My friend pinged me, asking if the AIA Pro Achiever 3.0 is a whole life plan or an investment-linked policy (ILP). I wish that one day, MAS can just legislate and make every insurance company state what kind of insurance policy is behind each fancy name.

In any case, AIA Pro Achiever is an ILP and I think popular enough that is frequently asked about. Many people in Singapore bought the plan, then freak out when they read online about how terrible ILP is.

The biggest problem with ILP is that we all bought them when we were financially less conscious, and when we became conscious, we realised we were so locked in that we could not redeploy our cash flows.

ILPs are a problem because we locked in our cash flow during a period that is the most risky for us to do it.

Since it is so popular, I thought it is better to spend sometime digesting the structure of the ILP and see if the Pro Achiever is really that costly as people make it out to be. You can look at this article as a favour I am doing for my friend. Since he is a more financially conscious investor, we look at ILP through the lens of an investor. This is my interpretation based on what I read in the following places:

- AIA Pro Achiever 3.0

- AIA Pro Achiever Brochure

- Product Summary of AIA Pro Achiever 3.0 Version 1.0 (Jan 2023)

I don’t own this product and we don’t recommend this plan currently at Havend.

The views are my own and not affiliated with Havend.

AIA Pro Achiever 3.0 is an ILP. Does it match your Financial Objective?

Some of the older people like myself would have been pitched Achiever since 2003-2004. This goes to show how long it has existed.

In its current form, AIA Pro Achiever is not like the traditional ILP but more of a 101 ILP, which is very, very light on the insurance component.

You would get the AIA Pro Achiever if your financial goal is for wealth accumulation for say your retirement, or some longer-term financial goals.

If you are looking at the Pro Achiever as killing two birds with one stone (the two birds being investment and insurance), then this plan is not for you.

I do think the investments under Pro Achiever is more suited for a financial goal with a longer-term time horizon as the fees in the short term can be kind high such that a unit trust that is heavy in fixed income may not perform well in the structure.

We will look at the impact of fees on returns later.

The Bonuses that You Could Receive.

Bonuses tend to be more units provided to give you an incentive if you:

- Invest a larger sum.

- Invest over a longer period.

- Stay invested longer.

They tend to be on the cumulative premium value instead of the total policy value (which means if you policy grow in value, they only give bonus on the premiums which is a lower value).

So here they are:

a. Welcome Bonus

A bonus paid on your regular premium upon your premium paid as a sort of welcome.

When: Between the first 1 to 3rd policy year.

What is paid: Additional units at prevailing prices.

Measured based on the percentage of your regular premium (not the amount of policy value. Also not on your cumulative regular premiums.)

The amount paid depends on the amount you invest:

The first table is applicable if you invest regularly over 10 years, the second if over 15 years and the third if over 20 years.

Notice that:

- The more you invest the bonus rate is higher. The difference can be night and day.

- The longer you invest regularly, the bonus rate is higher.

So this gives you an idea over the incentives. I always wonder that if lump sum investing is lucrative, why do we want to stretch it out over a longer period? Some of us cannot invest so much at one go and so dollar cost average over a longer period is sensible.

However, it will be weird if you have $500,000 and your planner ask you to invest over 20 years.

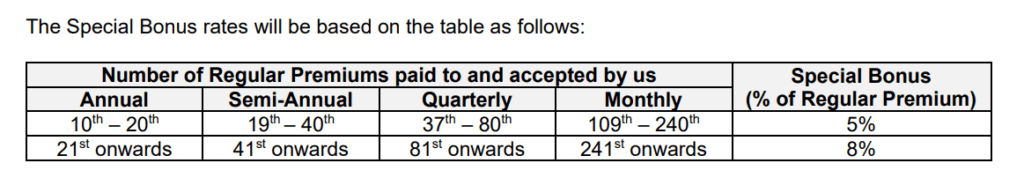

b. Special Bonus

Bonus will be paid out if you reach certain milestones.

When: Every year after 9th year (or starting on the 10th year)

What is paid: Additional units at prevailing prices.

Measured based on the percentage of your regular premium (not cumulative regular premiums)

This will be the main bulk of the reward.

Note that the rate is different for the 10th to 20th year and thereafter.

The longer you stay invest, the more incentive you will earn.

c. Maturity Benefit

The policy will pay out a maturity benefit equivalent of the policy value upon maturity after deducting the fees and charges.

This is not too different from any of your investments. They are just paying out the residual value.

The Charges that You will Incur.

The charges tend to be:

- Ongoing.

- Protect the insurer for the first few years.

- On the policy value instead of the total premiums paid (as reversed from the Bonus).

- Disincentivise you from selling out.

Understand the above and read the charges through these lens.

a. Premium Charge

Charged if you make any top-up, or more investments aside from your regular investments.

When: Any time you make additional top up.

