There is a ship in trouble and everyone seem to be talking about it.

The Edge Magazine ran an article titled Eagle Hospitality Trust could get wings clipped as key asset The Queen Mary sinks into disrepair.

Basically, Eagle Hospitality Trust (EHT) a REIT with full-service hotel assets in the United States owned a ship called The Queen Mary. It is an old ship. If you multiply Kyith’s age by 2 and it will still be older than Kyith.

Anyway, the ship is moored in the harbor and tourists, locals can stay in the 347 rooms and have fun there.

The Queen Mary Long Beach was acquired in Apr 2016 by Urban Commons and this year sold into Eagle Hospitality Trust.

There are 347 rooms, 1600 parking lots, 80,000 sq ft of meeting room spaces.

Owning the ship is one thing, but another aspect is the land surrounding where the ship is anchored.

The City of Long Beach holds the land title and lease it to Eagle Hospitality Trust (EHT) for 66 years. This land has the potential to be developed or subleased for other purposes.

Urban Commons (UC), EHT’s sponsors, lease the ship and the areas around, from EHT as a master lease (officially Urban Commons Queensway LLC).

The master leased tenure is 20 years + 14 years. The ship is moored at an X flood zone area which means there is minimal to moderate chance of flooding in this region.

The majority of the rent is fixed, with escalation, plus a variable component computed as 8% of the Gross Operating Profit.

The Queen Mary is a significant contributor to EHT’s bottom line and net asset value.

Unlike the rest of the hotels in the trust, Queen Mary is operated independently and the operator is Evolution Hospitality, a subsidiary of Ambridge (which operates the other EHT hotels)

In Nov 2016, Urban Commons and the City of Long Beach started a large scale improvement plan addressing both structural items at the property as well as repositioning and reopening unused public and revenue-generating spaces. This includes meeting spaces, restaurants, and attraction venues.

A total of US$23.5 mil is spent by Urban Common before the IPO. This was matched by US$23 mil spent by the City of Long Beach.

The money is spent repurposing of unutilized public spaces and structural works.

There was disruption during this period to both business and therefore, revenue. However, as work slowly competes, the revenue and profit margin slowly got better.

EHT’s purchase consideration was US$ 139.7 mil. The valuation is US$159.4 mil. (looks like we got a steal there, or….)

What is the Fuss About?

In the Edge Article, the City of Long Beach’s economic development director John Keisler said the operator (Urban Common) may lose its 66-year lease agreement if it fails to meet its obligations.

Since 2016, both the City of Long Beach and Urban Commons have sunk money into repairing it. However, inspection done by Independent inspector Edward Pribonic has shown that the condition of the ship is getting worse.

The article also states the following:

Three years ago, Urban Commons is reported to have taken on the lease despite a marine survey that unveiled that the ship’s deteriorating condition was “approaching the point of no return”.

According to that report, the total cost of ship repairs could range from US$235 million ($320 million) to US$289 million. In addition, it estimated that the work would take approximately five years to complete, with some 75% of repairs deemed “urgent”.

Keisler keep sending a letter to Urban Commons’ CEO but he had yet to respond.

Now if EHT loses this 66-year lease, it will effectively means US$159 million (the Queen Mary’s valuation) goes up in smoke.

Thus there is volatility in the share price.

How Should We Look at This

This is a tough cookie and in investing, we have to make decisions like these (so it makes you wonder how passive this income is).

The thing we need to ascertain is whether this is a long term problem or not. My take is, I don’t think it is.

But I cannot be totally sure, like most of the things I come across.

The first thing I think about is just write off the whole ship and see whether the valuation is attractive.

How the Financials if we Take Out Queen Mary

In the 2nd quarter result, EHT’s distributable income records about 36 days of operation. If we annualized it, we get around US$56.7 mil. Queen Mary is forecasted to contribute US$12.5 mil in rental income for FY2020.

This works out to be US$44.2 mil.

With 868 mil outstanding shares, the dividend per unit after excluding Queen Mary would be about 5.1 cents. The dividend yield based on the last share price of US$0.545 is 9.3%.

Hospitality properties tend to have more volatile rental earnings because a large part tends to be based on revenue. Thus, they should command a higher yield for margin of safety. Perhaps 7-8%.

