I started work after we came out from SARS in 2004. So I have been through the mental aspect of not knowing if you have a job when you graduated from university.

2008 was different in that I was already working but in my old company, the email will announced new hires every week.

This COVID-19 thing is a bit different. Not sure if it is because as an almost 40 year old, there are more people being furlough or retrenched.

I have not been retrenched before. Friends have shared with me that my old place is an iron rice bowl.

In the current workplace, we are doing OK, at least for now.

I am not going to be that guy to tell you what you should do.

I have read a few stuff out there and while they point you to resources such as the Ministry of Manpower, what are your rights, where to get support aid, they do not show you money-wise how you should pivot.

I came across some of these stuff in podcasts in the past. I think they might prove useful for you at this time.

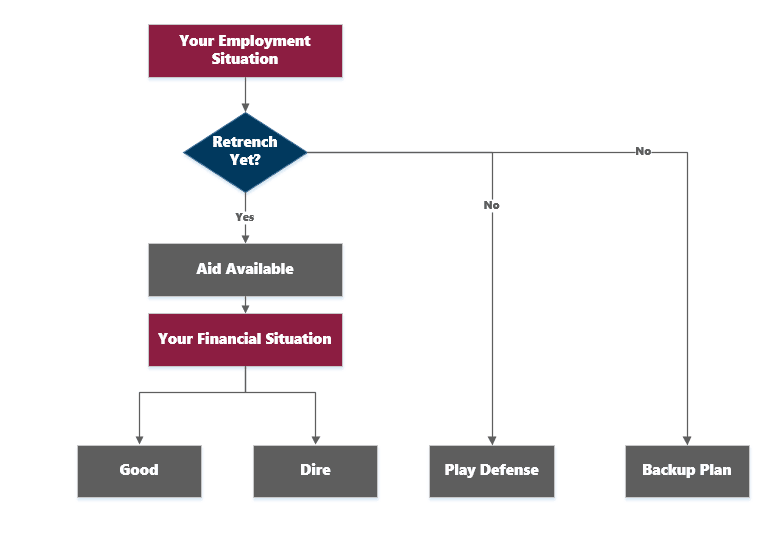

- A part of the content explores what you should do if you are laid off.

- There is also the part of the content where you are not laid off but you need to fortify your work position.

- Lastly, there is a little bit exploring about coming up with backup plans

Let’s minimize on flowery words and get straight to the content.

1. Take Stock of Your Current Situation

Which direction you should take, the urgency of how you should perform things, will depend on how great or how dire is your current situation.

Here are some things that you need to evaluate:

a. Evaluate Your Employment Situation

Do a cold, hard evaluation of your work situation by answering the following questions yourself:

- Why were you laid off?

- Are other people laid off during this period as well?

- Was it due to performance?

- How is the job market like out there for your scope of work?

- How valuable is your experience versus how much people are willing to pay you?

Figuring out and answering the questions above would enable you to know the kind of jobs, the companies that you should look for, how in-demand are you in this market and how many people you are competing with.

b. Find out What Kind of Aid is Available to You

In this special situation, the government is providing many aids and deferment that will help your cash flow a lot.

They include the following (but it is not an exhaustive list):

- If you lose your job a one-time $500 payout and 3 month cash grant of $800 each

- Defer income tax payments for May, June, July for 3 months

- $600 to $1200 for Singaporeans depending on your situation

- Service & conservancy rebates

- Suspension of student loan payment for 1 year

- Suspension of late payment arrears of mortgage for 3 days

- 3 quarterly payout of $3,000 for self employed if you previously earned money but no more than $2,300 and that you earn less than that

I do not wish for this guide to dwell specifically on COVID-19 aid, so you can check out these resources:

If you are a Singaporean, PR or Long Term Pass Holder, there are various degree of deferment of cash payout, rebates given.

c. Evaluate Your Financial Situation

Most of us as salaried employee have only one cash flow: Our income from work.