What is paid: 5% of each Top-up premium

Measured based on the percentage of your top-up premium.

This will be not ongoing but you can look at this 5% as the glaring sales charge you pay to invest.

b. Supplementary Charge

This is the main charge on your regular premiums.

When: Every year for the first 10 years.

What is paid: 3.9% of the regular premium policy value (not total premiums)

Measured based on the percentage of your current policy value.

If you missed any premium payments, this charge will extend longer.

Many people think this charge is 3.9% every year but that is not the case as it is for a limited duration.

The welcome bonus is suppose to alleviate this supplementary charge but many would find it difficult to see what is the net result.

c. Benefit Charge

This is the insurance cost for the death benefit.

There is a death and TPD benefit that is attached to this policy, which tends to be the cheapest premium around.

When: As long as the policy is in-force.

What is paid: An annual charge rate x Sum-at-risk.

The sum-at-risk means how much insurance coverage are we assuring.

For example, in the event that the insured dies, and the payout is $100,000 but the policy value is $80,000 the sum at risk is the difference of $20,000. If the payout is $100,000 but the policy value is $120,000, then the sum at risk is $0.

The benefit of this model is that if your investments do well, your insurance cost is kept very low.

If your policy value is always higher than the total premiums, then it is as if there is no insurance cost paid. But if you happen to be in the red by a little, the insurance charges assure you that at least you get back your total premiums.

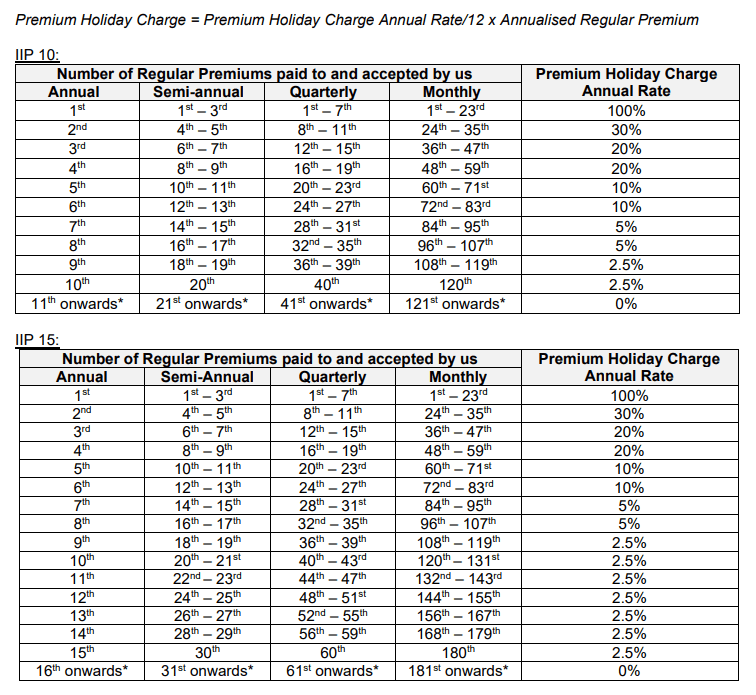

d. Premium Holiday Charge

If you miss a premium payment and your policy is on a premium holiday, a premium holiday charge will be imposed.

When: If you failed to make a payment. Charged on a monthly basis.

What is paid: (Premium holiday charge annual rate/12) x Annualized Regular Premium.

The idea is don’t be late for payment!

If you are not, then this is less of a problem.

I will show the 10 and 15 year regular premium paying premium holiday charge to let you see how heavy the charges are:

The charges go down over time but the most heavy in the first 5 years.

We can read it indirectly as saying that they need you to make payments at least in the first year if not they will make you pay for it. It is as if you don’t make premium payment, something bad will happen to them.

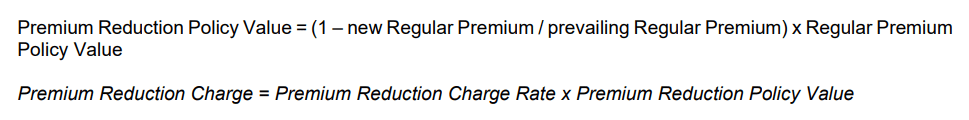

e. Premium Reduction Charge

The policy allows you to reduce the premium you pay (if you struggle to pay for it), but there is a charge.

When: If you decide when you want to reduce your premiums.

What is paid:

Basically, you are paying a charge on the percentage difference between the old premium (100%) and this new premium. If you are reducing from $20k premium to $2k, or 90%, you are paying a charge on 90%.