Given the overseas property and difference in currency, we can add 1% to it.

Thus 9.3% in dividend yield looks fair.

The other aspect is the net asset value.

EHT has a total asset of US$1353 mil and total liabilities of US$579 mil. Out of this liability, US$497 mil is debt. Cash comes up to US$67 mil. The investment property comes up to US$1200 mil

Queen Mary is last valued at US$159 mil.

The debt to asset of the whole trust is 48%. If we take out the cash then it’s 46%. If I don’t take all the liabilities but only interest-bearing debt, the debt to asset is 41.6%. From what I can see, Queen Mary was not used as a collateral to secure any of EHT’s loan.

But from the prospectus, there should be loan covenant should the trust breach certain debt to asset ratios. This will eat into the dividend. There is also the need for a REIT to try their best not to be overly leveraged.

The revised NAV is US$0.70. Thus EHT is currently trading at a 22% discount to this NAV.

Based on this, it is a bet whether someone is making a mountain out of a molehill.

Urban Common may have Realize this is Bigger Than

What they originally anticipated. Keisler explained more about the situation in an Oct 10 article.

Keisler said Urban Commons has pushed back the timeline as it works to navigate the complicated regulatory process, but the company has been clear that it intends to move forward with the project.

“One of the challenges in the short term is they’ve realized how complicated and expensive the ship is and how complicated the development environment is,” he said. “But they’re indicating that they’re still all in, and now they’re looking at how they can make it work.”

Sometimes I feel that folks like Keisler are trying to put this in the news so that Urban Commons can expedite things. I wonder how this would look on his resume if this whole thing fails on his watch. It is as if he is trying to show his guys or the people that “Hey, look! At least I am trying to do something to expedite the thing!”

After the update yesterday evening (28th Oct), I am still very confused about what is Mr. Keisler trying to do. Is it because Urban Commons is not doing a good job keeping up with the repair timeline or they have a change of heart and Mr. Keisler would like some public pressure to keep them obligated to go through with this.

Responsibilities of EHT and Urban Commons

How much contingent liabilities could EHT suffer from?

Here are some information on termination of agreement gathered from the EHT IPO Prospectus:

Termination Events

The master lessor and lessee can both terminate the agreement, in the event of the following:

- material damage to the premises or

- the whole or part(s) of the premises is condemned by any public or quasi-public authority, or private corporation or individual, having the power of condemnation so as to make it impracticable or unreasonable in the Master Lessee’s reasonable opinion to use the remaining portion as a hotel of the type and class immediately preceding such compulsory acquisition

EHT, the master lessor can terminate in the following conditions:

- EHT sells and assigns its interest of the premises and pays the master lessee a termination fee equal to the fair value of Master Lessee’s remaining term

- In the event of default of rent

- In Queen Mary case, termination of the ground lease

It feels to me, that UC can terminate this master lease agreement if the City of Long Beach condemns them.

The question is after that, the ship is returned to EHT. Is EHT liable for anything else (such as their commitment to repair the Queen Mary)?

This is an area that shareholders can seek clarification from management.

Update on 28th October: Eagle Hospitality Trust provided some answers to the queries by SGX. In the answers, EHT updated that should Urban Commons break the master lease, the amount of repair that EHT is liable for contractually is US$7 million.

That is a pretty manageable sum.

Someone at Valuebuddies also posted an update from Kiesler to the Acting City Manager of Long Beach on the progress of Queen Mary projects and Long Beach Cruise Terminal Domes. This was sent in September 2019. You can read it here.

It contains much information about the background of these repairs, what was completed, what is in progress and how much it cost.

The total projects that were completed and are in progress is valued near US$23 million.

