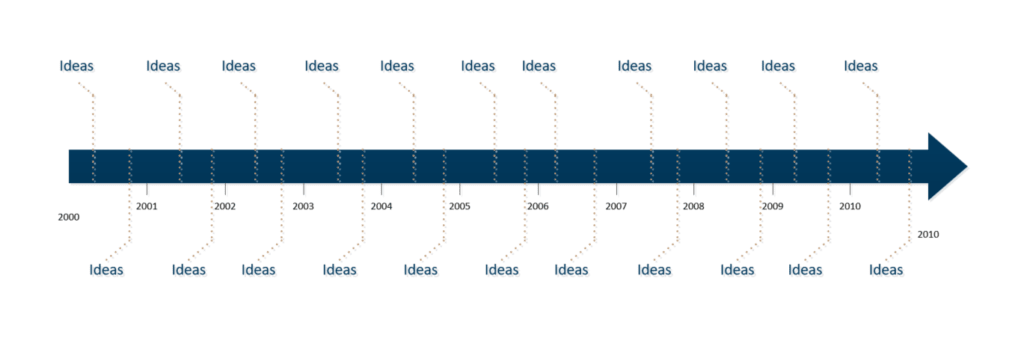

If I were to give one factor that makes dividend investing difficult for a lot of people it is a stream of constant ideas.

Ideas are companies, bonds of companies and other securities that you can invest in to earn a total return.

What you wish for is to set up a 15 stock portfolio that can give you a conservative 5% dividend yield. Your portfolio of 15 stocks have capital gains that keep up with inflation as well. You would assume that to be 2-3% a year.

Thus, in the long run, the average total return you will get is 5% + 2% = 7%.

The action plan: Find 15 of these great companies that will grow over time and won’t die and sit back enjoy the fruits of your labor.

I am here to tell you, that beautiful scenario is not going to happen.

If you cannot keep getting a stream of ideas, it makes dividend investing extremely difficult.

Framing it to the Accumulation Phase of Life

Let me niche down and frame what we are discussing here.

You can view dividend investing for different scheme of life you are living:

- When you know you have not reached the sum you need and are accumulating

- You think you have already achieved the sum of wealth you need and wishes to spend part of your wealth portfolio

Today’s discussion is more on #1.

How should we Frame your Dividend Portfolio during Accumulation?

During your accumulation phase, there is a high probability you do not need to cash flow from your portfolio.

Thus whatever cash flow that you receive, in the form of dividend income, needs to invest back into the portfolio.

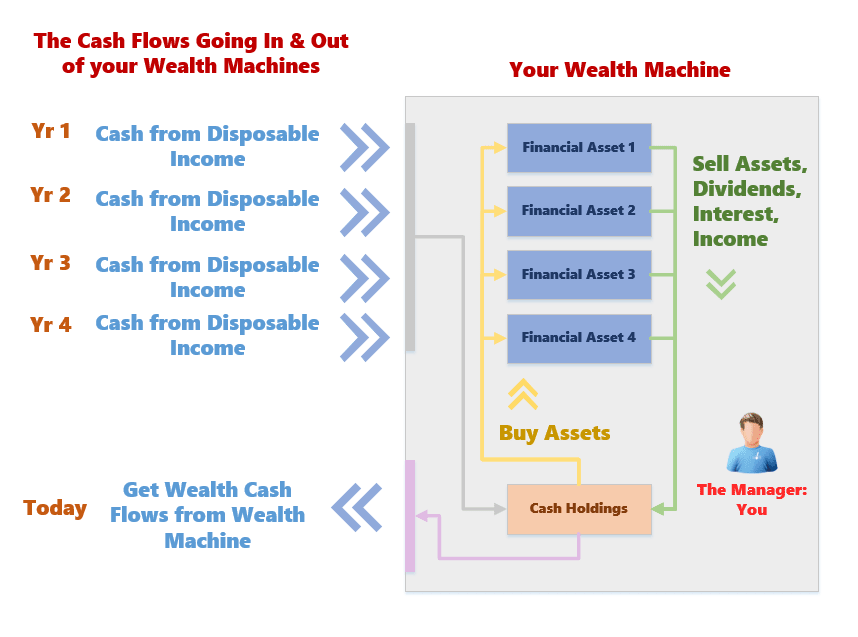

Suppose your Wealth Machine here in this diagram above is your dividend portfolio.

