Local broker Moomoo SG recently came up with a U.S. Treasury Trading feature on their platform.

With this feature, we can focus on and trade US Treasury. Trading US Treasury is not a revolutionary concept; you can do the same on other trading platforms.

Some of my readers have told me they saw a benefit in investing in the US Treasury directly a long time ago, but I have such a hard time finding the securities that are available for me to purchase and executing the purchase (I have since managed to locate the US Treasury securities on the said platform.)

This US Treasury Trading feature of Moomoo allows us to:

- Review a curated list of US Treasury bills and notes available for purchase. Twenty-plus such US Treasury securities are currently available for trading through the platform, with more being added monthly.

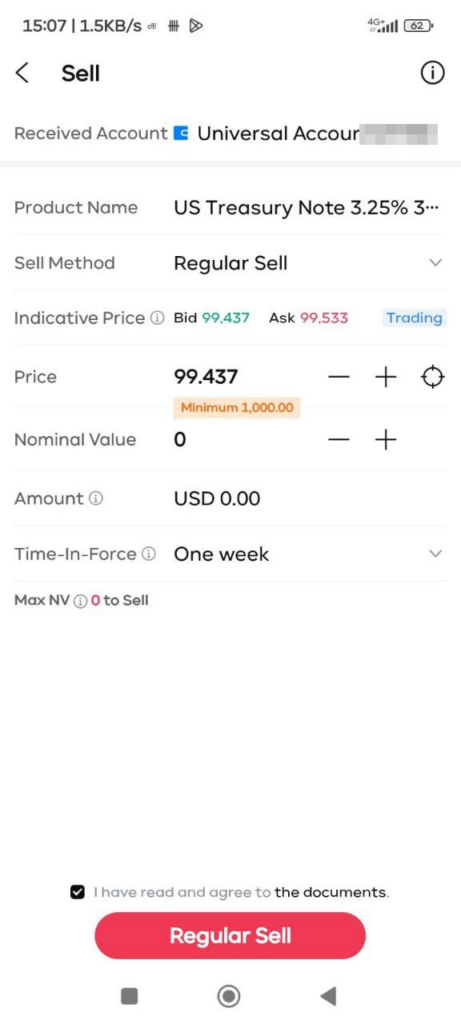

- Since Moomoo is a trading platform, you can sell your bond (with the prospect of capital gains or losses) if you need to have liquidity.

- The minimum platform fee for trading on Moomoo is $2, with a maximum platform fee of $15. Between that, the platform fee in percentage is 0.04%. There is a custody fee at an annualized rate of 0.08%. For the time being till the end of September 2024, the commission cost is zero. The minimum commission is competitive, but unlike other platforms, Moomoo charges a platform fee and custody fee instead.

- Convert your SGD to USD at reasonable rates.

- The minimum capital you can buy Treasury is US$1,000. You can increase your Treasury investments through multiples of US$1,000 increments.

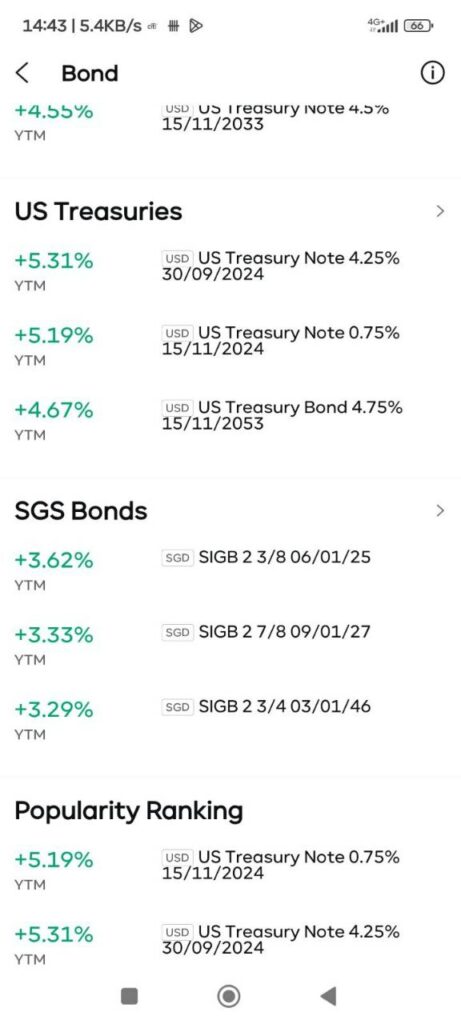

Aside from US Treasury bills and notes, you can also trade Singapore SGS bonds on the Moomoo platform. This means that you can purchase and hold SGD and USD government securities on Moomoo.