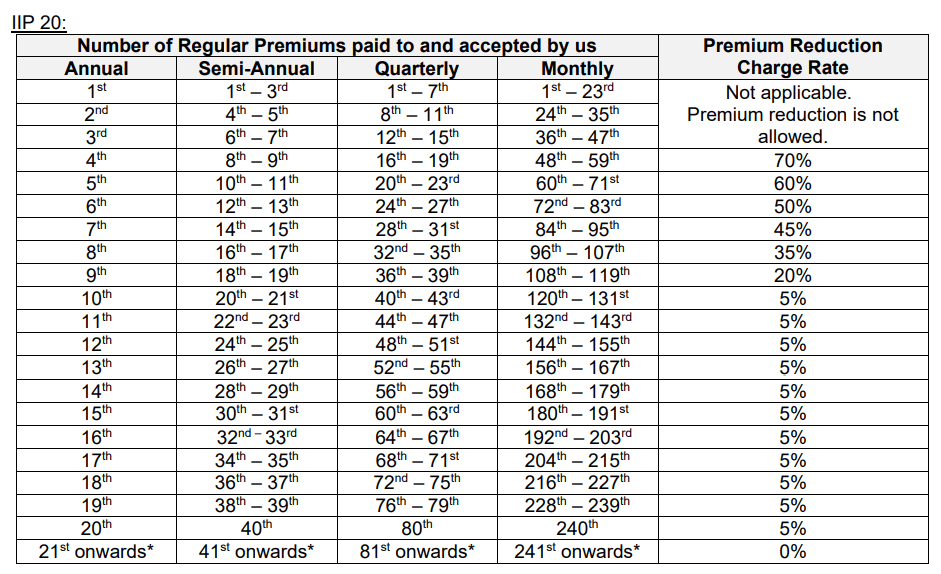

Here is the charge rate based on a 20-year regular premium paying policy:

First 3 years cannot change (which again shows you how sacred the early years are to them.) and the premium charge is so heavy that it is as if you don’t want to reduce the premium payment.

This is almost like a surrender charge.

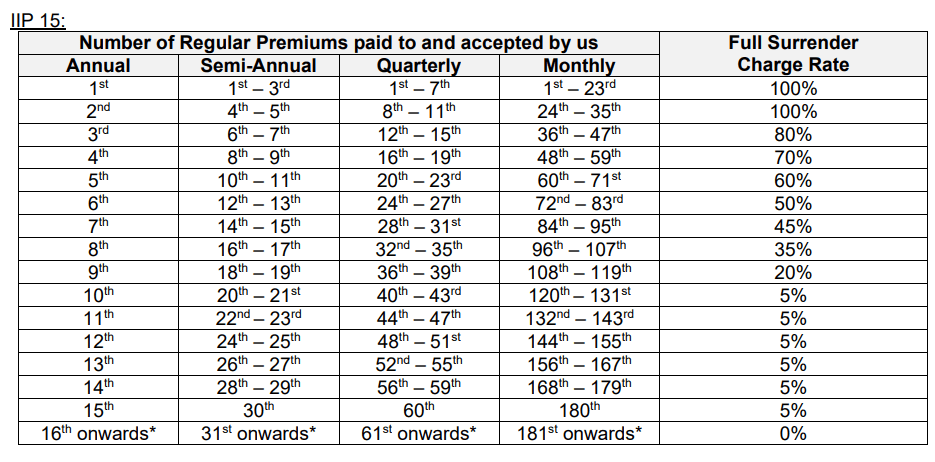

f. Surrender Charges.

Speaking of surrender charges, if you choose to surrender your policy early, you incur charges.

When: Any time you want to surrender or make a partial surrender.

What is paid: Surrender Charge Rate x Regular Premium policy value.

This is to stop you from surrendering.

If you surrender in the first few years, you almost lost all your premiums. The surrender charge usually scales based on how much you already paid to them so the charges are lower to zero if you have already pay the premiums.

The surrender charges penalize those who are less financially conscious or have made poor financial planning decisions in the past.

g. Fund Management Charge

Finally, the policy invest in an underlying unit trust.

The fund manager of the unit trust levy a fee. This is not seen at the ILP level but at the unit trust level.

When: Every year, as long as you own the unit trust in the ILP.

What is paid: A percentage of the policy value equivalent to the value of the unit trust. From what I see, it averages 1.25% p.a.

The Net Effect of the Bonus and Charges if You Invest for the Long Term.

Many netizens are slowly realizing the charges of ILPs are hefty.

But in truth, how hefty?

The real truth is that they also don’t know themselves because no one bother to calculate. They also don’t know how to calculate.

Suppose we have an investor Cindy who:

- Wants to build wealth with an AIA Pro Achiever.

- Is clear about her financial objective (unlike many who are less certain why they purchase the policy in the first place).

- Have a wealth building time horizon of 30 years.

