My colleague told me yesterday DBS came up with this report title “Will Property Still be Your Pot of Gold?”

Basically, DBS’s assessment is that properties, as an investment vehicle, may not be the best retirement investment in Singapore. Or something along those lines.

I think the news commentary around that article is a subject of debate for many.

But if you ask me, a lot of us are pondering about the property as an investment versus other asset classes as well.

What the DBS team did well was to let the data tell the story.

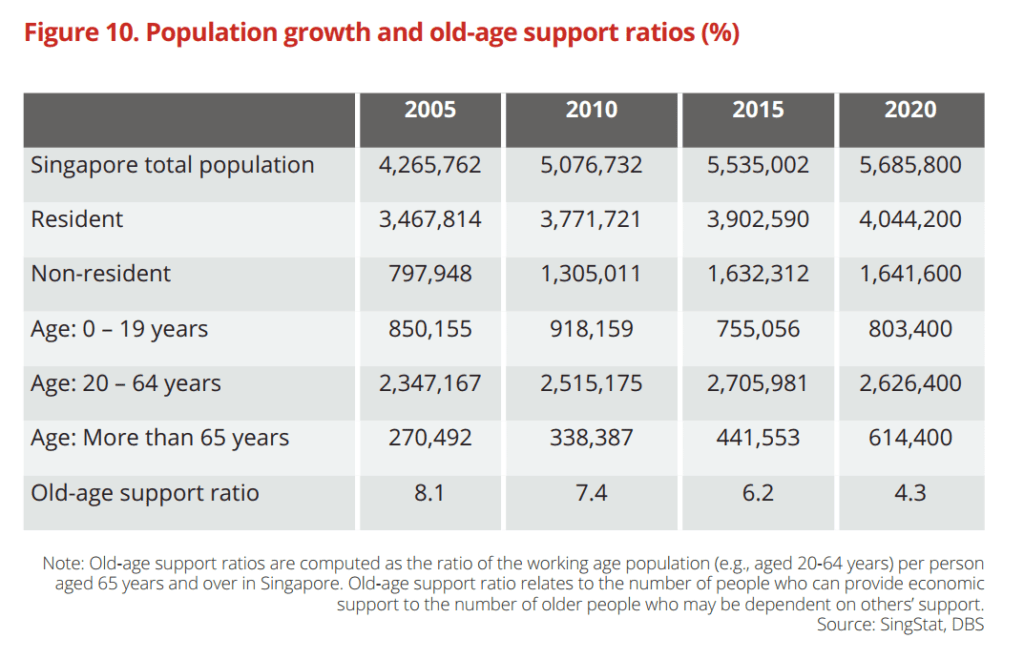

- Population growth has come down over the years. More adults are retiring and we were unable to successfully replace them with more babies.

- Private property is getting more expensive if we normalize the size of the home to what we used to have in the past.

- Growth rates have come down.

- Leverage plays a big factor in returns.

I find their models to be largely sensible.

Another common dispute was that their comparison of investment returns between buy-to-rent private property and equity returns was not an apple to apple comparison.

I think they are just comparing the sensible strategies that we would adopt. How many people would use high margins on equity investment? Most likely not! The cost of the loan is very different from property loans and the loan-to-value levels are also different.

DBS did show what the returns would have been if property loans and margin loans were banned. That will put both asset classes on equal footing.

The result would be that for the past decade, property returns, factoring rental income is not uniquely better than equities.

If there is one take-away, it is that there are alternatives to grow your wealth sensibly.

My push back against this report would be:

Equities are really volatile. Your investment is revalued daily. The value of your property is not. Not everyone is comfortable subjecting their hard-earned money to this volatility. They would add bonds. If bonds were added, the returns may not look as good versus the property.

Decoupling to purchase the second property is rampant. That seems to be the de facto move. So I wonder how many will see the returns expectations DBS provided for a second private investment property.

Ten years is a short period to determine future long term returns. DBS took a snapshot of the performance in the past decade. That is probably too short for us to make a judgement of future returns.

A second takeaway has to be: Be adequately diversified.

There are a few interesting data charts from DBS.

You can take a look here.

Property Growth as a Cohort has come Down Significantly

This data from the URA is not too surprising. DBS did a good job providing the average growth differences in the three different decades and the volatility (based on standard deviation)

The compounded returns have gone down over time, but so is the standard deviation. This compounded growth do not include rentals.

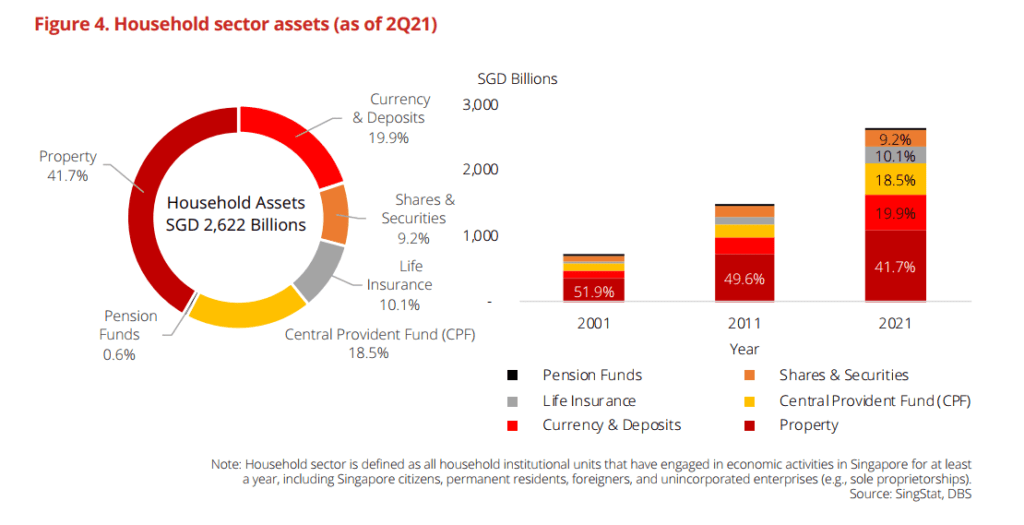

The majority of Singaporean’s Assets are in Properties, Cash and CPF

Singaporeans have not moved past three. Cash and CPF have grown tremendously.