Now, I got curious why we would be interested in investing in USD-denominated government fixed income when we can invest in SGD-denominated fixed income or a portfolio of fixed income using unit trusts or exchange-traded funds (ETFs), until I realized that this fixed-income trading feature may not be just for Singaporeans.

There are a few reasons why wealth builders in this region (and the US) are interested in investing in the US Treasury, and I am going through a couple of them.

Investors Own USD and Think that US Treasury Is Safe

One of the main reasons you would be interested in investing in the US Treasury is that you have USD and would like to invest in something safer where your capital is protected.

I was asked by my readers on and off about my thoughts about investing in the US Treasury.

If you invest in the US Treasury, you are investing in another country’s government fixed-income. There are different degrees of credit and term risks.

The US is an economic powerhouse. Its currency is currently the reserve currency, held by various central banks and international entities for global trade. The Singapore dollar is very strong, but many wealth builders feel comfortable holding some of their money in USD.

The United States currently have a credit rating slightly lower than Singapore.

Many wealth builders speculate on when they will invest in equities and wonder how to store their “war chest” safely yet earn some returns.

Some parents who send their children to the United States to study may also want their money to be invested safely.

Investors Want a Decent Return.

Direct, individual fixed income like the US Treasury is ideal because you will get your principal back intact at the end of the tenor if the issuer (in this case, the US Government) doesn’t default on the debt issue.

This is referred to as credit risk, which is the risk that the issuer will default (not pay you back the principal or interest).

Getting predictable coupons and principal returns through direct, individual fixed income allows people to have visibility and plan with reasonable peace of mind.

Some choose to seek higher fixed income by investing in bonds issued by listed business corporations or even unlisted ones. The returns are higher, but if they are priced efficiently, they also mean there is a risk the bond issuer will default on the coupon and principal repayment.

A wealth builder can earn higher returns by investing in longer-tenor US Treasury notes because the yield-to-maturity of longer-tenor notes is higher than shorter-tenor bills and notes.

This is referred to as term risk, which is the risk of losing out to inflation or another benchmark for staying invested in a lower-yielding fixed income when a new fixed income issue has a higher yield-to-maturity. If the current market interest rate rises, new fixed-income issues today will have a higher yield. The yield on the fixed income you currently hold, all else being equal, will look less attractive and therefore, the price will likely drop due to market forces.

You should remember that while the price of your bond can fall before the tenor’s end, the price will eventually go back to the original value at the end of the tenor, and your principal will be intact. Many wealth builders are thrown into confusion by the constant mass media bombardment of the risk of investing in bonds when interest rates rise. If you held a 5-year US Treasury Note till maturity and the note issuer does not default, you get back your principal and some coupon returns. What you “lose” out is the opportunity cost, and your money could have worked harder.

US Treasury bonds of different tenors can be ideal to help you meet your financial goals. For example, if your daughter requires USD monies in five years’ time, you are unwilling to risk the money by investing in equities. Whenever you have the money, you can purchase US Treasury bonds that will mature almost before the financial goal because the market is so liquid that there are many issues with 5, 4, 3, 2, and 1 year tenors.

When the Fed hiked the short-term market interest rate rapidly to its current level, the entire yield curve took some time to shift up.

The chart below shows how the US interest rate yield curve looks like currently:

Gone are the days when bond investors did not get decent compensation for the risk they were taking with fixed income. Whether it is a short-term or very long-term fixed income, yields have “reset” to a more decent level.

This makes US Treasury bills and notes look more attractive because of the high returns and certainty that they can get from them, helping them fulfil their financial goals.

A review of the new curated US Treasury feature will show you a series of Notes that mature at different time frames (the date at the end shows when the note will mature) and their current yield-to-maturity if you buy them at a price near the midpoint.

How You Can Purchase US Treasury Easily on the Moomoo Platform

I managed to purchase a US Treasury Note that matures in three months’ time with a Yield-to-Maturity of 5.2%. That yield looks tempting, but yield-to-maturity is quoted as an annualized yield, and since the tenor of this bond is just three months, my actual return is lower.

Firstly, you can find a curated list of bonds under Wealth and then the Bonds tag.

You will find bonds grouped appropriately. Touching on US Treasuries bring you to a larger list of fixed income securities.

If you review each US Treasury, you can see the yield-to-maturity you can earn (annualized) if you try to buy at the bid, or ask, or the fast bid, or fast ask.

You select Buy if you wish the system to put in a regular buy where you can queue at a price you desire to buy and sell at. Depending on the liquidity and market making, it might take some time before your order is clear or your order might not be cleared at all.