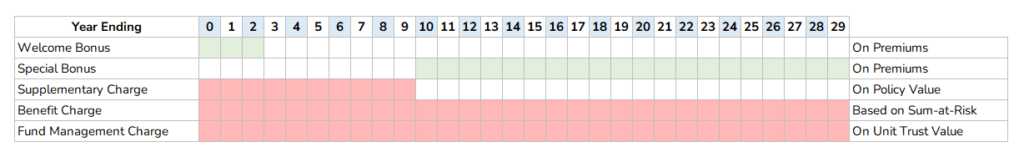

So the bonus and charges that will affect Cindy in her investment lifecycle is as follows:

- Welcome Bonus

- Special Bonus

- Supplementary Charge

- Benefit Charge

- Fund Management Charge

We leave out any thoughts about surrendering policy, reduction in premiums, topping up new money.

Suppose Cindy puts in $12,000 annual premiums for 20 years, which will net her the most welcome bonus. She will invest in the highest-risk kind of investment unit trusts.

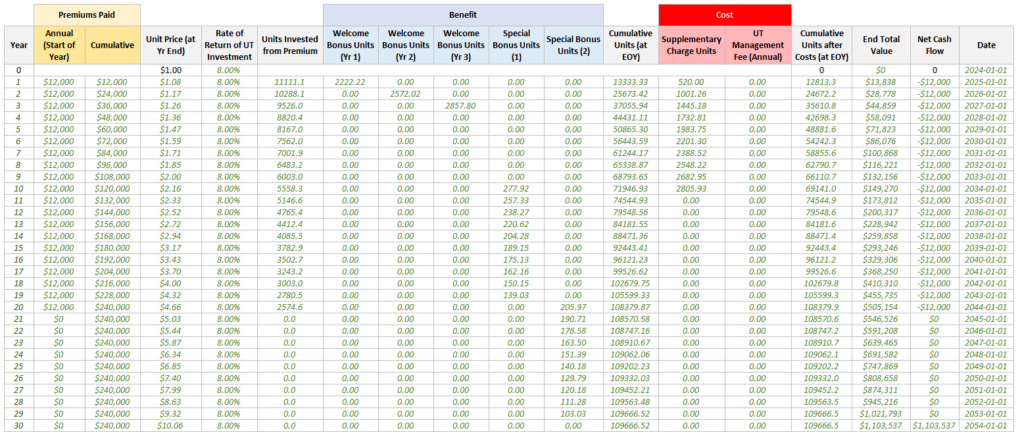

Here is a summary of the cash flows over the 30-year investment period:

The incentive is higher percentage but on each regular premium amount while some cost is relatively lower, but on the policy value that grows over time.

Now, firstly I want to simulate to find out aside from the investments, what is the net effect of the structure?

So I am only going to consider only:

- Welcome Bonus

- Special Bonus

- Supplementary Charge

Why take out the insurance and investment cost?

Let us try to be slightly fairer and first assume that we can put fundamentally sound, low-cost, market-beta investment instruments into the Pro Achiever. We assume that the portfolio does well and under the sum-at-risk model, there should not be much insurance cost.

In this way, we remove the distraction to look at how much this structure will reduce the overall return.

I crafted a spreadsheet calculator to help us figure out the net effect.

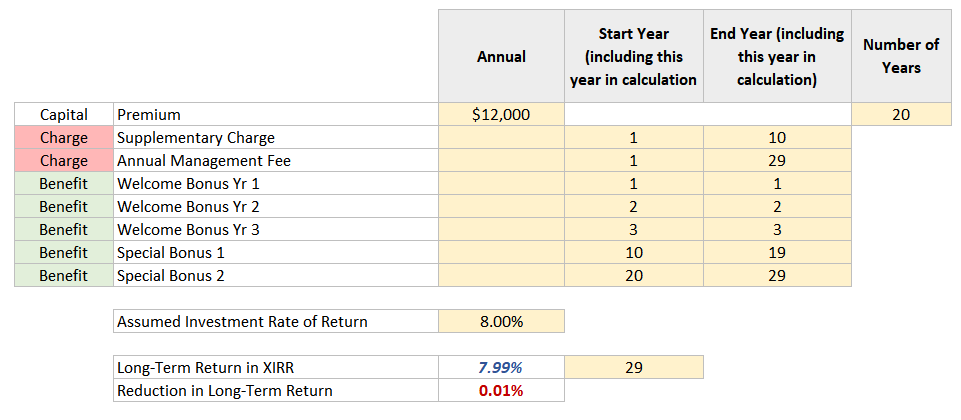

Ok, as a start, let us make sure without any bonus and charges, the calculator churns out the right results:

This table shows a summary of the inputs and the outputs. I just specify that we paid an annual premium of $12,000 for 20 years. We didn’t earn any bonus units or pay any charges.

At the end of 30 years, our long term rate of return is 7.99% (most likely due to the annual compounding effect) which is almost like the assumed investment rate of return.

If no cost and benefit, the numbers should tally!