When we lose that sole source of cash flow, we get into trouble because everything depends on that sole source of cash flow: Our family’s expenses, our mortgage, our retirement savings.

The name of the game is to get cash flow from anywhere in the most prudent way before you secure another job.

But before that you need to figure out a few things.

This can be done by answering the following questions:

- How much is your Core Expenses? Your Core Expenses are your most essential expenses plus some less essential expenses that help you maintain the morale of daily living. (You might want to read this article about the essential expenses in my life as a guide)

- For each category of spending how different is your current spending versus your Core Expenses?

- How much of a financial runway do you have? These are your financial assets that would be able to cash flow in challenging times

- Your emergency fund size

- Your liquid investments

- Policy loan availability from your cash value insurance plan

- Balance Transfer from banks

- Line of Credit on Your Home

- CPF Ordinary account for mortgage payment

- Note: Policy loan on insurance, balance transfer from banks, line of credit on your home has inherent risks if you do not know how to use them well. Learn about all the risks and scenarios they could cause more harm to your financial situation then help you.

- Calculate Based on your current spending, how many months you have before you need a job

- Calculate Based on your core expenses, how many months you have before you need a job

- What is the sequence to cash flow your existing assets? You might wish to take reference from this:

- Interest / Dividend / Rental Income

- *Use CPF OA to pay for mortgage

- Cash set aside as emergency fund

- Policy Loan from cash value insurance plans

- Balance transfer from Banks

- Line of Credit on Your Home

- Liquid Investments

- Borrow from Friends and Family

- Sell your residential property

Here are two examples to compute how long of a runway you have.

John previously spend $6,000 a month for a family of 4. However, the family’s core expenses are about $4,500 a month.

After factoring the financial aid and deferrals provided by the government in the previous section, the $4,500 will be cut to $3,400 a month

If John lines up his assets in terms of interest + dividend income, CPF OA to pay for mortgage, emergency fund, liquid investments, he has a total of $150,000.

John’s assets at this point gives him $150,000 / $3,400 = 44 months in runway. He can sequentially cash flow his financial assets.

He has 44 months to secure another job.

Mary on the other hand spend $10,000 on a family of 4. However, Mary believes the family’s core expenses is $9,000 a month.

After factoring the financial aid and deferrals provided by the government in the previous section, the $9,000 a month is cut to $6,000.

If Mary lines up all her assets, her assets come up to $50,000.

Mary’s assets gives her a run way of 8.3 months.

While Mary earns more, her situation is more dire. While John does not wish to liquidate his assets, technically he has a longer runway.

d. How Optimistic or Challenging is Your Situation?

Depending on your work situation and finance situation you are either

- Have runway to secure a job

- Do not have enough runway to secure a job

- Absolutely dire situation

Your reaction would determine where you fall in those three branches.

We will first discuss #3, where your situation is a bit extreme. You have nothing much saved up.

2. What You Should Do If Your Situation is Quite Bad

You have not planned well.

Your Posture:

- Need to take drastic steps

- You cannot be wasting any of the resources.

- Conserving as much as possible

There was a couple who got laid off in 2008. They took their time to enjoy this period and were less active in searching for job opportunities. By the time they got serious, their skills have atrophied, personal network have grown stale. Their confidence was shot and were forced to apply for jobs vastly below their last jobs.

a. Focus on Staying Busy

The more time you spend out of work, the more employers look at you as “damaged goods”.

Have some kind of job. Look for work like you mean it.

Tuck in the pride and request friends, former colleagues and family members for help:

- LinkedIn or Facebook

- Tell them you are looking for work and if you know of opportunities do let you know

- Tap your network of Alumni, Churches

Employers also have a hard time filling positions because candidates not often work out. They will prefer to work with people they are familiar with.

b. Cut Your Expenses

Suppose you spend $6500 the last month and you have $10,000. This amount would only last you one month plus.

