Manulife US REIT this morning provided their third quarter operational update. During operation updates, not many actual financial figures are provided.

The long-term shareholders who bought at much higher prices would be more concerned about whether management can successfully do something about their debt situation so that operations can return to normal.

The newer shareholders may smell value and wonder if there is a catalyst in sight that would mark Manulife US REIT as a turnaround play.

For some context, the US Office REIT breached the lenders’ financial covenant in some loan agreements, where the ratio of consolidated total unencumbered debt to consolidated total unencumbered assets should not be more than 60 per cent.

As such, the dividend distributions have to be halted.

The REIT’s current unencumbered gearing ratio stands at 59.9%. To compound their problems, the higher interest environment increases the expenses on REITs and also the hurdle rate, causing REITs in general to be valued lower.

This is a challenging situation, but more on that later.

The US Office Leasing Situation is Still Lacklustre.

Manulife’s occupancy fell from 88% in the same period last year to 84.7% this quarter.

This number is the occupancy if we consider the signed lease, but what may be more important is whether the physical occupancy has recovered.

While the office occupancy in New York City is around 50%, the physical occupancy of the properties belonging to Manulife is approximately 30-40%.

They have a long way to go before things recover.

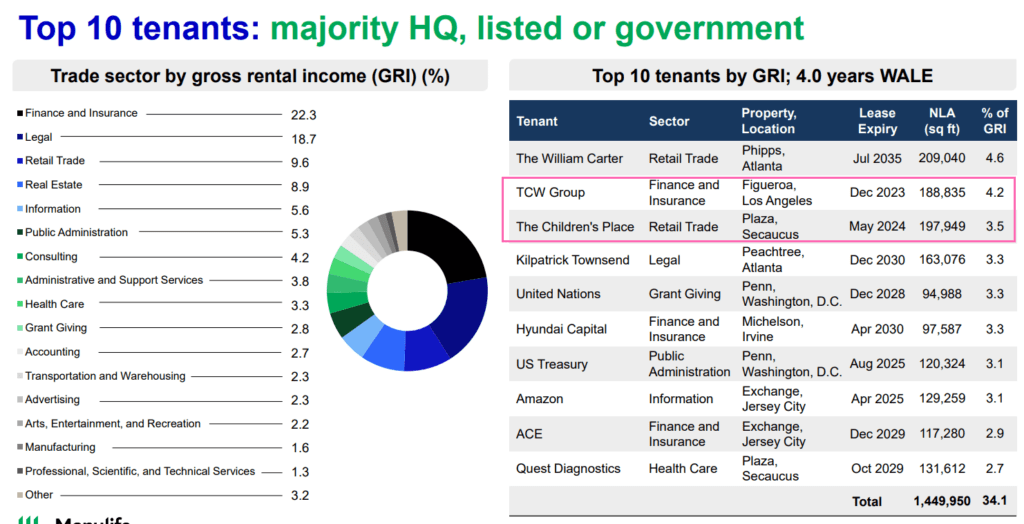

Two of Manulife US REIT’s major tenants in TCW Group and The Children’s Place, have indicated they will not be renewing the lease and breaking the leases. The REIT will have to try and re-lease the spaces actively.

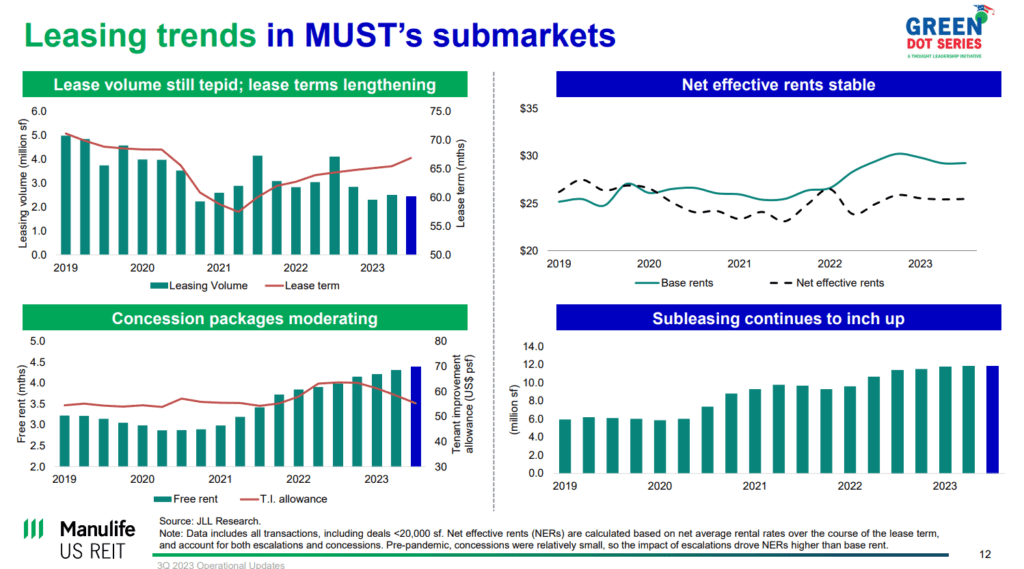

Manulife commissioned an analysis specifically about their sub-market, and the study shows that leasing volume in their submarket continues to be tepid. While the tenant incentives have declined, the landlords are giving more free rent periods.