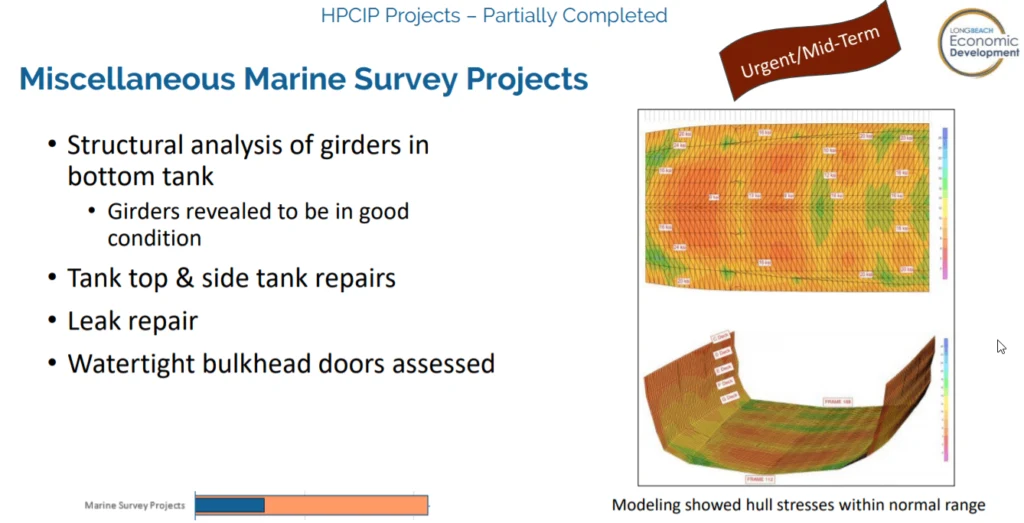

In the above section, we can see what the inspector has identified as critical and have asked the lessee (Urban Commons) to start scoping. It comes up to US$7 million.