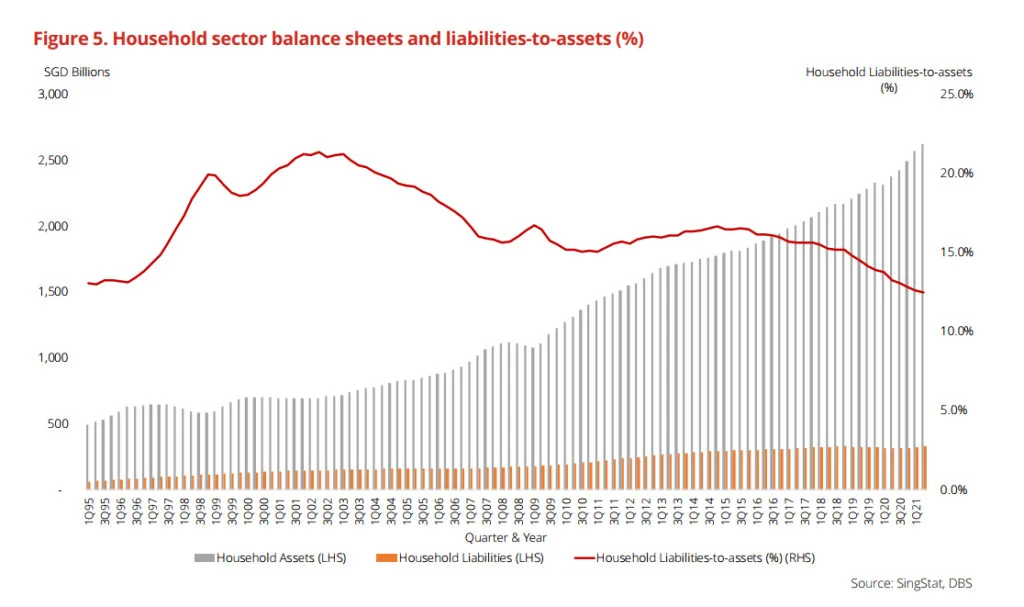

Singaporean’s Household Liability to Asset have Moderated over the Years

I think the biggest opportunity is that we are flushed with CPF, Cash due to the growth of our wealth. The series of tightening of the property market has created a situation that as a cohort, our household debt to the asset has moderated.

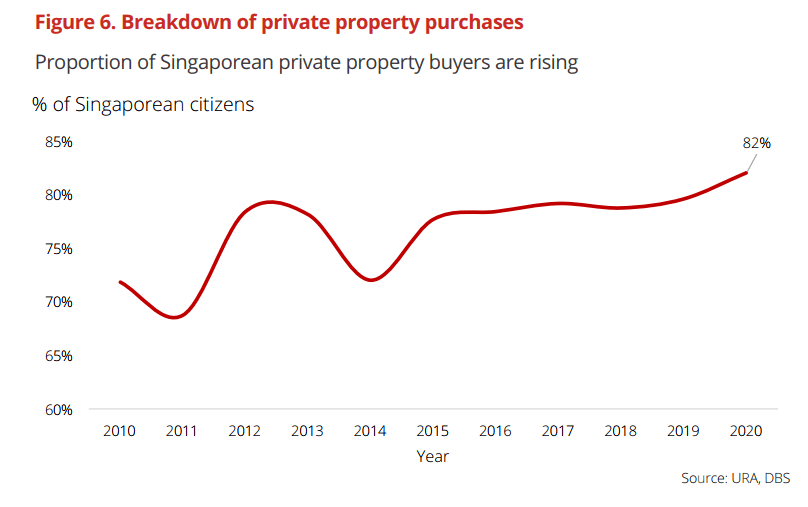

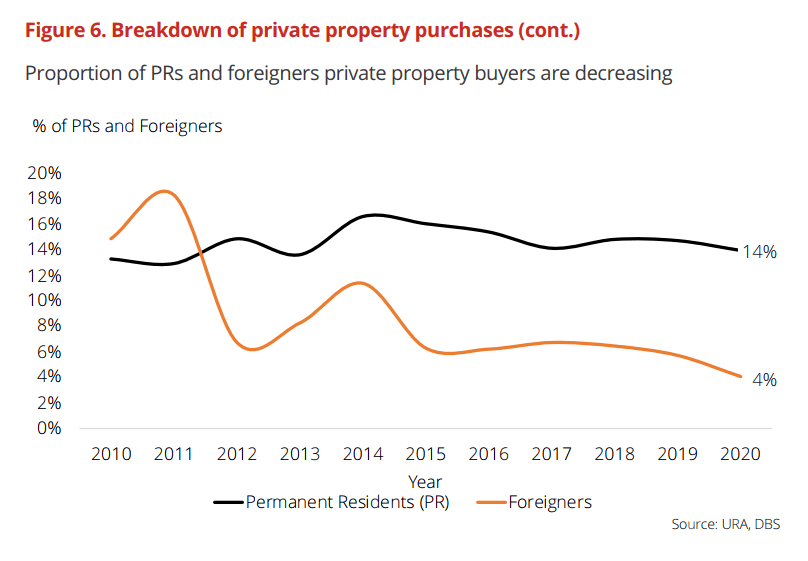

Property Sales to Singaporeans have gone up over time

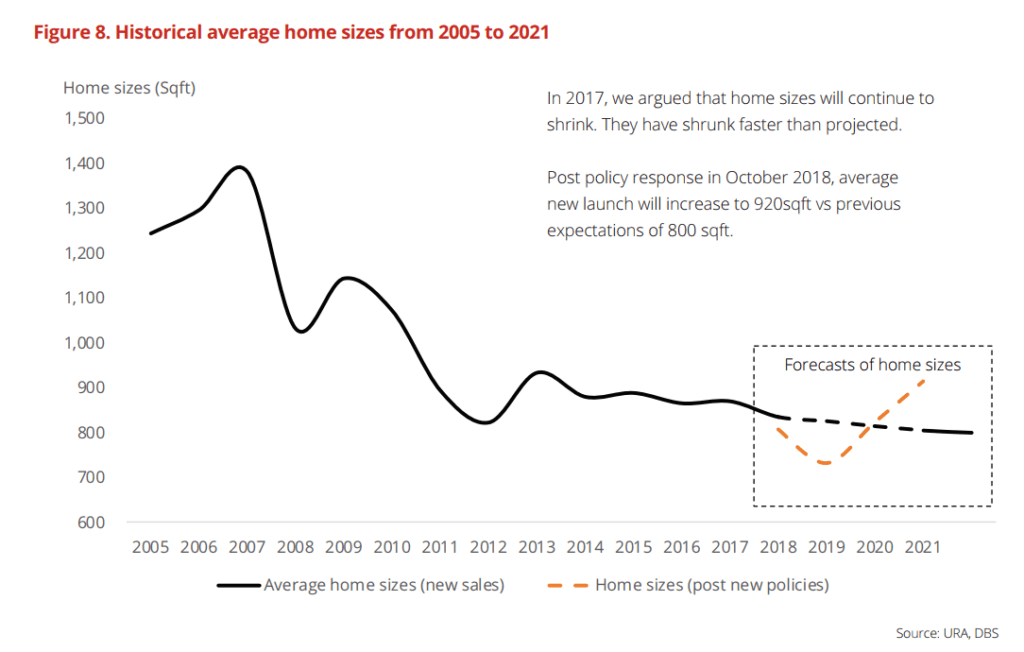

Singapore Home Size Have Gone Down Over Time

There was a period where the developers of property just cut out very small property. By listing units that are smaller, they make them more affordable to prospective buyers, even though based on per square feet, the prices are rather pricey.

