I have some of my money that is not in my main portfolio (you won’t see it in Haw Par).

I think it is time to do some due diligence to investigate the underlying health of the business. If it is okay, this might be a good place to park money in a special situation that is:

- Undervalued.

- Have a margin of safety.

- Simple to understand.

- Pays some dividends in the mean time.

This stock may fit the criteria to put in more of the net wealth that is not in the main portfolio.

Haw Par’s share price spiked up a few times before dropping down. Even with the recent good results, and improvement in dividend per share did not improve it.

My friend Xiaoboi has a very, very short commentary on Haw Par results where he say spinning out the Tiger Balm may help.

The following is my notes and the order of what I covered in my notes may be jumbled up. I find that it is important for me to go through my due diligence process to figure things out and re-arranging them for you benefit is not the priority.

So am sorry if you struggle to comprehend.

Thinking Through Haw Par’s Current Valuation

There are currently 221 million outstanding Haw Par shares. At $9.70, the market capitalization of Haw Par is $2.1 billion. US Small Cap companies are from $250 million to $2 billion.

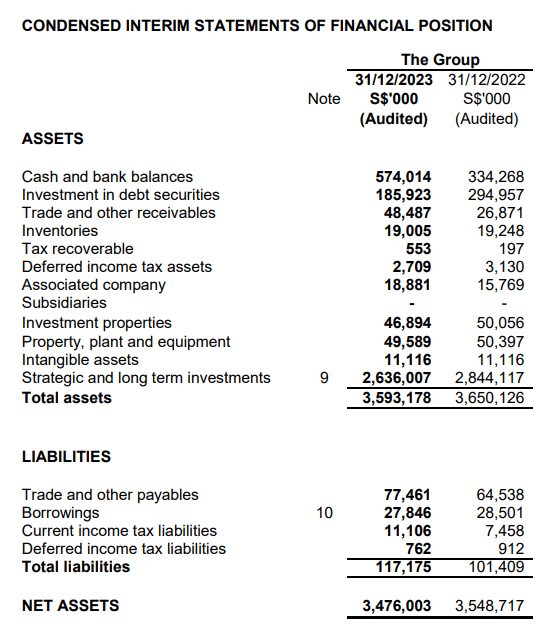

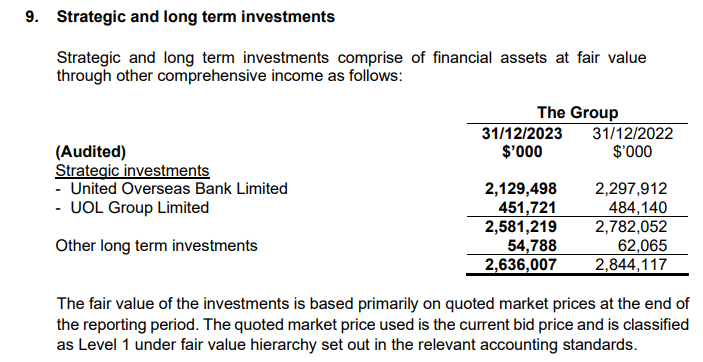

Per Haw Par’s full-year results, the company held a net cash position of $732 mil or 35% of their market capitalization. Aside from that, the major asset is $2.6 billion worth of Strategic and long-term investments. What are these?

The majority is made up of UOB bank shares worth $2.1 billion and UOL shares worth $451 million.

So, at a market capitalization of $2.1 billion we get:

- $732 mil worth of cash and short-term securities, net of debt.

- $2.1 billion worth of UOB Shares.

- $451 mil worth of UOL shares.

- Haw Par’s healthcare business.

That look like a good deal. Unless there is some unlocking, I think Haw Par will not trade close to the valuations (which is probably 50% higher) because there will always be some sort of conglomerate discount.

How many dividends from Haw Par’s dividends received is Haw Par paying out?

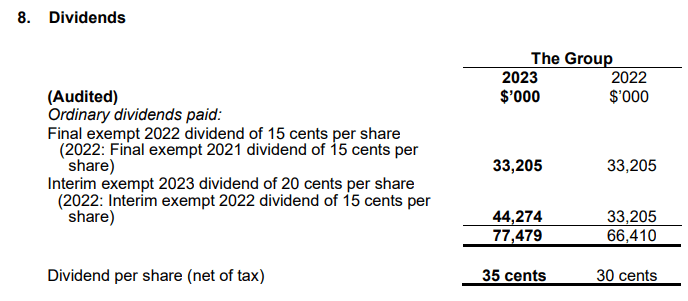

The table below is taken from SGX’s corporate action:

Haw Par seems to have raised their staple dividend per share from $0.20, to $0.30, to now $0.40. Perhaps will take a while before they raise it to $0.50.

At a share price of $9.70, the dividend yield works out to be 4.1% a year.

Not too shabby for me, but some will snicker why not just invest in the UOB shares directly since the dividend yield is much higher.

Well, it depends on your poison. If you prefer owning an asset, don’t need the income immediately, prefer something that has a higher margin of safety versus the intrinsic value, Haw Par makes more sense.

