My colleagues Mike and Eddy wrote this E-book called InsureWell for Smart Accumulators to help enlighten Singaporeans about their insurance protection.

You can download the E-book here.

You would need to leave your name and email address before you can download.

The book was ready some time ago, but I decided to share it here today because, coincidentally, I got some private messages or questions about whether:

- Are they adequately insured against XXX?

- Should they get this policy that their adviser recommends to them?

- How much should they insure against YYYY?

Now… these questions came about partly because you don’t have a proper insurance framework.

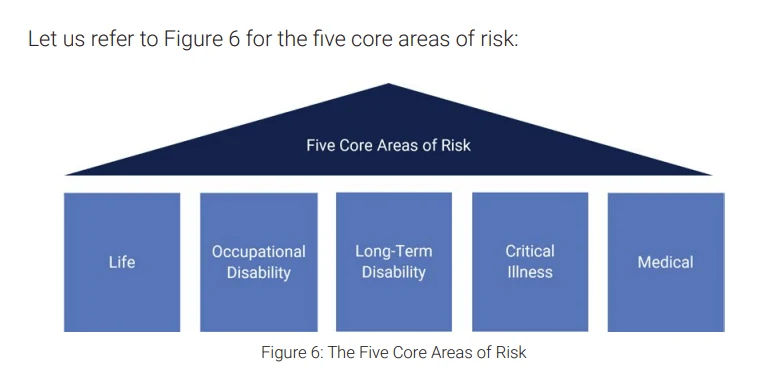

Without an insurance framework, you might not have a clear idea of how all the pieces fit together to protect all your risk areas.

This 60-page E-book is to help mentally shape how you look at insurance. Once you are clearer, then we talk about what to buy or even to buy at all.

The book is less about products but filled with things like the following.

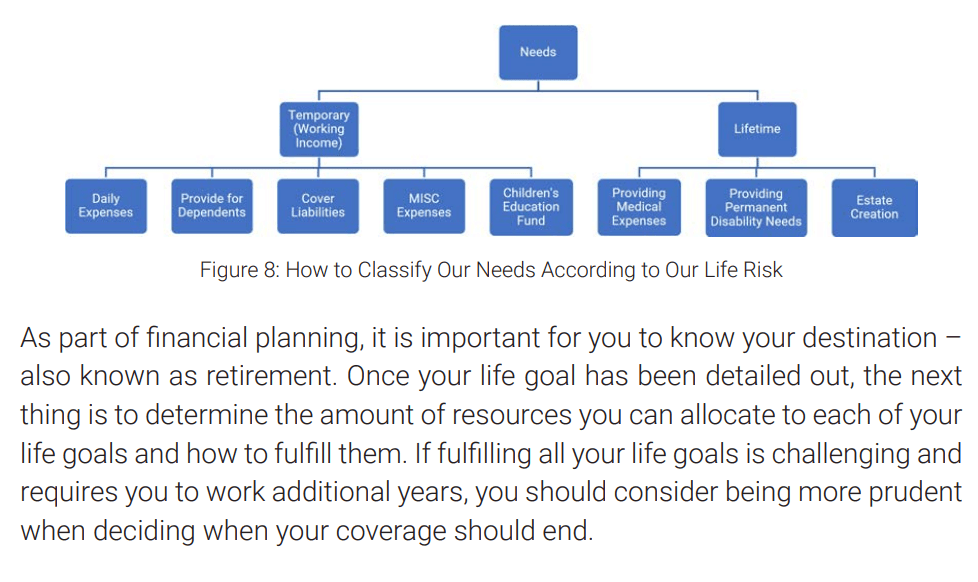

Not all risks last throughout your lifetime and because of that, you may not need to cover them for long duration. But what are those risk areas that are less permanent?

Figure 8 gives you some ideas, and in the book, we further elaborate on that.

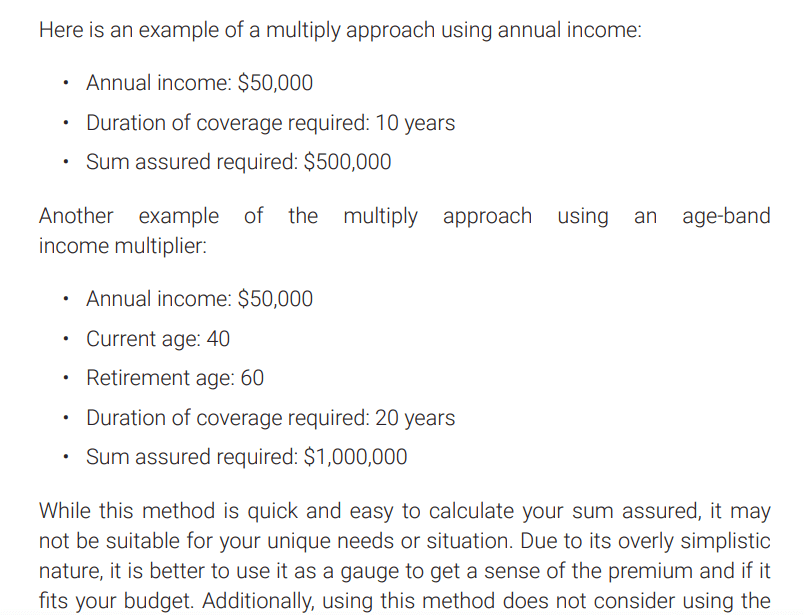

We try our best to use some simple examples to share how you can try to derive your own coverage.

