A few weeks ago, I met up with this reader who was a bit taken in by Adam Khoo’s presentation of medical device stocks. So he was wondering about my thoughts about healthcare stocks in our portfolio.

I have a blurry idea why Adam would specifically recommend medical device companies, but my reader made it clear that there are some areas of healthcare that Adam does not think are good ideas to invest in.

It is very nuance and I do not wish to pretend that I know a lot in that area but if he is interested he can take a look at some sector index data and see if it make sense for him. I passed the data to him but he seem to have a problem calculating the returns.

If you calculate returns wrongly, perhaps the interpretation will also be wrong, so maybe let me just put the data here for his interpretation.

The MSCI World and Emerging Market Healthcare Index

We have the returns data of the MSCI World and EM Healthcare Index from 2004 to the end Oct 2023 so we can contrast them to the MSCI World and EM index returns respectively to see how they compare.

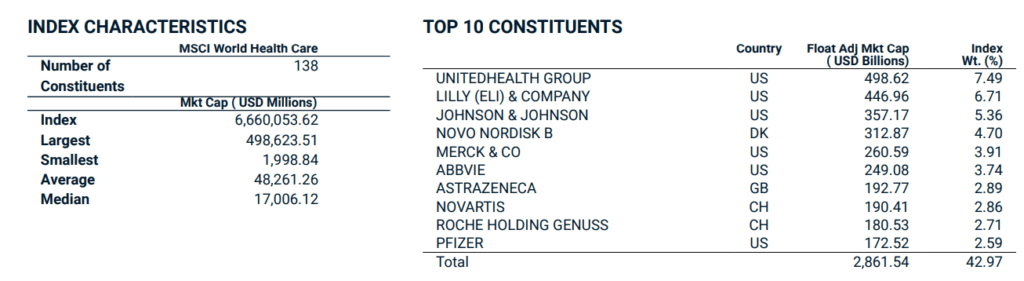

Here is the sub-sector breakdown and country weight of the MSCI World Healthcare Index:

Pharma stocks make up 42% of the index and we can find that the healthcare equipment is the second largest at 14%. US companies make up the bulk of it.

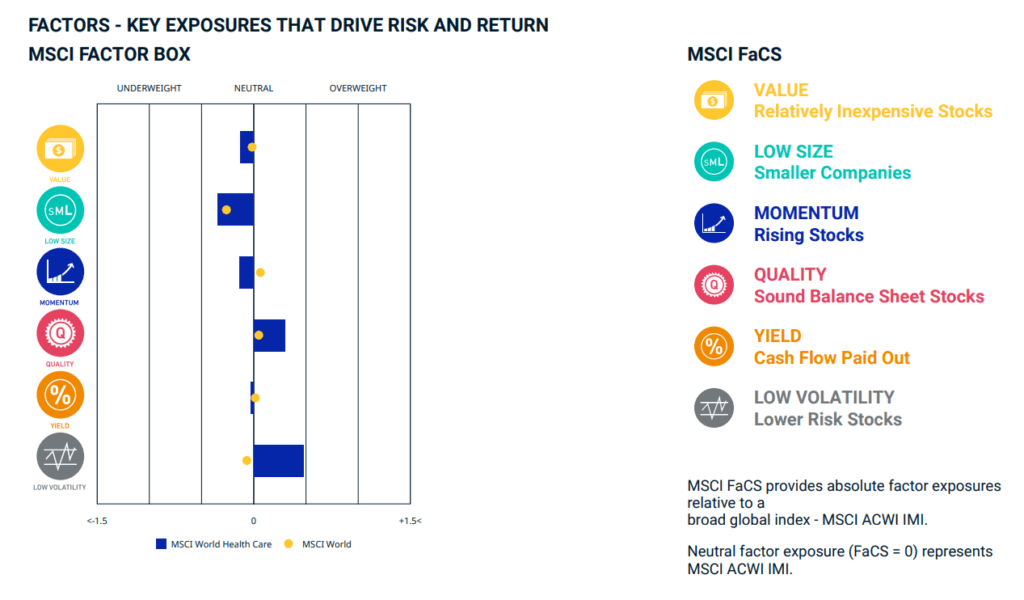

This chart shows the breakdown of factor exposures. The companies tend to exhibit low volatility and quality factor characteristics and not very small.

