In the past month, as part of the CPF policy changes, I have been making some changes to incorporate the new policy changes but also looking at whether some improvements can be made to our internal CPF Projector.

The most challenging part is to estimate the CPF LIFE Standard income that we may get given a certain amount of money we successfully accumulated in our CPF LIFE.

We all had to rely on the CPF LIFE Estimator to see the projected income. The estimator only works for those who are turning 55 years old recently, and if we are much younger, the estimator doesn’t work.

I decide to tabulate for a 55 and 56-year-old, given a different sum in their CPF RA at 65, what is the income recommended.

We take the CPF LIFE Standard income paid out at 65 (y-axis) and plot that against the capital in CPF RA accumulated at 65, we get a chart like this:

Visually, the chart looks like a straight line, but the line isn’t entirely straight. If you accumulated $65,000 in your CPF RA at 65, you get a higher CPF LIFE income relative to the CPF RA monies than if you have $730,000.

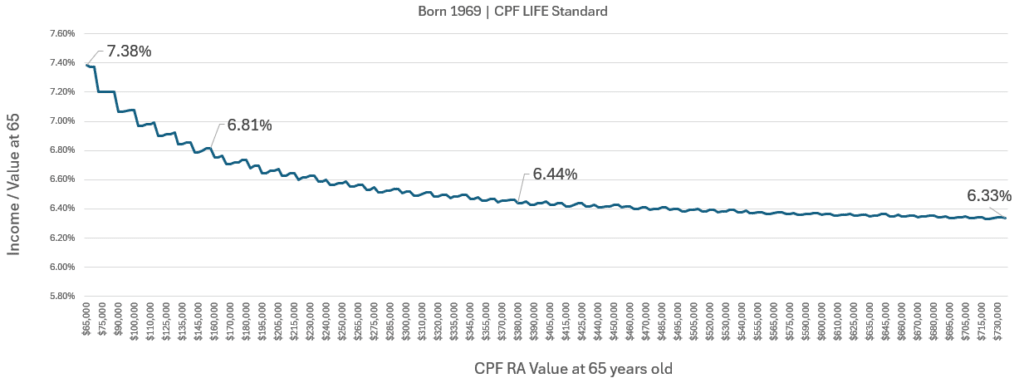

It is harder to see, which is why we plotted the income divide by capital at 65 years old against the capital at 65 years old:

Now, we can see that the income is higher if you have less money. If you have more money in your RA, the income paid out relative to the portfolio gets closer to 6%. If you have more income relative to the extra we earn from the first $60,000, using a 6% or 6.3, 6.4% as an income estimation makes more sense.

This 7%, 6.8%, 6.5%, 6.3% and 6.0% is useful as a rule-of-thumb to estimate how much income you can get on CPF LIFE Standard given your capital at 65.

For example, if you are projected to have $890,000 in your CPF RA, with top up to CPF ERS, perhaps you can use a 6.3% to estimate your CPF LIFE Standard income to be $56,070 yearly or $4,672 monthly.

Take note that, this income to capital relationship will change in the future if the bonus interest earned is more than the first $60,000. The relationship will also change if we are not talking about 65 but the other age you decide to start your CPF LIFE.

I wonder if there is an easy way to systemize this.

This might be helpful for you especially if you are more oriented by how much you have in your CPF RA at the age of 65 years old.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Cassidy Gan

Sunday 24th of March 2024

The commoners find no use to your written article. Things could be made simpler. By giving a few examples of those with a certain bracket of accumulated SA on reaching 65 for withdrawal or withdrawing at a later stage at 70. That's more meaningful. What we wish to see is the number not so much of on theories on getting better "yield". Something more tangible and realistic. This article is only suitable for those academics to message their high knowledge of financial powess. Good luck.

Kyith

Sunday 24th of March 2024

Hi Cassidy, I am not saying it is a better yield or what. There will be those who manage to accumulate this amount in their retirement account wonder how much income that they would have and how to supplement the rest. This rule of thumb allows that for their life planning purpose. Perhaps which part don't you understand? You can share and i can help you understand.