I noticed fewer clients coming in during this period. An adviser told me a few clients have canceled their appointments coming in.

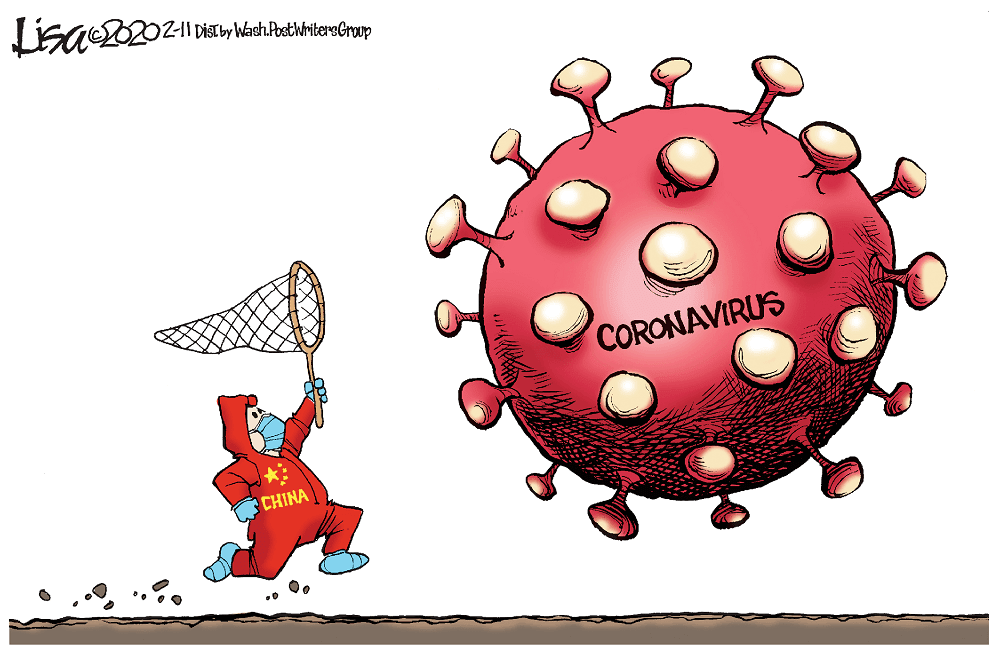

This Coronavirus feels like a seriously big hit to the businesses depending on local and overseas consumption, as well as certain services.

Singapore’s economy is likely to report some really shitty numbers. Singapore is a very open economy. We depend on the export and other countries buying what we created.

The way to alleviate this problem is to have adequate human isolation for a period. This killed not just exports but also local commerce.

I was commenting to Caveman that market prices seem to have discounted this period as a short term event and not of material consequence. There is no way the supply chain of the world are not affected in any way. Caveman shared with me that those small-medium enterprises will be cham because even in good times, their liquidity is going to be very tight. Now, without orders, and with limited cash-like assets, they will really feel it.

Workers will Face Even More Uncertainty if this Drags On

But the ones that I worried about the most are those workers who work for the SME. In Singapore, the biggest costs of doing business are rental and manpower.

While companies cannot do a lot about rental (associations have been asking for rent reduction), without business the best way to control the cost is to ask staff to take no-pay leave.

Cathay Airlines have asked 27,000 of their staff to take no-pay leave. Hong Kong Airlines cut 400 jobs. Asiana Airlines is also doing something similar.

If there is no business, then it makes a lot of sense to reduce variable labor costs. Workers in SME will be the most hit.

And I wonder whether you will be shocked to be put on no-pay leave.

The shock factor for each of us in these situations depends on the perception in our brain how safe the situation is versus how swift, how sudden, how improbable the incidents are. Those working in government sectors, or big MNC will be the least susceptible to this.

It will feel like an annoyance that they have to live with some annoying business continuity plan (BCP) inconvenience.

But for some, they are living from paycheck to paycheck.

They cannot have a period where there is no cash flow coming in. This is a nightmare for them.

I felt in 2019 and 2020, these incidents will make some people question whether it is a good idea not to have any safety buffer, or whether the safety buffer they have is an illusion.

The Misconception of the Role of Your Emergency Fund

Most people will search for authority to tell them how much they should have in their emergency fund, without thinking critically about how an emergency fund aids them in their life.

Experts tell us we should have 3-6 months of expenses saved up, compartmentalized in liquid amounts for “emergency”.

Some of you who wishes to optimize will ask the questions:

- Can I invest my emergency fund?

- Can I just have 1 month or 12 months?

The answer to that question is that: It depends.

You need to frame an emergency well.

When it comes to problems you faced in this world, they can be classified in the following 3 categories:

- Known knowns. Shit you know will happen

- Unknown knowns. Shit you don’t know will happen but more experienced or knowledgeable people would

- Unknown unknowns. Shit everyone likely do not know will happen. Think 4 improbable events all happening at once. Or a meteor hitting Thailand.

Civil unrest is #2. Coronavirus is #2. These two add up is probably #2.

We have seen developing countries having unrest before and some of the risk-conscious folks would have explored that when events like these happen in Singapore, what would be your rough course of action. You could also determine if your plan sound.

Some of us went through SARs before. It hasn’t happened for some years but it is probable.

An emergency fund is to address #2 or #3. #2 and #3 are events that you have not encountered, that shocked you and money is needed.

How much is enough in our emergency fund for us to prepare for events such as this?