In this phase, you are consistently injecting more capital from your disposable income into your dividend portfolio. These capital are then deployed into dividend stocks, or other securities as you deem fit.

When your dividend stocks distribute dividend income, or capital reduction, when you sell the dividend stocks, you do not pull out your capital from this dividend portfolio. It goes into cash holdings.

Cash holdings are the money that is earmarked to be reinvested.

Your money grows by

- Constant injection of capital

- Your dividend stocks earning a good total return

- As the investment manager, you make mainly good investment decisions

The opposite is also true. Your money destructs by

- Taking money out as wealth cash flow, perhaps more than a conservative amount

- Your dividend stocks does not earn a good total return

- As the investment manager, you make mainly poor investment decisions

There Will be Many Capital Allocation Decision Points

Dividend investing is not as passive as you think because there will be many points where you need to make investment decisions.

I will give some examples here:

- Your dividend stock gives a dividend income. Your dividend income is building up. Where do you deploy this cash holding that is ballooning?

- Your dividend stock is privatized. During this move, you get back your cost and perhaps some gain. In aggregate, you have a sum of money. This sum of money gets added to your cash holding

- Your dividend stock does a capital reduction or special dividend. This adds on to your cash holding

- Your dividend stock, predominately Real estate investment trusts (REITs) ask for a rights issue, preferential offering. This means they are asking you to put in more capital for a new investment or to shore up their balance sheet. Should you participate?

- Your dividend stock is doing well. Do you add on to what you already have?

- Your dividend stock is not doing well. Should you hold on to it or sell it?

All 6 examples are rather prevalent if you are doing dividend investing. It is difficult to run away from them. I do not think that if you are doing this for at least 20 years, you can insulate yourself from making these decisions.

Thus, if you are a dividend investor, it means you need to understand these corporate actions, have a framework in your head to know what are the good decisions you can make, and what are poor decisions you can make, and be comfortable to make these decisions.

Holding Cash is an Opportunity Cost

Many investors focus on the stock part of their net wealth and evaluate performance only for that portion.

At our firm, we have to reframe our clients to think from a portfolio perspective.

Suppose your average total return you earned from your portfolio of dividend stocks is 7% a year. Your average total return you earn from your cash is 1.5% a year (this assumes you know how to play those high yield savings account, or knows your way around getting higher low-risk returns. Here is an article to get you started)

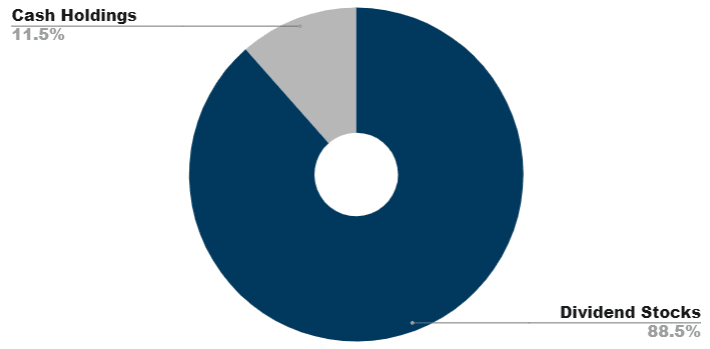

If you are well deployed your portfolio will look like this:

Most of the capital is deployed at a higher rate of return. Some cash is on the sidelines that you are evaluating how you should capital allocate.