However, if you cut the expenses to $3500, this amount will last you 2 months plus.

Cut the expenses to the essentials.

Even among the essentials, there may be an order of priority if you have limited money:

- Feed yourself. You cannot do much if you are hungry.

- Feed your spouse & your children.

- Provide basic utilities in life. Electricity, water, gas. Don’t get them turned off. Very low morale if you cannot call out, always staying in a dark room

- Must be able to move around. In Singapore, at least need to have basic transportation

- Maintain a roof over your head

Assess your credit card and bank statement.

Put every bill payment to manual paying. This is because in normal life, you subscribed to a lot of less essential stuff. After a while you would also not remember subscribing for them.

By putting your payment to manual, you can act as the firewall to control what gets paid and what will get warning letter.

Make the strategic and hard decision earlier, before you need it. Again those controversial fixed spending comes into the picture. If you wait until things get grave, whether you make those hard decisions or not may not matter much already.

i. Cutting down on Food

Remove the expensive food from your diet.

Cut out the take-outs and delivery.

Try to stop spending on people cooking for you. Cook for yourself. (Kyith: This might not yield that much difference in local context because the cost of cooking for a couple might not be that much lower than hawker food. But you can try once to see if it is cheaper.)

Fill your meals with the staples such as rice, beans and wheat. If you have some health condition that you cannot eat too much or these things, replace them accordingly.

Do not eat high excess amount of food. During normal times, you might be indulging in more than a normal portion for food. In tough times, you cannot indulge in larger portions, higher frequency.

However, it is important to make sure everyone do not go hungry.

ii. Control Your Transportation Cost

You need to get around.

But you may have more time than in the past. You do not need to save time. You just need to be on time. Public transport will do.

As to whether you should sell off the vehicle, it will depend.

In some climate, especially in this time and age, you can make use of your vehicle to make a living. That may cover the cost.

However, if you are not able to do that, the next thing to try is to negotiate with the bank when it comes to vehicle financing. Negotiate for only interest only payment, longer payment tenure.

If you wish to improve the cash flow can try to sell off the vehicle at the best price you can get.Don’t have to think about what happens

iii. On Utilities

Optimize your family usage. Don’t indulge in long baths. If you are not using some of the things, switch it off.

Be mindful of those things that requires a change in temperature (boiling water, refrigerator, air condition, heater). They use the most electricity.

Endure and optimize them.

For phone plans, you can switch to a more optimize one. Personally, I am on Giga’s $10 a month no contract plan that give 5GB, 100-minute talk time, 100 SMS a month.

It is not excessive and it should be enough.

c. When Supply of Manpower in Your Industry Outstrips Demand

There comes a time when there are so many people looking for work and so little firms offering it.

In this case, you might really need to look at job posting that requires you to be based overseas.

Not everyone is in a situation to be able to go overseas. So those who are nimbler will have an advantage here.

The cost of starting a business selling goods or service is lower now.

In this situation, you might need to consider hustling in entrepreneurship.

3. What You Should Do if You Have Gotten Your Finances in Order

You have planned well.

Your finances are in pretty good shape. Admittedly, your portfolio might not look as good versus six months ago.

What you need to do is to put some of the plans in motion.

a. Kick Start Finding Work

You have not reached your financial goals yet. There are still people you still need to provide for.

It is time to let those folks you have previously work in the industry that you are available.

Have a daily routine to ensure you have at least some semblance of work life. Treat your job hunting as a project.

b. Take a Break

This option is for those of you who have slogged for a large part of your working career and that you have built up your wealth.

You have always said that you could not catch a break and that the job demands a lot from you.

Now that you have been laid off, you can take the break that you always wanted because you have prepared well for it. Take this period to experience how an extended period of no work feels like. This will have prepared your philosophy towards retirement.

4. What You Can Do if You Are Not Being Laid Off

While you may not be furlough, laid off, depending on how well your company is doing, you might need to make sure you are not the next one being asked to leave.