These are also the two factors that tend to do better during recession and if your portfolio is largely MSCI World Healthcare, they tend to have lower volatility.

138 stocks make up the index where the top 10 forms 43% of it.

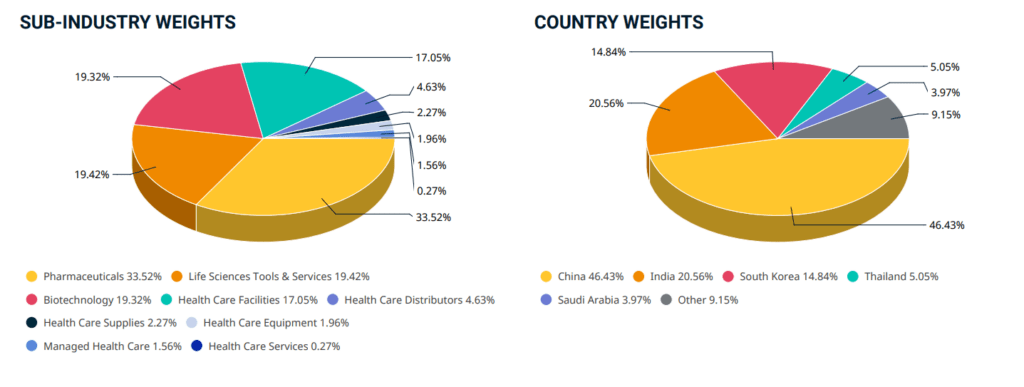

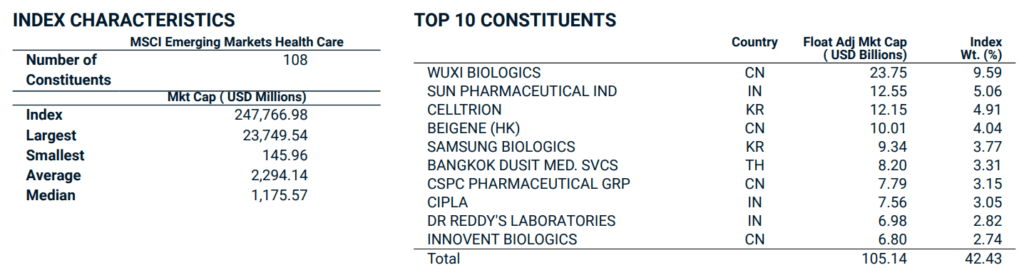

The pie charts below show the MSCI Emerging Market Healthcare Index:

The sub-sector breakdown is kinda similar except that in emerging markets, the Healthcare Facilities stocks have more weight. China, India and South Korean companies make up a large share of this.

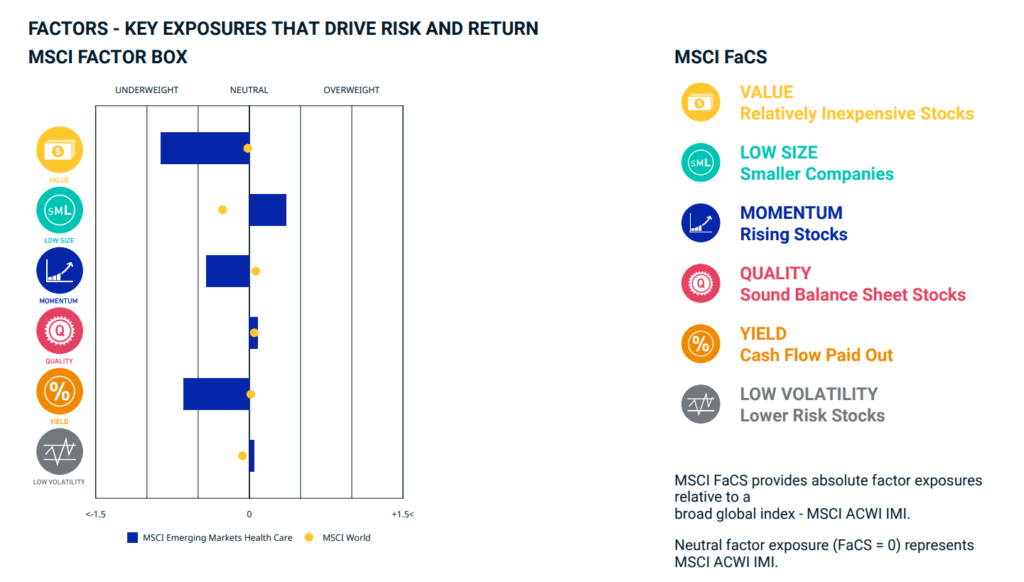

The interesting thing is how different the factor characteristics of the emerging market healthcare stocks look to the developed world one.