A change in the future family nucleus, affordability will cause this trend to continue.

Singapore Home Affordability

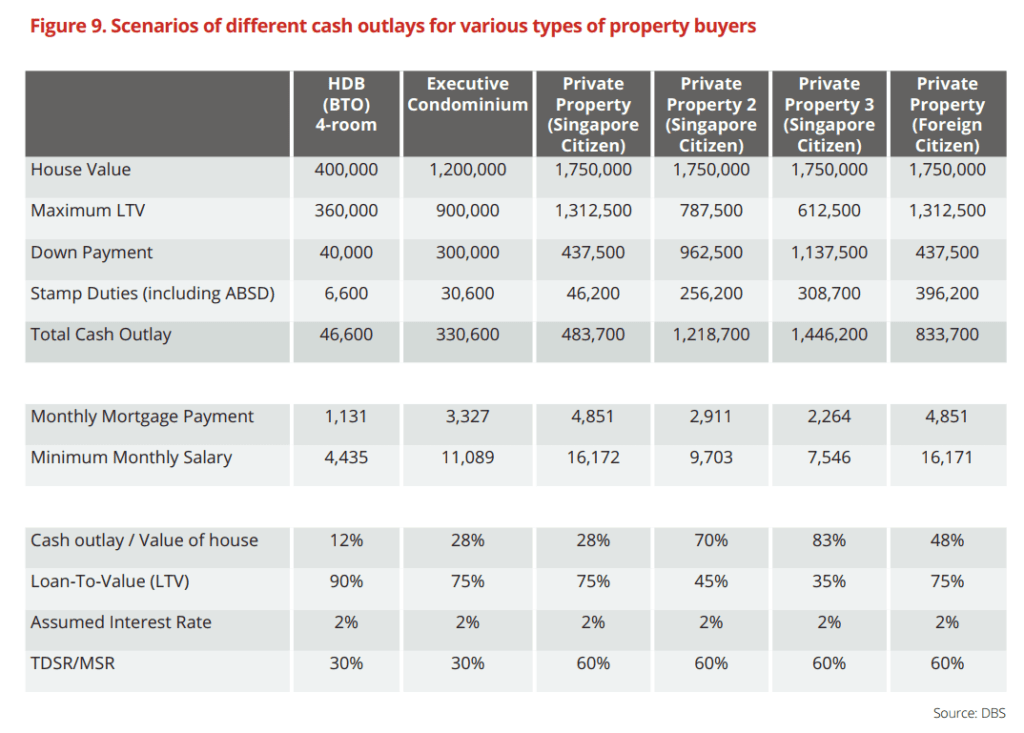

DBS did a good tabulation of how much it costs to purchase a second property or a third property. They assume that you take the max loan-to-value available.

The cash outlay for one property is about 28% for the first property.

If your home price goes up, the downpayment gets hefty.

In this table, you can really see the magic of the tightening measures. The low loan-to-value and ABSD have increased the cash outlay to a range of 48% to 83%.

This basically kills the leverage factor, which is what made the property so attractive.

But this is less of a problem as couples are decoupling.

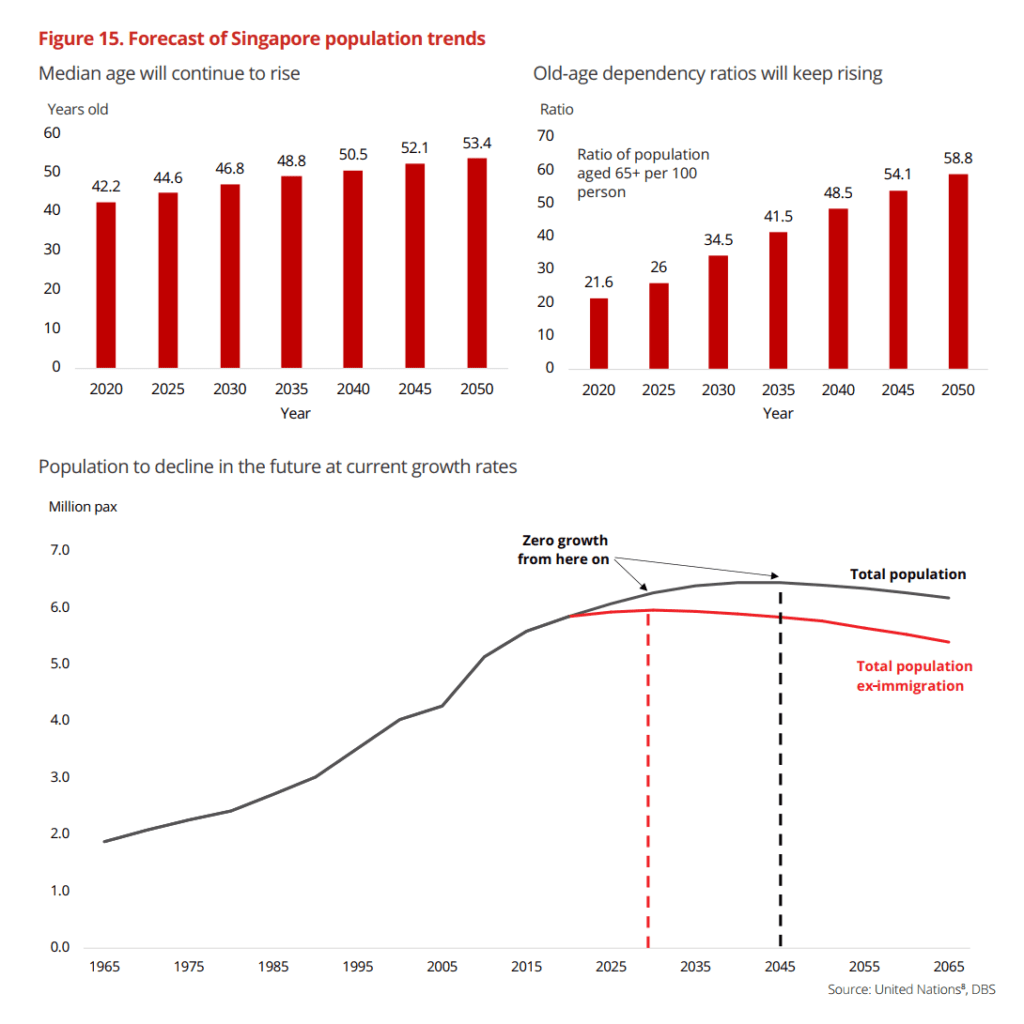

The Singapore Demographic Trend is Not Too Promising

The number of people that reached the official retirement age has increased while the younger cohorts have failed to increase.