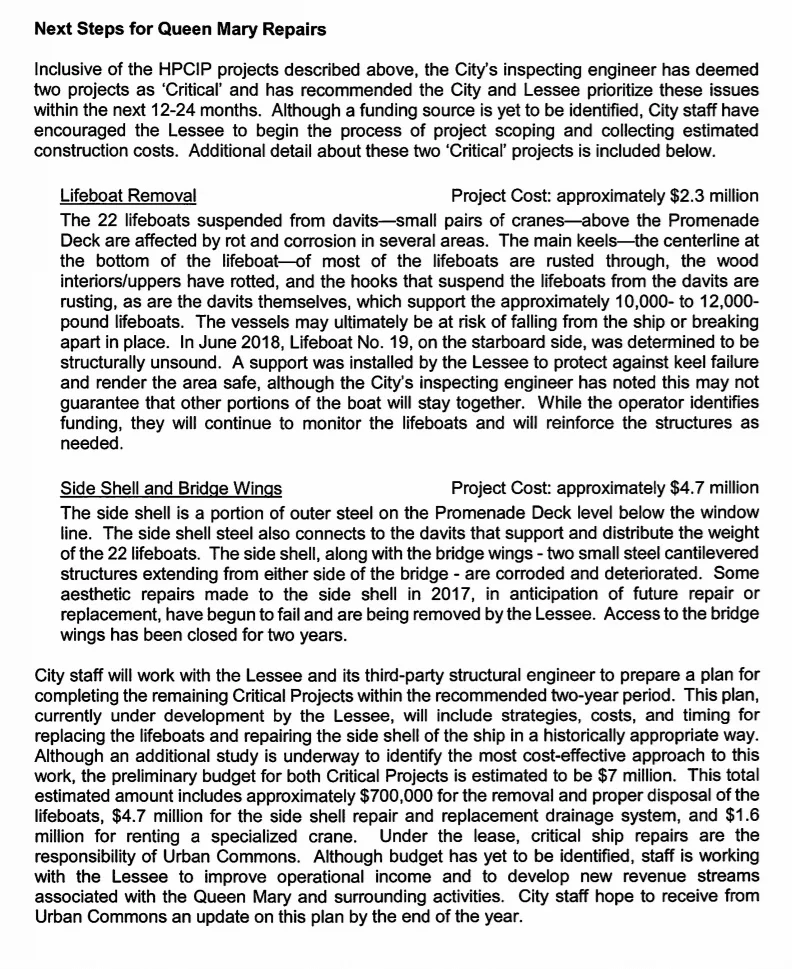

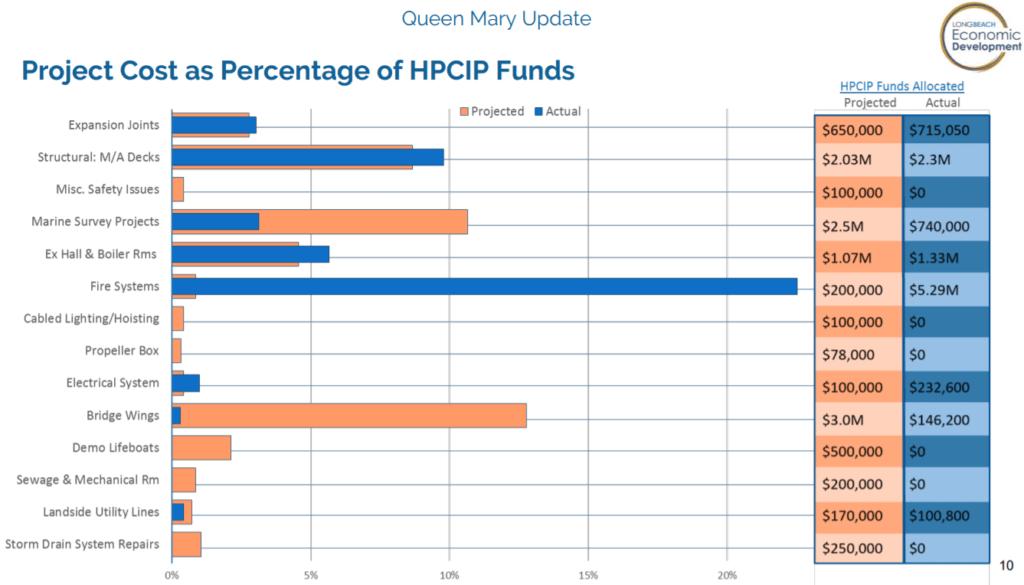

In the 2 slides above, we are able to see the projected cost of the individual projects and the actual cost.

Looking at this brings back some haunting memories of my old engineering life. We can see there is a fair bit of cost overrun. This would probably be what Mr. Keisler mentioned as a more challenging task than anticipated.

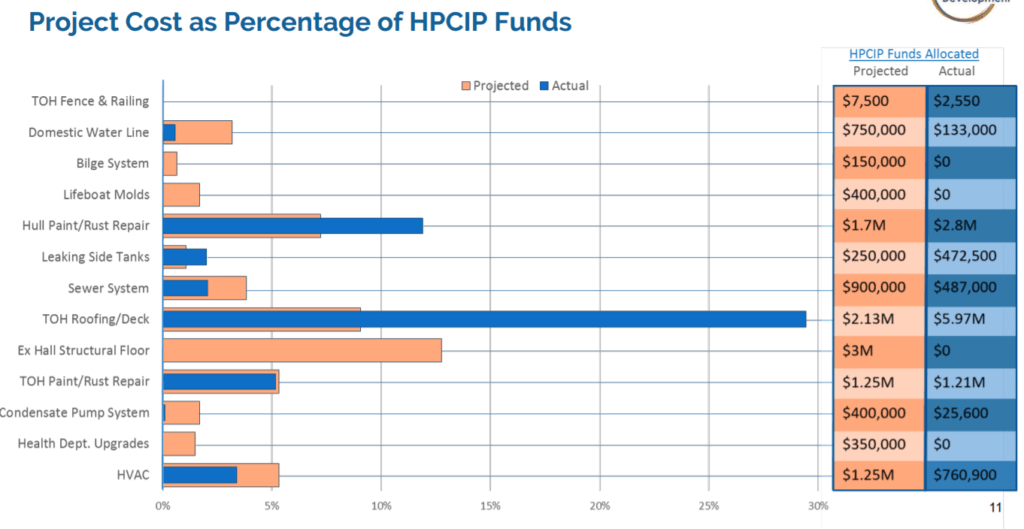

I am no expert but based on this, it looks like this is work in progress in an effort to ensure the ship does not sink. While there are many red areas, I guess this is what the repair is supposed to achieve.

Here are some of my conclusions:

- The CAPEX required is not to get the ship into sailing state. Rather it is to ensure that the whole thing is safe

- There is a lot of work to be done

- Majority of the work is work-in-progress or completed

- There are some cost overruns

- These should be funded by the existing CAPEX of US$23 mil. Not sure who will bear the cost overrun. Based on my project management experience, costs should be shared by the vendor and the client. In this case the City of Long Beach and Urban Commons

- Urban Commons have just received money from the IPO of EHT. They should still have funding for this

- Based on the agreed work-to-be-done it does not seem like it will come up to US$200 mil.