A $0.40 full-year dividend payout will cost Haw Par $88 mil.

Haw Par received the following dividend income from its share of UOB and UOL shares:

- 2022: $103 million

- 2023: $136 million

I think they have ample room to raise dividends but would prefer not to.

The $732 mil may generate around the region of $20 million if we use an average of 3%, or $10 mil if we use 1.5%.

The 4.1% dividend is very safe not just because of how low the dividend payout ratio is but also the nature of the assets, the amount of assets, all things considered.

Are the Retain Earnings/Dividends of Haw Par Increasing their Cash Holdings Over Time?

Haw Par is like a holding company with not too much reinvestment into their Tiger Balm business.

If they are not paying out the dividends then we should see this retained dividends accumulate over time. Let’s see if there are evidence of this in their cash holdings + investment in debt securities:

- 2023: $759 mil

- 2022: $628 mil

- 2021: $596 mil

- 2020: $554 mil

- 2019: $465 mil (There is a special dividend paid out in this year. The total dividend paid out was $1.15 per share)

- 2018: $519 mil

- 2017: $401 mil

- 2016: $313 mil

Took them six years to double. Of course, this could include the cash flow from the health care operating business. Part of the cash most likely belongs under the healthcare business as well so that cannot be easily extracted.

If this goes on further, the cash holdings of the company will swell even further.

They should take 10% and buy BTC and ETH.

How is Haw Par’s Healthcare or Tiger Balm Business Doing?

Let us tabulate the segmental healthcare side of things:

| Year | Segment Revenue | Segment Profit | Segment Assets | Return on Assets |

| 2023 | $213 mil | $64 mil | $153 mil | 42% |

| 2022 | $164 mil | $40 mil | $124 mil | 32% |

| 2021 | $125 mil | $21 mil | $180 mil | 17% |

| 2020 | $95 mil | $16 mil | $157 mil | 10% |

| 2019 | $224 mil | $74 mil | $167 mil | 44% |

| 2018 | $218 mil | $77 mil | $155 mil | 50% |

| 2017 | $202 mil | $69 mil | $107 mil | 34% |

| 2016 | $177 mil | $66 mil | $89 mil | 37% |

The Tiger Balm business is a unique, high return-on-assets business.

It took Haw Par three long years before the segment profits and revenue got back to pre-pandemic levels.

I would like to think this will speed up cash retention if the business continues as it is. I am not sure if there is a major change in trends, but I do think the habits of Tiger Balm users is not going to change much.

How Much Would the Healthcare Business aka Tiger Balm be Worth if Spun Off?

The reason why Haw Par would want to spin off the business is if it has an incentive to get a better valuation, for some purpose.

For what purpose, I also don’t know. They have been keeping it sleepy for so long and unless there is a reason to make it more shareholder rewarding, do the correct capital allocation decisions, I don’t see this happening.

But it is good to think about from a sum-of-parts angle, how much Haw Par is worth if the Healthcare business trades at a fair valuation.

Given the recurring cash flow business, using some sort of PE valuation may make sense.

Suppose we use $70 million in next financial year earnings, the business can trade at different price-earnings (PE).

If the business has quality, is more defensive, the PE would be higher.

Here are its valuation based on two different conservative PE:

- 15 times: $70 x 15 = $1.05 billion.

- 20 times: $70 x 20 = $1.4 billion.

Haw Par, with the other assets, would be worth between $4.3 billion to $4.6 billion. Haw par indeed trades at quite a big discount.

UOB

A large part of the dividends come from UOB and it would be prudent for us to think about UOB bank a bit.

UOB looks just like Haw Par, trading in a tight band/wedge and could break out in either way (in this case positive more so than negative).

In their latest financial results, they announced a raise in dividends, and at the current share price of $28.30, this will give UOB a dividend yield of 6.0%.

They are officially a high yielding company but the question is how much of their earnings are they paying out as dividends? I could look at their free cash flow or earnings, but usually, the cash flow statement of banks are too complicated for me to understand.

Here are the past payout ratios:

| Year | Dividend/Earnings |

| 2023 | 47% |

| 2022 | 44% |

| 2021 | 39% |

| 2020 | 63% |

| 2019 | 48% |

| 2018 | 41% |

| 2017 | 20% |

| 2016 | 29% |

| 2015 | 45% |

| 2014 | 21% |

| 2013 | 36% |

| 2012 | 34% |

| 2011 | 23% |

| 2010 | 11% |

| 2009 | 47% |

| 2008 | 51% |

| 2007 | 56% |

| 2006 | 38% |

| 2005 | 43% |

| 2004 | 52% |

Almost 20 years of UOB payout ratio shows that the payout based on 2020, was one of the highest at 63% but there are some low payout ratio of 11%.

This basically tell us that dividend paid out is not due to payout ratio. It is all over the place. Perhaps the payout is more due to the health of the business.

The dividend income revenue of Haw Par looks okay.

I think Haw Par can add $100 mil of cash to the balance sheet annually even after the Dividend Payout

Based on how I see Tiger Balm’s results, the past growth in cash holdings, I think this is possible.