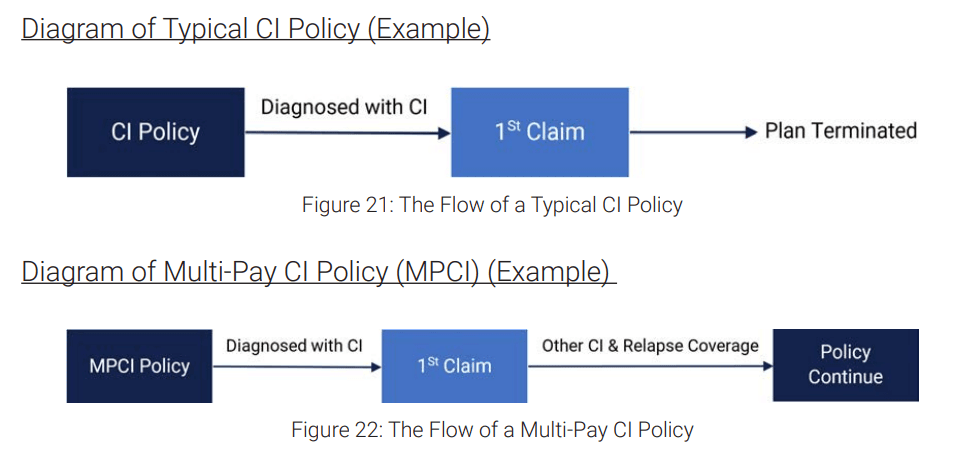

Some of you may have tried to understand some of these insurance stuff and struggled to figure out what are the critical characteristics for a protection category that we need to focus on. If we read an insurance brochure, there is just a bunch of benefits, some which are critical but a lot of benefits that may be thrown in as fillers or to make the product looks meaty.

We hope that this E-book help you pick out these critical characteristics.

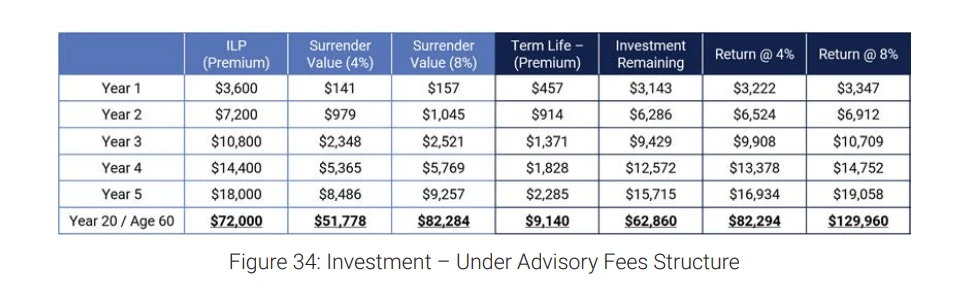

Last but not least, some numbers as guidance regarding how much it cost to protect so that you can frame your decisions better.

Havend Launch Webinar Tonight

Turns out, we will be hosting a webinar to launch Havend this evening (28th Mar 2024, Thursday) at 7:30 pm.

My boss Eddy will be explaining more about Havend.

If you are interested, you can sign up and join the webinar here.

Share the Ebook with Your Friends Who Needs Better Insurance Grounding

Have a read of the book.

If you felt that you have a friend, or many friends who seem to be always buying a lot of stuff, or a lot of seemingly wrong stuff, but difficult to convey insurance concepts to him or her, you might want to try with this book.

But have a read to make sure you kinda agree with our philosophy first.

We Are Open for Business

Just a disclosure that officially, I work for Havend but I am less involved with the insurance part of the business. So it is more like my colleagues dealing with insurance are open for business!

My colleagues Mike and David, our insurance specialists, have started providing InsureWell Assessments to:

- Our colleagues or staff in our sister companies.

- Family members of our colleagues.

- Prospects through our affiliate channels.

In the first phase, we want to take care of the closest people first, and we are ready to take on more.

You have bought a fair bit of policies but deep down, you wonder if you are adequately covered. The right thing to do is to seek advice to gain clarity over your current coverage. However, you are apprehensive to approach certain familiar channels because you are afraid that you would be pressured to buy something that may be less than adequate.

This is the problem we are trying to solve.

A safe Havend to make sure you are adequately covered.

You can fill in the form on our home page (Click on Talk to us today) to arrange for a free InsureWell Assessment.

Disclosure: Kyith works for Havend. He receives no remuneration for posts made aside from the regular salary Havend pays him. The views are his own. Perhaps also some Kopi Peng if they need to bribe him to do something.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Katie

Thursday 28th of March 2024

Thanks Kyith! I've read the book and I personally find it quite well written. Just curious, is Havend "related" to Providend? As in Providend owns Havend?

Kyith

Sunday 31st of March 2024

Hi Katie, Providend at the group level holds both Havend and Providend Ltd. That is the structure.