In the short span of 2012, we have seen a large rise in companies issuing perpetual bonds. And it is no surprise that some REITs are starting to take notice of this and look to take advantage of issuing perpetual bonds

What are perpetual bonds

Perpetual bonds are debts that pays a fixed coupon throughout its duration but where it differs from normal bonds is that it does not have a maturity date where the issuer will return you your principle sum.

Because there is no maturity dates, the interest required to compensate the bond holder will typically be higher.

Most of these bonds are callable which means that the issuer can choose to redeem the bonds, pay you back your capital.

Because they do not mature, they can be treated as equity as well.

Recent issues

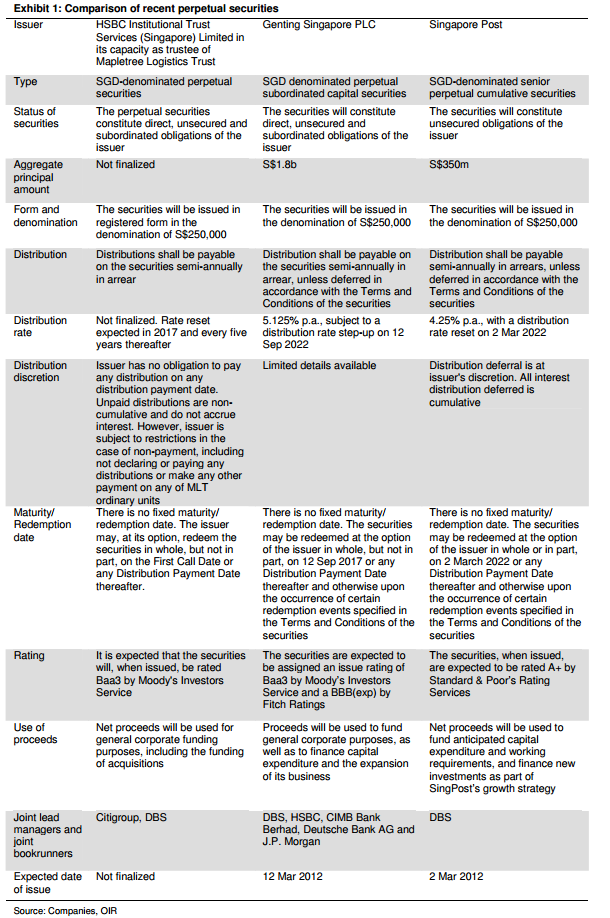

The following table shows a comparison of 2 recently issued perpetual bonds and one REIT Mapletree Logistic Trust who recently decide to explore this form of financing.

REITs can take advantage of the low interest environment

This would be a great time to take advantage of the low interest environment to issue a long or indefinite duration debt. No doubt, the coupon issued is much higher than normal debts, there isn’t a better time to issue a debt with numerous advantages than when the interest rate is at its lowest.

One has to wonder if there are interest expense advantages because Mapletree Logistics trust’s average debts is 2.3% while this perpetual issue would be much higher than that.

Reduces Aggregate Gearing Level

Since this debt can be considered as an equity, the REIT can reduce its gearing level by replacing its debts with this instrument. Interest expense is higher but rating may be improved

Reduces Refinance Risk

In the great financial crisis in 2008, one of the problems faced by REITs is unable to get cheap refinancing, if they can get any refinancing at all.

Having an instrument like this reduces the need to risk refinance at a higher rate.

Callable should interest rate drops further

The issuing REIT can choose to redeem the perpetual bonds if interest rate can get even cheaper and reissue at a cheaper rate.

Not as dilutive versus rights issues and private placements

Private placements and in some rights issues the existing share holders share of profits may be diluted but if perpetual is issued and the pool of equity remains constant, the equity holders interest is protected and they can enjoy roughly the same share of profits with the advantages that come with this form of financing.

Conclusion

I would expect many highly geared REITs to explore perpetual bonds. This dramatically reduces their refinance risks. However, it may not be all good news for existing shareholders because these debts do come in at higher interests which may reduce your share of profits.

I run a free Singapore Dividend Stock Tracker . It contains Singapore’s top dividend stocks both blue chip and high yield stock that are great for high yield investing. Do follow my Dividend Stock Tracker which is updated nightly here.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024