You can select Fast Buy, which is somewhat equivalent to an execution at the market price. This is an option you select if you are fine with the yield-to-maturity, less concern about the price and want to be done with it.

If we study the bid-ask spread, we are talking about a minor 0.04% difference. We should optimize our cost but at the same time, we should also not let basis points worth of cost difference from making our lives easier by just executing and securing the Treasury.

If you have reviewed enough and would like to make a trade, you can go to Accounts > Transfers and Exchange to exchange your SGD for USD because US Treasury are denominated in USD and you will need enough USD to purchase.

If you do not have enough USD, moomoo will treat you as on margin.

Out of Regular Buy and Fast Buy, I decided to use Fast Buy as the yield-to-maturity difference is not too significant.

After reviewing the trade options you selected, click confirm, and you should be good to go.

If you need liquidity, you will also have the option to sell the US Treasury bill and note you hold.

Now, let us go through some potential questions that you may have about buying US Treasury Bills through Moomoo.

Any Potential Tax Implications for Singapore-based Investors to Take Note of When Buying US Treasuries?

You might be curious about what kind of tax implications you would face when investing in US Treasuries. Would you be subjected to the same withholding tax and estate tax challenges as other US assets?

My article may reach Singapore-based investors with various nationalities. Some are tax residents in Singapore, but others are domiciled in another home country (despite working here) or are subject to a world-wide taxation system.

Tax issues can be complex for some, and if you are unclear about your personal situation, you might want to seek the help of a qualified tax consultant.

- You need to know your tax jurisdiction first and foremost.

- US Treasury are bonds issued by a US issuer and are subject to US tax laws.

Generally, for non-U.S. Person investors, interest earned on bonds and commercial paper issued by U.S Treasury or by US government agencies are generally exempted from U.S. tax withholding taxes if the interest qualifies as portfolio interest.

While U.S. Assets owned by non-U.S. Person investors are subject to 40% estate tax after the first $60,000 is exempted, U.S. Treasury bonds and corporate bonds of US publicly traded companies are exempt from estate tax.

Thus, most Singapore-based investors, aside from US persons, should be able to invest in Treasury with a peace of mind there.

The US Treasury Rates are all trading higher than Singapore’s government bond rates. Does it Make Sense?

At first glance, investing in US Treasury Notes will net us a higher return than investing in Singapore Government bonds.

You may be wondering, isn’t this a no-brainer kind of investment decision?

Aside from the credit risk of the US government compared to the Singapore government, you are also taking on currency risk when you invest in a fixed-income instrument denominated in another currency.

If you invest in a Treasury Note that matures in five years and US dollar is significantly lower, your fixed income investment will be lower when you convert back to Singapore dollar eventually. However, if you have a use for US dollar (if you have done some decent financial goal planning), then you do not suffer from such risk, except that due to the weakening of currency, the goods and services you would like to purchase will adjust its price upwards to compensate for the losses. This will impact your original investment goal because you may not have enough money eventually.

There may not be any significant difference when we invest in the higher yielding Treasury Note because we likely lose out in terms of a weaker currency when we convert. There is a Uncovered Interest Rate Parity (UIRP) theory that says the difference in the nominal interest rates between two countries is equal to the relative changes in the foreign exchange rate over the same time period.

If this theory is in play, then a wealth builder won’t be better off investing in US Treasury compared to Singapore government bonds. According to the MAS, the UIP relationship for Singapore has been corroborated in several empirical studies. In practice, the Singapore dollar interest rates have tended to be at a discount to the US dollar rates given market expectations that the Singapore dollar would appreciate against the US dollar.

Invest in US Treasury Bills & Notes with Moomoo Today!

From short-term, or intermediate emergency fund, to match the longer-term, conservative university tuition fee needs, there is no shortage of use-cases for us to make use of US Treasury.

Cash is currently not trash at the moment and if you are risk averse, then give moomoo a try, get used to it and next time you can have a platform that you can regularly buy and custodies your assets at.

It helps that the process to transfer to and from moomoo is seamless and fast. Moomoo has manage to craft a dedicated section that makes owning bonds more as a “buying” action than “trading” and this will help if you are a novice, risk averse investor.

You can start trading US Treasury bonds today till 30th of September and enjoy zero commission when you trade direct US and SG government securities.

If you have not signed up for an account with Moomoo SG, you can consider signing up now and try out their platform to get welcome rewards up to S$990.

I will help you breakdown what you need to do and the rewards that you can earn below:

You can use my moomoo referral link here if you are willing to give it a try.

All views express in this post are the independent opinions of Investment Moats. Neither Moomoo Singapore or its affiliates shall be liable for the content of the information provided. This advertisement has not been reviewed by the Monetary Authority of Singapore.