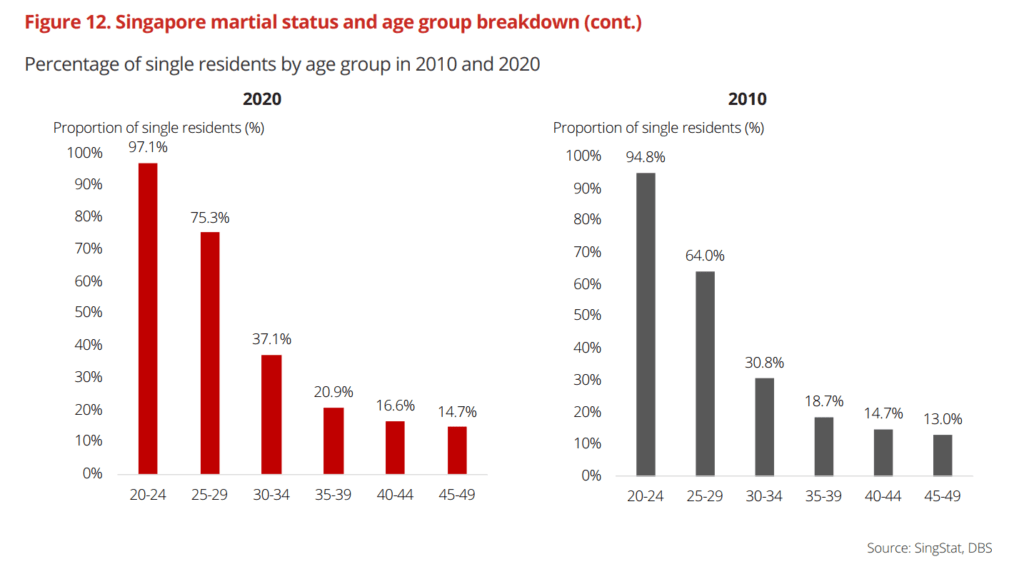

There is a greater percentage of singles compared to a decade ago. The notable increase is the 25 to 34 cohort.

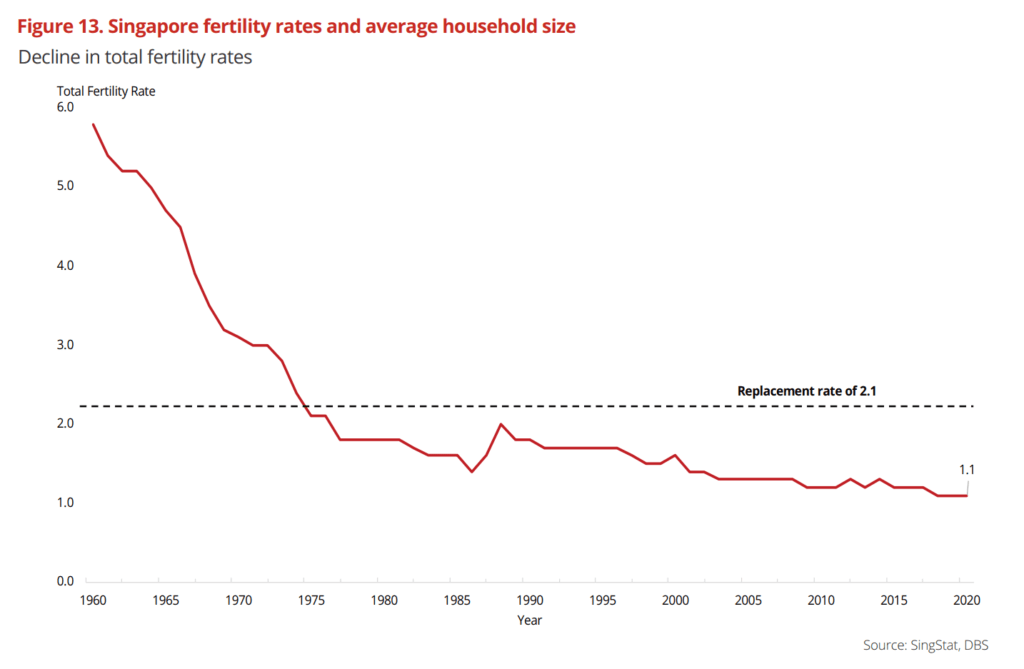

We never succeeded in improving the fertility rate.

The two things that they say drive long term growth are productivity and population growth. Productivity is usually hard to improve upon and if population growth is slowing down…

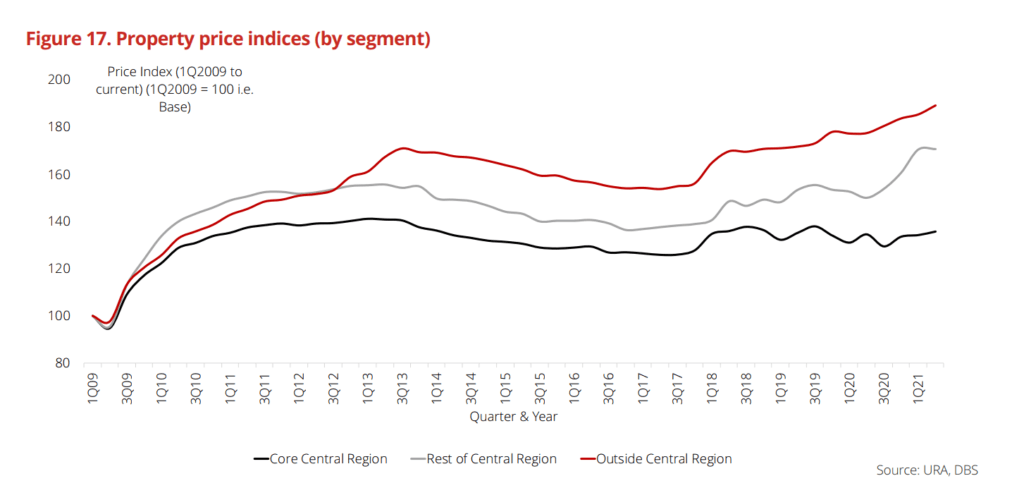

Prices in Greater Singapore Outskirts Haven Risen More

It seems that prices in the core central region has less appreciation in the last two years compared to the outer regions of Singapore.

