Ryan Kirlin, head of capital markets at systematic, evidence-based ETF shop Alpha Architect was asked on the Excess Returns podcast Show Us Your Portfolio series about his long-term goals for investing and what he is saving for (5 min 20 sec), and he gave an interesting answer that I would like to share with you.

He explained that we must understand what phase of life we are in.

And the amount of capital determines the phase we are in instead of our age.

If you only have $1,000 to your name, that amount does not matter at all, your priority is to generate $49,000 more or $99,000 more. Your work outside of investments will generate more than many investment decisions you will make.

But even if your capital doesn’t matter, you would have to recognize that you should not make idiotic financial mistakes like taking the money to buy depreciating assets or spending it all on things that have no value.

When Kirlin was 25 years old, he could take significant investment risks, and nothing mattered. Even if he lost all his capital, in New York, they could buy a slice of pizza for $1, and so Kirlin evaluated that in his worst-case scenario, what was the most important for him was to eat. The cost of the most crucial thing in that phase of his life was so cheap that he had no downsides.

Your capital is like a balancing beam.

With more capital, it “tilts” over until the weight of your financial decisions with your capital matters.

Your Life Will Only Change if You Have Accumulated a Sum of Money Significant Enough to Matter

I think what Ryan says makes a lot of sense.

We often associate our life phase with age because by and large because it is natural for us to accumulate a sum of wealth that is significant enough to change our phase of life.

But sometimes, some of us accumulate enough wealth faster or slower than others.

We have prospects in their thirties who just sold off their business and wondered how to look at the $10 million they have at 33 years old.

The probability of a business becoming a success and successfully being sold off is low, but it happens. If so, the amount may be significant enough to change the phase of life you are in not because of the age but due to what the amount of money can buy you.

Some phase of life is age dependent, if you inherit $120,000 at 13 years old, it doesn’t automatically mean you need to become a father.

While what money buys you is an important question, how important is the thing that money can buy vital to you?

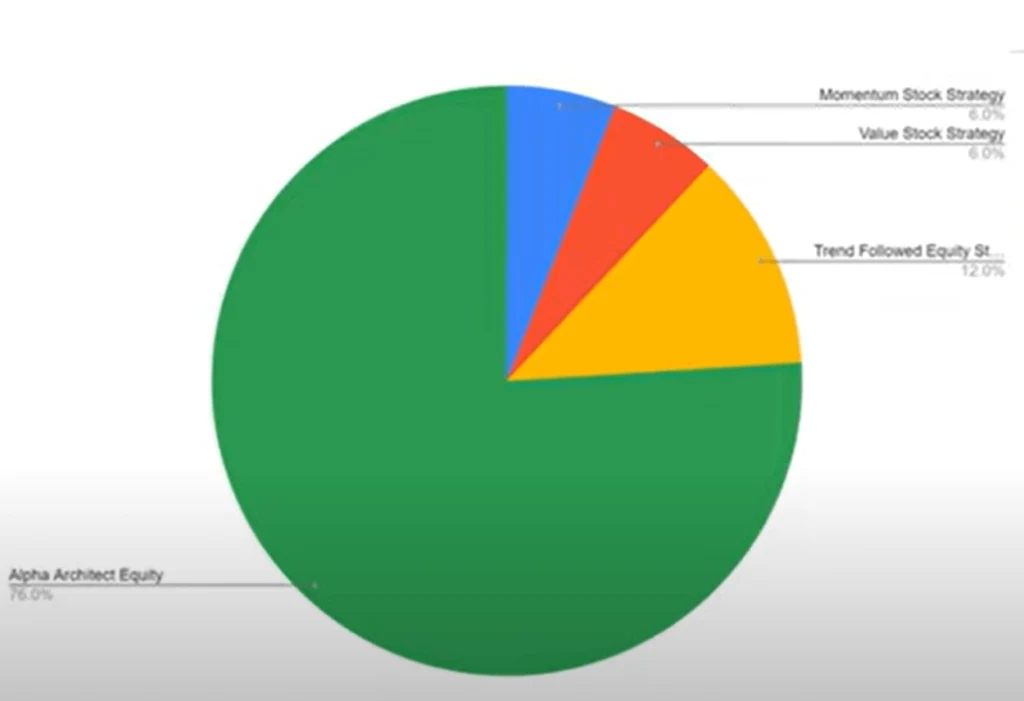

While Ryan was young, he built a sizable amount of equity in Alpha Architect’s business, so much so that it makes up 76% of his net wealth. What happens to Alpha Architect has a greater bearing on how things will go than his momentum, value and trend-following strategies.

In the podcast, the hosts discuss the investment decisions he has to make as a bearing of his large equity position in Alpha Architect’s business.

The amount he has to build up has probably shifted the phase of life to some financial security.

Financial security may be good to have for some who are less financially anxious when young but may be crucial for some with challenging childhood money stories.

If so, we have different degrees to which we can afford to lose what we have.

Some can brush it off easily, but it would be devastating for the financially anxious.

Building business equity, Trend-following and Style Factors

Aside from this, I thought its always nice to hear how someone who works in a factor shop manages his own portfolio.

Ryan shares how he got investing in Tesla right and eventually parlay into a rental property, how they look at trend-following, and why he separates value and momentum as separate strategy instead of using a value + momentum strategy.

When he was young, a higher priority in his financial focus is income and capital growth. Got married two years ago and since then have had a kid. A change in his situation has definitely changed his financial outlook.

One of the early adulting things is to realize the difference before and after getting married and having kids. Before these two milestones, Kirlin mentions that what concerns most of us is whether we can are able to pay rent and buy a slice of pizza but after that cash flow becomes one of the main concerns.

You can watch the rest of the interview here:

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024