How Eagle Hospitality Trust Could Recover or Die

In investing is not just about looking at things in a dualistic manner. It is thinking through what are the outcomes and how we can benefit or risk manage our position.

So here is how I look at things.

I think the repair job keeps progressing it should be OK. I am not certain Queen Mary is going to be a good experience. If you read the next section, I wonder if Evolution Hospitality, a subsidiary of Aimbridge, the operator of the hotels are the kind of folks you want to provide good customer experience.

The one who appointed them should be the sponsors. At this moment, these issues would result in investors giving the management negative points. And management is one of the key factors in assessing whether a REIT is quality or not (along with the future business, economic outlook of the area of operation and valuation)

I lean towards that EHT is not a good long term hold there.

Next, we think about the short term. How would this play out?

If the Queen Mary defaults, and EHT loses the 66-year land lease, then we can write off that part of the value and rental income.

Share price might spiral when there is dilution without accretive acquisition.

Even without the contingent liability, EHT is also very close to the 45% gearing limit. To be more sound, they might need to call for a rights issue to deleverage. That would kill the share price as well.

In this scenario, management would not be seen in a good light. It will be challenging to get any form of share price support.

The above scenario at this point seems unlikely to me.

The opposite is the share price will stage a recovery. But to what level? This will depend.

EHT’s share price is at a stage where people are asking a lot of questions about it and they are not giving good answers. Without strong support from investors share price will continue to languish.

Over the long term, even if this issue is behind us, the hotels in EHT would have to show some great results. This is to give investors confidence this is not a scam REIT or someone dumping assets into it.

Good results leads to share price recovery. This would make acquisitions easier. This is a favorable scenario.

So How is the Actual Condition of Queen Mary?

I have no idea. The air ticket to America is a bit pricey plus I do not have much leave days.

But if you are interested, take a look at TripAdvisor and see what the visitors say.

Here are some interesting ones:

I was a little bit anxious about staying on the ship. I’d heard reports that it had been ruined a bit and lost some of it’s character but that’s not the case at all. You actually feel like you have stepped back in time as you walk on board.

Sep 19

Sir Winston’s Restaurant is very good and the bar is adequate and there is plenty to see on the ship in the way of history. I didn’t take a guided tour but the ones I happened upon seemed very informative.

The bed was super comfortable but the room was not very soundproof. We endured the ecstasy of a couple in the next room for the best part of a minute. We almost applauded.

I think you could describe the stay as an experience rather than out and out comfort but we did enjoy the stay.

The Queen Mary was a beautiful ship, especially the elegant wood used everywhere. A gorgeous piece of history has descended to chairs with holes, duct taped floors, dirty carpeting. I only hope that future plans for this stunningly appealing ‘idea’ (who doesn’t like the ‘idea’ of visiting wonderfully restored parts of history?), are to completely refurbish the entire place. That would be a great thing!

Oct 19

Great experience! – Check in very smooth. We stayed in an outer stateside room and what you would expect from the time very traditional fittings and decor. Room spacious and quirky. The ship itself steeped in history. Observation deck great for a drink. We ate in Winston Churchill restaurant and couldn’t have been treated better. Beef Wellington was amazing. Celebrated wedding anniversary and they brought cake, chocolate strawberries and decorated chocolate which was a lovely surprise. Check out was seamless.

– Oct 2019

No hot water and staff lied to me about it – At check-in I inquired about upgrading to a harbor view room. I was told I could for $20 a day. I gladly paid the $20 and upon arriving to my room discovered that there was no hot water. I went back to the front desk to ask about this and was told all cabins in my section had no hot water and that they’ve been working on it all day. The next morning on before checking out we left our room and overheard an employee asking on the radio when they are going to start fixing the water because people have been asking him. So it turns out they never had anyone working on it and lied to me at the front desk when I went back to inquire about it. On top of that the front desk agent failed to even mention to me there was no hot water if I upgrade and just allowed me to upgrade to presumably boost her numbers. This is insanely bad customer service and I would urge everyone to not stay here.

