It is the REIT earnings season again, and the season usually starts off with some of Keppel’s REITs.

I wonder if some of the REITs have reached a certain value point.

The first off is Keppel DC REIT, which operates an international portfolio of data centres.

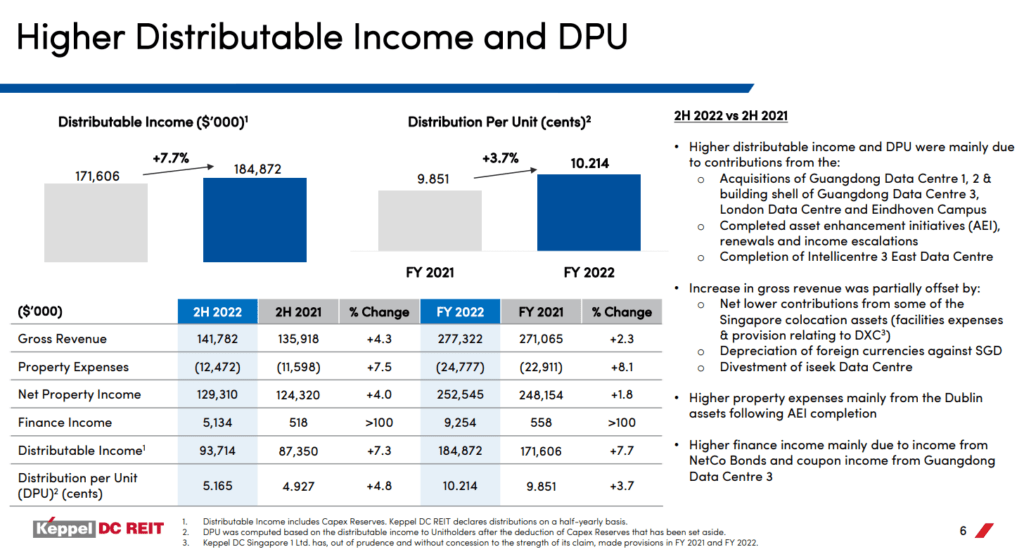

Keppel DC’s DPU looks strong relative to the same time last year.

But if we compare the results against six months ago, or 2H 2022, we can see that

