I have to thank Nick for highlighting this article to me.

We often first hand stereotype stocks based on the historical price movement. Take the example of this shipping stock Frontline (FRO). An observation of this stock from 2001 to 2011 will lead us to conclude that this stock is made for traders rather than investors because had you held on for 10 years you wouldn’t have made much.

But often a lot of things were not accounted for in a price chart

- The dividends. For an initial investment of 10 dollar per share, Frontline paid a total of 55 dollars of dividends. That’s almost a 2 bagger in itself.

- Spin-offs. In 2004 Frontline spin off their ships to a trust like company to let Frontline focus on the risks and rewards and the trust on operating the ships. Investors in Frontline get spin-off shares in this company Ship Finance. And Ship Finance pays a dividend as well. That’s not all, in 2007 Frontline spin off and gave its share holders shares in Golden Ocean, who pays a heft dividend as well.

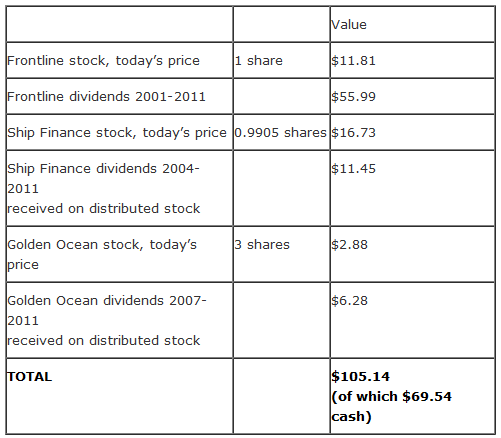

If we account for all these miscellanous payouts the return on that would be something like this:

That is an astounding return for a stock that ended up back to square one.

Conclusion

I have to admit that when everything is laid out this way, it is much clearer how good this investment was then saying that we should take into consideration dividends and spin-offs.

It is stocks that have a lot of underlying value like Keppel, SIA and Sembcorp that we need to scrutinize.

Even small shipping stocks like Chuan Hup and CWT amply reward their share holders or deep value investors who spend effort searching for it.

Take a look at other articles on Warren Buffett, Charlie Munger and Value Investing here in our Investment Moats Value Investing Vault.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Jared Seah

Sunday 31st of July 2011

Hello Drizzt,

I am reminded of Singtel. Its a good return for investors who "bought" from the government at either 1.90 or 2.50.

Although looking at Singtel's price today, it's not very sexy. But if we factor in all the dividends and capital reductions.

It beat all those "high yielders" that investors bought at IPO - after factoring in the share placements and rights issues. What's the point of 10% yield when my captial is cut in halve? Must wait another 10 years of dividends just to break-even! And that's assuming my dividends are not diluted...

Drizzt

Monday 1st of August 2011

hi Jared,

Singtel may not be a good example. to me it sounds like a garment or lee sien long's explanation why Singtel to Singaporeans is a success. It was sold at nearly 35 times earnings. the right price is suppose to be 90 cents then it is worth it.

Given the 17 years, i believe the returns are not as massive as compare to Keppel or SPH. Just saying. The price is almost the same.

J

Saturday 30th of July 2011

Erm.. i agree with what you said.

However, do we need to consider the inflation for 10 years? The value of the money would then be somewhat different.

Besides that, do we need to consider other opportunity cost along the way?

Drizzt

Sunday 31st of July 2011

hi J, we have to factor in the discount factor which is essentially opportunity cost in itself. setting a figure high compensate for it.

but if you look at the returns of this stock illustrated, you would realise the average investment in the last 10 years give you that kind of returns.

Createwealth8888

Saturday 30th of July 2011

Hi Drizt,

What you said is absolutley true on 'what the stock chart doesnt tell you dividends and spin-offs'.

I have collected the following dividends from Kep Corp and Semb Corp and their returns on initial investment:

Kep Corp (2001 - 2011) : 247% Semb Corp (2002 - 2011) : 228%

Drizzt

Sunday 31st of July 2011

hi Createwealth, those are great returns and hope to learn from you how you manage to uncover them.