The bottom right section shows that subleasing activity continues to go up. The subleasing movement shows us that the tenants are trying to sub-let more of their space out, which indicates the demand for actual physical space.

Manulife decided to IPO with properties that are different from Keppel Pacific Oak in that the tenant base are the more traditional, stable industries.

In normal circumstances, this tenant mix will provide stability. COVID caused a secular shift in the demand and supply for office space, and the location and tenant mix were the most disadvantageous.

How I Think Manulife US REIT Could Turn Around

Currently, a representative at the parent level has taken over the negotiation of the debt restructuring with the various banks. The objective is to work out a way to allow the REIT to continue and operate so that the lenders can also be paid. How the deal will eventually be structured is out of management’s hands and they would have to wait on the result of the negotiation of the debt restructuring.

With loans of different tenors and terms, it will likely not be a simple process. And most likely, the term of the loan is not going to be easy for the REIT.

As I listen to the Q3 operation update, I cannot help but wonder how all these would turn around.

I invested long enough to see how poorly managed REITs or business trusts turn around.

We need a combination of:

- A period of pain where the valuation of the trust corrects dramatically until some big players become attracted to the entity to take a chance with it.

- Change in management.

- Capital injections that are very dilutive to existing shareholders.

- Refinancing.

- Purchase of new assets to stabilize the business.

- Improvement in the operating environment.

This is how Manulife US REIT can recover, but likely, existing shareholders who have invested since $1 days would find it challenging to make back their capital.

This is the same for the Allco REIT, MacArthurCook REIT, and FSL Shipping Trust. They all became value propositions after #1 to #6 happened.

Existing shareholders exited in great disappointment, giving way to new investors sniffing around for special situation value play.

One of the oddest things about the situation with Manulife US REIT was the time it took for the parent to help the REIT. Much hunch is that this is a combination of a few factors:

- The parents are more familiar with how REIT operates in the US and less about how Singapore REIT works. The US REITs are predominately internally managed and it is odd that a REIT manager would ask for an external entity for help.

- The US-listed REIT usually pay out a smaller portion of their free cash flow as a dividend, retaining the rest for asset enhancement or some form of capex. Therefore, the sponsors may wonder why can’t the REIT solve its own issue.

- They might think the situation will improve on its own with time. The situation dramatically changed now that the loan covenants are breached, and they have to step in and do something.

If Manulife US REIT and the parent are more decisive as a collective, the effect might not be so significant.

Given where the REIT is currently traded, there would be more prominent investors interested in taking a significant stake in the REIT. There would also be more interested parties willing to purchase some of the office buildings at the right price.

The problem for a REIT is that seeking shareholders’ permission to sell or purchase (calling an EGM) will hinder the REIT’s ability to unlock some of the value on its balance sheet.

That is likely not the only challenge.

For US REITs listed in Singapore, there could be an additional tax minefield to navigate through. All these considerations to put the REIT on a better footing will have to be done in a way that does not affect their tax status. To maintain that tax status, each shareholder has to be limited to less than 10% share of the REIT will definitely affect what levers they can pull or in this case cannot pull.

They can call for a dilutive rights issue, but the parent cannot sweep it up.

They need suitors who can form a consortium of different shareholder entities to commit to capital injection so that the not more than 10% rule will not be violated.

I think what we can do right now is to wait until after the debt is restructured before further discussion. Interest rate falling and improving physical occupancy will help a lot.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Thinknotleft

Sunday 5th of November 2023

Hi, KORE latest slides show its capex proportion close to double of Prime and MUST; ie it spends much more in maintaining its offices than other 2 listed us office reits.

Hence, are MUST offices under-maintained or less attractive compared to its peers? If so, this is another negative factor to consider.

Kyith

Monday 6th of November 2023

Well we will see if the revaluation comes along if it matters. Thanks for the point Thinknotleft

tan

Sunday 5th of November 2023

Hi Kyith,

I enjoy reading all your wonderful write ups and learning alot from investment guru like you. I just went through your portfolio and am truly impressed with your investment prowess.

I have the following queries and hope you can enlighten me.

1. Your portfolio of stock is extremely large and I wonder how you monitor each individual stock

2. Am I right to assume that you started your investment journey around 2004 and managed to successfully accumulate a portfolio value in excess of $ 1.0 million over twenty years?

3. Based on linear projection, you would be increasing your portfolio by $50K annually

4. What is your average annual ROE you are hitting?

Looking forward to hearing from you. Have a great weekend ahead

Kyith

Monday 6th of November 2023

My XIRR over 2004 till now is 5%. Capital injection usually about $24,000 a year until perhaps 2021 when i stop injecting. Still have $15,000 SRS money if i need to.

My portfolio looks like a lot of items, but if you observe closely, you realize... there isn't a lot of position.