POSB provides a way to invest passively to build your wealth

Introduction

It has always been the case that it is difficult for the average folk to build wealth in a sensible manner.

The general consensus is that to build wealth you need to

- invest in properties

- speculate in stocks

- find get rich quick schemes

- get into banking line to get a fat paycheck

- start a business

- Seldom is it mentioned that equities is also a way of building wealth.

- This week POSB have released a rather good idea in the

- :

POSB has rolled out a regular savings plan for working Singaporeans over the age of 18 to build their retirement funds through investment.

With POSB Invest-Saver, savings and current account holders put a minimum of $100 a month into the Nikko AM Singapore STI ETF, an exchange traded fund managed by Nikko Asset Management Asia which last year paid a dividend of 2.1 per cent.

POSB account holders can sign up for the scheme online or at any of the 1,100 DBS/POSB automated teller machines island wide. A fixed amount can be invested monthly via GIRO.

DBS Bank’s managing director and group head, Tan Su Shan, said that the scheme “allows customers to take advantage of dollar cost averaging and save for their retirement in a smarter way without the need for a huge capital outlay”.

So what is this Nikko AM Singapore STI ETF?

The problem

The majority of the people that have a problem building wealth is as such

- Time occupied in a full time job

- Time occupied by family

- Limits the time to acquire the knowledge and skills to actively build wealth via

- Equities and bonds

- Real Estate

- Business

- Do not have a lump sum capital. They can only free up a stream of savings. Because they don’t have a lump sum they find it hard to

- Purchase Real Estate

- Start a brick and mortar business

- Purchase equities and bonds

- They just don’t want their money to rot and lose out to inflation

- They want to participate in the wealth generated with the progress of the country

Nikko STI ETF

Enter the Exchange Traded Fund. Nikko STI ETF is a exchange traded fund listed on the Singapore Stock Exchange.

In simple terms, it is an unit trust that invest in a basket of stocks, listed on the Singapore Stock Exchange.

STI ETF mirrors a group of stocks that constitutes the FTSE STI Index. This STI Index contains the top 30 companies of the SGX Mainboard universe, ranked by full market capitalisation.

You can view Nikko STI ETF factsheet here.

What is the the FTSE STI Index consist of

These are some of the companies that made up the index currently (Jun 2013):

- Singapore Telecom

- OCBC

- DBS

- UOB

- Jardine Matheson

- Keppel Corp

- Jardine Strategic

- Hong Kong Land

- Global Logistics Properties

- Genting Singapore

- Capital Land

- Singapore Press Holdings

- Wilmar

- ST Engineering

- City Development

- Thai Beverage

- Singapore Exchange

- Capitamall Trust

- Singapore Airlines

- Hutchinson Port Trust

- Jardine Cycle and Carraige

- Sembcorp Industries

- Comfort Delgro

- Golden Agri

- Noble

- Sembcorp Marine

- Starhub

- Capitamalls Asia

- Olam

- SIA Engineering

The advantage here is that previously you need to use a unit trust to buy or that you need to spend a large amount of money to buy.

With the STI ETF, you can buy all these blue chips in a single swoop.

These are the largest company in Singapore by market capitalisation, so if some of the company became smaller, or some companies out of this index grew to become big, FTSE will replace the smaller companies with the bigger companies.

That way should an up and coming company become important in Singapore, you will also participate in its growth.

Growing with the progress of the economy

The complaint on the ground have been that the citizen’s do not have an easy way to participate in the country’s progress, that they should allow us to invest in Temasek.

Well, now you can invest in majority of those Temasek linked shares at one swoop.

When the country does well, the underlying companies that supports the country generally do well.

When they make money now, earnings get generated and the value of the companies appreciate.

You now have a chance to participate in this progress.

What are the advantages of investing in an ETF

I generally favor a passive investing approach with an efficient ETF over unit trust, endowment insurance policy.