The bump in share price due to adding this on the balance sheet, all else (such as valuation) being equal, should go up.

How does that translate to the valuation?

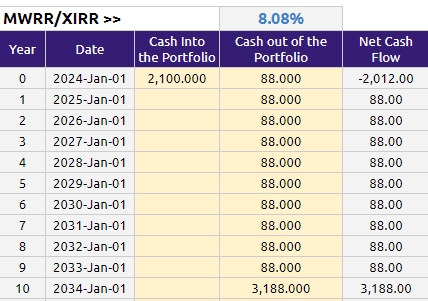

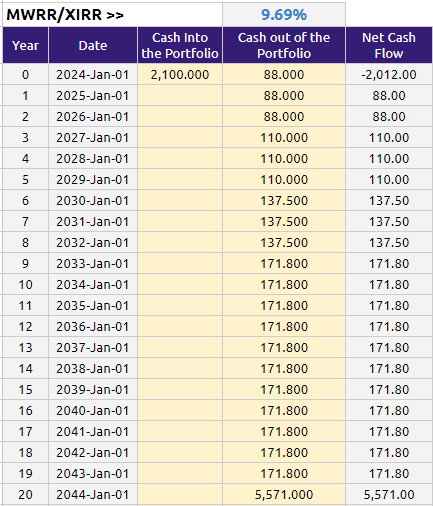

Suppose we do a reverse Internal rate of return (XIRR) to see under a certain conservative scenario, what kind of rate of return we are getting.

I will assume:

- We receive $88 million a year in dividends. No dividend growth.

- We accumulate $100 million a year in cash for ten years that doesn’t really compound much.

- Haw Par share price didn’t go anywhere for ten years.

What would the XIRR be?

With these parameters, we get an XIRR of 8%. It would be great if the XIRR reaches 10%, which means it may not be that extremely undervalue as we think. While Tiger Balm is a high ROA business with not much additional capital expenditure needs, the overall allocation is that of a mature business that leans closer to being conservative and defensive. I would hardly doubt calling it a quality business does it justice.

The margin of safety includes:

- There should be some dividend growth realistically.

- If the 100 mil add does add some growth to it.

- Tiger Balm grows.

If we do an XIRR over 20 years but with more realistic parameters:

In an interval of three years, we grow the dividend per unit by 25%, for three times before staying stagnant. We embed 5% growth in the $100 mil added annually.

The XIRR look slightly better.

Conclusion

Haw Par feels like a sort of junk, high-yield bond masquerading as a stock. Some may not like me calling it a junk bond but that is what junk bond feels like: some sort of equity with a good income angle. I am not sure whether an investor will get a good capital appreciation out of this, much like a junk bond. It is not as interest rate sensitive as the typical bonds, just like junk bonds.

If we look at the fundamentals presented, this may be the junk bond that is a sweet spot if an investor is willing to do their homework.

Haw Par qualify as a stock that you can purchase with your CPF OA money, up to 35% of your OA.

Some thing for me to think about.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Thinknotleft

Sunday 10th of March 2024

Good post on highlighting the under-valued Haw Par.

Some thoughts: 1) Haw Par's net assets fell $3.55bil in 2022 to $3.48bil in 2023. This is likely due to lower fair value of its strategic investments. Looking at the total comprehensive income, which includes fair value changes of its strategic investments, it is $4.8mil in 2023 vs $403mil in 2022.

Taking long term perspective (presuming if one is investing CPF-OA in Haw Par and would like it to be a buy and hold decision): 2) If Tiger Palm is very cash-generative and needs little cash to grow, better for Haw Par to keep it for Tiger Palm's growing cashflow.

3) Haw Par should review its cash needs. Rather than growing its $700+ mil cash and investment in short-term sercurities and earning low returns, it can consider (i) having higher dividend payout ratio, such as 70% or higher. or (ii) using excess cash to acquire minority stakes in gooddividend-paying companies or majority stakes in cashflow generating companies.

(I don't own Haw Par. )

Kyith

Tuesday 12th of March 2024

Hi Thinknotleft, I think coming from good allocator that is the right thing to do. But many have let me know that this is a value trap because they don't do the above. Actually, they may be saving the money for an acquisition and that would be very scary if they do not have a track record of acquiring things.

Klkk3

Sunday 10th of March 2024

If 4.1% yield I rather buy ES3, which is the entire basket of STI constituents, same yield same issue with prices stuck in a range since GFC .

Or, I would rather look at JMH , which is also a conglomerate trading at 5+ % yield , 40% payout ratio and 0.4 Pb ratio , top 5 constituent stock in STI after 3 banks and Singtel.

Singtel is an interesting stock to watch , their investment in Airtel India (airtel stock has grown 9x from their purchase price), they recently sold 0.8% at 700M SGD profit , they have another 28% stake left in Airtel. Source from a Business times article last week.

Kyith

Tuesday 12th of March 2024

Hi Klkk3, I noticed JMH as well. That is something good to think about.