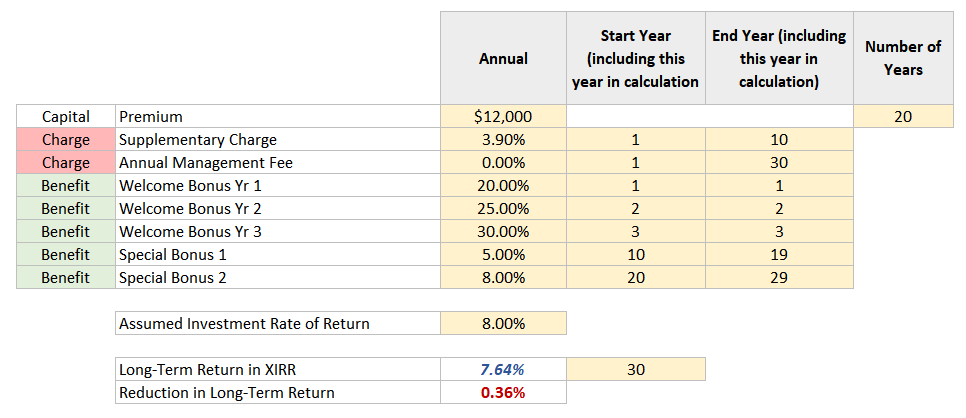

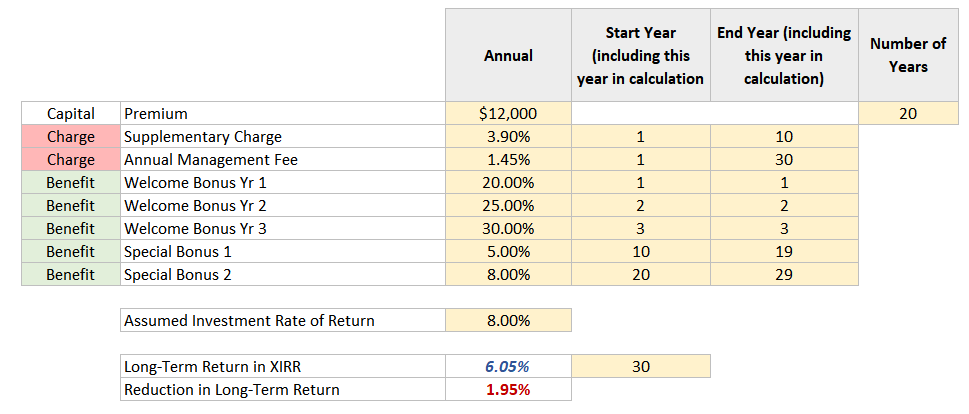

Now let us put in the bonus and the cost that Cindy’s Pro Achiever would be subjected to, less the investment annual management fee:

Cindy would have put in $240,000 in total premiums over this 30 years and her investments would have grown to $1.1 million at the end of 30-years.

The long term cost, which reduces the returns, works out to be about 0.36% p.a.

This might surprise some because the cost looks lower than what we paid to the robo-advisers structure if your assets under management is not that high.

Here are the actual workings:

I don’t know how many people would want to see this but basically you can see the welcome benefit and special units earned at various years and also the supplementary units charged.

What if we factor in the annual management fee?

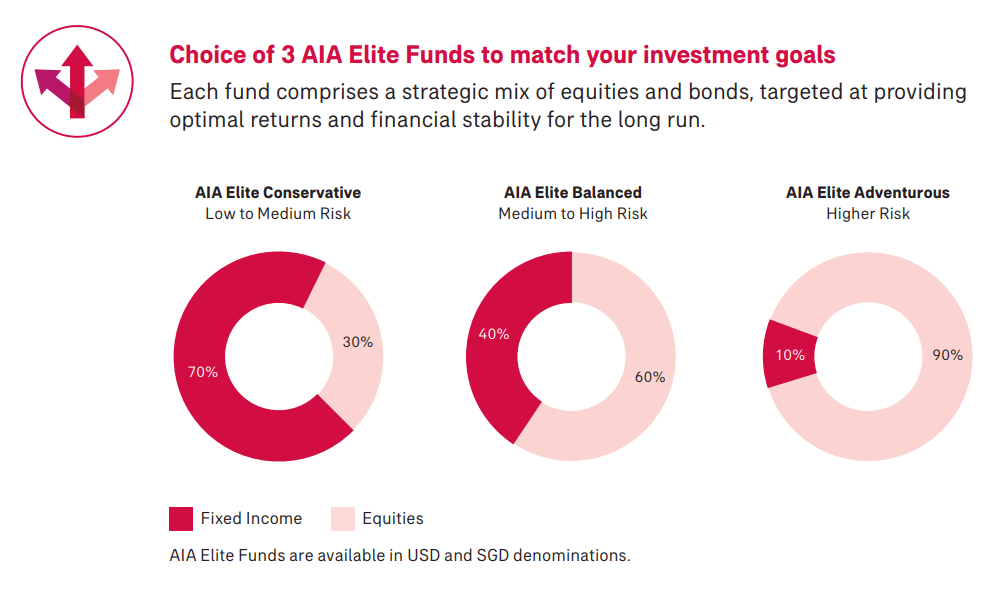

If we look at most of the funds that you can invest with Pro Achiever, which is the three portfolios above, the management fee is:

- AIA Elite Conservative: 1.05% p.a.