Here are some things to think about.

Your Goal: You do not want to be fired from your job

The General Approach You Should Take: Be the most valuable employee in the company.

Do a Cost-Benefit Analysis of your Current Job. Carry out an honest assessment of your job prospects (This seems to be raised up again and again).

- Evaluate if you are an expensive salary for your company

- Are you an older and relatively expensive employee?

- Are you an employee that is bringing in revenue? Sales people bring in the money and tends not to be the first to be fired

- How is your performance from the eyes of the company? Generally, company will cut the poorer performers

- Are you in an industry that is struggling or doing well?

As employees, we need to focus on creating value for the company AND showing this to the company.

The company you work for needs to survive or be positioned to emerge from this challenging phase better than competitors. Help your company do that.

At each level of the company, there are certain KPI that your bosses need to fulfil so that overall, the company progressed forward. Your job is to help your boss fulfil those KPI so that your boss is satisfied, see that you are providing value and that you are dependable. Make their life easy.

Recognize that you are collaborating your fellow employees but also competing with them. Outwork your fellow employees. This may not be so difficult because the average employee may do unproductive things, skive at the office. Most people don’t work all the time, so if you are more productive versus them, you have an edge.

If you feel that you care less about, feel less enthusiastic about, consider whether it is better to change. If you are trying to steal time from the company at work, that may be an indication that you are feeling it.

While working hard can be painful, being unemployed could be more painful for a lot of people.

One of the metrics that some bosses noticed is the little urgency in different employees. A good example is the urgency at walking, getting some mundane things done. Keeping your desk clean and keep yourself well groomed.

Make people around you better. Build the old boys or old girls network, which will come in handy when things get desperate.

The way you work, and carry yourself is an advertisement for prospective employers. Prospective employers are your clients, users, suppliers you interact with. People wish to bring in good, competent people into their firms, especially those that they are comfortable working with currently.

5. If You don’t think You will be Laid Off But wish to Make a Backup Plan

Some of us get lulled into the mode where we think it will never happen to us. However, there are some who are affected enough to be aware that they should count their blessing it has not happen to them.

But they should at least have prepared for it.

So this is a little bit of help how you can prepare for it.

Why would you consider doing this in the first place: Even if you tried your best, there are some things that are not within your control.

The Right Approach to Take: Be a risk manager. Think defensively and create defensive plans. Be ahead of the trends. See ahead.

People in stressful professions such as firemen, police and military tackle this by mentally and physically rehearse the scenarios that can happen. When those situations happen, there is less shell shock, actions can take place.

A good example is a couple who were in sales devastated by a job loss. For some reason, the couple lost their job. But they didn’t overcome the ordeal of the loss and so contingency actions such as rationalizing their expenses were not done. Part of the reason was the potential loss in pride if they were to take drastic, but necessary spending rationalization.

Their confidence was affected and for sales people, being confident is very important.

a. Assessing Your Current Situation

Here is a question to think about:

How many months can you live your current lifestyle if you lost your job?

This determines how wealthy you are. Whether you can cash flow your current lifestyle with your assets (either through income, or just selling and spending the asset)

If you have trouble figuring this out, then may be you need to get educated about personal finance or get a trusted adviser to help you. (You may start with my Build Wealth Foundations series, which is free)

b. Live a Nimbler Life

Refrain from having a high consumption, high leveraged lifestyle. If you have low fixed expenses, then you have flexibility in life.

Here is an example:

If you have high income, but you are highly leveraged, even with the high income, you will likely still be wiped out. A good documentary example to emphasize this point: The Queen of Versailles.

If you have a high income but high consumption, you need to find an equivalent high income job to sustain that lifestyle (if you believe you cannot right-size your spending). However, if your consumption is more controlled, you have greater options that could alleviate your situation.

