Knowing the average return of a particular investment region, asset class or strategy only helps you in a minor part of your planning.

But many of you tend to overemphasize on average returns so much that, the culprit of an overconfident and less conservative plan might be yourself.

Joe Wiggins, who currently work as Director of Research at St James Place and author of the book The Intelligent Fund Investor wrote a good piece about this concept call Ergodicity.

Ergodicity is very related to the topic that average return can mislead your investment decision-making easily.

The main idea behind ergodicity is that there is a difference between:

- The average result produced by a group of people carrying out an activity and

- The average result of an individual doing the same thing through time

Here are a few things if there is a difference:

- One number is bigger than the other.

- The reality may shock you if you expect both numbers to be the same.

- Very often, the best decision takes into consideration Math + Real Impact. Most people may only consider one.

Joe gave us a few examples to understand the difference between an Ergodic and a non-Ergodic system.

Playing A Game of Russian Roulette as a Group Versus an Individual.

If you decide things solely based on math, then you would play a game of Russian Roulette with a group of people:

- You have a gun that holds 6 bullets but only has 1 in the chamber.

- You use the gun to play Russian roulette with a group of 19 other people.

- Each person takes a turn to spin the gun chamber, then hold the gun to your temple and pull the trigger.

- If you are successful, you win $1 million. If not, you die.

- The probability of death is “low” at 17%.

- The probability of becoming a millionaire is 83%.

Playing Russian Roulette in a group is more attractive than playing the game by yourself because if you play yourself, all 20 times the gun is pointed to your temple.

This version of Russian Roulette is a non-ergodic system. The expected value of the group differs sharply to the average of an individual carrying out the action through time.

The average or expected value is deeply misleading compared to your very own experience.

Home Insurance = A Win on Average For the Insurer.

- If we view the expected value of buying insurance as a group, the number would be a negative number. This means on average, we are losing money on buying insurance.

- If we made our decision solely based on math, we would never buy this money-losing proposition because the insurance company is the winner.

- The experience of the group in this case is not important than the experience of the individual.

- What you care about is the impact to your own wealth and the implication if the event befalls you is significant.

Inequality in this World.

- The GDP of a country tell us how the country is doing.

- The number does not tell us about the experience of individuals in the country.

- Wealth may be accumulating in a small selected group while the situation for most are getting worse by the years.

Describing Investing in the Market in a Different Way.

The three examples before help you see the difference between the weaknesses of an Ergodic system.

In real life, the impact of making or losing money will affect us behavorially.

Consider the following game most of us may be familiar with:

- Suppose you have $100 and are offered a gamble involving a series of coin flips.

- For each flip, heads will increase your wealth by 50%.

- Tails will decrease your wealth by 40%.

- Flip 100 times.

- Expected Return of the game: 5%

- In a simulation of 10,000 individuals flipping the coin 100 times each, the average wealth is $16,000. The median is only $0.51. This means 86% of the 10,000 individuals saw their wealth decline.

This game seemingly look like the stock market.

If you are a fan of average returns, then you would play this game.

However, if I describe that there are probability of increasing your wealth AND probability that your wealth would decrease, some would outright reject this game.

But as well look into the math of this game, there is something you should know.

The median player ends up with so little wealth while the average wealth is $16,000. Why like that?

If you play this game, would you belong to the median or average?

Strangely, the game that Joe describes looks like this excess lifetime returns of the individual stocks in the Russell 3000 index. This chart sought to help adjust our lens when looking at buy-and-holding individual stocks versus buy-and-holding the market.

The people who rejected the game are scared. Sometimes scarred by the previous few flips. And that is quite rational.

While the math shows it is positive, the risk of us being the unlucky ones become more and more apparent as we continue to play the game.

Overweighting the Probability of Rare Events with Extreme Outcomes.

A recent paper by Ole Peters and colleagues looked into the individuals who happen to overweight the probability of rare events with extreme outcomes.

Instead of saying that this is an error of judgement on their part, perhaps this is more of a reflection of their greater uncertainty.

These individuals may have less info on uncommon events, especially if historical frequency of occurrence is low. They tend to suffer from over or underconfidence in the assumptions.

We should also acknowledge that if the event comes through for us, we will suffer from the risk of ruin.

What Does All This Mean?

Average is useful to know roughly where returns will be, but you have to acknowledge that we may not earn average returns.

I have a page where I consolidate 10-year, 15-year, 20-year long term returns. You can view the long term returns here.

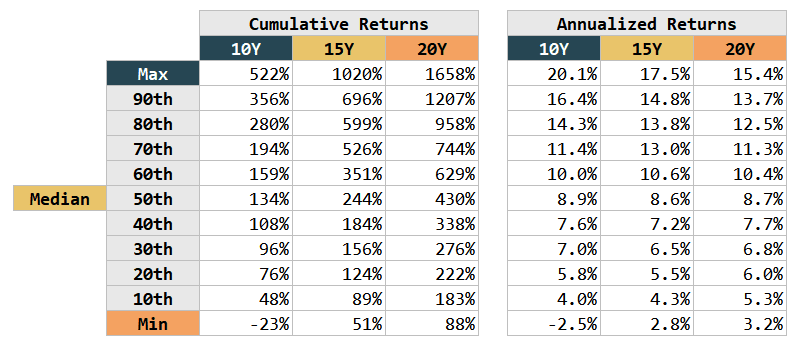

Let me share the MSCI World data here:

Cumulative returns are unannualized return showing how much compounded returns you can make if you hold for 10, 15, or 20 years. The median returns are pretty good at around 8.5%.

However, you may get 14% a year for 15 years if you are lucky but you are also likely to get 4.3% a year for 15 years if you are less lucky.

Remember that I said the best decision is a combination of Math + Real Impact.

The table above shows you the real math. But what is the real impact to your plan?

If your financial goal is really important to you that you cannot have a single cent less, maybe it make sense to respect that you can be unlucky and plan by setting aside more capital for your financial goal.

- If you are lucky, your plan works and you may be able to harvest your money earlier or divert extra money to your financial goal.

- If you are unlucky, your plan works because you accounted for this and while your investments are disappointing, you can still achieve your financial goal.

High returns doesn’t always mean that your plan will work. Psychology plays a big role in that high returns would often come with high volatility. Refer to the coin flip game.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- Singapore Savings Bonds SSB August 2024 Yield Fell to 3.22% (SBAUG24 GX24080W) - July 1, 2024

- Five Years. - July 1, 2024

- Knowing the Average Returns of Your Investments Does Not Help You (Part 3) - June 30, 2024

lim

Sunday 30th of June 2024

For the game where tails lose 40% and heads gain 50%, this is just trying to trick people not good at maths with percentages. As the saying goes, if you lose 50%, you need to earn 100% to break even.

On the other hand, if tails lose $4 and heads gain $5, definitely you should play.

Kyith

Sunday 30th of June 2024

Well, the idea is that if there is some possible losses, it will affect whether people will play the game or not.