- AIA Elite Balanced: 1.25% p.a.

- AIA Elite Adventurous: 1.45% p.a.

You can check out the details of the funds here.

They don’t look cheap. The cost is like the cost structure when I started investing.

So if we put in the 1.45% p.a. fee here is how the long term returns look like:

Cindy can only accumulate $798,500 with a long-term return of 6.05%. About 1.95% p.a. is lost to costs.

Now, if we reduce the cost from 1.45% to 0.50%, the long term return would improve to 7.09% or she would have grown the value to $986k instead.

The bigger problem seem to be the high annual management fee then the cost structure it seems.

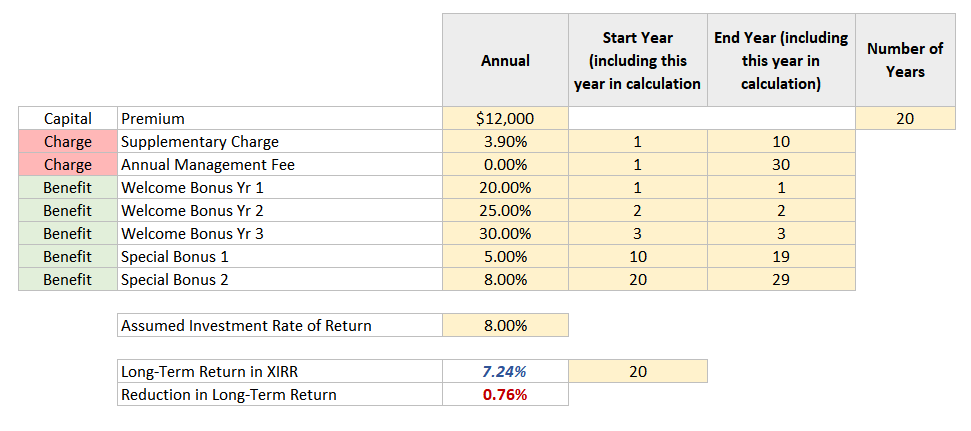

What if we invest for 20 years instead of 30 years?

Let us go back to the comparison without factoring in the annual fund management fee but we reduce the investment years to 20 years.

The long-term return reduction is 0.76% instead of 0.36%. The cost basis doubled.

- A lot of the charges and benefits are paid and given early.

- If you invest longer, the cost gets digested with time.

- Again shows that ILPs like AIA Pro Achiever work better if your investment time horizon is long. If you have a short term mindset, this ILP may not work out so well for you.

What if Cindy invests only $2,500 a year for only 10 years?

I got a little curious how big is the impact of small welcome bonus and a short payment period. The welcome bonus if the amount Cindy invest is small. Only the first year you will earn the welcome bonus. But I would think if the premium period is shorter, it will not make much of a difference.

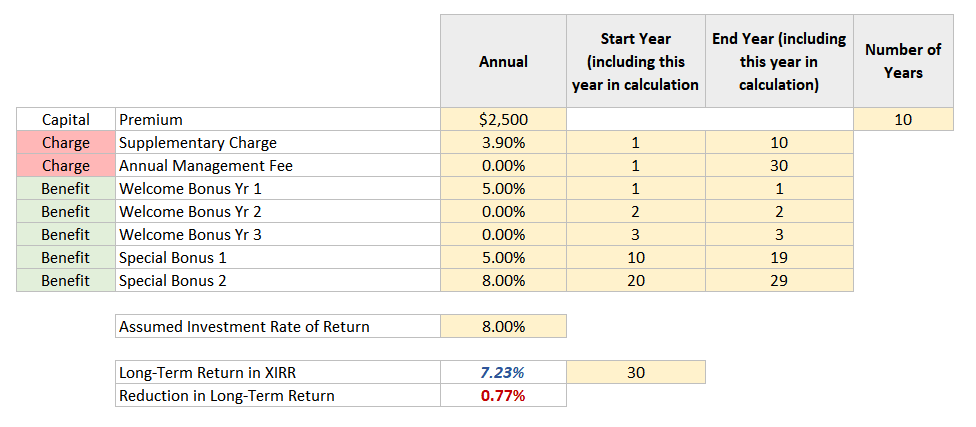

In the summary table below, we simulate a 10 year premium payment term of $2,500 a year but we invest for 30 years:

Instead of 0.36% p.a., the reduction in long-term return is more than doubled at 0.77% p.a.