Keep your life light and flexible. Sometimes, it is not that there is no job, but the jobs in demand is not in your location. If you are light and agile, you can grab that opportunity.

c. Have Reserves Before You Need It

Have easily available cash reserves (also known as emergency buffers)

- Depends on how stable or unstable is your job

- Are both spouse working or not?

- Is the aggregate income fluctuating or more fixed?

Established a home equity line of credit before being laid off not when you need it.

In certain environments, consider having some reserve of food.

Review your company benefits and consider what will happen if you lose them. For some, their health insurance, disability income covers their family.

d. Keeping Prospective Employment Options Open

Major thing is to focus on getting your next job. If you have done what you should (based on the episode How to Not Get Laid Off in the Next Recession) you should do better than most.

Keep a list of jobs and businesses when you are interested in. This can be your suppliers, users, vendors, competitors. It is advantageous to prepared first because when you need it, you might not be in the best mental capacity to come up with the list.

Keep list of future ideas. Keep a list of head-hunters. Keep records of your accomplishments.

6. The Many Ways You Could Lose Your Job

A shout out to Henry Ling on Investing Note for helping me with this section.

Henry helped list out a host of reasons why you can be fired. What you realize is that your life could be going smoothly and it just take some mistake or some poor relationship to ruin things:

- Poor performance during probation

- Consistent poor performance after confirmation e.g failure to hit sales targets or new accounts targets, excessive MC and unpaid leave or incompetence, etc

- Death

- Physical incapacity

- Indiscipline like consistent lateness, fighting in the office, etc

- Infractions like leaking of confidential information, stealing, disclosing or selling intellectual properties, unauthorized logging into other’s email, etc

- Medical-Certificates-related matters like shopping while on MC, forging MC, collusion with doctors to get MC, pay for MC but not ill.

- Office money matters like bribery, use of office money for personal matters, transferring company money to personal accounts, unauthorized use of money e.g to pay personal debt, keeping collected money from sales, etc

- Falsification of information during job application or during tenure e.g purchase of degree, false working experience, false health information.

- Change of management – relevance of jobs in new arrangement

- Inability to work in teams

- Behavior issues e.g arrogance, refusal to listen to feedback, failure to work with other departments, etc

- Due to your job in the hierarchy e.g if you are the Deputy MD, or Assistant General Manager, or Assistant to the MD, or secretary, or telephone operator, or other jobs that can be easily gotten rid off without any pains to others.

There are also reasons not due within the company

- change in competitive landscape

- obsolescence of products or services

- technology advances

- failure to keep up with technological changes

- in a sun-set industry

- pandemic or other earthquakes in the economic landscape

The Last Word

I could not locate the original source but eventually was able to spot them on Player.FM.

If you wish to listen to them in full here they are:

- Recession is Coming: How to Not Get Laid Off In the Next Recession

- Make a Backup Plan In Case You Get Laid Off In The Coming Recession: Simple Action Steps For You To Consider

- You Just Got Laid Off. Here’s What To Do Next!

- Cullen Roche: What Do you Do When the Shit Hits the Fan?

- How to Respond to An Emergency Loss of Income

After reviewing some of these action steps, you might find them really radical and over the top.

I assure you, they are not. If your situation is Ok, a lot of what you do is going through the motion.

But if your situation is dire, then being over the top might just give you enough runway to secure some work, some cash flow instead of being in financial ruin fast.

In another time period when we are not so affluent, what was proposed is the most realistic thing to do. If you are in india and you are in financial dire straits, this is what they would do. So why should you not cut things fast and as much as you can?

Let me know if I am missing something.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Shaun

Sunday 12th of April 2020

Don't think you're missing anything! I would go further and say that everyone should always be planning like this constantly and always ensuring we constantly upgrade and increase our repertoire to remain relevant.

Kyith

Monday 13th of April 2020

Hi Shaun, thanks for your comment. That sounds like more diversification than deepening our expertise.