Your average total return a year going forward could be closer to 6.37%.

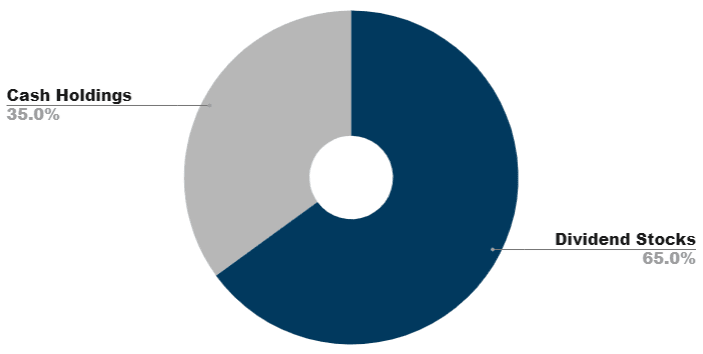

Now, if you hold too much cash, the situation will be like this:

Your average total return goes down to 5.08%.

Now I am going to talk more about the cash portion. We are framing this from the accumulation perspective. You are not taking distribution for spending.

You are likely not de-risking your portfolio. If you are approaching the point where you are going to spend from your dividend portfolio (estimate 5 to 10 years before), then it makes sense to rebalance your portfolio to a less volatile one.

But this is an accumulation phase and should be evaluated as such.

If you have a high cash allocation, that is OK.

You are making a capital allocation decision that you

- do not have good ideas now

- a byproduct of #1 may be that the market does not present some value

You will have to note that if your total return is 5.08%, to get a long term return of 7% on average, it means in the future, you have to earn on average 8-12% a year for a few years, just to get back to 7%.

In frisbee, you can slow down and not run around like a headless chicken. But when you see that opportunity, you need to sprint like hell and make it count. Keeping cash is similar. There is an opportunity cost there.

If you earn 10% for a few years later, it is not better. You are just making up for the low returns in the past.

This is Why You Need a Consistent Stream of Prospects / Ideas

When you consistently have capital coming in and needing to be recycled and you need to put them to work to earn the return, what it means is that… you need to know where to deploy the money into.

You would not have this problem under a few possible conditions:

- You will buy into your existing portfolio of stocks by finding the more value stocks and adding on to them

- You will buy into your existing portfolio regardless of how they are doing

- The company you selected have strong competitive moats that are very wide, owners show that they are good managers with integrity and the business have a consistently good ROE

#3 is the golden goose and what every dividend stock investor think they have. The reality is that… not all of them are like this.

Most investors would agree with #1. Less will lean towards #2.

#2 is what a lot of novice dividend investor think dividend investing is.

In #3, you will do a lot of the hard work at the front, and reap the fruits of the labor. You will have to do a lot of recurring work in #1.

So what this means is that in order to build your wealth with dividend investing you need a stream of prospects or ideas.

When you run out of ideas, that is when your portfolio may self destruct.

Let us Expand on Ideas/Prospects

To get ideas and prospects, you have to do the work of being in touch with the capital markets.

You have to know what is out there

- those better companies

- those not so good companies that you will not invest

- out of those better companies, how is the valuations

- which not so good companies became… investable

If this sounds like a second job then it is. You need to become a part-time fund manager. So you have to be equipped with a fund manager or financial analyst skillset.

That is what most of us developed. My life is about:

- Work

- Less family

- A lot of fund management and financial analyst

- Blogging

You can do it but you have to develop the skillset. It is doable and it is better to pick it up when you are in your 20s or early 30s because your cognitive abilities and physical energy is at its peak.

Now back to ideas.

In finance, we call this problem – Reinvestment Risk.

If you use dividend investing in accumulation you cannot run away with this.

Even evaluating where to deploy your capital to, within your existing holdings is an idea. This versus a stock outside your portfolio.

When you do not have the time for this fund management and investing work…

You run out of ideas.