There are many advantages but I think this article sums it up best:

13 reasons index mutual funds and ETFs rule

The advantages can be summarized as follows:

- You get wide diversification in a single package

- ETF have low operating expenses

- ETF have low internal trading expenses

- Because of their lower turnover, ETF reduce your tax exposure

- ETF give you control of your exposure to the specific asset classes you want

- When you buy an STI ETF, you know what you are getting, the performance of an index

- You will most likely get average returns

- You won’t have to worry about monitoring the performance of a fund manager

- The rebalance is automatic without you worrying whether by selling, you will miss out on a manager’s “hot streak”

Here is good video that explains Exchange Traded Fund:

What do we mean when we say passive investing?

Generally, it is an investing approach where we invest for appreciation with minimal maintenance. Many people will think that investing in the stock market requires a second job acquiring a skillset and spending energy on this second job.

Often times much methodology such as value investing, dividend investing, trading requires such time and skills build up.

A very general ETF can provide that passive wealth building alternative.

The STI ETF pays a Dividend

Just like your bank pays interest rate, the STI ETF pays a dividend.

When a blue chip like SPH or DBS earns at the end of the year, they will pay out a portion of what they earn as your stake in the company.

The STI ETF, since it is an aggregate of majority of the blue chips, will aggregate the dividends and pay out to you.

In the case of my friend, you will see that out of the 21.9% total gains, he earns 8.95% of it as dividends.

Dividends make up 40% of his returns.

And his dividends will get more and more:

- Remember he is adding $1000 every month, so as he accumulates more, so is his dividends

- As inflation and progress sets in, the earnings of the companies get more, so does the dividends (note that in the reverse, if the country stagnates or declines, your dividends becomes smaller)

The current prevailing dividend yield based on current STI ETF price is 2.2-2.4%. That is not too shabby and certainly almost equal to the 10 year Singapore Government Bond rate.

Remember, dividend payout amount is not fixed.

Update (24 Jul ’13): There are 2 ETFs that tracks the FTSE STI Index. One is this Nikko STI ETF, and the other is SPDR STI ETF. I realize that Nikko actually pay much less dividends compare to the SPDR STI ETF. Currently from this point of view, it is less attractive compare to the SPDR STI ETF.

At price $3.30 and a dividend per share in 2012 of 6.5 cents, the dividend is 1.9% for Nikko versus 9.5 cents (2.8%)

Dollar cost average at a very low amount

The great thing about Invest-Saver is that it allows you to save with a minimum of $100 per month.

This is a boon for folks who always say that they cannot squeeze money out to build wealth.

You don’t get lower than $100.

For those that can go higher do go higher than the minimum!

What kind of returns can you get

The thing about equities is that you won’t know whether you will be getting –3%, 6% or 9% going forward. You can only use history as a gauge.

I did an article comparing the STI Index ETF versus DBS, UOB and OCBC (read here)

The total annualized return is 9%. Of the 121% returns 38% of the returns come from dividends.

Note: Future performance may differ from the past.

Will you lose money?

Whether you will lose money or not depends on whether the individual let their own overconfidence, risk adverse nature and other cognitive problems get in the way

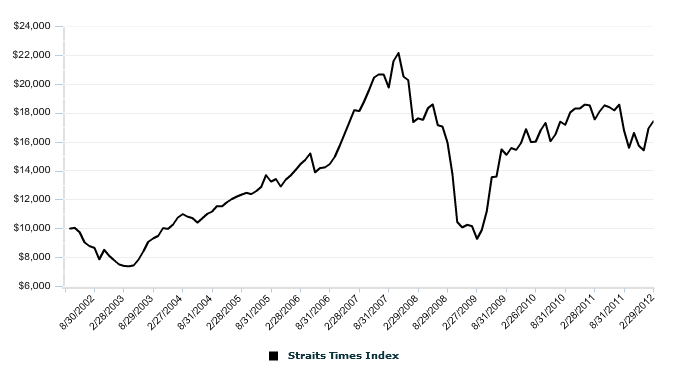

By looking at the index above, you can tell that if you are putting your money in for a short duration, you will suffer some big losses.