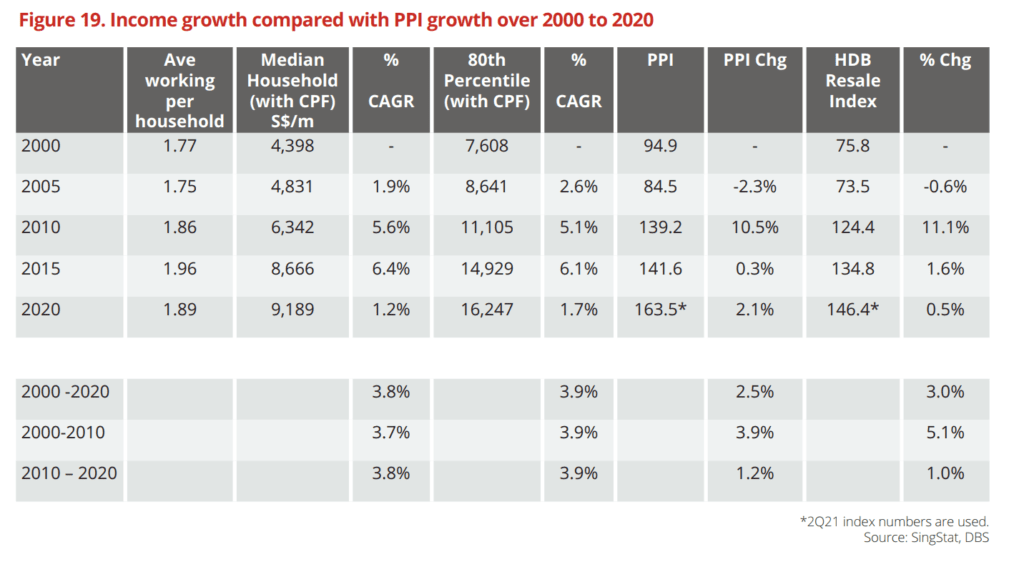

Property Price Increase Out of Sync with Income Increases

DBS seem to think that over the years the income increases have largely kept pace with property increases.

The table above shows the compounded growth (CAGR) of the household income of the median household, as well as those who are richer (80th percentile).

In the last 5 years income has stagnated. I am not sure if you observe the same thing, but that is not what I am observing on the ground (or my peers are doing really well).

If there is anything that this table shows, I feel that the growth in the property index is less correlated with our household income.

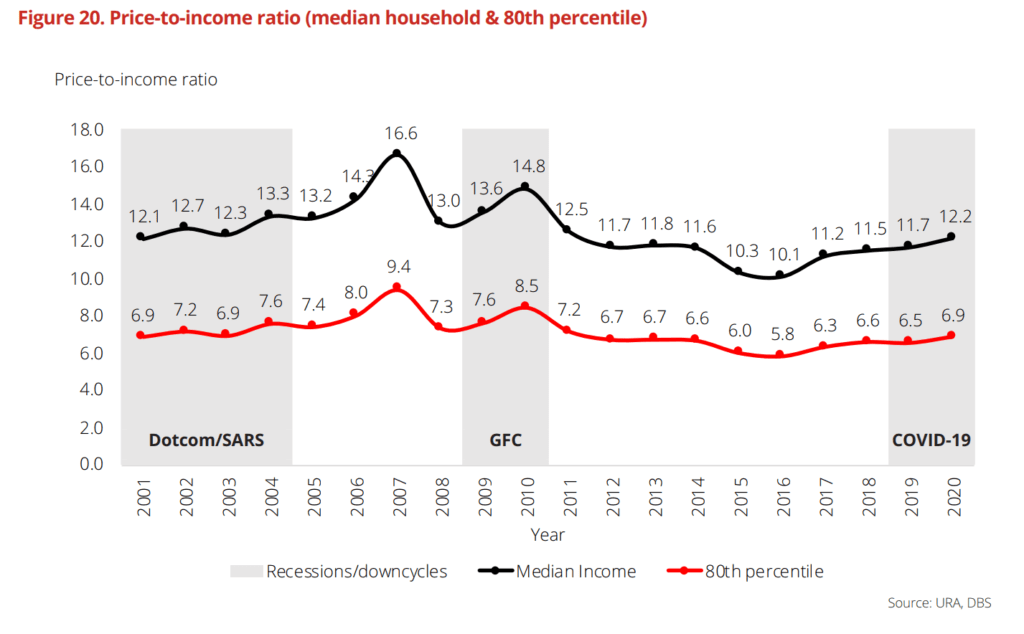

This is a very very good chart to show our historical price-to-income.

This is one of the metrics to assess how to overvalue properties are.

Right now, they are about the average over this 20 year period.

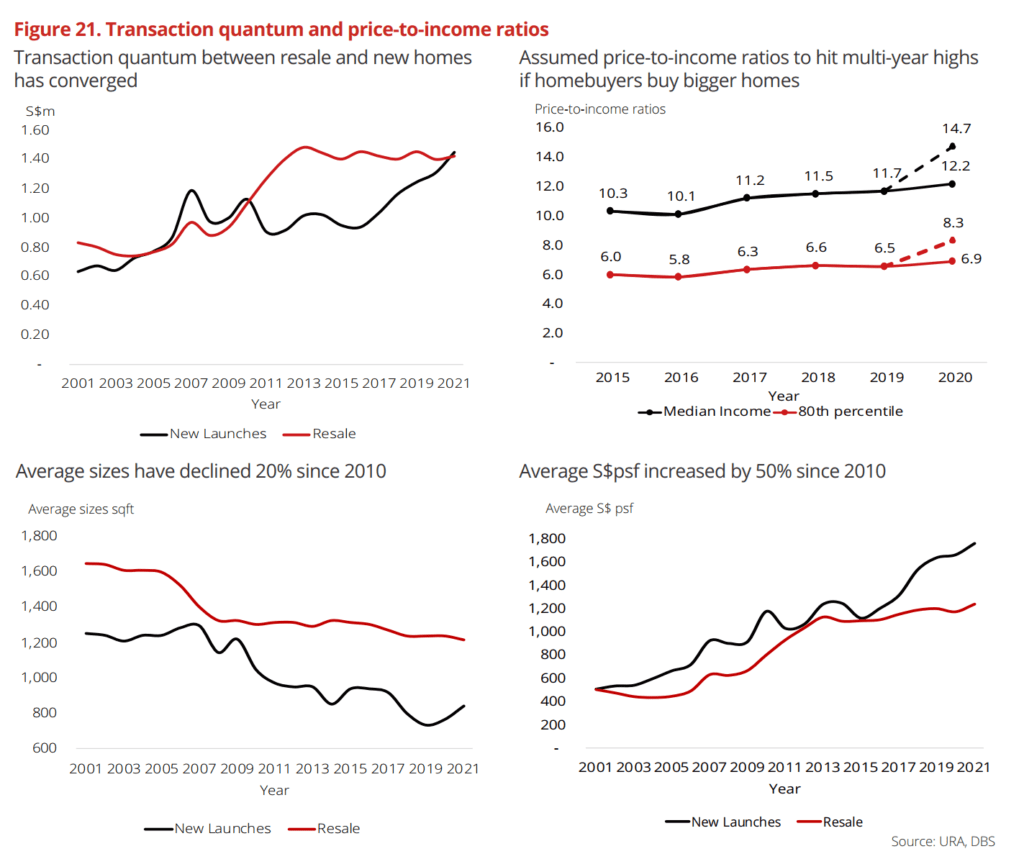

DBS noted that while affordability is there, the size of the home has dropped by 20%.

If we use old standards, then we actually can afford less.

This also shows the limitation of just assessing the market using one metric.