The no hot water can be excused because it’s an old ship and stuff happens. What bothers me is that the lady at the front desk never once thought to tell me that there was no hot water if I upgrade and pay more and also lie to me about it being fixed.

Oct 19

I will say first that if you want to experience staying on the ship you should. But we found the bed was super small and the walls were super thin. The room was clean, but the shower was too short, which I feel like is more the era but worth knowing. We also got so many hidden fees it wound up costing quite a bit more than the original quote. It was unique and the ship itself is very beautiful and full of so much interesting history.

Oct 19

The general feeling you get is that this ain’t the best functioning hotel, this ain’t the best experience when it comes to hotel stay and people tend to really like visiting it and staying there.

Ok that is enough blabbering about this ship.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Rick

Monday 4th of November 2019

So the story looks like this (my theory): the Yuans sold 6 hotels at double the price to EHT (from 1xxm to 2xxm), but EHT " forced" them to subscribe the IPO for 2xxm. Effectively Yuans get paid in EHT shares for the 6 hotels. EHT didn' t really pay anything, but get a high " book" value so can artificailly inflate the IPO price.

No wonder Yuans are selling like no tomorrow: whatever cash they can get from the shares, are the actual cash proceeds for their hotels. So their floor is 50%, 39c. Yuans are not the sponsor neither the manager, they have no interest in the reit. They just want to get the cash. The pice collapse not his problem. Anything above 40c doable.

For the REIT price, valuation at 50% price to " book" start to look correct since book is inflated. Give it another 20% discount for weak sponsor (hotel reit dun get 100% price to book, 80% to 90% only). Looks like the fair price floor is reaching. (Shame to Colliers and HVS who " value" them at whatever price UC asked)

Guys, relax, it' s quite fun to watch this. I' m vested at 55c for quite a big size and I' m not worried. The hotels are real, revenues are real, and we are not far from fair value. At 50c I will add some more.

(btw I read somewhere the other 12 hotels Yuans " advise" UC at the acquisition only, not UC buy from the Yuans. Can someone with deeper info check this ? )

Rick

Monday 4th of November 2019

See the profit margin of ASAP :-

" These hotels are: Sheraton Denver Tech Center, Crowne Plaza Dallas Near Galleria-Addison, Hilton Houston Galleria Area, Hilton Atlanta Northeast, Renaissance Woodbridge and Doubletree by Hilton Salt Lake City.

Crowne Plaza Dallas was purchased by ASAP for US$27.6 million ($37.4 million) and sold the hotel into EHT for US$50.7 million. Its adopted valuation in the REIT is US$57.8 million. ASAP acquired Renaissance Woodbridge for US$30 million and sold the property into EHT for US$67.1 million the valuation adopted in the REIT is US$76.6 million.

ASAP acquired Doubletree by Hilton Salt Lake City in 2017 for US$31.38 million, the REIT acquired it for US$53.4 million at IPO and its valuation in the REIT is US$60.9 million."

Rick

Friday 1st of November 2019

SGX filing shown many SSH were selling their shares again these few days

DL

Thursday 31st of October 2019

Hi.

I am mechanical engineering trained (and still practicing), the red zone you saw in the picture is a stress plot of an Finite Element Analysis.

Red zone in this type of stress plot doesnt mean it failed because the colors only illustrate the stress level relative to highest value.

Looking at the stress of 24 ksi, we a factor of safety of 1.3 (but subject to correct load case and modelling)

Kyith

Thursday 31st of October 2019

Hi DL thanks for clarifying this!

Alan

Wednesday 30th of October 2019

Where the Large Shareholders Already Aware of This Situation? Possibly, given that 2 major shareholders has sold in the recent month perhaps they could have known about the details of this report before the news became widespread. Two major sale where declared by substantial shareholders in the month of Oct-2019:

Norbert Shih Hau Yuan – sale of 5mil units at US$0.675 via off-market transactions Tong Jinquan – sale of 10mil units at US$0.650 via off-market transactions While we cannot conclusively say for sure, but considering the timing of the sale, its certainly a possibility that they may have known something which isn’t apparent to the rest of the markets yet.

Kyith

Thursday 31st of October 2019

Actually... someone sold a big chunk at $0.55 the day before as well.