One of my readers informed me that if I want a good ‘value’ factor fund that keeps up with the index during these challenging times, I have to take note of the Pacer US Cash Cows 100 ETF.

That ETF is represented by a very nice ticker called COWZ.

And if I want an ETF that sub-selects from the small-cap space, they do offer a ‘smaller’ cow called CALF.

ETF Stream has announced that Pacer have listed three UCITS ETFs in Europe: the COWZ, ICOW and GCOW.

They are listed in the Dublin and Netherlands stock exchange and not London Stock Exchange.

I tried to see if the tickers are available on Interactive Brokers, but unfortunately, I could not find them. That is quite a bummer.

Here is a quick summary of the three ETFs:

I missed out on the total expense ratio of COWZ which works out to be 0.49%.

The benefit for international investors of the UCITS version is that they would be more withholding and estate tax efficient. Unfortunately, you would have to find a broker that allows you to trade at the Irish and Netherlands exchange.

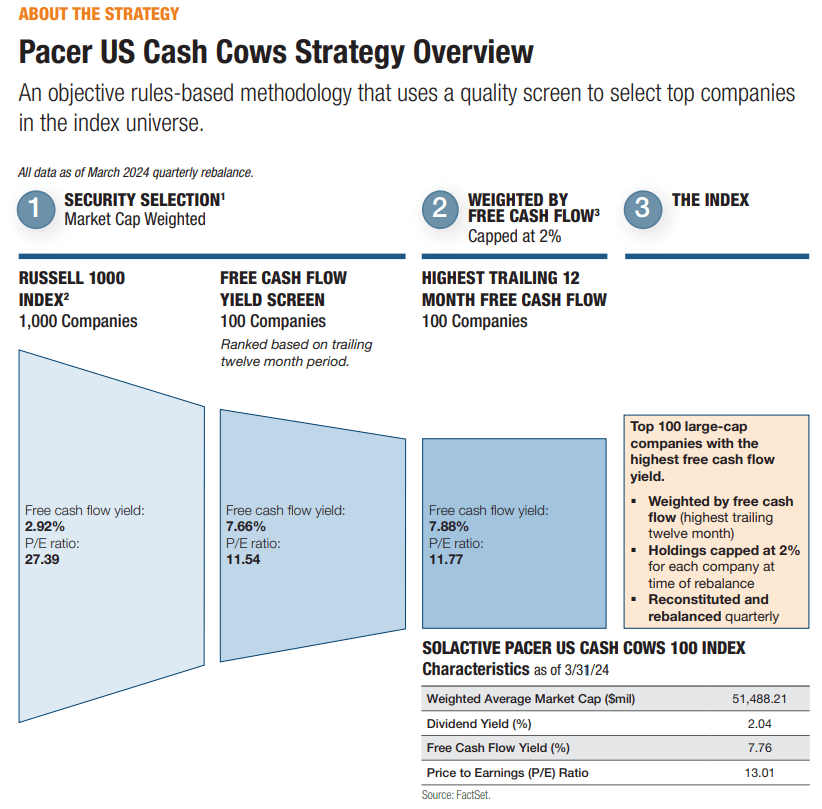

These PACER ETFs are considered as systematically active ETFS.

How would I explain them??

If you are a stock investor, you may have heard of this investor called Warren Buffett. He invests through this company called Berkshire Hathaway. Many of us learn from him that we should look for companies that give good recurring owner’s earnings.

This is the cash flow earnings a company earns after paying off the maintenance capex.

Many of us know this as a cash flow call free cash flow.

If you identify with the concept, you would try to find company that

- Has recurring free cash flow.

- Trades at a reasonable to cheap price to free cash flow.

You can attempt to do that on your own.

Or is there a solution that systematically executes this without you doing it?

PACER tries to implement this.

Take the case of COWZ which draws from the Russell 1000 group of large cap US companies. You can see the average free cash flow yield of the companies and the price-earnings ratio. They rank the 1,000 companies based on the free cash flow yield of the trailing 12-month period and select the top 100. The free cash flow yield is higher at 7.66% and they are also cheaper with a PE of 11.5 times.

Then Pacer weights them based on Free Cash Flow.

They systematically do this every quarter.

The top sectors doing his ends up with 23% in energy and 18% in consumer discretionary. Financials and REITs are omitted from the Free Cash flow ranking. So are companies with negative free cash flows.

You may identify with such a strategy and systematically active ETF performs this.

I thought a “flow” type of valuation strategy, compared to a “book value” type, would result in more profitability-based companies but turns out Information Technology is not so high.

Here is COWZ performance against the Dimensional US High relative Profitability mutual fund, Vanguard SP500 Index Fund and WisdomTree US Quality Dividend Growth Fund:

Performance is pretty good. I would say… with an UCITS options, we have another good quality/profitability implementation if you would like to express similar investment philosophy.

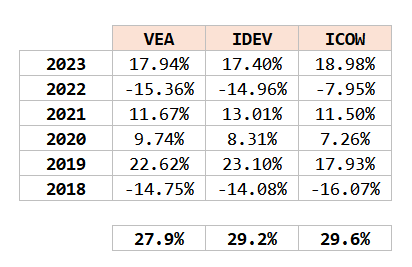

I also compare ICOW’s performance against two developed markets ex US ETFs (VEA and IDEV):

Overall, the performance have kept up despite value companies not doing well during this period.

I think we will take note of PACER and its suite of ETFs in this space. It is good that more managers are cross listing their funds over in Europe.

Just hopefully they are available on Interactive Brokers.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- What is There to Like and Dislike about Interactive Brokers Desktop - June 21, 2024

- Is Market Index Concentration Good or Bad for Index Investors? - June 18, 2024

- Now You Can Trade US Treasury Notes & Bills on Moomoo SG - June 15, 2024

James

Wednesday 12th of June 2024

Hi Kyith,

Thank you for the write-up. Does GCOW UCITS comes with a dividend distributing version?

Kyith

Friday 14th of June 2024

Hi James, unfortunately there don't seem to have one.