In the top-right chart, if we use the old property size, the price-to-income ratio has gone up significantly, which means that homes today are dearer if we adjusted the size.

You can observe the decline in size over time for new launches in the third chart. Price per square foot has increased over time.

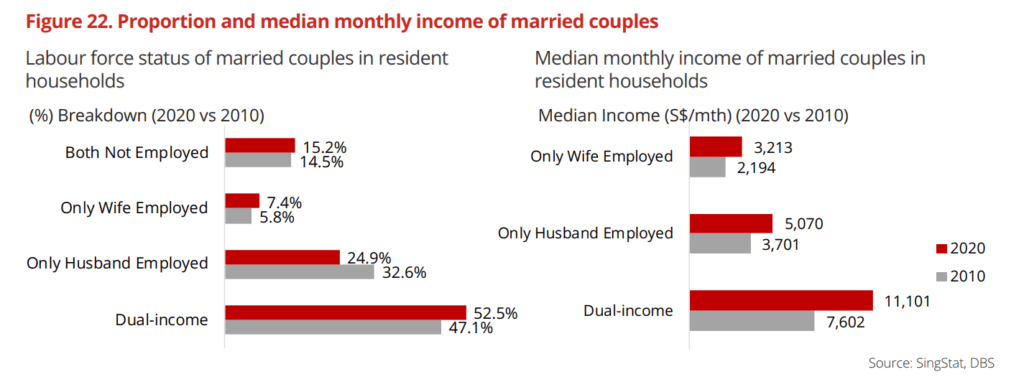

Nature of Household Income

Some interesting info.

There are like 15% of households where both are not employed.

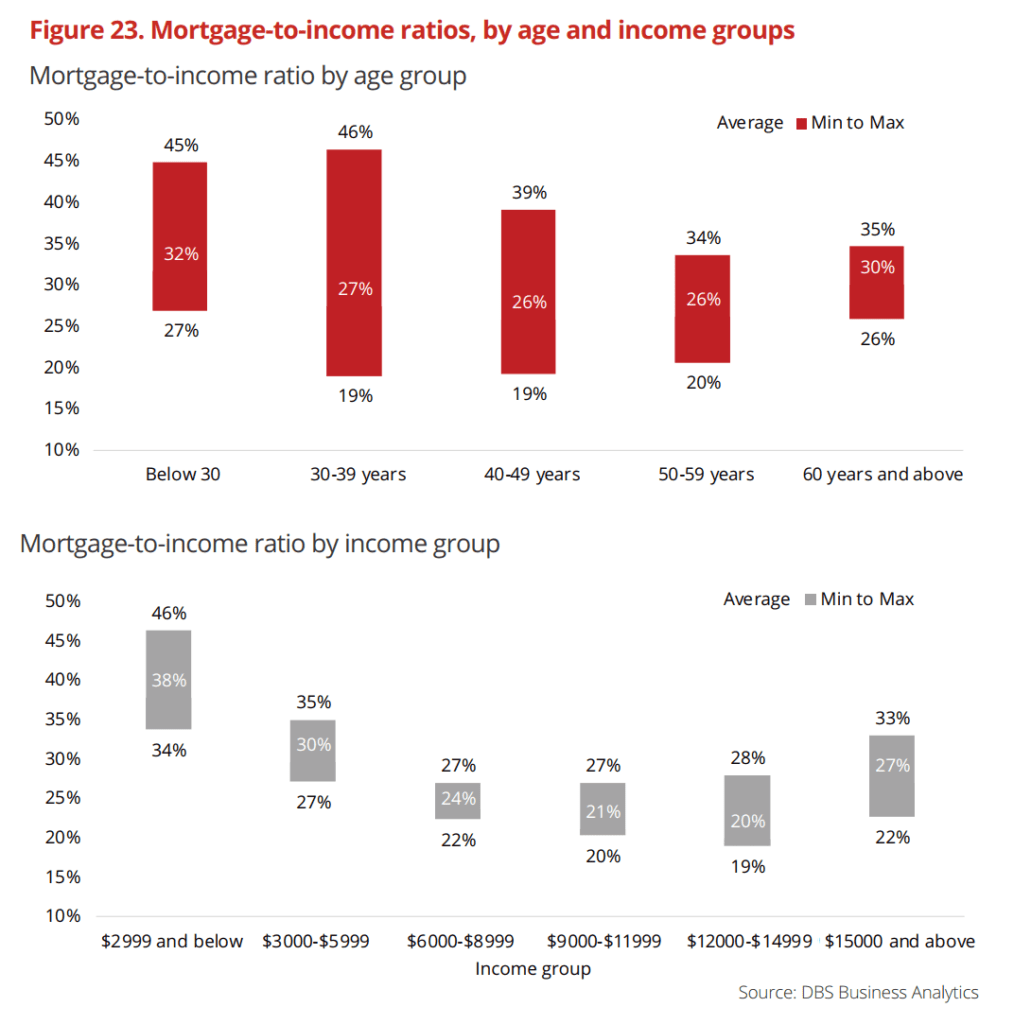

Mortgage-to-Income Ratio of Singaporeans

Based on DBS’s estimate, a 20% drop in our income will drive the mortgage servicing ratio up by 5-9%.

Usually, if you keep your mortgage-to-income ratio to 30-35% you are relatively healthy.

From the charts above, most of the folks on average are in the healthy range except for those whose household income is lower than $3000.

It emphasize the challenge the poor faced.

What we noticed is that for those in the 30 to 49, there is a wide disparity in mortgage-to-income. There are some who took on the low mortgages but there are also others who took on mortgages that constitute almost 40% to 50% of their paycheck.