But what if your time horizon is 10 years or longer?

I wrote an article showing what my friend did. He decide to diligently put in $1000 every month into a STI ETF 2 months before the financial crisis brought down the market. (Read the full article here)

My friend was strong in that he did not give in to fear or irrational behavior and continue to add $1000, $1000 till today.

(Click to see larger image)

This is his result ending in April 2013, which he started in May 2007.

You can see that my friend’s commission is 25 dollars and so his “sales charges” is actually 2.5%!

That is 150% more than what POSB Invest-Saver is offering which is 1%.

His returns till date is 21.9%.

This is after

- investing at the wrong time

- investing throughout one of the worst bear market in the recent history

You have time on your side. Make use of it

I am not gonna minced my words to please people. Short term anything can happen. For many folks, the thought of seeing their hard earned cash lose even $1 freaks them out.

My friend was in the worst situation. You don’t get a shittier short term loss like him (60% down)

Short term is more or less random; longer term, the odds move in your favor. And very long term approaches 100% positive returns, even after inflation.

“Hold stocks for a year (Wall Street’s territory) and you’re at the mercy of the market’s madness — maybe a huge up year, or maybe a devastating loss. Five years, and you’re doing better. Ten years, and there’s a good chance you’ll be sitting on positive annual returns. Hold them for 20, 30, or 50 years, and there has never been a period in history when stocks produced an average annual loss. In fact, the worst you’ve done over any 30-year period in history is increased your money two-and-a-half fold after inflation. Wall Street would love to think about those numbers. Alas, it’s busy chasing its monthly benchmarks.”

In this total real market return chart for US stock market from 1871 to 2012 (141 years), you will see that on a 1 day, 2 months short term basis, the chance of you earning a positive returns is close to a coin flip.

But as you progress up to 5 years, based on historical, 80% ends up positive.

10 years its 88%. The longer your holding power, your odds get better.

Here is another look.

On a 1 year basis you can get a maximum of 53% returns (wow) or a -38% returns (boo!).

As you go longer, the volatility becomes lesser

Investing a stream of cash flow and being young

To further enhance the case, remember: You are accumulating assets. Would you want to accumulate assets do you want to accumulate them at a cheap price or a dear price?

When your time horizon is 10 years or more, bear markets present opportunities to buy cheaply.

My friend’s return wouldn’t be as great had he just sat idle.

Remember, his highest price purchase was when STI index is at 3800, and after 4 years we have not even cross 3500! Yet his returns are positive!

You are investing a stream of cash flow for a large number of years.

The previous section analyse when your holdings in a particular year will end up positive after x number of years.

But you will be putting money in for more than 10 years.

Assume you put in $100 per month which comes up to $1200 in a year.

If you are unlucky, the first year you get hit by a 80% market decline, your 1200 becomes $240.

That looks really bad, but consider that in year 2, you have another 1200 coming online and investing at a low price.

Even if the market continues to remain low for another 2 years, you end up adding 2400 at a low price.

When market rebounds after 3 years (which is usually how long a long bear market lasts) you end up having 3600 at a really low price and 1200 at a high price.

This is what worked in your favor.

STI ETF have a low expense ratio

There is an annual management fee baked into the STI ETF (don’t worry there is no one time payment, your ETF result already is nett off this management fee)

The fee is around 0.30.4%

Update (24 Jul ’13): SPDR STI ETF expense ratio is 0.3%

How low is this?

A look up of all the leading Singapore Unit trust shows that they are 0.87% upwards. Some even as high as 1.89%!

Why does cost matter?

Imagine that all else equal, the future returns of a unit trust and STI ETF is 6% per annum.

Before you start earning money, the unit trust will have a hurdle rate of average 1.5%. The STI ETF will only have a hurdle rate of 0.30%.

To earn that 6%, the unit trust will have to make 7.5%, the STI ETF will have a hurdle rate of only 6.3%

Now we haven’t add in the sales charges.