They tend to be smaller, relative to the index, more expensive, lower yield and lower in momentum.

They have a small cap, growth kind of profile. A reminder that healthcare stocks at different scale, can exhibit different profiles.

108 stocks form the EM Healthcare Index with the top 10 taking up 42% of the Index. 10% of the index is Wuxi Biologics.

The Returns

For the past 29 years since Jan 1995, the MSCI World Health Care Index did 10.4% p.a. while the MSCI World Index did 7.7% p.a. That is a crazy 2.7% a year more or a 116% difference. For the past 23 years since Jan 2001, the MSCI EM Health Care Index did 6.9% p.a. while the MSCI EM Index did 7.1% p.a. So the MSCI EM Health Care did not do better than the EM index in general.

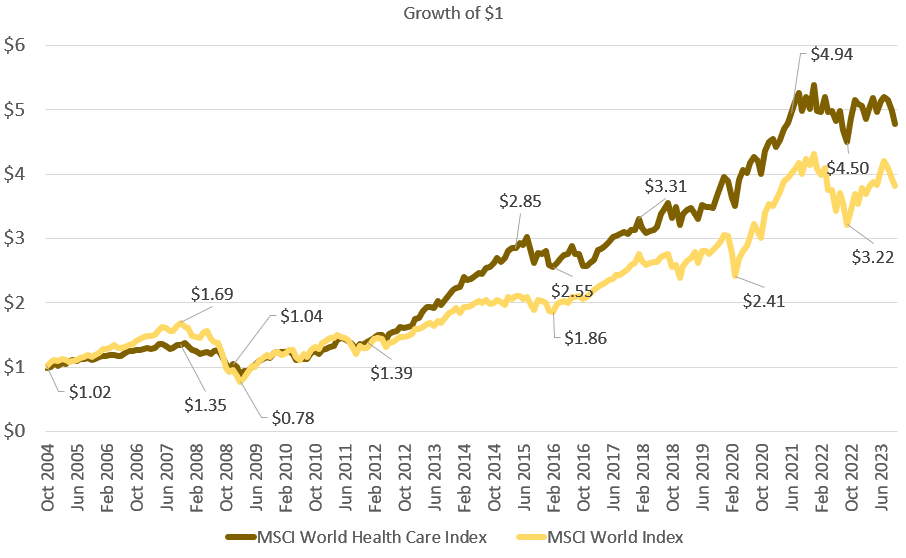

Here is how $1 will grow if you invest in the MSCI World Healthcare and World Index from Oct 2004 till today (about 20 years):

Surprisingly, I thought the healthcare stocks did better from 2004 till 2010 but apparently, the broad-based index did better.

That 2004 to 2010 emphasize the lost decade in USA stocks. From that point on, if you had just focus on healthcare stocks, you would have done better but the MSCI world isn’t very shabby either.

Here is how the EM Healthcare index compare against EM index:

If we stop investing and sell our investment today, you won’t do too different. $1 became about $3.

During the emerging market boom of the early 2000, the emerging market healthcare stocks didn’t do as well as the broad-based index. But since then, emerging market stocks have done better. The peaks and collapse exhibit the volatile characteristic of small caps.

The 5-Year Rolling Return Comparison

Now, let us take a look at the five-year rolling return.

We want to see if an investor invested $1, at any point in the past 20 years, how is their annualized return.