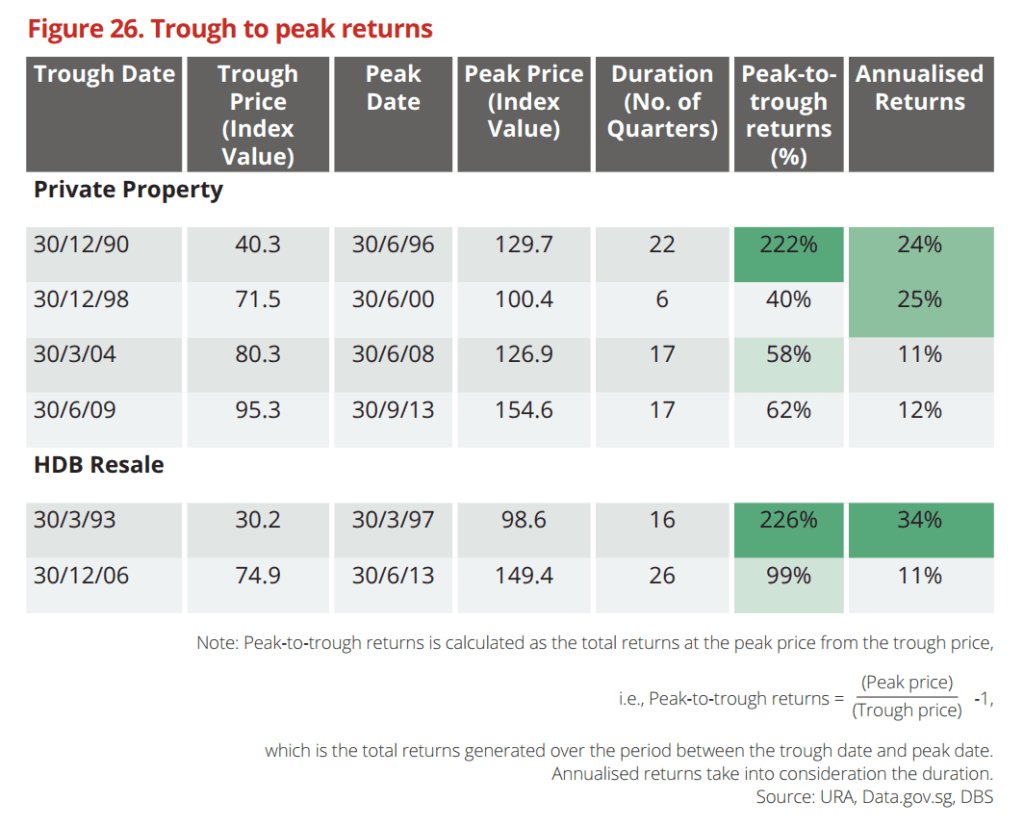

Historical Singapore Bottom to Top Returns

This table above may be something property agents will show their clients.

From the bottom to the top, how long is the bull based on quarter, and what are the annualized returns.

Returns without leverage, and rental income, is higher than 10% a year.

You can imagine with those two.

The best return happens to be an HDB flat instead of private property.

However, returns have come down over time.

Singapore Property Returns in the Last Decade Versus Different Equity Returns

This is perhaps the most controversial part of the paper.

DBS explained that there is this very popular investment train of thought:

Long-term returns of properties would ultimately justify the hefty one-off costs incurred at the initial stage of investment.

Further together with leverage, property returns are often said to be unbeatable.

So DBS went about to see if that is true or not for the last decade.

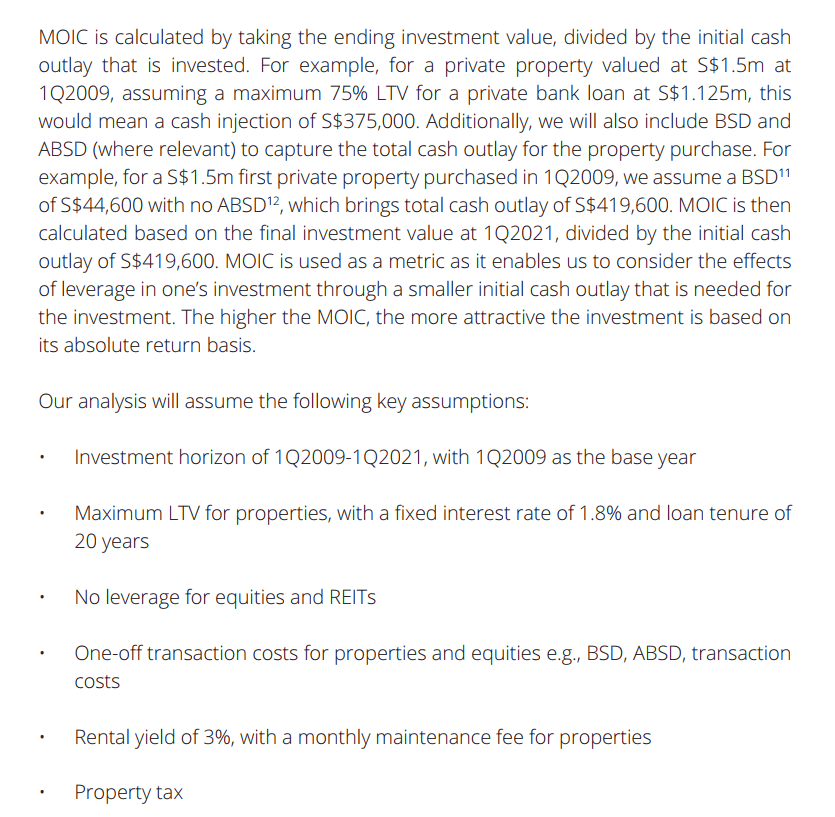

They measure a couple of property strategies against buying and holding different equity indexes over the last decade, measuring based on multiple on invested capital (MOIC)

Here is the definition of MOIC and the assumptions used in this portion of the analysis:

I think the assumptions are rather reasonable. I do think there are some costs not factored in. The cost cannot be just the maintenance fee and property tax.