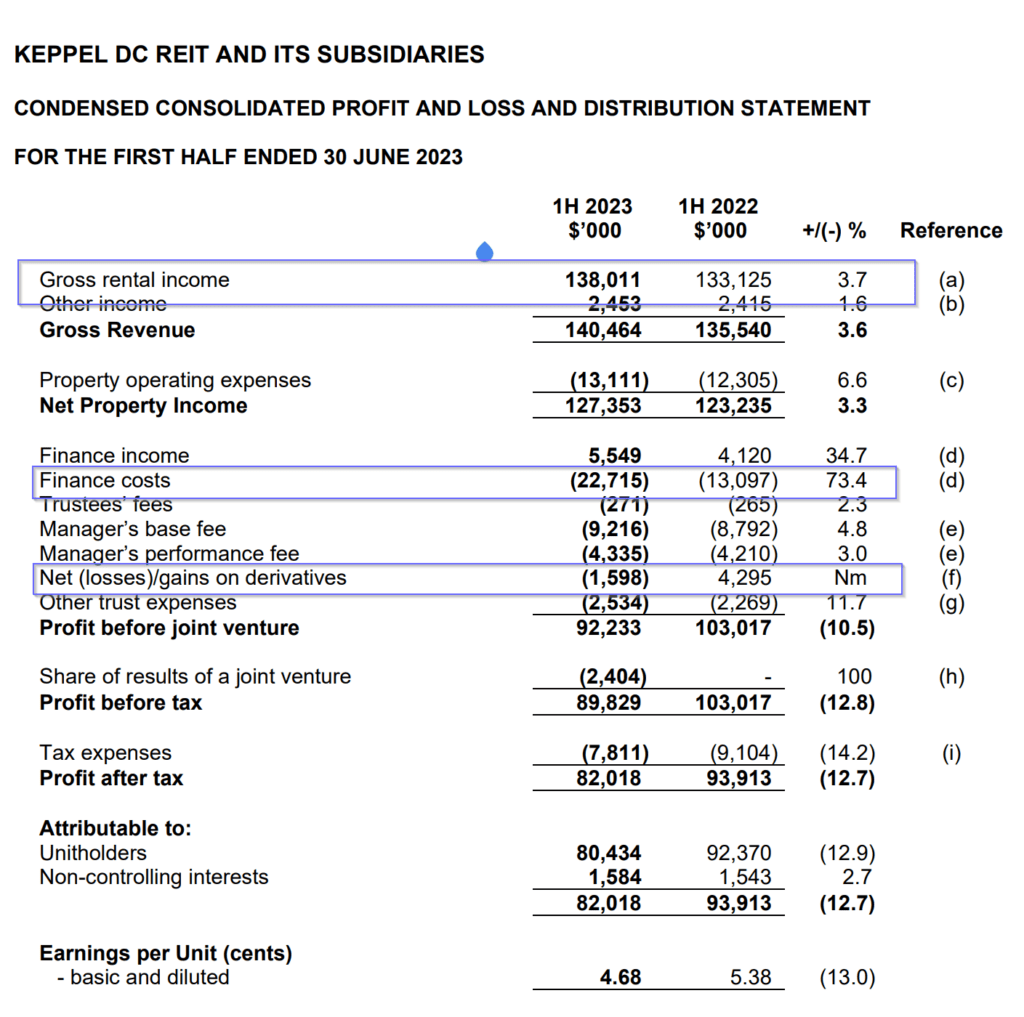

- Gross revenue has come down slightly.

- Net property income has come down.

- Distributable income has also come down.

The main culprit is a rise in finance or interest costs due to a 300-400% change in the interest rate environment.

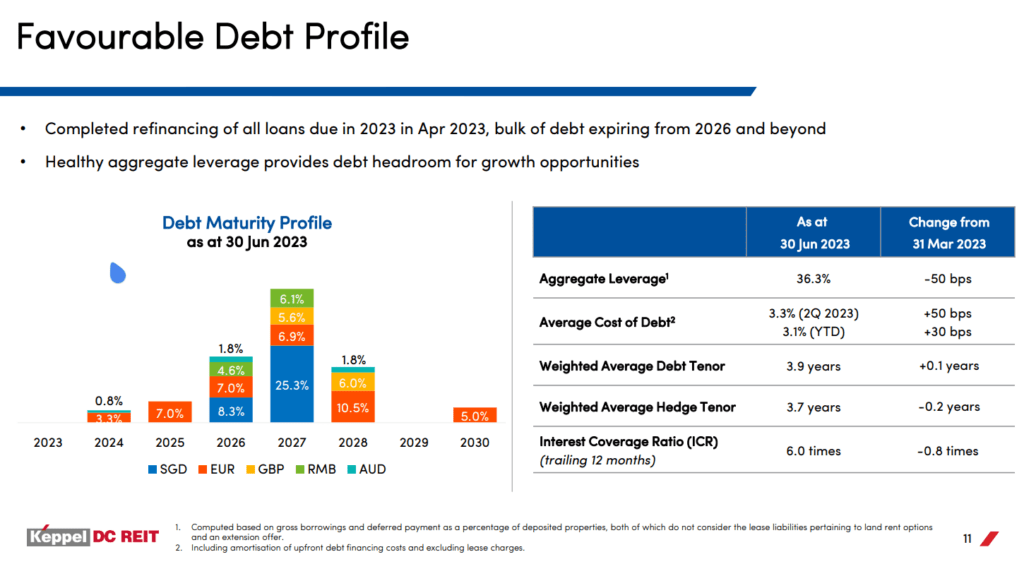

Here is the current average cost of debt (2Q 2023):

The average cost of debt stands at 3.3% a year.