It is hard to say. The best is to have as much as you can!

The investment or financial dilemma is that if you put all your money in liquid assets, the returns are low and there is an opportunity cost to holding 100% of your net wealth in liquid assets.

The answer is therefore 3-6 months of expenses. If an emergency needs more, liquidate some longer-term, volatile assets.

Liquidating your emergency fund sounds very irresponsible and what we should not be advocating, but if you think about it, an emergency is an emergency because your life is impacted!

For example, when you are put on no-pay leave and there is no income coming in, there is a real urgency to ensure you can tied through this period.

The concept of an emergency fund is to have a sinking fund for the improbable. But your sinking fund might not always be enough and it’s ok.

It is better to have some sinking fund than nothing. This sinking fund allows you to minimize life disruption.

If you understand the above well, you would know that in some situations, you have to break the cardinal rule of selling your investments.

For some emergencies, you might need to break the cardinal rule of having to borrow money!

What Most Misunderstood About Their Emergency Fund

Some people use their emergency fund to plan for #1. That is not an emergency. That is a saving goal of events that is less probable.

For example, ff you know your boyfriend always gives a last-minute ultimatum that both of you need to go for a quick holiday that is not an emergency.

Save up beforehand for vacations. It will happen soon enough but you just do not know when.

Or that your job is volatile. Some months you will bring in less money. It’s the nature of your job. You should have worked out a system to smoothed out the money aspect. (You can read my article on how freelancers should manager their money)

At the end of the day, even a 2 year worth of expenses saved up may not be enough for some medical cases that your loved ones suffered (you cannot use critical illness insurance to cover because it is not on you but another person)

We can only try to do our best.

Wargame What Your Family Would Do If Shitty Situations Occurs

Having sound financial planning is important but being resilient is further than just managing the tangible money that you have.

The way to build resilience is to first confront the situation we most feared rather than lie to ourselves that this would not happen to us. That we have moved on passed that.

In army exercises, the higher-ups put commanders through a training exercise to see the commanders and their men’s reaction to certain scenarios that are both probable but rare.

The commanders work in an environment that would allow them to be vulnerable to any inadequacies of their current capability, be aware of certain nuances that they would have glossed over normally.

Another name for this is called red-teaming.

Red-teaming can be applied to businesses as well as our lives, not to mention our finances.

Some of the scenarios that you could work through are:

- One spouse losing their job for 6-months, 1-year, 3-years

- Both spouse losing the job

- One spouse being disabled

- The family won $1 million dollars

The result of going through these exercises is that some of my more thoughtful friends ensure that their mortgage could be paid with one of their income, have 3 years of mortgage in their CPF OA, one spouse works in a bond-like company one spouse in an equity-like company.

The best output I feel you should have is a different set of expense budgets.

You would have:

- one budget for how you are spending now

- one budget for how you would spend in these scenarios, and the actions necessary to get there

For example, if something were to happen, the grade of food, products that you will buy will change. Some expenses will be cut down. Some expenses cannot be cut down.

By going through red-teaming, you would know in the event of these situation, whether you could live on a smaller budget. For some who cannot, then you would really need to build-up large buffers.

Here are some resources on this topic:

- Art of Manliness Podcast #564: Assault Your Assumptions Through Red Teaming

- Radical Personal Finance 194-You Just Got Laid Off. Here’s What To Do Next!

- Investment Moats: War-game the Scenario of your Salary getting cut from $9500 to $7000 BEFORE it gets cut

Summary

I feel that as a country the biggest opportunity from this crisis is to have a profound change in how we look at cleanliness, preparedness, sufficiency.

As an individual, the biggest opportunity may be to realize how vulnerable our situation could be, even though we earn a good income and everything looks optimistic.

You would not value your emergency fund if you have not gone through one (and I hope you can learn that value through my blog or some other way instead of finding out through a situation you have to experience).

There will be many that look at how I would think about wargaming in life as a very paranoid behavior.

I will let you tell me if this is really paranoid or there is real value here.

Those of my friends who been retrench, and could not find a job for 1 year would agree that in our plan, there is always a virtue of being able to live smaller than we usually would.

I think many areas of commerce on the ground is crawling right now and we should expect some crazy support in the Singapore Budget this afternoon.

Whatever it is, everyone should be vigilant about their health and hygiene during this period. Let us hope we can emerge from this Coronavirus in one piece.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Sinkie

Tuesday 18th of February 2020

This is the time when real financial advisors have their work cut out for them. Then again for some horses, doesn't matter if you drag them to the river. If they won't drink, they won't drink.

I'm one of those more "optimistic" ones. But markets are too optimistic currently, especially those in the West. The worse period is still ahead, in the March/April period. And after that, many more months of picking up the pieces & supply networks as well as repairing the psychological damage of both consumers & businesses.

However markets are 6-12 months forward looking. So when the infection numbers start to taper off for both China & outside-China, prices will recover fast & sharp. Even though companies may still be going bankrupt & employees still being retrenched in the 10s of thousands.

If you think back to 2004, you know that the job market was still really bad, even though stocks have chionged upwards for almost 1 year already.

Isaac

Tuesday 18th of February 2020

I really like the part of whereby you mention (or caveman) that securities have been pricing this Pandemic as short term. There is indeed some wider supply chain issues that is yet to uncover yet. And that might affect securities prices in the near future. The market is currently too optimistic I feel.

Btw who is caveman?