The moral of the story is that your 6% earnings is not definite but costs are permanent, and they will affect your returns.

Its not just returns compound, cost compounds as well.

Are you smarter than the market?

There are the smarter folks who think they can be better than the market.

I mean, surely we can do better than a mechanical index that is managed by a machine right?

The truth is that we will suffer from irrational behavior and only a few of us are able to overcome it.

It will be better to do what my friend did, which is ignore the market and diligently dollar cost average monthly into the STI ETF.

And less you think a fund manager can do better, these brightest minds in the US have barely kept up with the index (in this case the Vanguard Total Stock Market is like a US market index ETF)

Since 2004, the hedge funds have shown to consistently lose to the mechanical index.

They have missed this years bull largely because they took the wrong side.

So are you better than these brightest minds?

Your Wealth Building Plan going forward

1. Pay yourself first by allocating to a plan like the Invest-Saver

Plan out your disposable income. Decide before spending how much you can divert to building wealth.

In this case the consistent stream you divert to the Wealth Chest will be invested in Stocks through this Invest-Saver.

You will monthly contribute to Invest-Saver.

After which, then you plan the rest.

So no matter how much you spend, you know that you have already taken care of wealth building.

Here are some articles to help you to plan your money:

- Get Rich – How to pay yourself first: The important first step is to build up your savings. Without a stream of cash flow, you cannot conservatively get rich. Here is how you can build a habit out of it.

- How to create a budget in 10 easy steps: Here is my guide with an overview of why you need a budget plan and how to plan for it.

- How to budget your money well with FREE Mvelopes: Envelope budgeting is one of the best way to plan and control your finances. This is a detail guide how to carry this out.

- Another How To guide to Envelope Budgeting with Quicken: Here is how i carry out envelope budgeting with the very comprehensive Quicken.

- Saving Money – Divide up your savings: Many folks ignore the different horizons you will need your money but instead treat all saving as the same. Here’s showing you a better method.

- Saving Money – Save your increment: What if you want to maintain your standard of living but still want to save, a researcher may have a solution for you

- Saving Money – Your first $100k before 30: Many lament you cannot save 100k before 30 years old. A Straits Times article show you otherwise

2. Focus on the plan and what you can control

Paul Merrimen at MarketWatch is an excellent writer and he provides 12 best retirement lessons. I find No Three particularly helpful here:

Three: I have learned to focus on the things I can control and leave the rest to play out, as they certainly will, in an unknown future. What can I control? Expenses, taxes, turnover costs, diversification, asset class selection, to name a few. Most of the rest of what the media focuses on is only noise.

I can also control (to some degree, at least) my emotions and my expectations and my discipline. I have learned that it’s extremely worthwhile for me to do so.

If you review the Step 1 of your plan you have already:

- Select an instrument that is rather efficient in Expenses, Taxes and Turnover costs that is diversified (it is advisable to have a global world ETF as part of your allocation to be truly diversified)

- You have precommited to dollar cost average before spending into such an investment plan

What you need to take care of are your emotions and expectations.

This sounds easy but essentially its very hard. You will be consistently distracted by news that the market is plunging or the market is doing very well.

Treat this as a savings.

One thing that my friend did very well was that he can tune the noise out and stick to the plan

Once you understand this overall plan, there is nothing much to learn. If you must learn about managing your emotional state.

A lot of people lost a capital that is dearer than money: emotional capital. It stops you from buying low.

Don’t think you are above the average. If everyone thinks they are above the average, then who is below the average?

Read this.

Update [25 Aug 2013]: The market corrects 10% and how do you managed your emotional state? I written an article on it.

3. Get on with life!

The best thing about passive investing ( the methodology of investing by dollar cost average consistently into a mechanical fund that follows an index) is that

- It is a simple plan to understand and execute

- You don’t need to do market research, or crack your brains to time when to enter when to get out

- Pay $5000 for a course that teaches you that

- Spend nights planning your next trade, what to buy and what to sell

Basically, it is about not getting a second job.