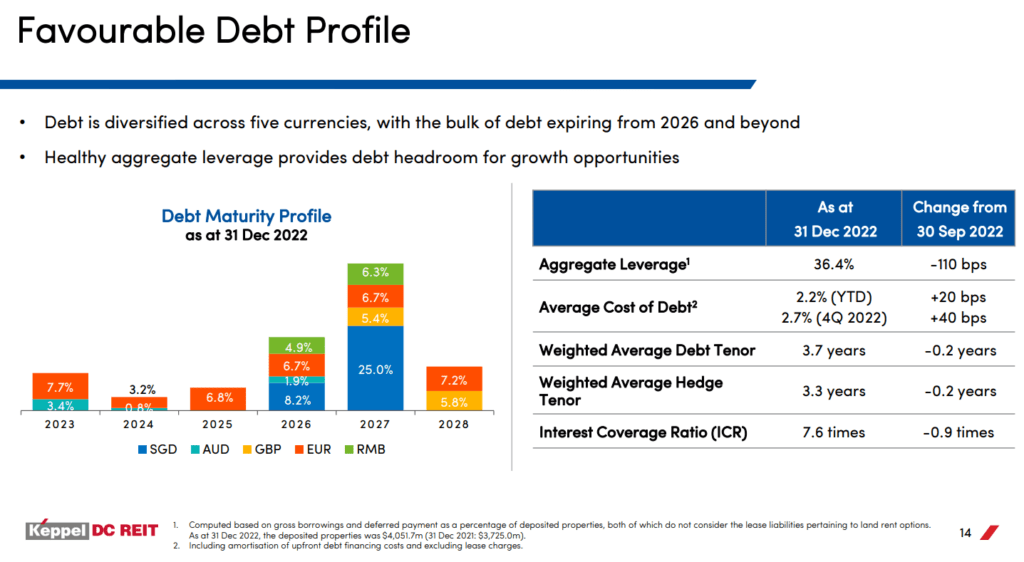

Now take a look at the average six months ago:

The average cost of debt is at 2.2% a year.

A 50% rise.

We do see that the gross rental income rising due to the effect of built-in rental escalation, but the increase in finance cost is too great. That, and the changes due to the currency hedging effect creates such volatility, that management has to pull some levers to balance things off.

The good thing is that the degree of debt maturing in 2024 is minimal and management is hoping for two years of rental escalation to offset the higher interest cost revision for debt maturing in 2025 (or for interest cost to moderate down.)

My Very Simple Thought Process Behind Keppel DC REIT

The WALE of Keppel DC is rather intermediate at 8.4 years on average, with built-in rental escalation. 8.4 years of 3% a year rental escalation will bring up the rental revenue by 28%, which hopefully will eventually offset the 50% increase in the cost of debt that may eventually set in.

The difference between a REIT and a bond is the revenue adjustment potential. A higher interest rate is not always bad for REIT.

Very unexpected, and very dramatic interest cost changes are the shock, that we are all currently experiencing.

Keppel DC’s rental escalation will at most balance off the interest rise but likely overall, the DPU will be capped.

Then you got to ask yourself: Keppel DC REIT is like a 10-year corporate bond, with risk, capped coupon, trading at 4.4% a year in dividend yield.

Is it attractive?

At least it doesn’t have so many problems:

- The data centre operations look at least healthy.

- Well-diversified revenue sources with international diversification.

A longer duration pseudo bond like a REIT gives you cash flow stability but is the most sensitive to interest rate shock (like the one we see in 2022). But we went through the shock of a 100% change in interest cost and the likely future magnitude of change is less dramatic, which should affect REITs share price less.

A long WALE REIT gives cash flow stability and is more attractive than a shorter WALE REIT.

A shorter WALE REIT is more beneficial when the interest rate changes.

There are always pros and cons and Keppel DC is a good play if you expect interest cost to moderate downwards in the longer term.

But if the interest rate stays higher for longer, it is less appealing.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.