You have a harder time reinvesting your income. What may happen is that your cash accumulates and your portfolio allocation becomes unbalanced.

A dividend portfolio also self destructs when the portfolio manager does not pay enough attention to his or her current holdings. She fails to see a change in fundamentals, that the stock have overshoot its valuation.

The stock goes into a tailspin in the first instance, and in the second instance, the fund manager fails to lock in a gain.

I strongly believe many novice dividend investors underestimate the level of work required. They were sold this nice concept that it is easy.

So What is the Role of Dividends in Accumulation?

I am not beating down this way of investing during accumulation. I have a tilt towards investing for dividends.

Dividends has 2 purposes:

- It gives you a metric to see whether a stock may be undervalued

- It gives you a regular return to manage the non-operating owner risk

When dividend yield is high, it may mean that:

- the stock has a problem. the dividend is not sustainable

- the stock has a problem. Once the problem is fixed, the dividend at this price is undervalued

#2 is obviously a buy and #1 is obviously not a buy. Your job is to discern between #1 and #2.

But you can see the dividend here is used as a metric to see whether the stock is fully valued or undervalued or fair value. You are evaluating against its peers.

Risk managing against non-operating owner risk

When you buy a stock, you are buying ownership of a company. But you are not the owner or the CEO. Your prospecting may tell you that this business is operating this way, that they should be doing the things you are comfortable with. But things can turn pretty fast.

There is always the possibility that the company is not what it seems.

If your stock prospecting skills are really good, you can weed out a lot of garbage stocks. However, there is always that possibility even with good prospecting skills you cannot weed them out.

If you are the owner of the firm, you will have a much better idea of what is going on in your own company.

You can choose not to take any dividends but take scrip or reinvest your money back into the company. This is because you know the direction of the firm is going, and there is no funny shit going on in there.

When you are not the owner-operator, taking dividends is a way of getting regular payouts instead of waiting for one huge payday.

In the grand scheme of things, we want to invest in a company that grows very well, we know the owners and the culture is good, shareholder-friendly, good capital allocators and high ROE.

We would not wish to take dividends there.

But the reality is that there are a lot of garbage out there masquerading as good companies.

By taking dividends regularly, you are managing your risk in this investment.

Also, watching their ability to pay a dividend and the dividend policy set, is an indicator of the health of the firm.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

Hakim

Sunday 13th of October 2019

Very well written. This is why in my opinion that dangling the compound interest to grow wealth is not practical at all. Such vehicle only applies for cpf but illiquid or high interest savings acct but low interest and criteria. Put 100k or 10k a yr into market and see it compound in 30 years to million? Is it even guaranteed? No. U still need to identify and move your money about. The money only kind of "compound" in the sense that you reinvest into another counter or same counter. But depending on prices will determine your yield or you are using dollar cost averaging which also affect yield.

We definitely need to think and study on where we reinvest the next accumulated capital during the accumulation of wealth stage.

Hence when stories to inspire people to start on their financial journey with that compound interest, personally I faced an obstacle. Cause there's no such investment vehicle that can compound like those examples. Every month invest 500 or 1k and it will become this big AMT 30 years later. But there's no guarantee. In the sense that on the 29th year it crashed. So u still need ideas on when to cash out. So investments should never be locked. Anyway I prefer the cash flow perspective which is more inspiring (see wealth growing) and attainable compare to an 8th wonder of the world that is really passive but doesn't exist. Yes it is part time work haha.

But yes compound interest is still powerful. But it is too powerful that is it sustainable for the payer. It means the money they invested must make enough money to pay the interest.

Kyith

Sunday 13th of October 2019

Hi Hakim, could you elaborate on the cash flow perspective which is more inspiring?

I think when you are accumulating, we should be thinking about total return. we could go for dividend income stocks because we know it better. it is often better to invest in something we strive to be competent in then putting in something we are not very sure about.