Do you want to spend more time

- Performing better at work to get more increment, which in turn divert more money to Invest-Saver to build wealth

- Watching your kids grow up

- Spending time with your elderly parents

- Living life basically

Not all of your $100 will be invested

(Update: 7 Jun 2015)

A reader have kindly updated to me that, under POSB invest saver, they will try to invest $100 of what you put in, but because the $100 partly goes to pay the 1% commission, and that they can only buy rounded units to a certain extend, they will not fully invest the full $100.

Those will be refunded to you. This can be referenced from the quarterly statement. Here is his commentary:

For January 12, the price according to the Quarterly statement is $3.4.

The monthly invested amount is $100. Therefore the fee is 1% or $1.

The units bought is $99/$3.4 round down to 2 decimal place which is 29.11 (rounding is very important).

Therefore they refund us the residual units (0.11 * $3.4) round down to 2 decimal place = $0.37. They also refund us 1% of $0.37 = 0.0037. They will refund us a total of $0.37+$0.0037 (round up to 2 decimal place) = $0.3737, round up is $0.38.

So commission will be $1 – 1% refunded of residual units or $0.0037 = $0.9963.

Transacted price = $100 – Unit Realization $0.38 = $99.62

Commission in % = $0.9963/$99.62 = 1%!

Most importantly we require the price at which POSB bought the units at. It is only supplied via Quarterly Statements.

Summary

I hope this explains the benefits of POSB Invest Saver.

Personally, I really don’t like seeing the propaganda talk that accompanied this by SGX or government sources coming up with articles like this:

SGX Study Says Higher Risk Return Investments Could Bring More Retirement Savings

Nevertheless, some things are necessary evil, and I do view it as such.

I feel that locally, the unit trust that are actively manage seems to do better than a passive mechanical index. Their long term results do show that.

And that 1% sales fee is still not the cheapest.

For myself, I use the Standard Chartered Trading with their no minimum commission, I will be paying 0.256% commission whenever I add the Nikko STI ETF.

Of course at a price of 3.3, the minimum amount that I can add is $330 compared to $100 for Invest-Saver

Hope I went through most considerations. If not do shoot any queries you have.

To get started with dividend investing, start by bookmarking my Dividend Stock Tracker which shows the prevailing yields of blue chip dividend stocks, utilities, REITs updated nightly.

Make use of the free Stock Portfolio Tracker to track your dividend stock by transactions to show your total returns.

For my best articles on investing, growing money check out the resources section.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Jereme

Sunday 6th of May 2018

Hi Kyith,

Pardon if this is a dumb question, but in order to use the Standard Chartered online trading I would need to open a savings account with them right?

Kyith

Friday 11th of May 2018

Hi, the account have settlement account which is like savings account. I think technically you might not need to. It has been some time since I signed up a new account with them so things could have changed

Xin

Friday 1st of September 2017

Hi!

I am looking at diversification for other foreign etfs.

Planning to use the dollar cost averaging strategy, invest $2500 every 3 months to cut down transaction costs($25) to 1%. I understand that us market has a withholding fee of 30% thus am not looking at that for now. As investing in foreign etf there is currency risk as well. Some countries also have certain fees. Hence, i would like to ask if theres any relatively low cost foreign etf that you would recommend?

I am planning to invest for long term of at least 10 years.

I hope to hear from you soon!

Thank you so much!

Warmest regards, Xin

Kyith

Sunday 3rd of September 2017

Hi Xin, if your plan is to accumulate to invest quarterly so as to minimize expenses, you might want to go for a cheaper brokerage. Since your choice is to purchase the ETF on an overseas exchange, than it does not matter as foreign shares, regardless of brokers are not stored in your CDP. There is a 30% dividend withholding tax, and of course some exchange such as USA, London have estate duty/death taxes.

