huat ah!!!

Kyith

Monday 3rd of January 2022

Hi save4arainyday88, when your money is still at CPF SA, you can use that general rule that any amount above FRS can be withdrawn. When your money crosses to CPF RA, that is not valid anymore. So then RSTU money and its RSTU interest cannot be taken out.

CK

Sunday 2nd of January 2022

Hi Kyith... How about money from housing loan refund? Are we able to withdraw then assuming we have exceeded FRS in OA + SA at 55yo.

Kyith

Monday 3rd of January 2022

Hi CK, if i am right refund money goes to CPF OA and that seldom is in this equations.

Eddy

Thursday 30th of December 2021

#1 RSTU interest cannot be withdraw

https://i.postimg.cc/Z52PhNYx/Xnip2021-12-29-12-10-45.png

Kyith

Thursday 30th of December 2021

If the interest is in your CPF SA and you have met the full retirement sum and the RSTU interest is above that, i think you can withdraw. this is from the discussion with the sources that i have.

FC

Wednesday 29th of December 2021

Kyith, once again, another amazing article to make something as complex as cpf sounds relatively easier to digest.

one question: wrt to the john/steven i.e. The main reason is that Steven’s RSTU monies ($100,000) are not used to evaluate if he satisfies the BRS limit of $90,500. Only $28,000 is used, which is less than $90,500. Therefore, Steven cannot withdraw any.

how about Steven's RSTU interest earned over the years? can this be withdrawn? will it depend on his age?

this will mean, before steven 55 yo, this #1 will be #7 (The interest earned on your RSTU monies that reside in your CPF RA cannot be withdrawn, even if you pledge/charge your properties.)?

another one: This is when you start noticing that if you top-up to FRS early in your CPF SA, technically you can withdraw the interest earned on your RSTU monies (#1)

can you elaborate on how to withdraw the interest?

FC

Thursday 30th of December 2021

@Sinkie, when u say withdraw, does that mean in cash? i didnt realise you can withdraw the accum interest at all. this is interesting.

Sinkie

Wednesday 29th of December 2021

Retirees with substantial balances in *both* OA and SA often go to CPF branch in early Dec to withdraw their ytd (Jan-Nov) accumulated interest (both OA and SA), if they don't want to run-down their SA balance.

If your balance is all in SA (perhaps due to using CPF-SA shielding hack), then you can wait till early Jan to withdraw the earned full-year SA interest.

Kyith

Wednesday 29th of December 2021

if its #1, which is before or at 55 years old the RSTU interest above FRS can take out.

I think don't look at it that you can specifically withdraw that interest. You cannot control it. CPF has a sequence that they will withdraw CPF SA interest follow by CPF OA interest, follow by CPF SA money, follow by CPF OA money. All these stuff i explain is for those who wish to do nitty gritty planning.

retirewithfi

Wednesday 29th of December 2021

Just to illustrate how complicated the whole scheme is, the second milestone for shifting monies to RA doesn't occur at 65 anymore for the cohort turning 65 from 2023 onwards, it now happens at the payout start age (which may be deferred till 70) and this recent change happened this year, source: https://www.cpf.gov.sg/member/infohub/news/cpf-related-announcements/cpf-amendment-bill-highlights-2021

Kyith

Wednesday 29th of December 2021

thanks retirewithfi, i thought its this way, but when i read it for the first time round, i didn't think this way. let me change it.