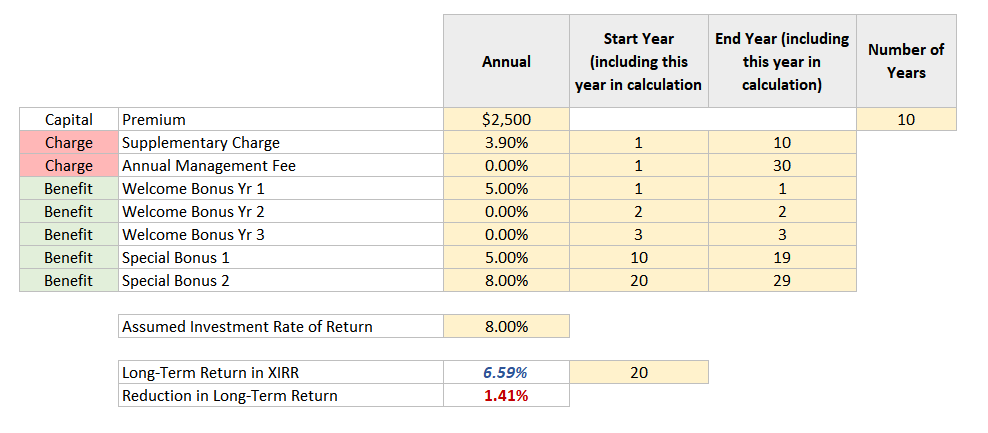

What if we invest for a shorter period of 20 years?

The reduction in return jumps even more.

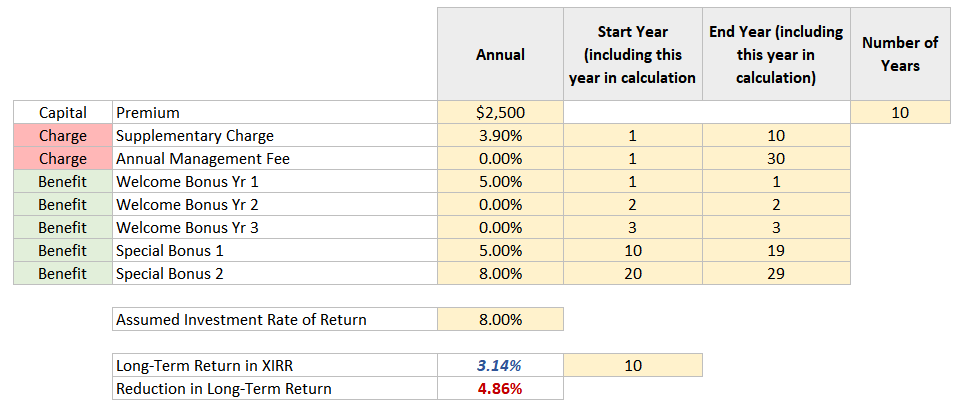

And if you invest, and surrender after you finish paying at year 10, the reduction in returns is more absurd.

Investment choice aside, the bigger impact seem to be less of the ILP structure but whether you can stay invested long enough.

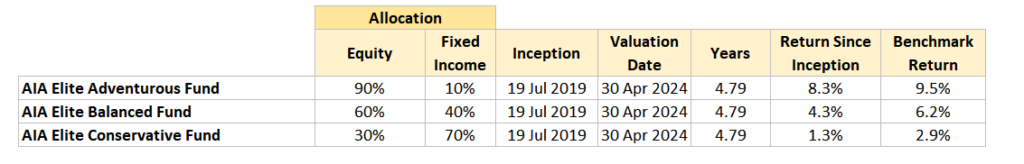

Portfolio Performance of the 3 AIA Elite Fund of Funds.

According to the brochure, AIA seem to be recommending the following three inhouse portfolios. These portfolios are fund of funds with different allocation of fixed income and equity.

The portfolio has a 4.8 years of track record (if we measure it until end April):

The benchmark is different allocation of MSCI World Total Net Return Index and Bloomberg Global Agregate Corporate Total Return Index.

All three funds underperform their benchmark with at least a 1% difference.

Some Notes Regarding the Insurance Aspect of Pro Achiever 3.0

While I say the insurance component is very, very toned down versus the older ILPs, there are still some insurance component and it would be good that I spend some time to explain how I see these components.

I would compare them to traditional investments that you can buy outside an insurance structure and see if the insurance components provide significant upside over investments without the protection elements.

The Death Benefit Don’t Mean Much Except…

If the insured passes away, the policy will payout the higher of:

- Total regular premium paid, plus the top-up premium and premium reduction top-up amount less total withdrawals.

- The policy value.

If you have appointed a secondary insured, there will be no payout upon the death of the insured.