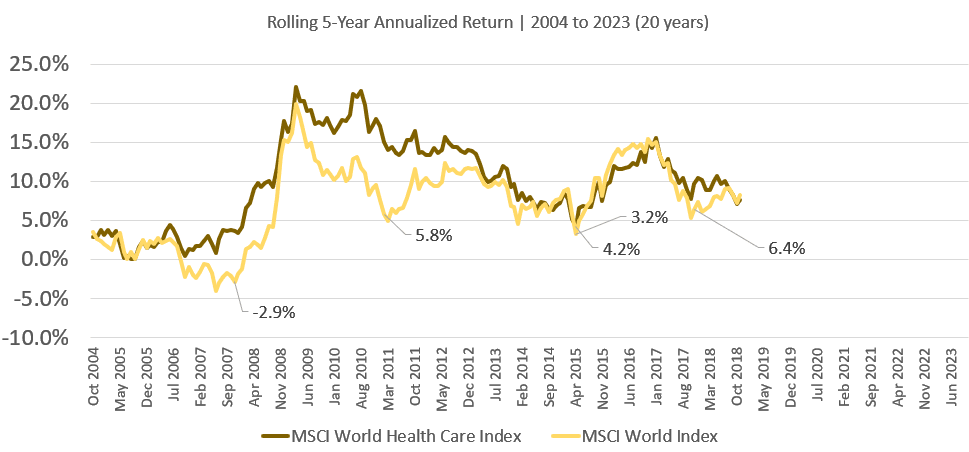

Here is the five-year rolling return of the MSCI World Healthcare against the World Index:

Do note that every point on this chart represents a five-year annualized return. If you see -2.9% p.a., it means the compounded growth if you invest at that point for the next five years is -2.9% a year.

The profiles look the same but you can see the quality and low volatility nature of the healthcare index. If you had invested at the height before the GFC, your return for the net five years will be -4.1% a year but the healthcare stocks will do 0.9% a year.

What is interesting also is that if you have invested at the bottom in 2009, the returns are roughly the same (22% a year for five years for Healthcare vs 20% a year for five years for the broad-based index).

If we were to summarize:

- Do better during downturns.

- Keep up and capture similar returns during the period of 2004 to 2023.

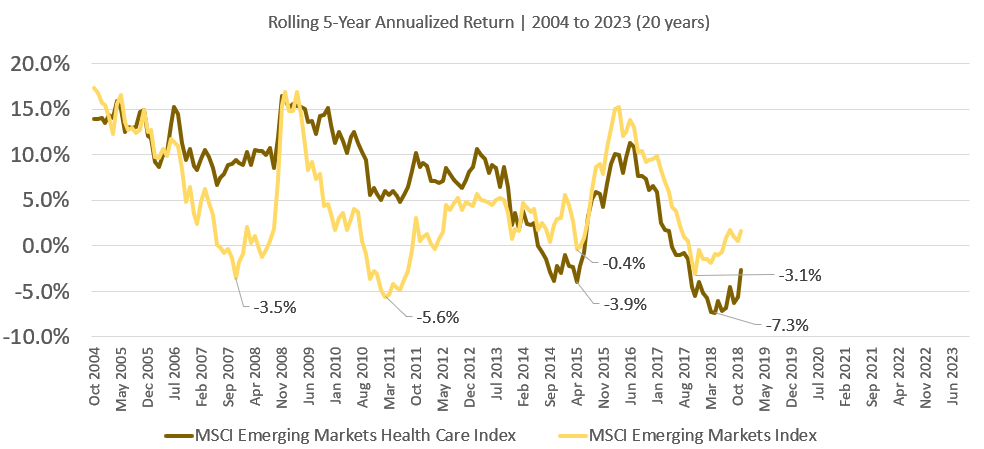

Here is the five-year rolling return of the MSCI Emerging Market Healthcare Index and the broad-market index:

If you invest at 2004 to any point before 2014, your returns in EM Healthcare would be pretty good. Less volatility than the broad-market index. But after that, you get the same pattern. It just feels like a wild, wild west.

Last Word

I always feel its weird to invest in a sector but many seem to feel we are at an age where technology is going to do better than anything else and so we should just invest in the technology sector.

I can see a reason to invest in the large-cap, well developed healthcare stocks for its quality and low volatility profile. A more risk-averse investor would have a much more manageable experience.

But at some point, perhaps in the future even quality companies can be expensive, relative to any point in the past. When that happens, you might not see that defensive nature anymore.

If you are interesting in investing in the MSCI World Healthcare Index, State Street have a UCITS ETF called SPDR® MSCI World Health Care UCITS ETF (ticker WHEA) .

You can buy it through a low-cost broker that can trade London Stock Exchange such as Interactive Brokers.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.