Due to the tax arrangement for the vanguard ETF domiciled in ireland, the dividend withholding tax for the set of vanguard etf listed on the london stock exchange is 15%. There is a 325,000 pounds exclusion on a 40% inheritance tax tough (amount above 325,000 tax 40%)

However you get to access to ishares and vanguard ETF which have low expense ratios.

Another possible consideration is the vanguard ETF in Hong Kong stock exchange. They do have dividend withholding tax but should be exempted from estate duty.

The currency risk.... is subjective. If you purchase a stock listed on the SGX such as riverstone, whose raw materials are in Ringgit and income is in USD, you also have currency risk. The ETF is somewhat the same.

Imagine you buy a ETF denominated in USD that covers only 2 countries Korea and Japan.

You(SGD) ETF Underlying Stocks(Yen or Won)

You have to switch the USD twice. You exchange your sgd to usd to buy the ETF. The manager of the ETF would need to take the USD to buy the stocks in yen or korean won. If USD severely depreciates, your SGD buys more USD, but if all else remain equal, you need more USD to buy the same amount of Yen and Korean won stocks.

So the currency risk is between SGD and the underlying stocks.

hope this help.

Jackson

Thursday 8th of September 2016

Hi Kyith,

Thanks for the article! Was reading through the post and just have this query. For standard chartered online trading, while there is zero commission charges, what happens in the event that the entity is no longer solvent? I am of the understanding that unlike other brokerages, standard chartered does not keep your holdings in a cdp account.

Kyith

Saturday 10th of September 2016

Hi Jackson, Standard Chartered Online Trading have a minimum commission of $10 already. This is a 2016 change. If SCB gets into trouble, theoractically your money is held by a trustee who acts on your behalf. The government can designate another bank or institution to take over. This you do not have a choice.

It should be noted that CDP is only for Singapore based shares. For overseas ones, the custodian is always your brokerages, which is why there are dividend handling fees and custodian fees.

Jay

Thursday 12th of May 2016

Hi Kyith,

Great article! I have a few questions in mind and wonder if you got any suggestions to them?

I am in my mid 20s and have accumulated a portfolio of 40,000SGD worth of Singapore's equities. I am looking forward to starting setting a side of cash per month (500SGD) for ETF investing. There are various options available currently

i.) POSB RSP ii.) Standard Chartered Trading iii.) Standard Chartered Vangard VOO S&P500

My main concern for i.) POSB RSP in STI is not going to provide me any diversification outside of Singapore. The 1% charge is also higher as compared to Standard Chartered.

Concern for ii.) is will i be able to achieve dollar cost average given that if were to invest once every 3 months (1,500). Will this be more cost effective and how will my returns be affected? 1500SGD is able to get me 5 lots. Will it be the same as dollar cost averaging if i were to purchase 5 lots every quarter. Can you let me know how you're investing ETF using SCT.

Option iii gave me the diversification i am looking for but is the FX exchange rate worth it? I was told that SC gave a very poor exchange rating for SGD/USD.

Will be helpful if you can provide me your opinions.

Thank you!

SpringFlower

Sunday 14th of February 2016

Dear Kyith,

First of all, I have to say thanks to this blog. It does give me valuable investment knowledge and experiences that I am grateful for.

I also started my investment with unit trusts but I have liquidated most of them, leaving only one.

It is true that through comparison ETF provides lower costs (vs Unit trusts). In addition, it is again true that I do not have so much time to monitor market movement.

I have some funds in CPF-OA. In view of limited time and financial knowledge. I am contemplating in putting all my CPF funds into STI-ETF and world stock market ETF and let funds grow there.

Would you agree with the above? Would appreciate your views. Thank you.

Kyith

Monday 15th of February 2016

Hi SpringFlower, it is great to know that. I think you will find that the management of such a simple portfolio to be more refreshing. i was about to say its not areally a good idea to have all in sti etf, and you mention world stock market etf. my question would be how to get that exposure with ETF on CPF OA. I do not have a good solution for the currently.