There can be a couple of scenarios if we compare against the traditional investments:

- If the unit trust suffers a drawdown and the insured passes away. The beneficiary benefits compare to a plain vanilla investment because the payout is more than the actual value.

- If the unit trust does well and the insured passes away. The insurance would not be of much use.

For a young person, scenario 1 is not very likely. If you passed away young, the payout is your total premiums and while it will be useful for your beneficiary, I doubt it will be as useful as a term insurance which insures years of your current income.

If there is a drawdown in the future, the policy value after the drawdown is likely more than the total premiums, so this renders the death benefit useless.

Where the death benefit is useful is if you nominate a beneficiary to the policy. In the event of death, the beneficiary would be able to tap upon the money without going through a grant of probate.

This will provide much needed estate liquidity.

Accidental Death Benefit.

This is the same situation as the death benefit.

There is like 100% more payout if the insured dies due to an injury within 90 days from the data of the accident that occurs within 2 policy years.

The difference with traditional investment is 100% more. Since this is regular premium and not a $400,000 lump-sum single premium, the magnitude is less consequential than the traditional term policy.

Term Riders that Can be Attached.

On AIA’s website, they explained that you can attach some term riders to the policy.

From what I can decipher, the riders are referring to death benefit, terminal illness and cancer and total permanent disability and you can cover them to age 65, 85 or 100.

We mentioned death benefit before this so that is not too special. While having death benefit to 100 sounds nice, if the coverage is based on your policy value (assuming the value exceeds the total premiums paid) then how is it different from a traditional investment?

I think TPD cover typically ends before 65-70 years old so this will again only be beneficial if your policy suffers a drawdown early that results in your policy value less than the total premiums paid.

Critical Protection Waiver Riders Can be Useful.

You can attach either

- Early Critical Protector Waiver of Premium (II) or

- Critical Protector Waiver of Premium (II) riders.

If the insured suffers from early critical illness or advanced stage critical illness, future premiums will be waived and will continue to accumulate value.

These premium waivers are like insurance on the insurance premiums.

Provided that the premiums are not too dear, these premium waivers ensure that the policy continues accumulating value and you can have peace of mind to recuperate, diverting your resources to treatment if necessary instead of paying the premiums of Pro Achiever.

Conclusion

I think not many people have the patience to finish such a long breakdown like this. Depending your level of understanding, you might find AIA Pro Achiever to be tolerable or you would take your chance with an ILP to build your wealth.

In case you cannot focus on the forest, here is what I think are the important points:

- The Pro Achiever 3.0 is an 101 ILP.

- It is meant to build wealth. If you are looking for something that is a mixture of protection and investments, this is not it.

- There are a bunch of bonus units given to you and charges that are recurring or if a certain event happens. When you add them up, people had a hard time figuring out if the overall structure is a bad thing or a good thing. And if it is bad, how bad is the structure.

- If we view the ILP through a long term, 30 year accumulation lens, the structure is not expensive at all.

- But if you add in the fund annual management fee, which is very expensive, then the overall cost will not be beneficial to wealth building… unless the fund manager or the adviser added value in some ways.

- Judging by the past 4.8 years of track record of the fund of funds recommended, there isn’t evidence that the fund manager adds value for the hefty fees paid.

- But if you can only invest in 20 years, or even shorter like 10 years, then the cost structure becomes more and more expensive. The cost structure incentivises you to stay invested for the long term but I think most people also don’t know what they are buying, or eventually cannot remember why they buy this policy in the first place.

- Many people eventually regret buying the policy when they are financially less conscious. Some remain financially unconscious for a long time. The charges ensures that if you make the wrong financial decision, you have no choice but to commit to paying the policy because of the high surrender and premium reduction charges.

- Investors would either bite the bullet, surrender the policy early and lose all their money and make sure they eventually make sounder investment decision. Or they can restructure their policy by switching to funds that are more align to their new investment philosophy. While the ILP may not be the best structure, trying your best to capture market risk might give you some return that will bring you closer to your financial goal.

- There are some features of the ILP that wins a traditional plain vanilla investment. Being able to nominate a beneficiary to the policy for estate liquidity and critical protection waiver riders are some of the perks.

- Ultimately, ILPs like Pro Achiever are hard to recommend because people make the purchase decisions when they are the least conscious financially, and an ILP locks their cash flow so that they cannot course correct.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Early-July 2024 to Rise to 3.78% (for the Singaporean Savers) - June 27, 2024

- Why the S&P 500 Should Do Better Than the Other Segments of the Market Fundamentally. - June 23, 2024

- What is There to Like and Dislike about Interactive Brokers Desktop - June 21, 2024

MG

Friday 14th of June 2024

This is the best and most detailed analysis I have ever seen on such products. Thanks for putting all the effort. Investors would prevent a lot of mistakes, and would save countless amount of money and mental peace.

Kyith

Friday 14th of June 2024

Thank you. Hope it is helpful enough