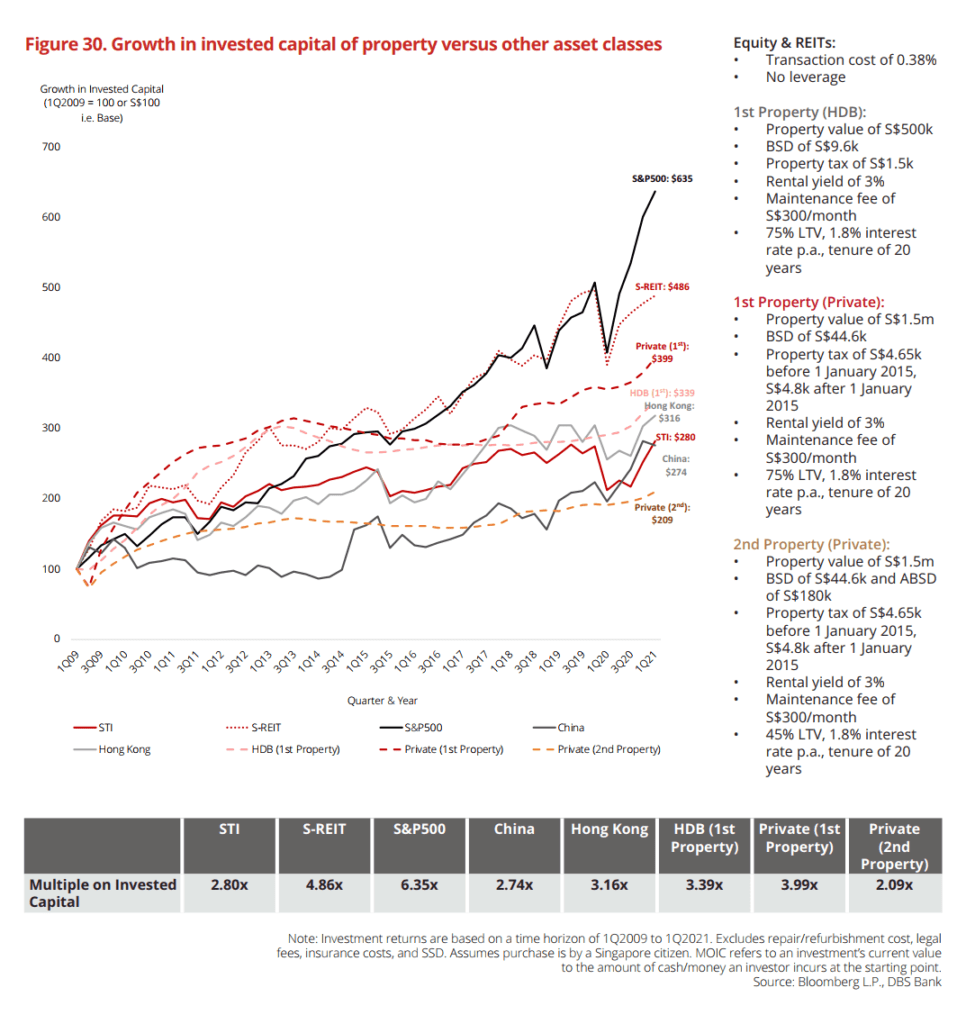

Here is the result:

If you had invested in S&P 500 and REITs, you would have done better than private property during this period.

However, if you have invested in the China, Singapore or Hong Kong index, your result would be poorer than your 1st private property investment.

I think this is fair. Some indices did well, some indices did not do as well.

I would look at it from other perspectives:

- It does not mean that property during this period, is the only means to build wealth.

- So many people decouple to avert the ABSD! So how many would take up the 2nd private property option? Perhaps only if they spot a bargain.

- A lot of us know that the Singapore and Hong Kong equity market has been challenging during this period. Yet if you can still build decent wealth with them, it’s not too bad. There were missed opportunity costs but the equity market is able to scale your capital much better than property, with less complexity.

- They did better than your second investment property. This is mainly due to the lower leverage and ABSD. The ABSD act as an additional cost.

Honestly, I don’t know what to make of this.

- The next 10 years or 20 years may look very different from the past.

- S&P 500, REITs, China, Hong Kong and Singapore equity indices might mean revert. Performance would differ.

- Property measures would not stay constant.

I think the major take-away from this portion of the analysis is: Buy and hold private property is not the only investment with equivalent returns.

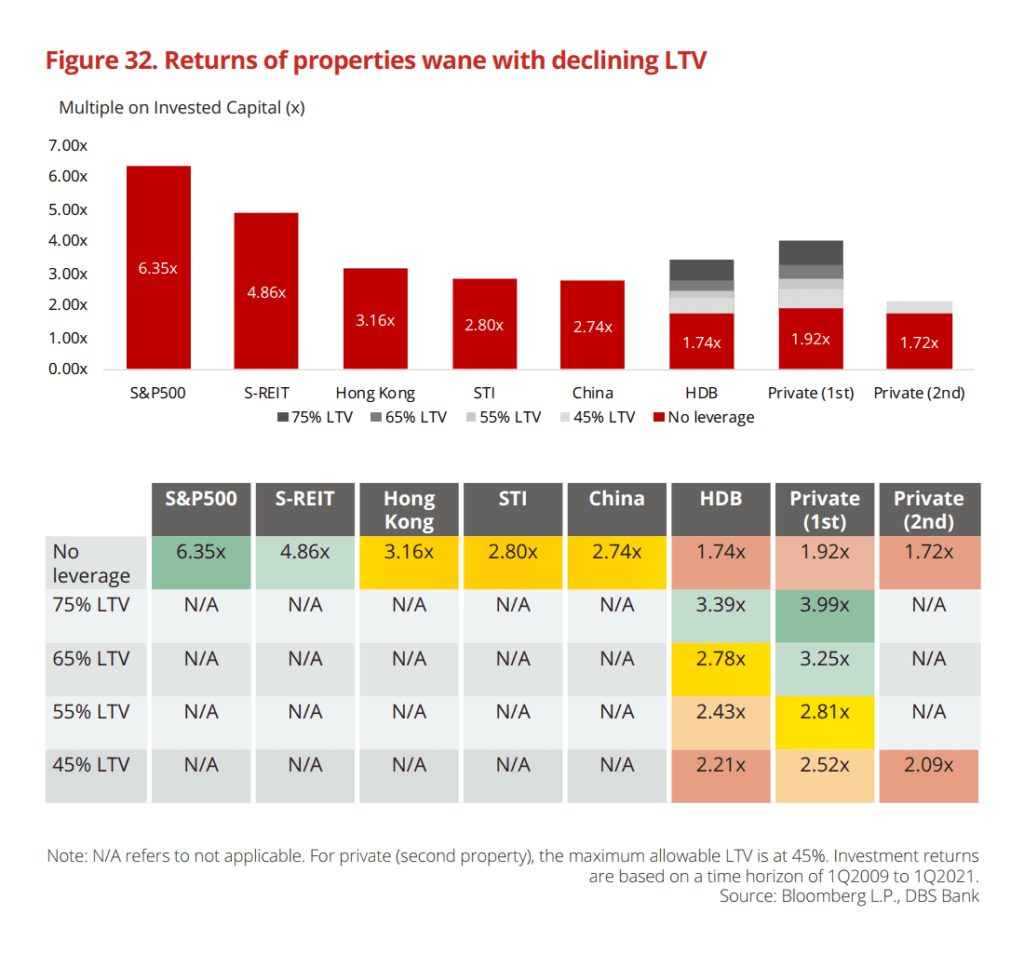

In the illustration above, DBS show that without leverage, property returns are not too different from equity returns.

And the magic of the cooling measure is really to dampen returns by reducing the leverage factor.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

H

Thursday 21st of October 2021

It is a good step forward that the big boys come out to talk about viable alternatives to property.... Property gets lots of "marketing" directly or indirect in the media and also gets push on the ground by agents. Pure stocks (as oppose to ILPs, funds etc ) get a lot less "marketing", partly be cause the commissions are peanuts and so there is a lot less incentive to do so...

But besides return, any investment should consider risk as well... the risk profile of stocks and property is very different. Most obvious would be concentration risk (county, location, asset class, timing) and liquidity vs volatility.

To me, concentration risk is a very real risk... there it is not a certainty that SG will continue to do well for the next 30 years. We just think that cos we lived all our lives in SG.

Having a huge % of your NAV in 2 or 3 properties in a single country is risk. A single political event, natural disaster, regional instability could make your property do very badly. Even if SG does well, the place you bought may for what ever reason do badly and you would have failed to capture the returns of other property classes or locations in SG.

Additional side effect is, being such a big ticket, you can't sell a portion of the property if you need to raise money. And you can only take a loan out of it if you have meaningful income...

You can't divide your property among your dependents unless you sell it.... what happens if you die when the property market was in the doldrums.

Lots of people don't consider these risks. Just the risks of winning or losing money.

You don't have any of these problems with stocks/equity.